📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

3.70%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

2026-02-26

💰 Dividend History

Current year to date yield:

4.81%

📅 SGX Earnings Announcements for O10

Far East Orchard Limited (O10)

Market: SGX |

Currency: SGD

Address: 6 Eu Tong Sen Street

Far East Orchard Limited, an investment holding company, engages in the hotel operations and property investment activities in Singapore, Australia, the United Kingdom, Japan, Malaysia, Germany, and Denmark. It operates through Hospitality ? Management Services, Hospitality ? Operations, Hospitality ? Property Ownership, Property ? Student Accommodation, Property ? Development, and Property ? Investment segments. The company primarily develops residential, commercial, hospitality, and purpose-built student accommodation (PBSA) properties. It also owns and operates hotels and PBSA properties. In addition, the company manages and leases properties. The company was formerly known as Orchard Parade Holdings Limited and changed its name to Far East Orchard Limited in July 2012. The company was incorporated in 1967 and is headquartered in Singapore. Far East Orchard Limited is a subsidiary of Far East Organization Pte. Ltd.

Show more

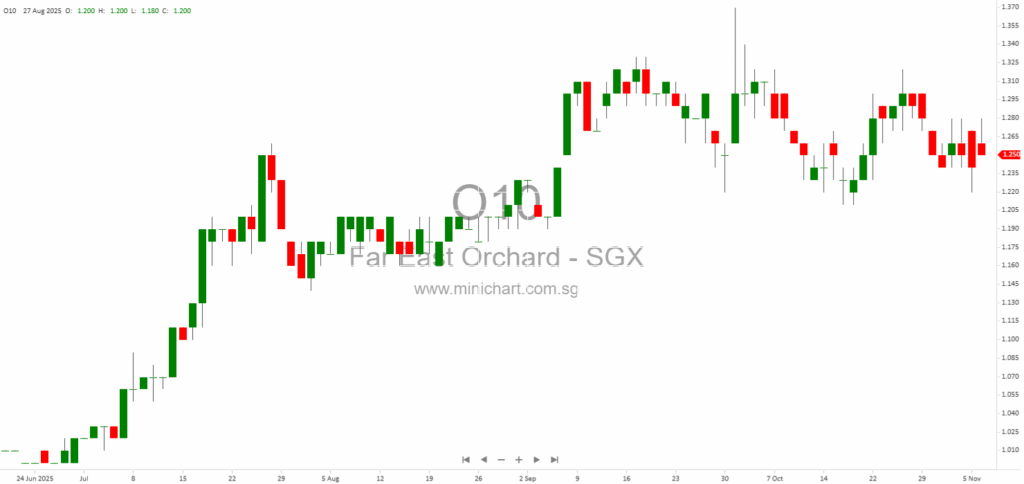

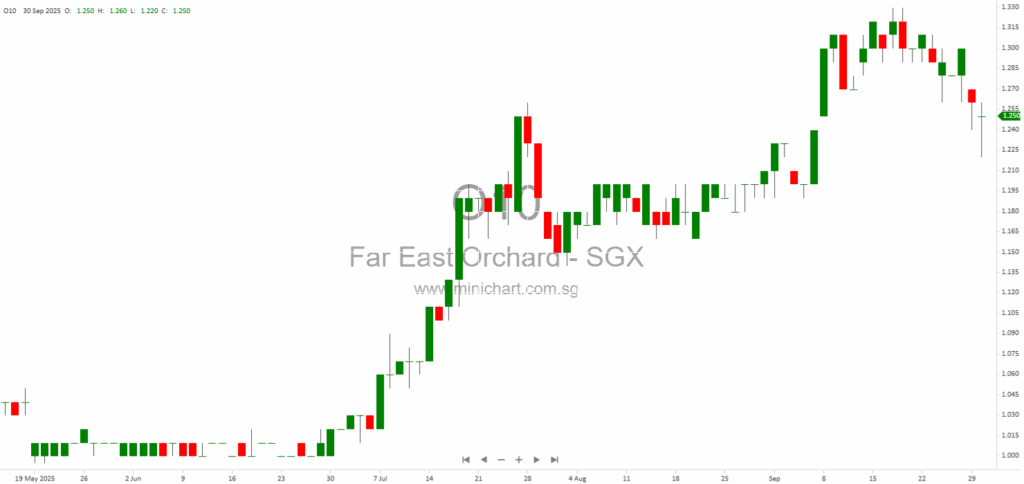

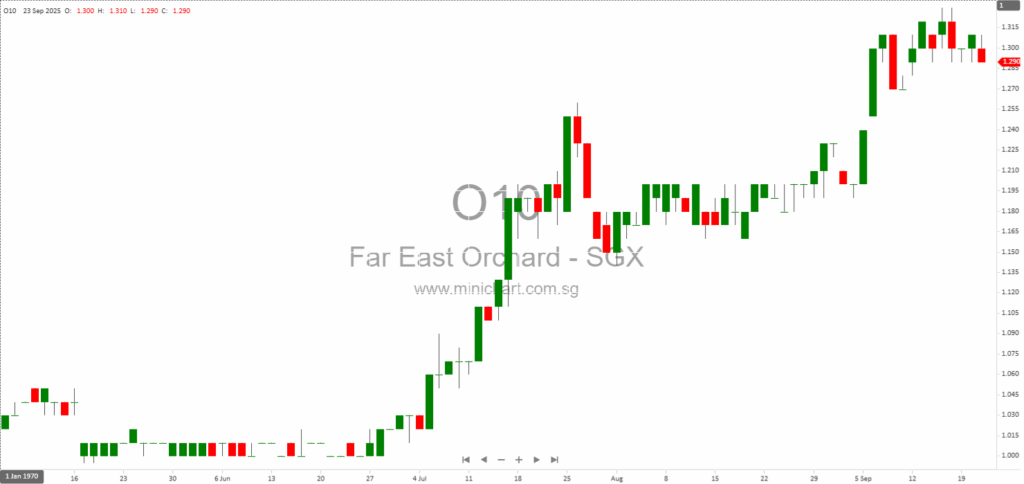

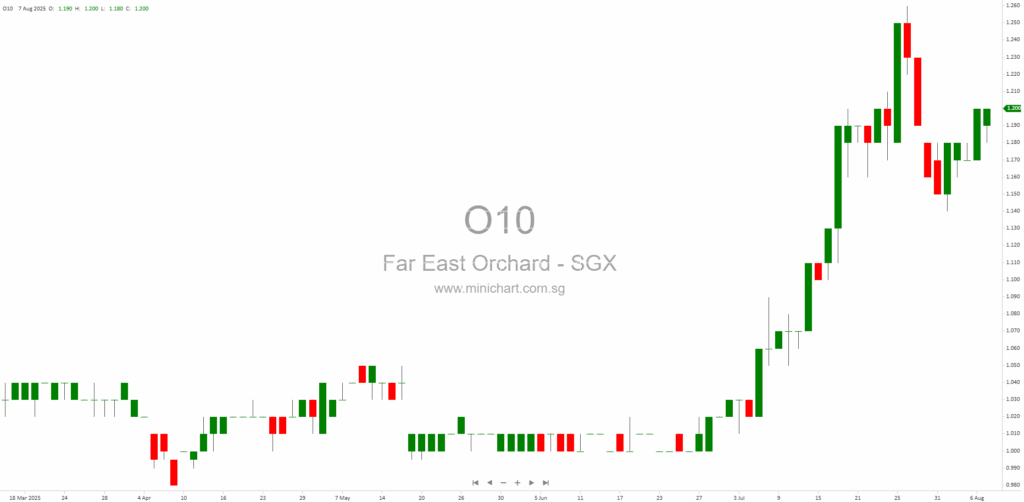

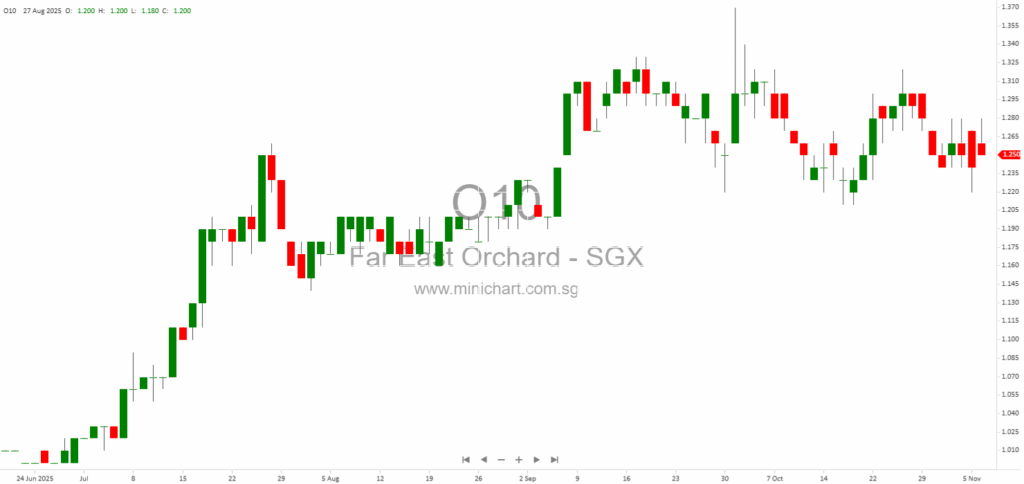

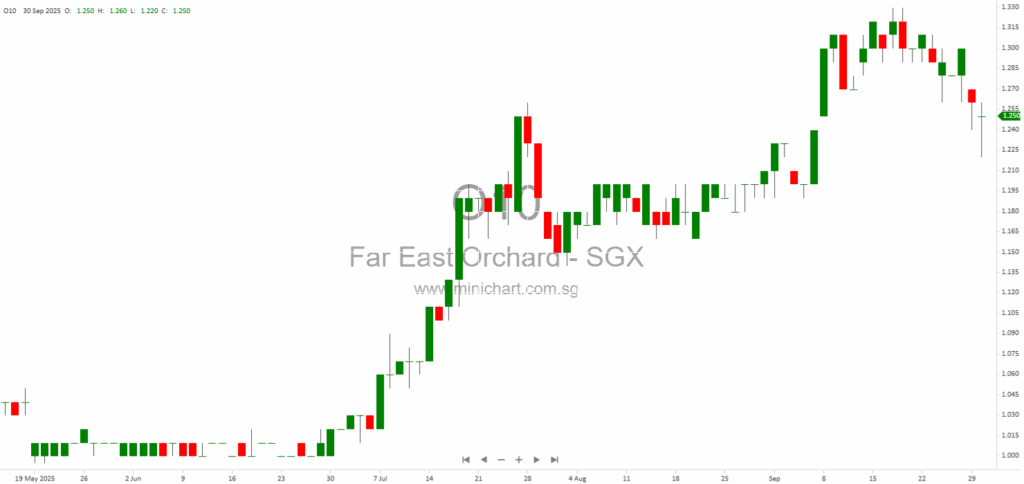

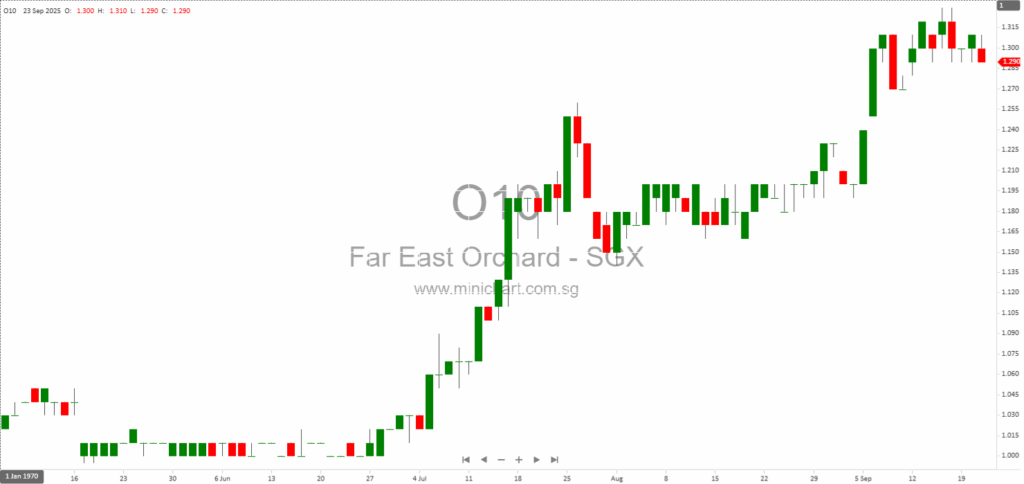

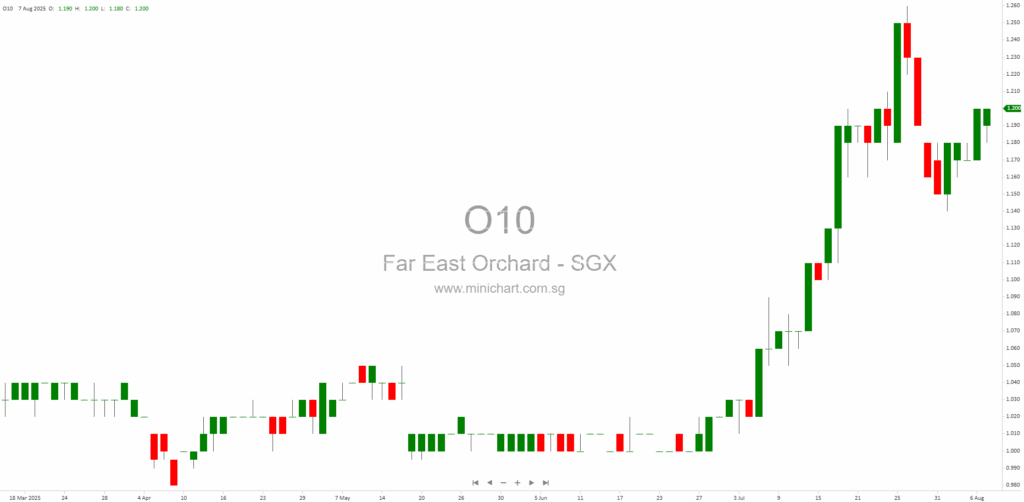

📈 Far East Orchard Limited Historical Chart

🧾 Recent Financial Statement Analysis

November 6, 2025

Far East Orchard Limited 9M FY2025 Business Update: Investor Insights Far East Orchard Limited Reports Strong Profit Boosted by Strategic Acquisitions and One-off Gains Key Highlights of the 9M FY2025 Business Update Net Profit Surges: Far East Orchard Limited (“Far…

September 30, 2025

Far East Orchard Boosts Stake in UK Student Accommodation Giant: Shareholders Eye Growth, Recurring Income, and UK Expansion Far East Orchard Boosts Stake in UK Student Accommodation Giant: Shareholders Eye Growth, Recurring Income, and UK Expansion Key Highlights for Investors…

