📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

-

- EPS Growth Range (1Y):

-

- Net Income Growth Range (1Y):

-

- Revenue Growth Range (1Y):

-

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

2.34%

📅 SGX Earnings Announcements for SK6U.SI

| Date of Broadcast |

Title |

Financial Year Ended |

Paragon REIT (SK6U.SI)

Market: SGX |

Currency: SGD

Address: 1000 Toa Payoh North

PARAGON REIT is a Singapore-based real estate investment trust established principally to invest in a portfolio of income-producing real estate primarily for retail purposes in AsiaPacific, as well as real estate-related assets. PARAGON REIT has a portfolio of five assets in Singapore and Australia. Its portfolio of properties in Singapore comprises a 99-year leasehold interest in Paragon that commenced on 24 July 2013, a 99-year leasehold interest in The Clementi Mall that commenced on 31 August 2010 and a 99-year leasehold interest in The Rail Mall that commenced on 18 March 1947. These Singapore properties have an aggregate net lettable area of approximately 960,000 sq. ft. In Australia, PARAGON REIT owns a 50% freehold interest in Westfield Marion Shopping Centre, the largest regional shopping centre in Adelaide, South Australia. PARAGON REIT also owns an 85% interest in Figtree Grove Shopping Centre, a freehold subregional shopping centre in Wollongong, New South Wales, Australia. Both Australian properties have an aggregate gross lettable area of approximately 1.7 million sq. ft.

Show more

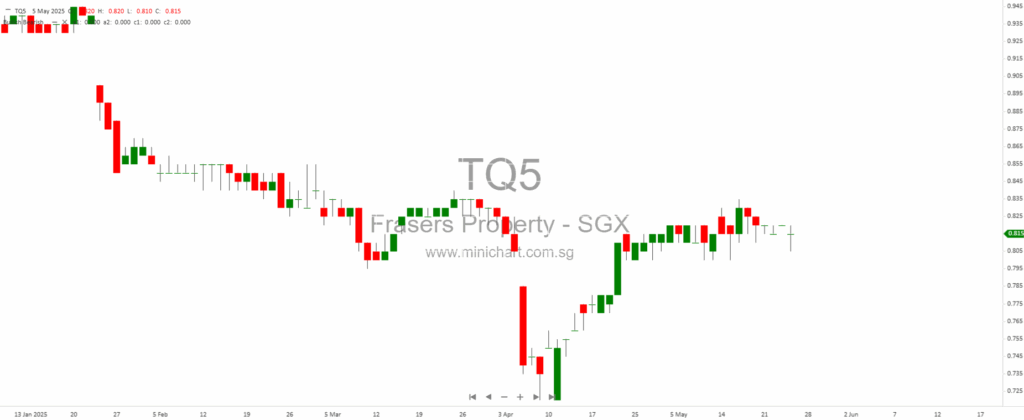

📈 Paragon REIT Historical Chart

🧾 Recent Financial Statement Analysis

📰 Related News & Research

Showing results matched by any of: SK6U.SI, Paragon REIT

May 27, 2025

The recent announcements of Frasers Hospitality Trust (FHT) (SGX:ACV) and Paragon Reit (SGX:SK6U) opting to go private have ignited debate about the long-term sustainability of Singapore-listed REITs, especially those focused on traditional property sectors. 📉 FHT Goes Private Amid Growth…

April 1, 2025

Lim & Tan Securities' Comprehensive Market Analysis: Navigating the Evolving Landscape Date of Report: 27 March 2025 Paragon REIT Privatization Offer: An Attractive Opportunity for Unitholders Paragon REIT (\$0.97, up 0.5 cent) has announced a scheme document for its proposed…

February 12, 2025

In-Depth Financial Analysis of Paragon REIT and Peer Companies In-Depth Financial Analysis of Paragon REIT and Peer Companies Broker: CGS International Date of Report: February 11, 2025 Overview of Paragon REIT Paragon REIT (PGNREIT) is under the spotlight with a…

December 13, 2024

Could Paragon, Singapore’s Crown Jewel, Soon Be Sold? Singapore’s iconic Paragon mall, located in the heart of Orchard Road, is sparking widespread speculation about its future as key stakeholders consider selling the luxury property. This move would mark a pivotal…

November 11, 2024

Introduction Welcome to the comprehensive analysis of Paragon REIT and its peer companies across various sectors. This detailed report provides insights into the financial performance, future projections, and key metrics of each company, offering an in-depth look at their market…