📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

1.91%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

2026-02-26

💰 Dividend History

Current year to date yield:

1.91%

📅 SGX Earnings Announcements for LJ3

OUE Limited (LJ3)

Market: SGX |

Currency: SGD

Address: 50 Collyer Quay

OUE Limited operates as a real estate development, investment, and management company in Singapore, the People's Republic of China, Japan, and Indonesia. It operates through Real Estate, Healthcare, and Others segments. The Real Estate segment comprises investment properties and fund management business, including rental of investment properties and management of real estate funds and investment properties under development; hospitality business, such as operation of hotels and hotel management; and development properties business, which engages in the sale of residential properties and other properties under development. Its Healthcare segment is involved in the operation of investment holdings, development of medical real estate, healthcare-related assets, and integrated mixed-use developments; and provision of healthcare services and management of healthcare investment trusts. The Others segment operates food and beverage outlets and consumer-related investments. The company was formerly known as Overseas Union Enterprise Limited. OUE Limited was incorporated in 1964 and is headquartered in Singapore. OUE Limited is a subsidiary of Oue Realty Pte Ltd.

Show more

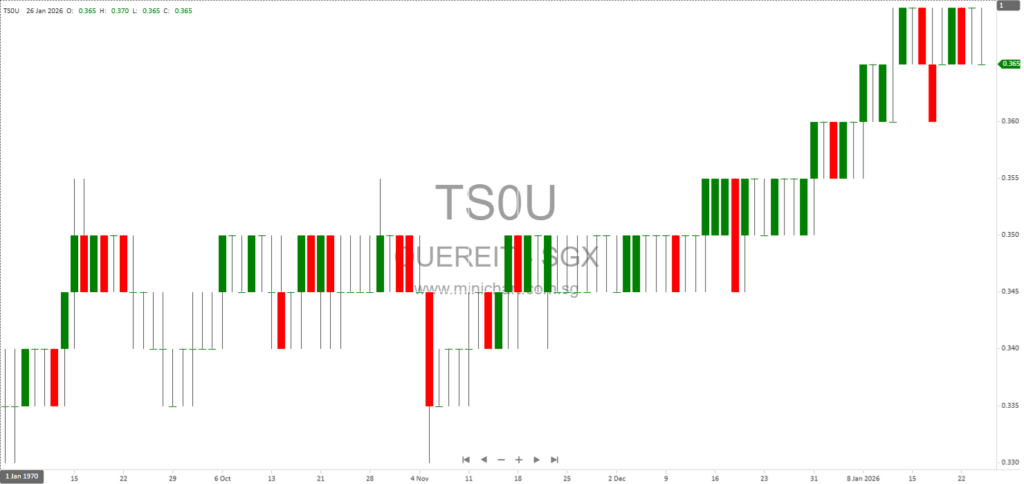

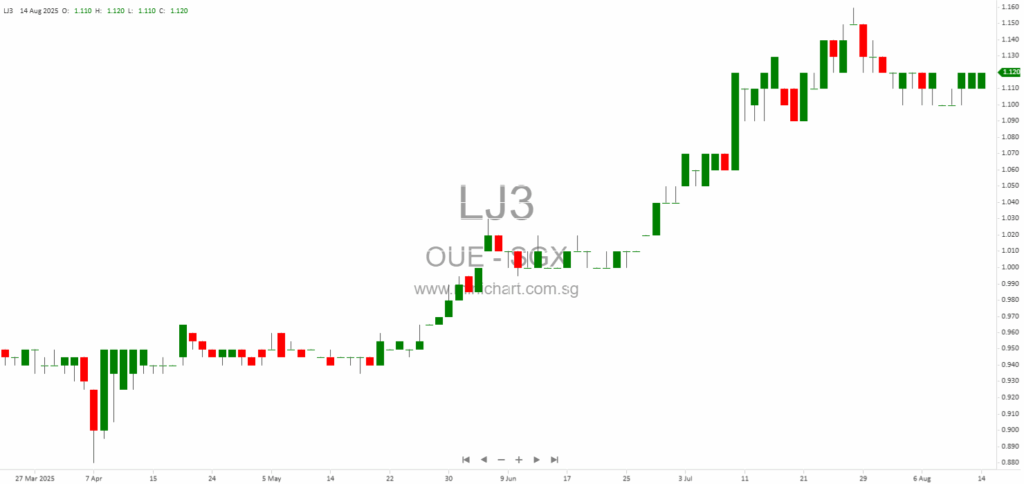

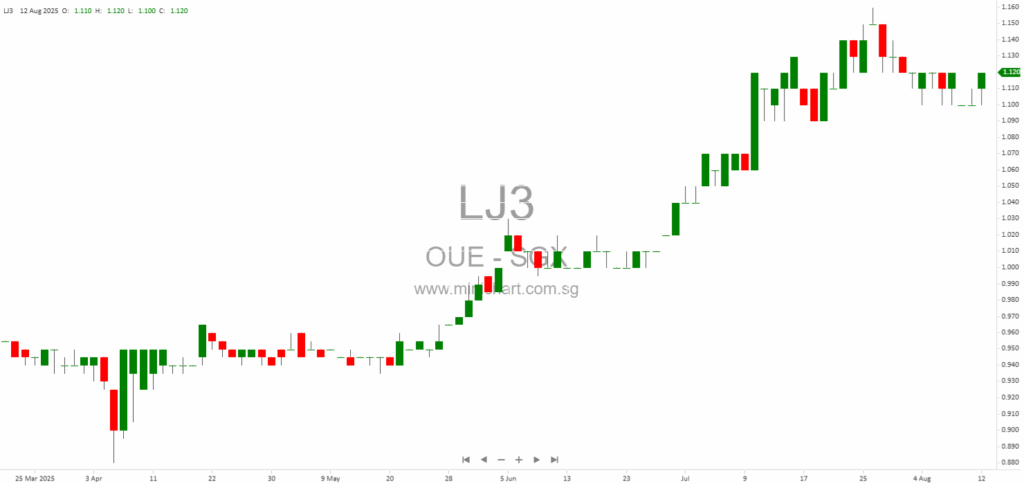

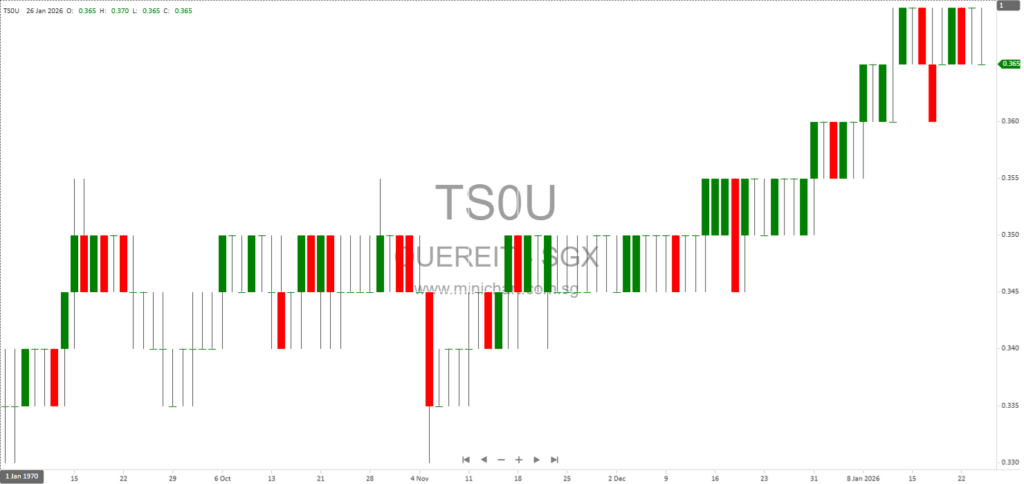

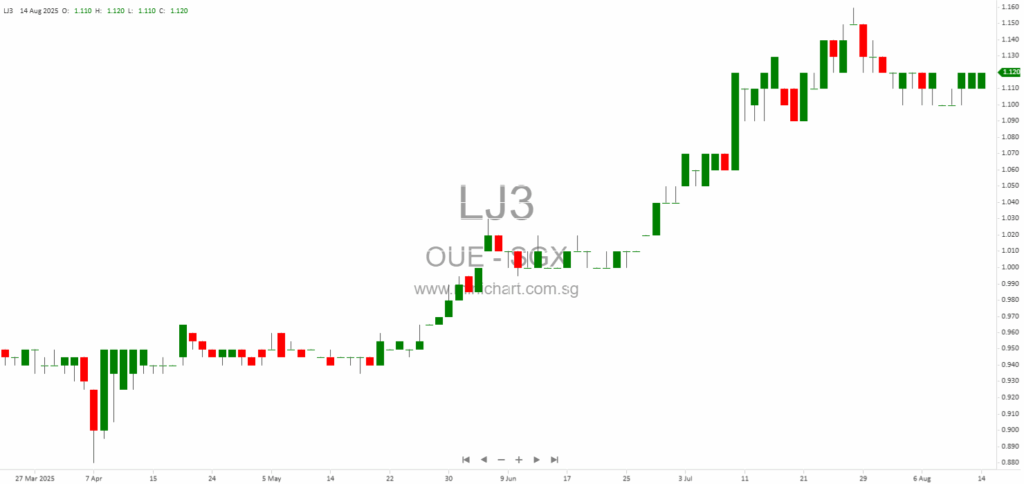

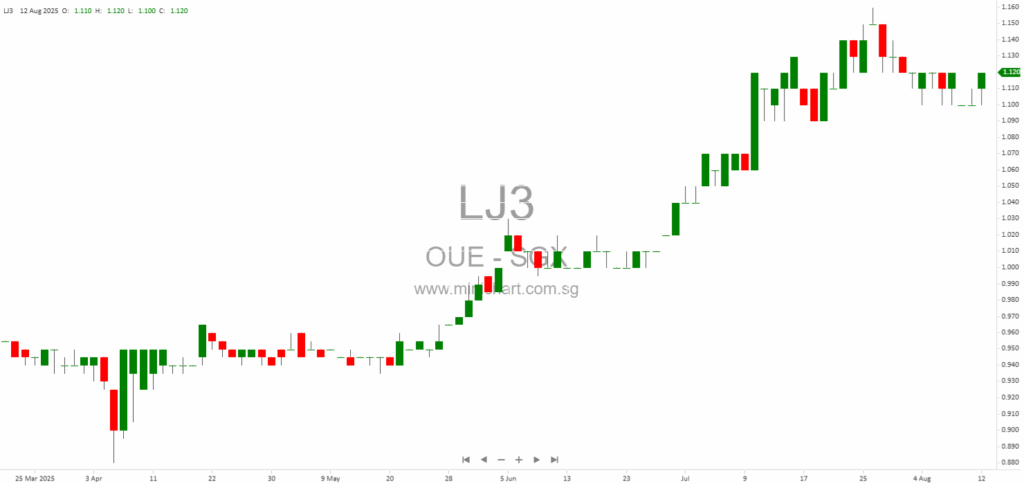

📈 OUE Limited Historical Chart

🧾 Recent Financial Statement Analysis

February 13, 2026

OUE Limited: FY2025 Profit Guidance and Financial Performance Update OUE Limited has issued a profit guidance for the financial year ended 31 December 2025. The company expects to post a loss attributable to shareholders, driven by several significant non-cash items,…

January 26, 2026

OUE REIT FY2025 Financial Analysis: Robust DPU Growth and Strategic Asset Management OUE Real Estate Investment Trust (OUE REIT) has released its financial results for the six months and full year ended 31 December 2025. The report highlights the trust’s…

January 14, 2026

OUE REIT Discloses Facility Agreement with Ownership-Linked Covenants OUE REIT Announces S\$45 Million Unsecured Facility Agreement with Ownership-Linked Covenants Key Highlights OUE REIT secures a S\$45 million unsecured facility via a Facility Agreement dated 14 January 2026. Purpose of the…

January 5, 2026

OUE Real Estate Investment Trust: Financial Results Announcement OUE Real Estate Investment Trust (OUE REIT), managed by OUE REIT Management Pte. Ltd., has released a notice regarding the upcoming disclosure of its unaudited financial results for the second half and…

December 25, 2025

Key Highlights Acquisition Completion Date: 24 December 2025 Stake Acquired: Approximately 19.32% of the total issued share capital of OUE Healthcare Limited (OUEH) Seller: Browny Healthcare Pte. Ltd. Number of Shares Acquired: 858,412,248 ordinary shares in OUEH Announcement Date: 16…

December 17, 2025

OUE Limited to Increase Stake in OUE Healthcare Limited Through S\$20.7 Million Share Acquisition OUE Limited to Boost Ownership in OUE Healthcare Limited via S\$20.7 Million Share Acquisition Key Highlights OUE Limited, via its wholly-owned subsidiary Treasure International Holdings Pte.…

August 14, 2025

OUE Limited Boosts Stakes in OUE REIT and First REIT: What It Means for Shareholders in 2025 OUE Limited Boosts Stakes in OUE REIT and First REIT: What It Means for Shareholders in 2025 Key Points From the Announcement OUE…

