📊 Statistics

- Analyst 1 Year Price Target:

$0.40

- Upside/Downside from Analyst Target:

12.22%

- Broker Call:

8

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

4.20%

📅 SGX Earnings Announcements for MXNU

Elite UK REIT (MXNU)

Market: SGX |

Currency: GBP

Address: Suntec Tower Three

Elite UK REIT operates as a real estate investment trust. It primarily invests in commercial assets and real estate-related assets in the United Kingdom. The company's investment properties comprise freehold properties located in London and South East, North West, Midlands, North East, South West, Yorkshire and Humber, East, Scotland, and Wales. It qualifies as a real estate investment trust for federal income tax purposes. The company was formerly known as Elite Commercial REIT and changed its name to Elite UK REIT in May 2024. Elite Commercial REIT Management Pte. Ltd. operates as the manager of Elite UK REIT. Elite UK REIT was founded in 2018 and is based in Singapore.

Show more

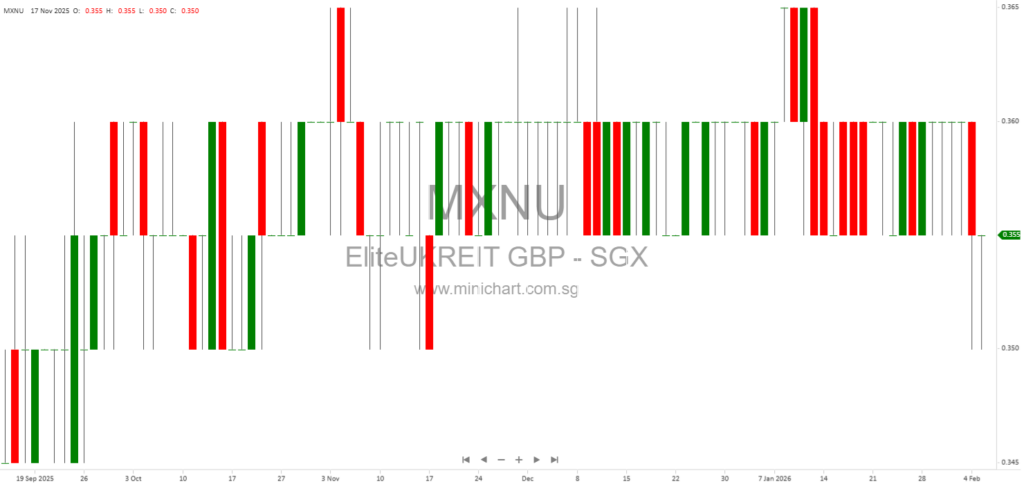

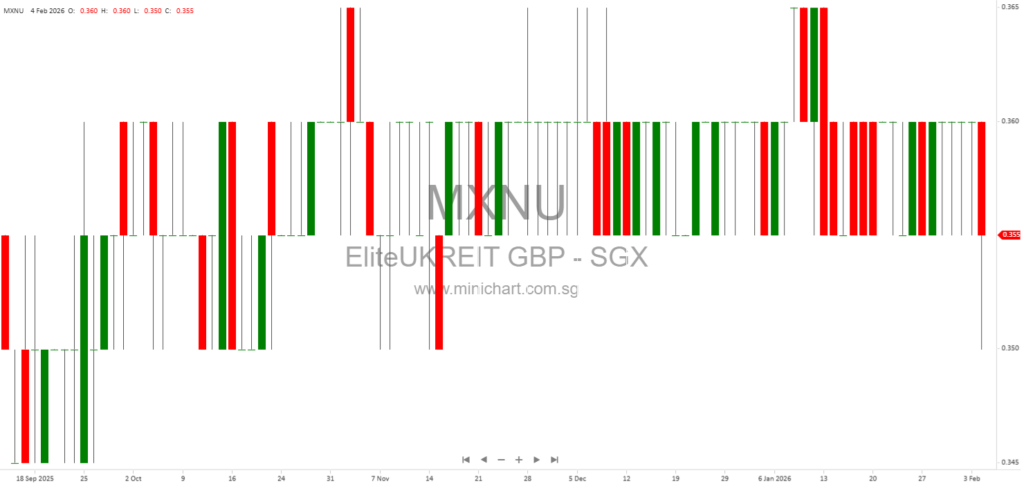

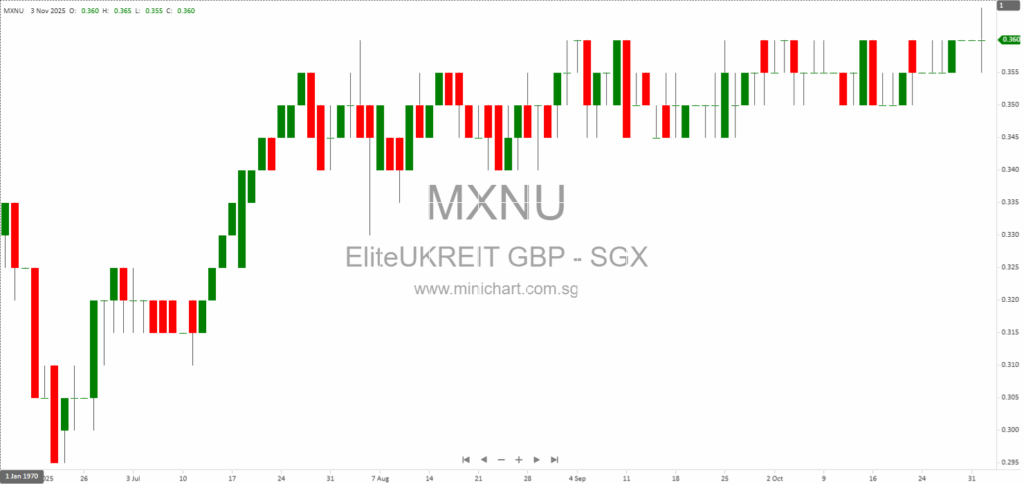

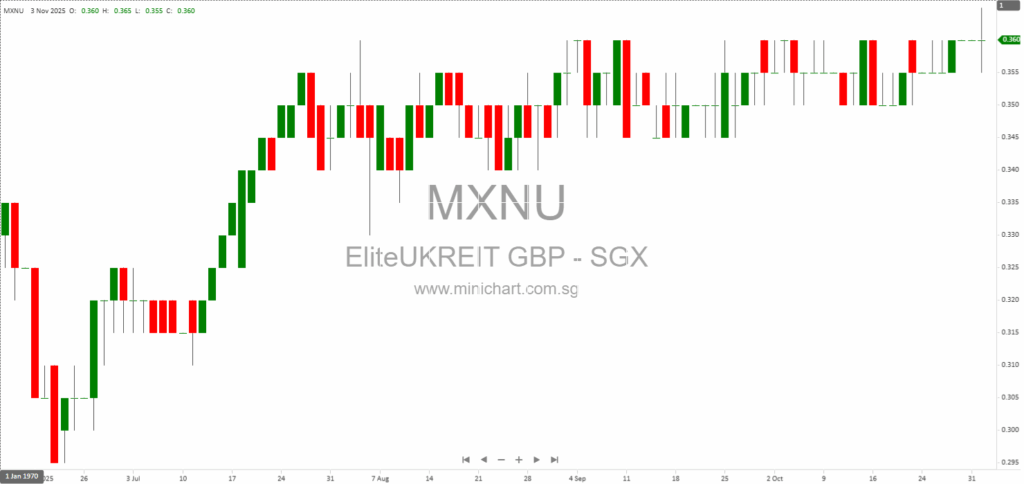

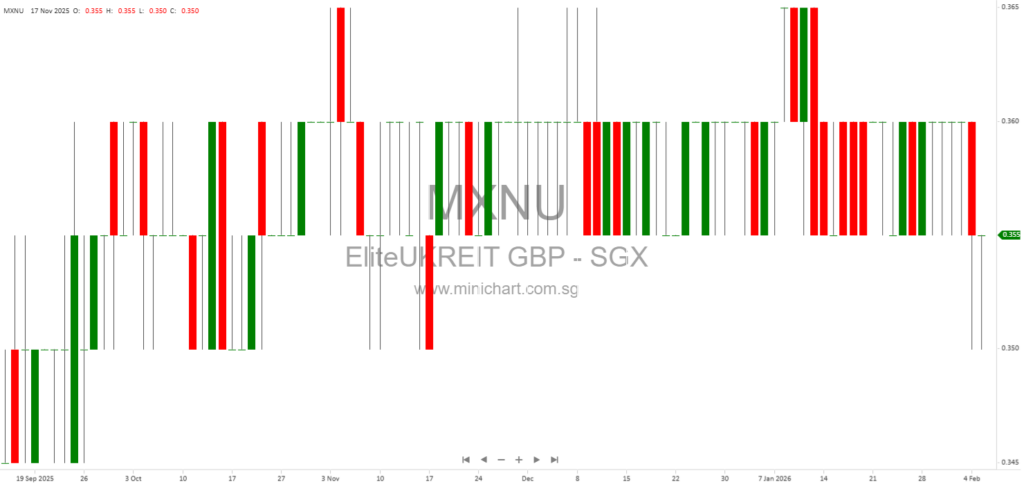

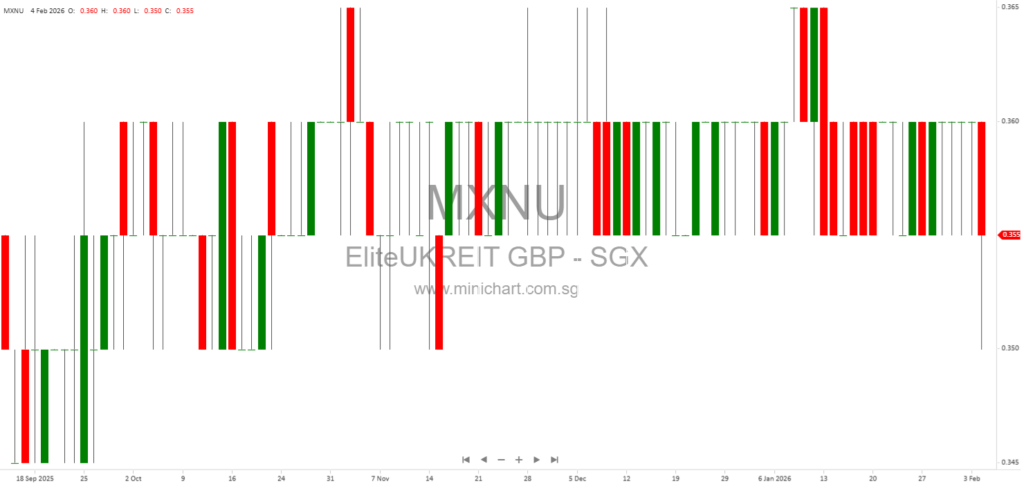

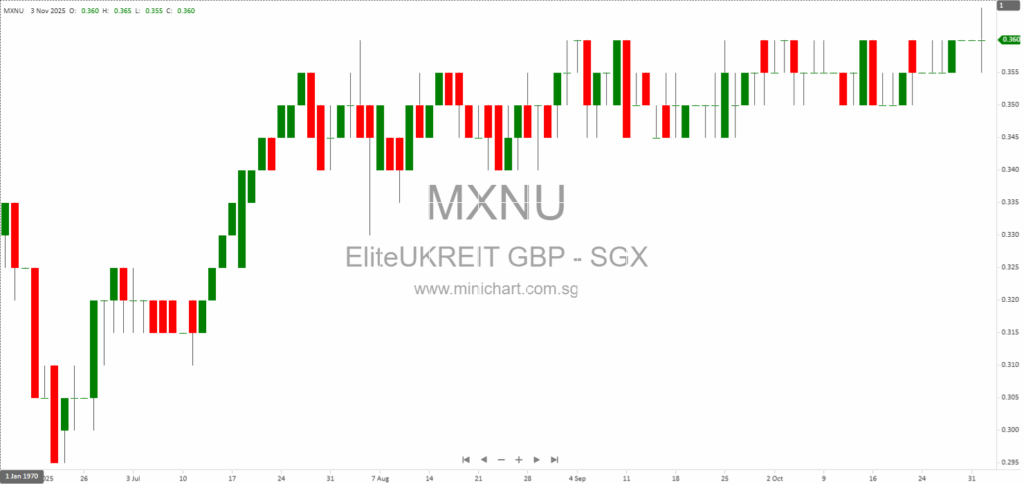

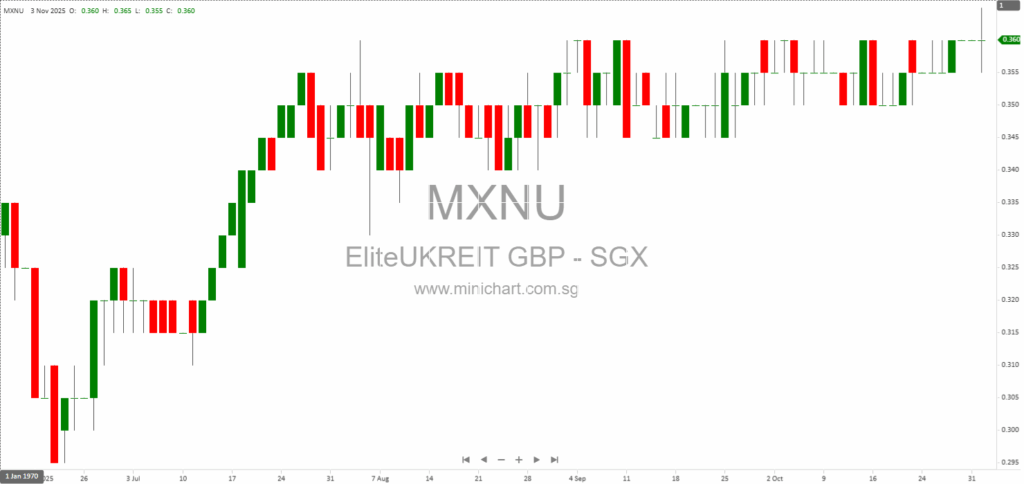

