📊 Statistics

- Analyst 1 Year Price Target:

$11.46

- Upside/Downside from Analyst Target:

2.99%

- Broker Call:

8

- Dividend Minimum 3 Year Yield:

2.54%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

10-25%

-

Upcoming Earnings Date:

2026-02-26

💰 Dividend History

Current year to date yield:

3.08%

📅 SGX Earnings Announcements for U14

UOL Group Limited (U14)

Market: SGX |

Currency: SGD

Address: 101 Thomson Road

UOL Group Limited (UOL) is a leading Singapore-listed property and hospitality group with total assets of about $23 billion. The Company has a diversified portfolio of development and investment properties, hotels and serviced suites in Asia, Oceania, Europe, North America and Africa. With a track record of over 60 years, UOL strongly believes in delivering product excellence and quality service in all its business ventures. UOL, through its hotel subsidiary Pan Pacific Hotels Group Limited, owns three acclaimed brands namely ?Pan Pacific?, PARKROYAL COLLECTION and PARKROYAL. The Company's Singapore-listed property subsidiary, Singapore Land Group Limited, owns an extensive portfolio of prime commercial assets and hotels in Singapore. UOL has won numerous accolades including Distinguished Patron of the Arts Award by National Arts Council, Champions of Good by National Volunteer & Philanthropy Centre, Sustainability Impact Awards by The Business Times and UOB, Community Chest Awards, the Building and Construction Authority Quality Excellence Award, Council on Tall Buildings and Urban Habitat Awards, and FIABCI Prix d'Excellence Award.

