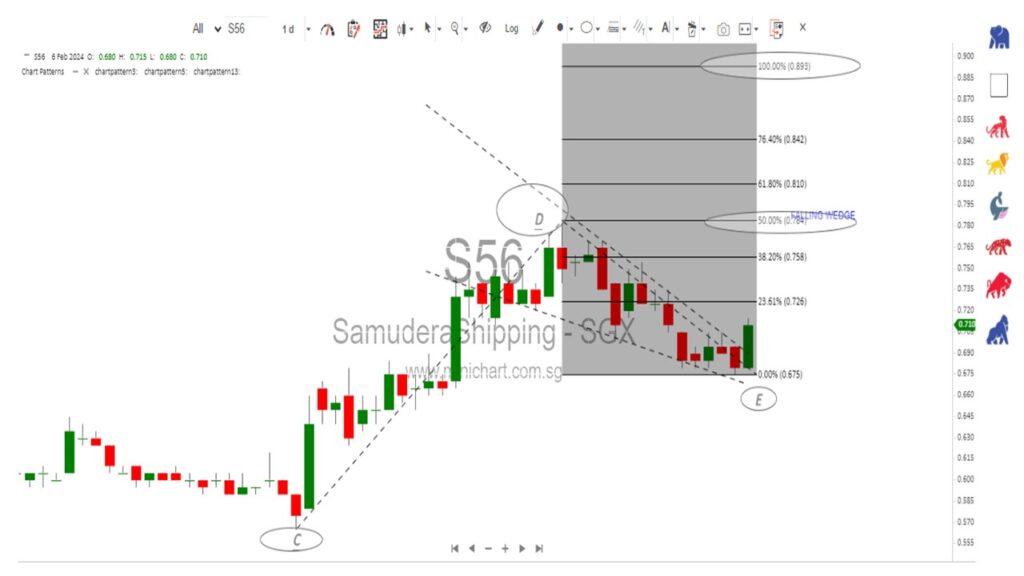

Samudara has just broken a “Bullish Falling Wedge Chart Pattern” designed by Minichart as it is a bullish formation, and the price will rise from here.

There are a few reasons why the uptrend of this chart pattern will continue.

A look back at the history of the Samudara chart shows that the price rose aggressively when it broke a bullish chart pattern and fell like a falling knife when it broke a bearish chart pattern.

Therefore, it is likely that the price will rise again if it breaks the bullish chart pattern today. Watch out for when the stochastic indicator breaks through the 30 level. This will be a trigger for a price rise.

The price has also broken through the downtrend line today. With the algorithm developed by us, Minichart can automatically draw upward and downward trend lines in the chart.

For example, when the price broke through the downtrend line at point A, the price shot upwards. When it broke through the upward trend line (defined by Minichart) at point B, the price fell sustainably.

So what is the target price for Samudera?

We can use the Fibonacci projection method to determine the potential price target for the breakout from the falling wedge. Using the Fibonacci extension tool, we can make a projection from point C (the low of the trend) to point D (the high of the trend) and then project upwards from E to find the price target.

The first target is the 50% level of $0.785,

followed by the 100% level of $0.895.

Containerised feeder shipping services are offered by Samudera Shipping Line Limited, which also owns and operates oceangoing ships. The Company also owns and charters ships, offers air and sea freight forwarding, and runs container freight terminal and shipping agency services through its subsidiaries.

According to a Monday (Jan. 15) market update from the Singapore Exchange (SGX), transport stocks have been rising since November 2023, when the price of Brent Crude Oil remained below US$80 per barrel. This upward trend is predicted to continue throughout 2024.

The World Trade Organisation has projected a 3.3% increase in the volume of global merchandise trade this year, which is a stronger growth rate than last year, according to SGX. In a similar vein, the International Air Transport Association projects that by 2024, the Asia-Pacific region’s total passenger demand will have returned to pre-Covid levels.

Samudera Shipping, Cosco Shipping International (Singapore) and Chasen Holdings, and were the three top performers during the last two weeks among Singapore’s ten most traded transportation equities. The three achieved gains of 16.6% on average, thanks to increased trade turnover in comparison to 2023 levels.