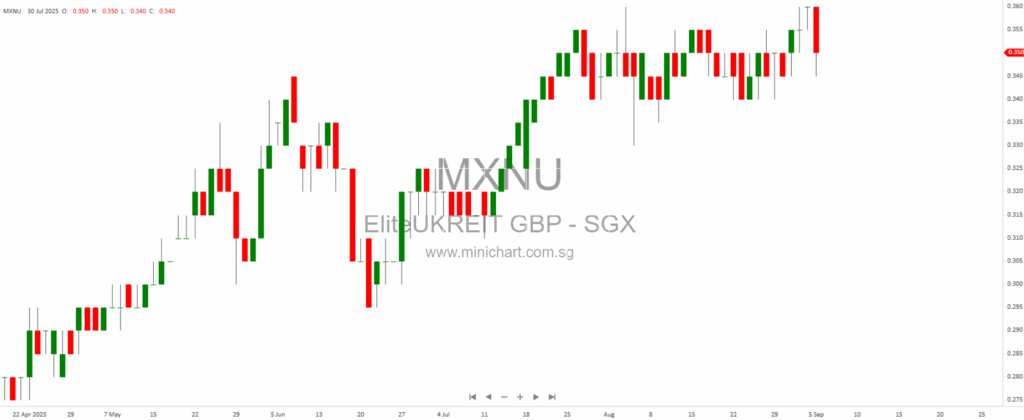

📈 Elite UK REIT Historical Chart

🧾 Recent Financial Statement Analysis

February 9, 2026

Elite UK REIT FY2025 Financial Results: A Detailed Investor Analysis Elite UK REIT has released its FY2025 financial results, highlighting strong operational performance, strategic portfolio management, and robust distribution growth. Below, we provide a structured breakdown of the key financial…