September 23, 2025

Far East Orchard 1H FY2025: Special Dividend, UK PBSA Expansion, and Strategic Shifts Signal Growth Potential Far East Orchard 1H FY2025: Special Dividend, UK PBSA Expansion, and Strategic Shifts Signal Growth Potential Key Highlights from Far East Orchard's 1H FY2025…

August 7, 2025

Far East Orchard Limited: 1H 2025 Financial Analysis Far East Orchard Limited (“FEOR”) has released its unaudited condensed interim financial statements for the six months ended 30 June 2025. The report gives investors a comprehensive view of the company’s latest…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: O10, Far East Orchard Limited, Far East Orchard, FEOR SP, FAR EAST ORCHARD LTD, FAR EAST ORCHARD

November 6, 2025

Far East Orchard Limited 9M FY2025 Business Update: Investor Insights Far East Orchard Limited Reports Strong Profit Boosted by Strategic Acquisitions and One-off Gains Key Highlights of the 9M FY2025 Business Update Net Profit Surges: Far East Orchard Limited (“Far…

October 1, 2025

Broker: Maybank Research Pte Ltd Date of Report: 1 October 2025 Excerpt from Maybank Research Pte Ltd report. Singtel: Recent Optus emergency call outages had limited impact; near-term risks include minor subscriber churn and costs, but Singtel's diversified business and…

September 30, 2025

Far East Orchard Boosts Stake in UK Student Accommodation Giant: Shareholders Eye Growth, Recurring Income, and UK Expansion Far East Orchard Boosts Stake in UK Student Accommodation Giant: Shareholders Eye Growth, Recurring Income, and UK Expansion Key Highlights for Investors…

September 23, 2025

Far East Orchard 1H FY2025: Special Dividend, UK PBSA Expansion, and Strategic Shifts Signal Growth Potential Far East Orchard 1H FY2025: Special Dividend, UK PBSA Expansion, and Strategic Shifts Signal Growth Potential Key Highlights from Far East Orchard's 1H FY2025…

August 7, 2025

Far East Orchard Limited: 1H 2025 Financial Analysis Far East Orchard Limited (“FEOR”) has released its unaudited condensed interim financial statements for the six months ended 30 June 2025. The report gives investors a comprehensive view of the company’s latest…