Show more

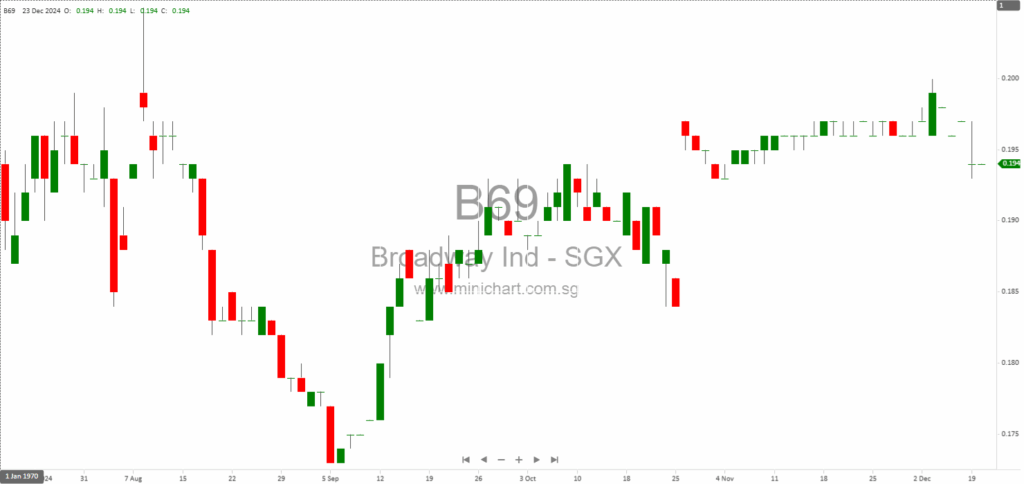

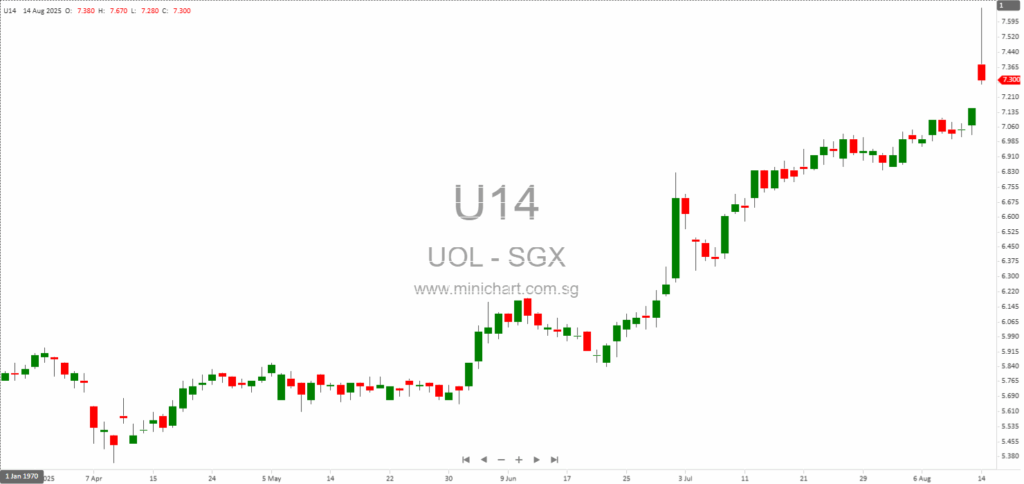

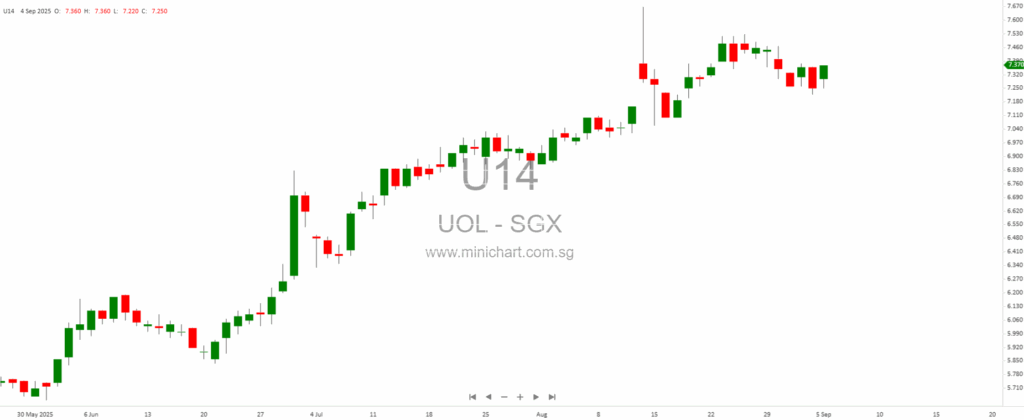

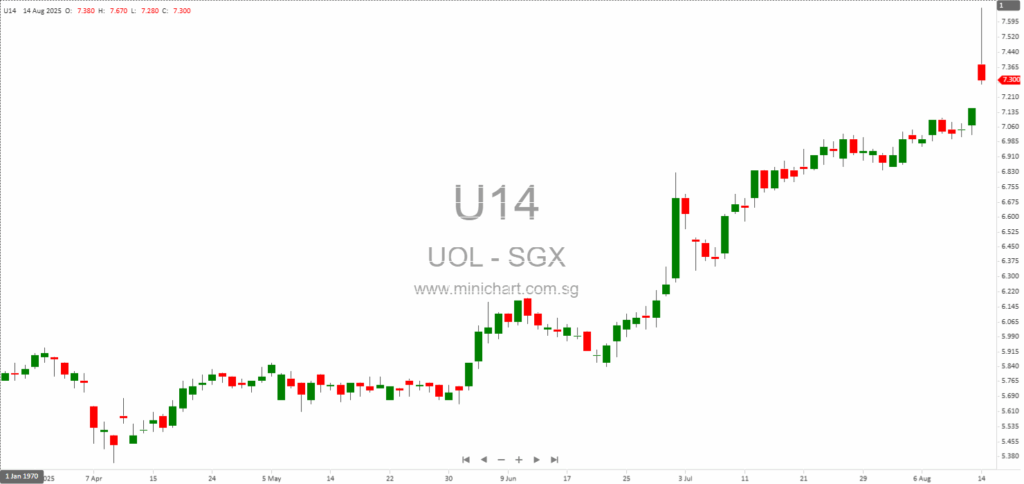

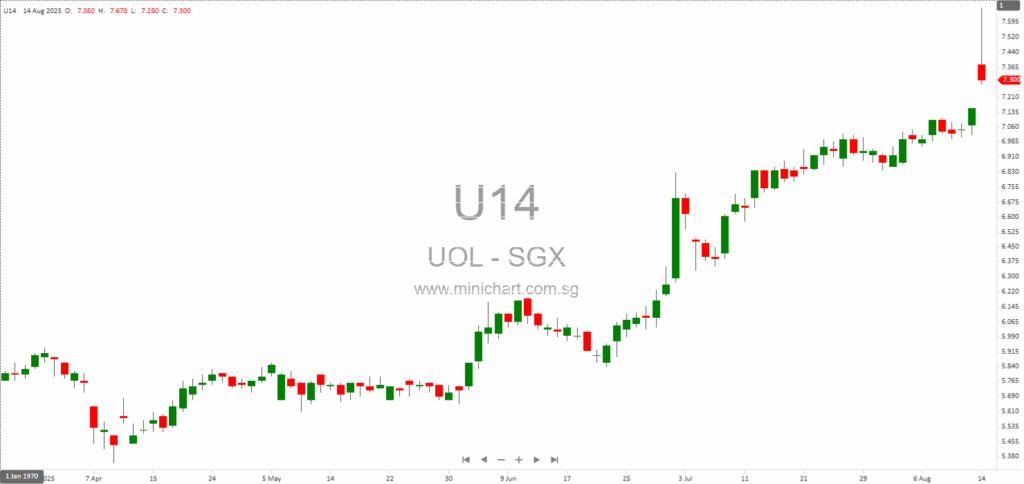

📈 UOL Group Limited Historical Chart

🧾 Recent Financial Statement Analysis

February 9, 2026

UOL Group Announces Joint Development Deed for Hougang Central Project UOL Group Announces Joint Development Deed for Integrated Residential and Commercial Site at Hougang Central, Singapore Key Points and Details for Investors Joint Venture Established: UOL Group Limited, together with…

January 30, 2026

UOL Group Limited Announces Sale of Pan Pacific Tianjin Hotel UOL Group Limited Announces Sale of Pan Pacific Tianjin Hotel for RMB238 Million Summary of the Transaction Seller: Tianjin UOL Xiwang Real Estate Development Co., Ltd., a wholly-owned subsidiary of…

January 14, 2026

UOL Group Awarded Hougang Central Integrated Site – Key Details for Investors UOL Group Awarded Tender for Integrated Residential and Commercial Site at Hougang Central Summary of Key Highlights Consortium Awarded Major Tender: UOL Group Limited ("UOL"), through its indirect…

January 14, 2026

Singapore Land Group Awarded Hougang Central Integrated Site: Full Details for Investors Singapore Land Group Secures Major Integrated Site at Hougang Central: Full Investor Brief Key Highlights Singapore Land Group Limited ("SingLand") has been awarded, together with consortium partners, the…

October 31, 2025

Broadway Industrial Group Advances Strategic Expansion with Key Payment Update on 51% Acquisition of Chinese and Thai Precision Tool Firms Key Points: Broadway Industrial Group Limited is acquiring 51% equity interests in Shenzhen Zhuoluoyu Precision Tool Co., Ltd. (ZSZ) and…

October 16, 2025