February 5, 2026

Elite UK REIT Secures £24.3 Million Government Lease Extensions: Key Details for Investors Elite UK REIT Secures £24.3 Million Government Lease Extensions: Key Details for Investors Overview Elite UK REIT Management Pte. Ltd., the manager of Elite UK REIT, has…

February 5, 2026

Elite UK REIT Secures Major Lease Regear with UK Government: Key Outcomes for Investors Elite UK REIT Announces Major Lease Regear with UK Government Overview: Significant Lease Regear with DWP Elite UK REIT has announced the successful execution of new…

November 4, 2025

Elite UK REIT Delivers Robust DPU Growth, Strategic Asset Repositioning, and Solid Balance Sheet in 9M 2025 Elite UK REIT Delivers Robust DPU Growth, Strategic Asset Repositioning, and Solid Balance Sheet in 9M 2025 Key Financial Highlights Distribution Per Unit…

November 4, 2025

Elite UK REIT Delivers Strong Growth, Expands into Student Housing and Data Centres: Major Moves Signal Upside for Investors Key Highlights from Elite UK REIT’s 3Q 2025 Business Update Elite UK REIT, a UK-focused real estate investment trust listed in…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: MXNU, Elite UK REIT

February 9, 2026

Elite UK REIT FY2025 Financial Results: A Detailed Investor Analysis Elite UK REIT has released its FY2025 financial results, highlighting strong operational performance, strategic portfolio management, and robust distribution growth. Below, we provide a structured breakdown of the key financial…

February 5, 2026

Elite UK REIT Secures £24.3 Million Government Lease Extensions: Key Details for Investors Elite UK REIT Secures £24.3 Million Government Lease Extensions: Key Details for Investors Overview Elite UK REIT Management Pte. Ltd., the manager of Elite UK REIT, has…

February 5, 2026

Elite UK REIT Secures Major Lease Regear with UK Government: Key Outcomes for Investors Elite UK REIT Announces Major Lease Regear with UK Government Overview: Significant Lease Regear with DWP Elite UK REIT has announced the successful execution of new…

January 8, 2026

Broker Name: PSPL Date of Report: (Date not explicitly stated in the document; inferred to be post-November 2025 based on mentioned data.) Excerpt from PSPL report. Report Summary Elite UK REIT is undergoing lease regearing, with around 95.7% of leases…

November 20, 2025

Broker Name: KGI Securities (Singapore) Pte. Ltd. Date of Report: November 19, 2025 Excerpt from KGI Securities (Singapore) report. Report Summary Elite UK REIT delivered robust distributable income growth (+6.2% YoY) and increased DPU (+9.4% YoY) in 9M25, supported by…

November 5, 2025

Broker Name: CGS International Date of Report: November 4, 2025 Excerpt from CGS International report. Report Summary Elite UK REIT reported strong 9M25 results, with DPU up 9.4% year-on-year and distributable income rising 6.2%, supported by interest cost savings and…

November 4, 2025

Lim & Tan Securities, 4 November 2025 Excerpt from Lim & Tan Securities report. Report Summary: The Singapore market (FSSTI) continues its strong performance, with a 17.3% year-to-date gain. Major global indices also remain robust, led by tech-heavy benchmarks. Elite…

November 4, 2025

Elite UK REIT Delivers Robust DPU Growth, Strategic Asset Repositioning, and Solid Balance Sheet in 9M 2025 Elite UK REIT Delivers Robust DPU Growth, Strategic Asset Repositioning, and Solid Balance Sheet in 9M 2025 Key Financial Highlights Distribution Per Unit…

November 4, 2025

Elite UK REIT Delivers Strong Growth, Expands into Student Housing and Data Centres: Major Moves Signal Upside for Investors Key Highlights from Elite UK REIT’s 3Q 2025 Business Update Elite UK REIT, a UK-focused real estate investment trust listed in…

September 7, 2025

Elite UK REIT Strengthens Balance Sheet, Eyes Growth in Living Assets and Data Centres SGX:MXNU.SI:Elite UK REITSGX:D05.SI:DBS Group Elite UK REIT, the only UK-focused REIT listed in Singapore, has brought its net gearing down by 680 basis points to 40.7%…