📊 Statistics

- Analyst 1 Year Price Target:

$0.70

- Upside/Downside from Analyst Target:

11.47%

- Broker Call:

3

- Dividend Minimum 3 Year Yield:

5.70%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

7.21%

📅 SGX Earnings Announcements for Q5T

Far East Hospitality Trust (Q5T)

Market: SGX |

Currency: SGD

Address: 1 Tanglin Road, #05-01

Far East H-Trust is a Singapore-Focused Hotel and Serviced Residence Hospitality Trust listed on the Main Board of The Singapore Exchange Securities Trading Limited (?SGX-ST?). Comprising Far East Hospitality Real Estate Investment Trust (?Far East H-REIT?) and Far East Hospitality Business Trust (?Far East H-BT?), Far East H-Trust was listed on the SGX-ST on 27 August 2012 and has a portfolio of 13 properties totaling 3,334 hotel rooms and serviced residence units valued at approximately S$2.58 billion as at 31 December 2024. In addition, Far East HREIT holds a 30.0% stake in Fontaine Investment Pte Ltd (a joint venture with Far East Organization Centre Pte. Ltd., a member company of Far East Organization), which has developed three hotels in Sentosa. Managed by FEO Hospitality Asset Management Pte. Ltd. and FEO Hospitality Trust Management Pte. Ltd. (collectively, the ?Managers?) and sponsored by members of Far East Organization Group (the ?Sponsor?), Far East H-Trust seeks to provide Stapled Securityholders with regular, stable and growing distributions on a half-yearly basis.

