📊 Statistics

- Analyst 1 Year Price Target:

$1.45

- Upside/Downside from Analyst Target:

11.23%

- Broker Call:

11

- Dividend Minimum 3 Year Yield:

5.40%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

2026-04-29

-

EPS Estimate:

0.02

💰 Dividend History

Current year to date yield:

10.76%

📅 SGX Earnings Announcements for M44U

Mapletree Logistics Trust (M44U)

Market: SGX |

Currency: SGD

Address: 10 Pasir Panjang Road

MLT, the first Asia Pacific-focused logistics REIT in Singapore, was listed on the SGX-ST Main Board on 28 July 2005. MLT's principal strategy is to invest in a diversified portfolio of income-producing logistics real estate and real estate-related assets. As at 30 September 2025, it has a portfolio of 175 properties in Singapore, Australia, China, Hong Kong SAR, India, Japan, Malaysia, South Korea and Vietnam with assets under management of S$13.0 billion. MLT is managed by Mapletree Logistics Trust Management Ltd., a wholly owned subsidiary of Mapletree Investments Pte Ltd.

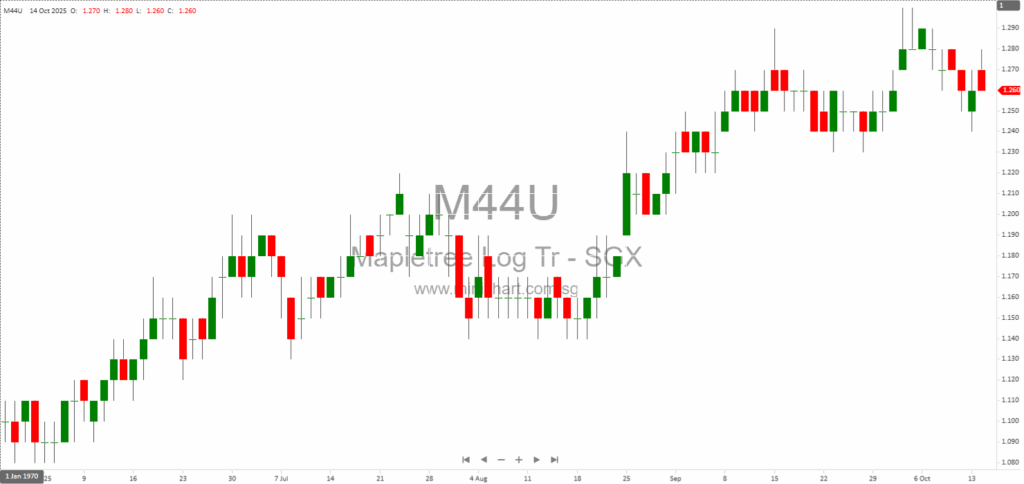

📈 Mapletree Logistics Trust Historical Chart

🧾 Recent Financial Statement Analysis

January 26, 2026

Mapletree Logistics Trust: 3Q FY25/26 Financial Analysis and Investor Insights Mapletree Logistics Trust (MLT) has released its financial results for the third quarter of FY25/26. This article provides a structured analysis of the key financial highlights, trends, and strategic developments…

January 22, 2026

Mapletree Logistics Trust: Disclosure of Debt Facility Conditions – Key Investor Update Mapletree Logistics Trust Announces Key Debt Facility Conditions: Potential Impact on Shareholders Mapletree Logistics Trust Management Ltd. (MLTM), the manager of Mapletree Logistics Trust (MLT), has issued an…

January 12, 2026

Mapletree Logistics Trust (MLT): Third Quarter FY25/26 Financial Results Announcement Mapletree Logistics Trust Management Ltd., the Manager of Mapletree Logistics Trust (“MLT”), has announced that the financial results for the third quarter of the financial year 2025/2026, ended 31 December…

January 9, 2026

Mapletree Logistics Trust 2Q & 1H FY25/26 Financial Results: Key Insights and Outlook Mapletree Logistics Trust Delivers Resilient 2Q & 1H FY25/26 Results Amid Headwinds Highlights, Strategic Moves, and Investor Implications Mapletree Logistics Trust (MLT), Asia Pacific's first listed logistics…

October 14, 2025

Mapletree Logistics Trust: Announcement of 2Q & 1H FY2025/2026 Financial Results Mapletree Logistics Trust Management Ltd. ("MLT") has provided an official announcement regarding the upcoming release of its financial results for the Second Quarter and First Half of Financial Year…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: M44U, Mapletree Logistics Trust

January 28, 2026

Lim & Tan Securities, 28 January 2026 Excerpt from Lim & Tan Securities report. The Singapore market (FSSTI) is up 6.0% year-to-date, reaching a 52-week high, with mixed performances across global indices and commodities. Grand Banks Yachts (GBY) is highlighted…

January 28, 2026

Broker Name: Maybank Research Pte Ltd Date of Report: January 27, 2026 Excerpt from Maybank Research Pte Ltd report. Report Summary Mapletree Logistics Trust (MLT) reported a stable 3Q26 distribution per unit (DPU) of SGD1.816 cents, up 0.1% quarter-on-quarter, but…

January 28, 2026

Broker Name: UOB Kay Hian Date of Report: 28 January 2026 Excerpt from UOB Kay Hian report. Report Summary Mapletree Logistics Trust (MLT) reported 3QFY26 DPU of 1.816 S cents, down 9.3% year-on-year, mainly due to the cessation of divestment…

January 28, 2026

Lim & Tan Securities, 28 January 2026 Excerpt from Lim & Tan Securities report. The FSSTI Index rose to a 52-week high, with Singapore and most major markets showing YTD gains, though US stocks closed mixed. Grand Banks Yachts (GBY)…

January 28, 2026

Broker Name: Maybank Research Pte Ltd Date of Report: January 27, 2026 Excerpt from Maybank Research Pte Ltd report. Mapletree Logistics Trust (MLT) delivered a stable 3Q FY26 performance with a slight quarterly increase in distribution per unit (DPU), but…

January 28, 2026

Broker Name: DBS Date of Report: (Date not specified in document; inferred to be latest post-3QFY26 results) Excerpt from DBS report. Report Summary Mapletree Logistics Trust (MLT) reported 3QFY26 DPU of 1.817 Scts, stable quarter-on-quarter and above internal expectations, driven…

January 27, 2026

Broker Name: CGS International Date of Report: January 27, 2026 Excerpt from CGS International report. Report Summary Mapletree Logistics Trust’s (MLT) 3Q/9MFY26 DPU was broadly in line with expectations, with rental reversions staying positive outside China and negative trends in…

January 27, 2026

Broker Name: CGS International Date of Report: January 27, 2026 Excerpt from CGS International report. Report Summary Mapletree Logistics Trust (MLT) reported a 3.1% year-on-year drop in 3QFY26 revenue and a 9.3% decline in DPU, mainly due to divestments and…

January 26, 2026

Mapletree Logistics Trust: 3Q FY25/26 Financial Analysis and Investor Insights Mapletree Logistics Trust (MLT) has released its financial results for the third quarter of FY25/26. This article provides a structured analysis of the key financial highlights, trends, and strategic developments…

January 22, 2026

Mapletree Logistics Trust: Disclosure of Debt Facility Conditions – Key Investor Update Mapletree Logistics Trust Announces Key Debt Facility Conditions: Potential Impact on Shareholders Mapletree Logistics Trust Management Ltd. (MLTM), the manager of Mapletree Logistics Trust (MLT), has issued an…