UOL Group Clinches \$524 Million Tender for Prime Dorset Road Residential Site: What Investors Need to Know UOL Group Clinches \$524 Million Tender for Prime Dorset Road Residential Site: What Investors Need to Know Key Highlights Tender Awarded: UOL Group…

October 13, 2025

UOL Group’s 2025 Investor Update: Strategic Acquisitions, Robust Financials, and Major Pipeline Set to Drive Share Price Momentum UOL Group’s 2025 Investor Update: Strategic Acquisitions, Robust Financials, and Major Pipeline Set to Drive Share Price Momentum Overview: UOL Group’s Growing…

August 14, 2025

UOL Group Makes Bold £43.5 Million Entry into UK Student Accommodation: What Investors Need to Know UOL Group Makes Bold £43.5 Million Entry into UK Student Accommodation: What Investors Need to Know Key Highlights UOL Group Limited acquires Varley Park…

August 14, 2025

UOL Group Makes First Foray into UK Student Housing with £43.5 Million Varley Park Acquisition – What Investors Need to Know UOL Group Makes First Foray into UK Student Housing with £43.5 Million Varley Park Acquisition – What Investors Need…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: U14, UOL Group Limited, UOL, UOL SP, UOL GROUP LTD, UOL GROUP

February 9, 2026

UOL Group Announces Joint Development Deed for Hougang Central Project UOL Group Announces Joint Development Deed for Integrated Residential and Commercial Site at Hougang Central, Singapore Key Points and Details for Investors Joint Venture Established: UOL Group Limited, together with…

February 2, 2026

Broker Name: DBS Bank Ltd Date of Report: 2 Feb 2026 Excerpt from DBS Bank Ltd report. Report Summary UOL Group and Singapore Land Group (SPLG) are poised for multi-year value unlocking, mainly driven by the redevelopment of Marina Square,…

January 30, 2026

UOL Group Limited Announces Sale of Pan Pacific Tianjin Hotel UOL Group Limited Announces Sale of Pan Pacific Tianjin Hotel for RMB238 Million Summary of the Transaction Seller: Tianjin UOL Xiwang Real Estate Development Co., Ltd., a wholly-owned subsidiary of…