Show more

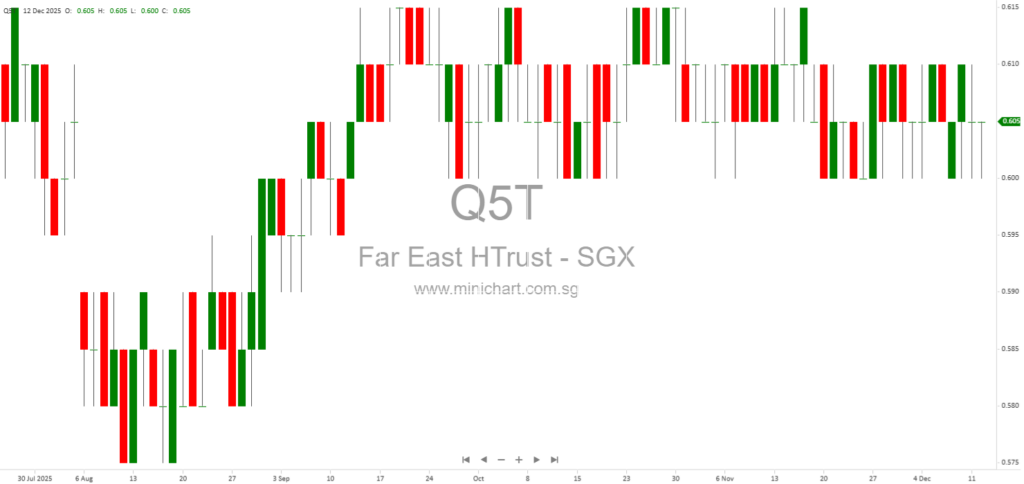

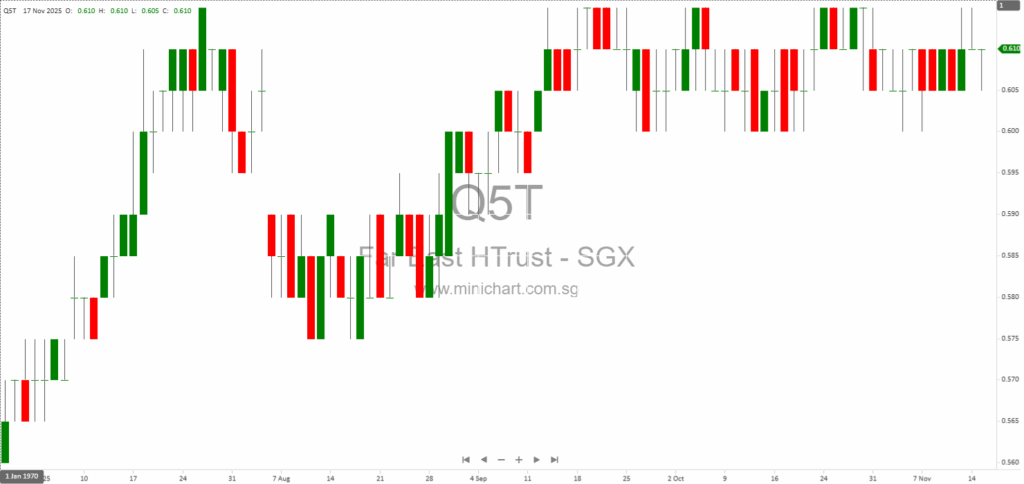

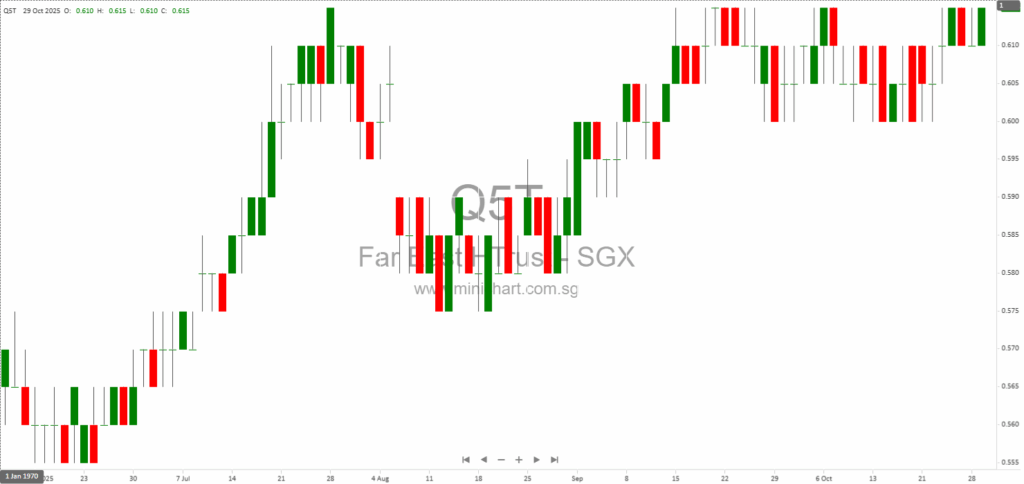

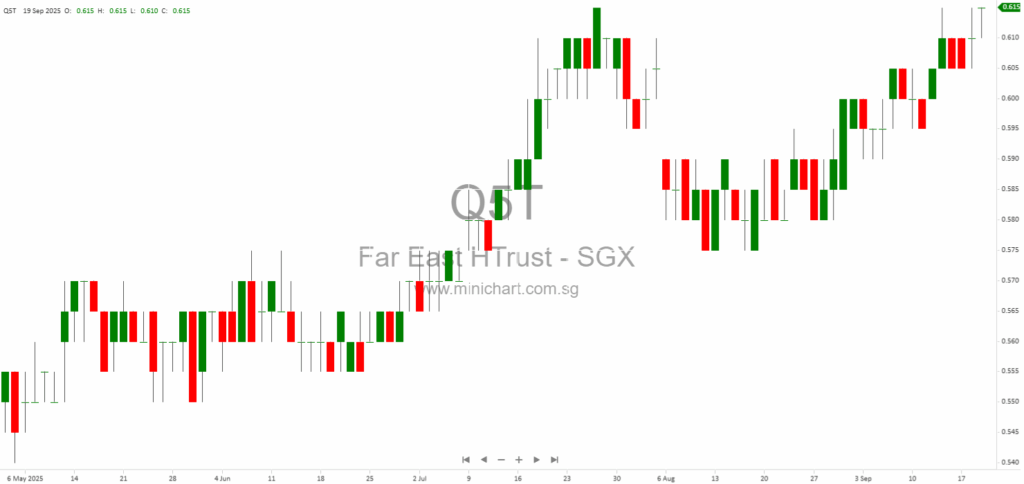

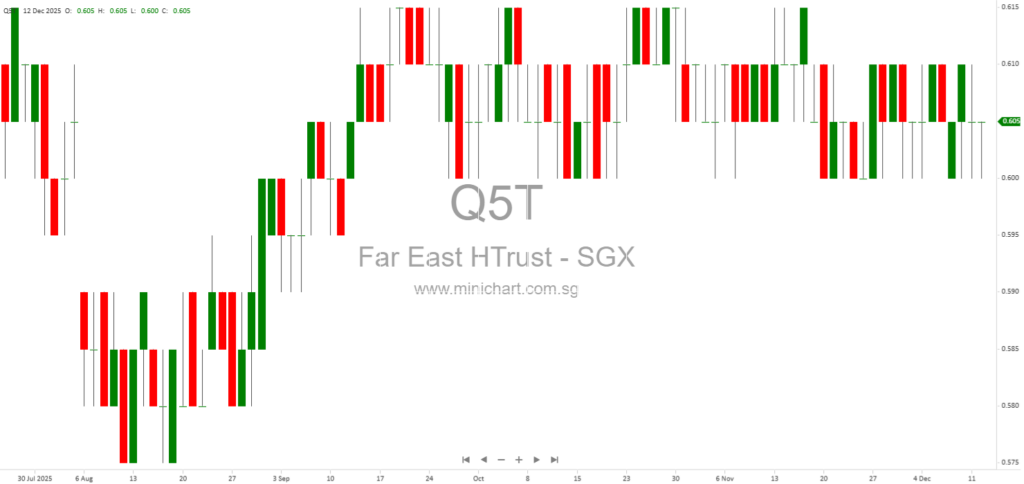

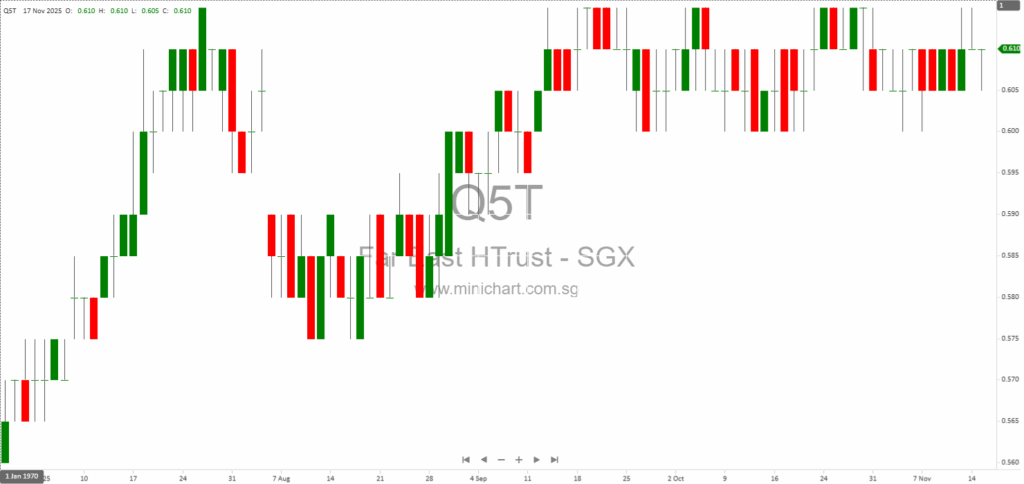

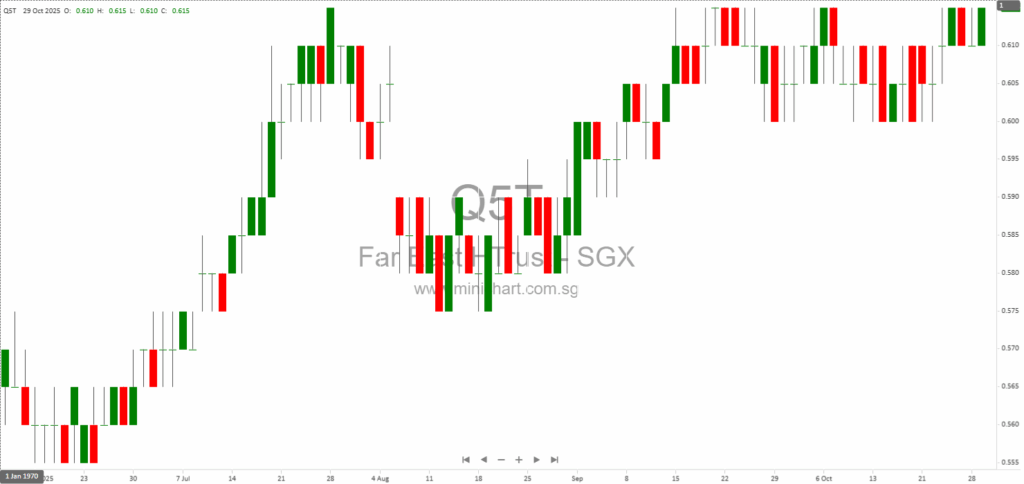

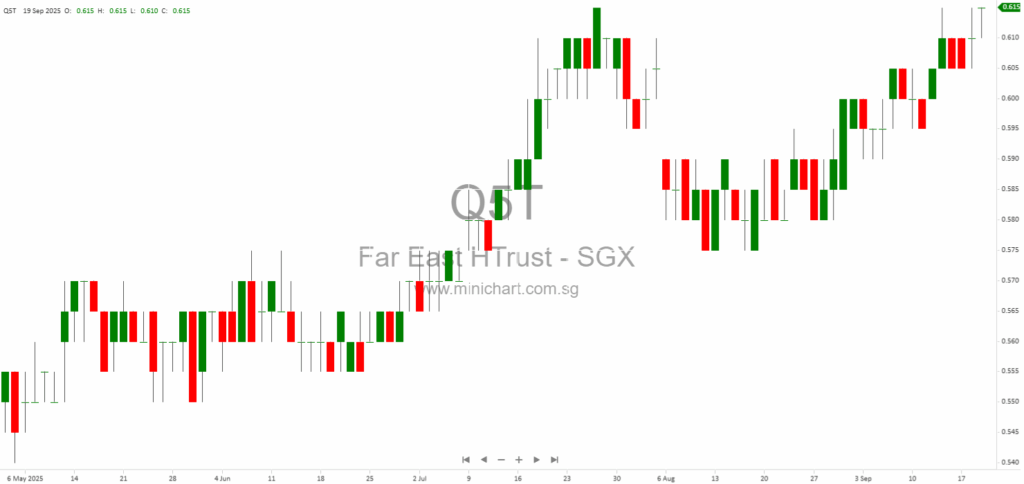

📈 Far East Hospitality Trust Historical Chart

🧾 Recent Financial Statement Analysis

December 12, 2025

Far East Hospitality Trust Announces S\$101.4 Million Sustainability-Linked Facility Agreement—Key Shareholder Information Far East Hospitality Trust Secures S\$101.4 Million Sustainability-Linked Loan: Key Shareholder Implications Overview Far East Hospitality Trust (“FEHT”), comprising Far East Hospitality Real Estate Investment Trust (“Far East…

November 17, 2025

Key Highlights Gross Revenue: For the nine months ended September 2025 (YTD Sep 2025), Far East Hospitality Trust (FEHT) reported gross revenue of S\$81.9 million, a marginal decrease of 0.7% year-on-year (YoY). This was mainly attributed to softer performance in…

