📊 Statistics

- Analyst 1 Year Price Target:

$1.78

- Upside/Downside from Analyst Target:

8.46%

- Broker Call:

13

- Dividend Minimum 3 Year Yield:

1.56%

- EPS Growth Range (1Y):

0-10%

- Net Income Growth Range (1Y):

0-10%

- Revenue Growth Range (1Y):

10-25%

-

Upcoming Earnings Date:

2026-02-25

💰 Dividend History

Current year to date yield:

2.58%

📅 SGX Earnings Announcements for E28

Frencken Group Limited (E28)

Market: SGX |

Currency: SGD

Address: Wisma Great Eastern

Frencken Group Limited, an investment holding company, provides original design, original equipment, and diversified integrated manufacturing solutions worldwide. The company operates in two segments, Mechatronics and Integrated Manufacturing Services (IMS). The Mechatronics segment designs, develops, and produces precision-engineered systems and machines, electromechanical assemblies, and high precision parts and components for original equipment manufacturers in the medical, semiconductor, analytical, pharmaceutical, and industrial/factory automation, aerospace, and other industries. It also offers value engineering, prototyping, program management, supply chain management, precision machining components and sheet metal parts manufacturing, and modular and equipment system assembly, integration, testing, and commissioning; process and manufacturing; production engineering; and turnkey project management and configuration control services. The IMS segment provides integrated contract design and manufacturing services to the automotive and office automation industries. This segment designs, engineers, manufactures, and sells filters; manufactures molds and dies, plastic products, and component sub-assemblies; and offers plastic injection moulding, fabrication/surface finishes, eco vapor deposition, and fully automated assembly and box build/final test, as well as designs and trades in micro-mechanical product components for automotive industry. The company also engages in the property holding activities; and provides vacuum coating, thermal treatment, and other related services for plastic components, as well as produces, tests, and trades in adhesive and thermal management products. Frencken Group Limited was incorporated in 1999 and is based in Penang, Malaysia.

Show more

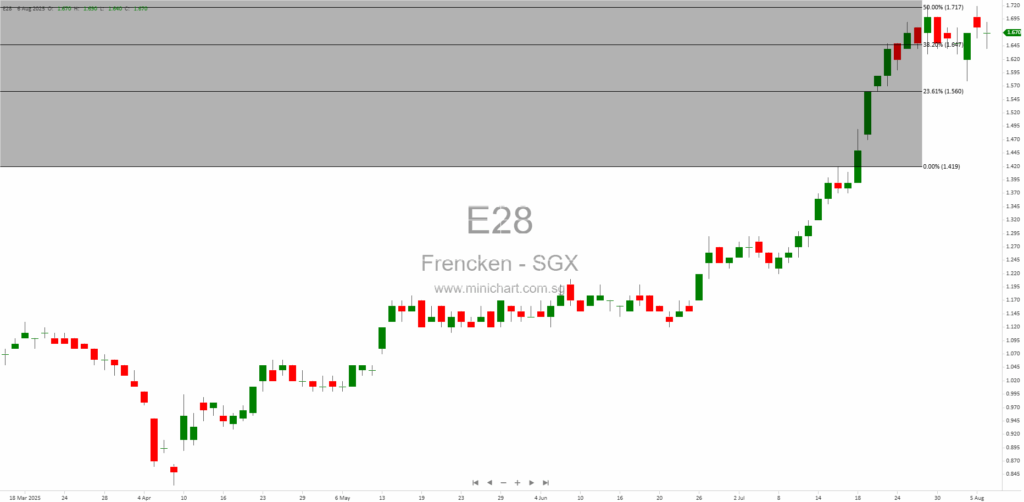

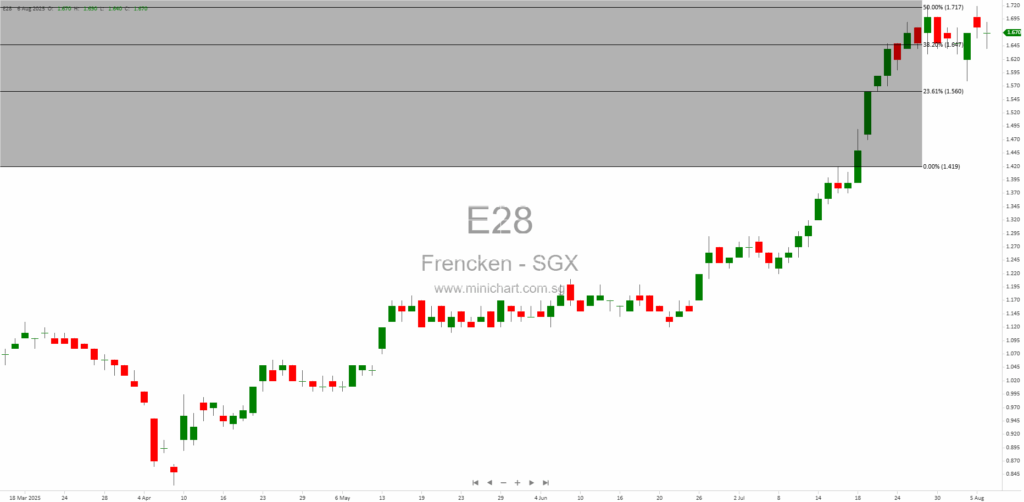

📈 Frencken Group Limited Historical Chart

🧾 Recent Financial Statement Analysis

November 16, 2025

Frencken Group Limited 3Q25 Business Update: Key Highlights and Investor Insights Frencken Group Limited 3Q25 Business Update: Strong Revenue Growth Amid Ongoing Economic Uncertainties Key Financial Highlights for Investors Revenue Growth: Frencken Group Limited recorded a 6.5% year-on-year (yoy) increase…