January 14, 2026

UOL Group Awarded Hougang Central Integrated Site – Key Details for Investors UOL Group Awarded Tender for Integrated Residential and Commercial Site at Hougang Central Summary of Key Highlights Consortium Awarded Major Tender: UOL Group Limited ("UOL"), through its indirect…

January 14, 2026

Singapore Land Group Awarded Hougang Central Integrated Site: Full Details for Investors Singapore Land Group Secures Major Integrated Site at Hougang Central: Full Investor Brief Key Highlights Singapore Land Group Limited ("SingLand") has been awarded, together with consortium partners, the…

December 17, 2025

Broker Name: Lim & Tan Securities Date of Report: 17 December 2025 Excerpt from Lim & Tan Securities report. Report Summary Singapore’s FSSTI Index showed a year-to-date gain of 20.9%, while global indices had mixed performances. US stocks closed mixed…

November 19, 2025

Broker Name: OCBC Investment Research Date of Report: 18 November 2025 Excerpt from OCBC Investment Research report. Report Summary UOL Group Ltd is rated BUY with a fair value estimate of SGD10.06, as its residential property portfolio remains resilient despite…

November 18, 2025

Broker Name: OCBC Investment Research Date of Report: 18 November 2025 Excerpt from OCBC Investment Research report. Report Summary UOL Group Ltd is rated BUY, with a fair value estimate raised to SGD10.06, driven by resilient residential property metrics, high…

October 31, 2025

Broadway Industrial Group Advances Strategic Expansion with Key Payment Update on 51% Acquisition of Chinese and Thai Precision Tool Firms Key Points: Broadway Industrial Group Limited is acquiring 51% equity interests in Shenzhen Zhuoluoyu Precision Tool Co., Ltd. (ZSZ) and…

October 16, 2025

UOL Group Clinches \$524 Million Tender for Prime Dorset Road Residential Site: What Investors Need to Know UOL Group Clinches \$524 Million Tender for Prime Dorset Road Residential Site: What Investors Need to Know Key Highlights Tender Awarded: UOL Group…

October 13, 2025

UOL Group’s 2025 Investor Update: Strategic Acquisitions, Robust Financials, and Major Pipeline Set to Drive Share Price Momentum UOL Group’s 2025 Investor Update: Strategic Acquisitions, Robust Financials, and Major Pipeline Set to Drive Share Price Momentum Overview: UOL Group’s Growing…

September 7, 2025

Could UOL Group Unlock Value Through a REIT? CLSA Thinks So SGX:U14.SI:UOL GroupSGX:C38U.SI:CapitaLand Integrated Commercial Trust (CICT)SGX:T82U.SI:Suntec REITSGX:K71U.SI:Keppel REITSGX:D05.SI:DBS Group CLSA, in a Sept 5 report, flagged a potential REIT listing as one of UOL Group’s biggest catalysts alongside the…

August 14, 2025

UOL Group Makes Bold £43.5 Million Entry into UK Student Accommodation: What Investors Need to Know UOL Group Makes Bold £43.5 Million Entry into UK Student Accommodation: What Investors Need to Know Key Highlights UOL Group Limited acquires Varley Park…

August 14, 2025

UOL Group Makes First Foray into UK Student Housing with £43.5 Million Varley Park Acquisition – What Investors Need to Know UOL Group Makes First Foray into UK Student Housing with £43.5 Million Varley Park Acquisition – What Investors Need…

August 14, 2025

CGS International August 13, 2025 UOL Group Delivers Strong 1H25 Performance: Robust Residential Sales, Rising Rental Income, and Focused Portfolio Optimization Drive Growth 1H25 Earnings Beat: Powered by Residential Momentum UOL Group reported 1H25 earnings per share (EPS) of 24.33…

May 13, 2025

CGS International May 13, 2025 Singapore Retail Research: Navigating Market Trends with Key Stock Insights Market Overview: Overnight Recap Investors reacted positively to US-China trade de-escalation, triggering a stock market rally and a shift away from defensive assets like bonds,…

March 4, 2025

Overview This comprehensive report presents a detailed analysis of UOL Group Ltd, a leading Singapore-listed property and hospitality group, along with an in-depth valuation comparison against its listed peers. Spanning diverse segments such as property development, property investments, and hotel…

September 16, 2024

UOL Group Ltd – Technical Buy Last Price: S$5.57 Bullish Reversal Confirmed Key Technical Highlights: Entry Prices: S$5.57 S$5.27 S$5.13 Support Levels: Support 1: S$5.29 Support 2: S$5.09 Stop Loss: S$4.49 Resistance Levels: Resistance 1: S$5.76 Resistance 2: S$6.40 Target…