October 30, 2025

Far East Hospitality Trust 3Q 2025: Japan Expansion Bolsters Revenue, Singapore Hotels Face Headwinds Far East Hospitality Trust 3Q 2025: Japan Expansion Bolsters Revenue, Singapore Hotels Face Headwinds Key Highlights From 3Q 2025 Financial Update Far East Hospitality Trust (“FEHT”)…

September 19, 2025

Far East Hospitality Trust Faces Earnings Pressure Amid Singapore Hotel Slowdown, Eyes Growth in Japan Far East Hospitality Trust Faces Earnings Pressure Amid Singapore Hotel Slowdown, Eyes Growth in Japan Key Takeaways from Far East Hospitality Trust’s 1H 2025 Results…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: Q5T, Far East Hospitality Trust

December 12, 2025

Far East Hospitality Trust Announces S\$101.4 Million Sustainability-Linked Facility Agreement—Key Shareholder Information Far East Hospitality Trust Secures S\$101.4 Million Sustainability-Linked Loan: Key Shareholder Implications Overview Far East Hospitality Trust (“FEHT”), comprising Far East Hospitality Real Estate Investment Trust (“Far East…

November 17, 2025

Key Highlights Gross Revenue: For the nine months ended September 2025 (YTD Sep 2025), Far East Hospitality Trust (FEHT) reported gross revenue of S\$81.9 million, a marginal decrease of 0.7% year-on-year (YoY). This was mainly attributed to softer performance in…

November 3, 2025

Broker Name: CGS International Date of Report: October 31, 2025 Excerpt from CGS International report. Report Summary Far East Hospitality Trust (FEHT) reported steady 3Q25 results, with revenue and net property income (NPI) in line with expectations, supported mainly by…

October 30, 2025

Far East Hospitality Trust 3Q 2025: Japan Expansion Bolsters Revenue, Singapore Hotels Face Headwinds Far East Hospitality Trust 3Q 2025: Japan Expansion Bolsters Revenue, Singapore Hotels Face Headwinds Key Highlights From 3Q 2025 Financial Update Far East Hospitality Trust (“FEHT”)…

September 19, 2025

Far East Hospitality Trust Faces Earnings Pressure Amid Singapore Hotel Slowdown, Eyes Growth in Japan Far East Hospitality Trust Faces Earnings Pressure Amid Singapore Hotel Slowdown, Eyes Growth in Japan Key Takeaways from Far East Hospitality Trust’s 1H 2025 Results…

August 4, 2025

Maybank Research Pte Ltd August 1, 2025 Far East Hospitality Trust: Navigating Softer Singapore Hospitality with Strategic Overseas Expansion Overview: Key Takeaways from Far East Hospitality Trust’s Latest Results Far East Hospitality Trust (FEHT), the first and only Singapore-focused hotel…

August 4, 2025

CGS International August 4, 2025 Far East Hospitality Trust: Navigating a Softer Hospitality Market with Resilience and Strategic Moves Introduction: Resilience Amidst Hospitality Sector Cooldown Far East Hospitality Trust (FEHT) remains a notable player in Singapore’s REIT landscape, demonstrating resilience…

May 2, 2025

CGS International April 30, 2025 Far East Hospitality Trust Faces Mixed Outlook in 2025: In-Depth Analysis, Peer Review, and ESG Insights Overview: FEHT’s 1Q25 Performance and Key Takeaways Far East Hospitality Trust (FEHT), a leading Singapore REIT focused on hospitality,…

March 31, 2025

Far East Hospitality Trust: Poised for Robust Recovery as Singapore Tourism Rebounds Lim & Tan Securities | 21 March 2025 Consistent Performance Amidst Challenges In its FY2024 annual report, Far East Hospitality Trust (Far East H-Trust) delivered a stable financial…

March 31, 2025

Lim & Tan Securities | 21 March 2025 Unlocking the Potential of Hospitality and Edible Oil: A Comprehensive Analysis Far East Hospitality Trust Delivers Stable Performance, Positions for Continued Growth Far East Hospitality Trust's Resilient Performance Amidst Challenging Conditions 1…