August 12, 2025

OUE Limited Completes Joint Venture with Tokyo Century for Landmark Hotel at Changi Airport Terminal 2 Key Points for Retail Investors OUE Limited has officially completed a joint venture with Tokyo Century Corporation, focusing on the development of a new…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: LJ3, OUE Limited, OUE, OUE SP, OUE LTD

February 13, 2026

OUE Limited: FY2025 Profit Guidance and Financial Performance Update OUE Limited has issued a profit guidance for the financial year ended 31 December 2025. The company expects to post a loss attributable to shareholders, driven by several significant non-cash items,…

January 30, 2026

Broker: Maybank Research Pte Ltd Date of Report: 30 January 2026 Excerpt from Maybank Research Pte Ltd report. Report Summary OUE REIT and Mapletree Logistics Trust both reported improved performance, driven by lower finance costs, resilient rental reversion, and effective…

January 28, 2026

Broker Name: DBS Date of Report: Inferred as early 2025 (latest company data cited is FY25) Excerpt from DBS report. Report Summary A severe US winter storm is causing temporary disruptions in energy supply and air travel; DBS remains constructive…

January 28, 2026

Broker Name: CGS International Date of Report: January 28, 2026 Excerpt from CGS International report. Report Summary OUE REIT’s FY25 distribution per unit outperformed estimates, driven by strong commercial office performance, finance cost savings, and a rebound in hospitality, with…

January 28, 2026

Broker: CGS International Date of Report: January 28, 2026 Excerpt from CGS International report. Report Summary OUE REIT delivered a strong FY25, with a Distribution Per Unit (DPU) of 2.23 Singapore cents, exceeding expectations due to a hospitality rebound, finance…

January 28, 2026

Broker: DBS Date of Report: 26 Jan 2026 Excerpt from DBS report. Report Summary OUE REIT’s FY25 DPU rose 8.3% year-on-year to 2.23 Scts, beating DBS and consensus estimates by about 10%, mainly due to lower-than-expected finance costs. Cost of…

January 27, 2026

Lim & Tan Securities, 27 January 2026 Excerpt from Lim & Tan Securities report. Singapore’s FSSTI Index rose 4.6% year-to-date, with strong momentum in technology, banking, and manufacturing sectors. Innotek, a key Nvidia supplier, surged 42% YTD but is now…

January 26, 2026

OUE REIT FY2025 Financial Analysis: Robust DPU Growth and Strategic Asset Management OUE Real Estate Investment Trust (OUE REIT) has released its financial results for the six months and full year ended 31 December 2025. The report highlights the trust’s…

January 14, 2026

OUE REIT Discloses Facility Agreement with Ownership-Linked Covenants OUE REIT Announces S\$45 Million Unsecured Facility Agreement with Ownership-Linked Covenants Key Highlights OUE REIT secures a S\$45 million unsecured facility via a Facility Agreement dated 14 January 2026. Purpose of the…

January 5, 2026

OUE Real Estate Investment Trust: Financial Results Announcement OUE Real Estate Investment Trust (OUE REIT), managed by OUE REIT Management Pte. Ltd., has released a notice regarding the upcoming disclosure of its unaudited financial results for the second half and…

December 25, 2025

Key Highlights Acquisition Completion Date: 24 December 2025 Stake Acquired: Approximately 19.32% of the total issued share capital of OUE Healthcare Limited (OUEH) Seller: Browny Healthcare Pte. Ltd. Number of Shares Acquired: 858,412,248 ordinary shares in OUEH Announcement Date: 16…

December 17, 2025

OUE Limited to Increase Stake in OUE Healthcare Limited Through S\$20.7 Million Share Acquisition OUE Limited to Boost Ownership in OUE Healthcare Limited via S\$20.7 Million Share Acquisition Key Highlights OUE Limited, via its wholly-owned subsidiary Treasure International Holdings Pte.…

August 14, 2025

OUE Limited Boosts Stakes in OUE REIT and First REIT: What It Means for Shareholders in 2025 OUE Limited Boosts Stakes in OUE REIT and First REIT: What It Means for Shareholders in 2025 Key Points From the Announcement OUE…

August 12, 2025

OUE Limited Completes Joint Venture with Tokyo Century for Landmark Hotel at Changi Airport Terminal 2 Key Points for Retail Investors OUE Limited has officially completed a joint venture with Tokyo Century Corporation, focusing on the development of a new…