August 6, 2025

Frencken Group Limited: Announcement of 1H25 Financial Results Release Frencken Group Limited, a global integrated technology solutions company serving multinational clients in sectors such as analytical life sciences, automotive, healthcare, industrial, and semiconductors, has announced the release date for its…

November 19, 2024

Frencken Group's Strong Q3 Performance: A Positive Outlook Amidst Global Uncertainties Frencken Group's Strong Q3 Performance: A Positive Outlook Amidst Global Uncertainties Frencken Group Limited has reported a commendable performance for the third quarter of 2024, witnessing a 7.7% year-on-year…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: E28, Frencken Group Limited, Frencken, FRKN SP, FRENCKEN GROUP LTD, FRENCKEN GROUP

January 13, 2026

CGS International, January 13, 2026 Excerpt from CGS International report. Global markets are experiencing uncertainty due to renewed concerns over the independence of the US Federal Reserve, as political pressures mount and legal confrontations emerge, leading to increased diversification away…

November 18, 2025

Broker Name: Lim & Tan Securities Date of Report: 18 November 2025 Excerpt from Lim & Tan Securities report. Report Summary: The FSSTI Index rose 20% year-to-date, outperforming several global indices, with active trading volumes and values. Frencken Group reported…

November 18, 2025

Broker Name: Maybank Research Pte Ltd Date of Report: November 17, 2025 Excerpt from Maybank Research Pte Ltd report. Report Summary Frencken Group's 3Q25 PATMI of SGD9.9m is in line with expectations, but short-term weakness is expected in 4Q25 due…

November 18, 2025

Broker Name: Lim & Tan Securities Date of Report: 18 November 2025 Excerpt from Lim & Tan Securities report. The FSSTI Index showed resilience, closing at 4,543.6 with a year-to-date gain of 20%, outperforming several major global indices. Frencken Group…

November 18, 2025

Broker Name: CGS International Securities Date of Report: November 17, 2025 Excerpt from CGS International Securities report. Report Summary Frencken Group’s 9M25 revenue grew 12.5% year-on-year to S\$642.8m, mainly driven by the mechatronics segment, but net profit rose just 9.1%…

November 16, 2025

Frencken Group Limited 3Q25 Business Update: Key Highlights and Investor Insights Frencken Group Limited 3Q25 Business Update: Strong Revenue Growth Amid Ongoing Economic Uncertainties Key Financial Highlights for Investors Revenue Growth: Frencken Group Limited recorded a 6.5% year-on-year (yoy) increase…

August 19, 2025

Broker: Maybank Research Pte Ltd Date of Report: August 17, 2025 Frencken Group: Earnings Outlook Softens for 2H25, But Long-Term Growth Remains Intact Overview: Frencken Group Faces Challenging 2H25, Yet Maintains Strong Strategic Position Frencken Group Ltd (FRKN SP), a…

August 19, 2025

Broker Name: Maybank Research Pte Ltd Date of Report: August 17, 2025 Frencken Group: Navigating Weak H2 Guidance, Long-Term Growth, and Semiconductor Recovery Executive Summary: Frencken Group's Outlook Amid Disappointing 2H25 Guidance Frencken Group Ltd (FRKN SP), a prominent technology…

August 18, 2025

Broker: Maybank Research Pte Ltd Date of Report: August 17, 2025 Frencken Group: Navigating 2025 Headwinds, Positioned for Semiconductor Recovery Key Takeaways Target Price Cut to SGD1.60, BUY Maintained: Maybank lowers its target price from SGD1.75 to SGD1.60 but sustains…

August 6, 2025

Frencken Group Limited: Announcement of 1H25 Financial Results Release Frencken Group Limited, a global integrated technology solutions company serving multinational clients in sectors such as analytical life sciences, automotive, healthcare, industrial, and semiconductors, has announced the release date for its…

May 22, 2025

CGS International May 21, 2025 Frencken Group Ltd: Lowered Growth Outlook but Strong Semiconductor Segment Drives Optimism Frencken Group Ltd (FRKN SP) faces revised growth expectations, but a resilient semiconductor segment and strategic initiatives underpin a positive outlook. This analysis…

April 28, 2025

Frencken Group Ltd: Navigating Tariffs and Maintaining Growth in a Shifting Global Landscape CGS International April 22, 2025 Frencken Group Ltd: Navigating Tariffs and Maintaining Growth in a Shifting Global Landscape Frencken Group Ltd: Maintaining 1H25F Revenue Outlook Frencken Group…

April 28, 2025

CGS International April 24, 2025 Singapore Market Insights: Nanofilm Technologies & Frencken Group Analysis - April 2025 This report provides an in-depth analysis of Frencken Group Ltd and Nanofilm Technologies Int'l Ltd, offering technical and fundamental perspectives relevant to investors.…

March 5, 2025

Introduction The comprehensive research report on Frencken Group Ltd, issued by CGS International on February 28, 2025, offers an in‐depth review of the company’s financial performance, strategic initiatives, segmental outlook, and valuation metrics. With a strong focus on the semiconductor…

March 3, 2025

Frencken Group Ltd Deep Dive: Growth in Semiconductors and Robust Financial Performance Frencken Group Ltd Deep Dive: Growth in Semiconductors and Robust Financial Performance Broker: CGS International Securities Singapore Pte. Ltd. Date of Report: February 28, 2025 Executive Summary The…

October 15, 2024

Date: October 14, 2024Broker: Maybank Research Pte LtdOverview of Frencken Group LtdFrencken Group Ltd (FRKN SP) is a Singapore-based technology hardware manufacturer specializing in the production of high-mix, low-volume, high-complexity components and modules. The company serves various industries, including semiconductors,…