📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

50-100%

- Net Income Growth Range (1Y):

50-100%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

2026-03-12

💰 Dividend History

Current year to date yield:

1.09%

📅 SGX Earnings Announcements for K03

Khong Guan Limited (K03)

Market: SGX |

Currency: SGD

Address: No. 03-01 Khong Guan Building

Khong Guan Limited, an investment holding company, engages in trading of wheat flour and other edible products in Singapore and Malaysia. It operates through Trading of Wheat Flour and Consumer Goods; and Others segment. The company offers wheat flour, biscuits, oatmeal, pulses, cereals, and other consumer goods. It also trades in shares listed primarily in Singapore and Malaysia. In addition, the company exports its products. The company was formerly known as Khong Guan Flour Milling Limited and changed its name to Khong Guan Limited in November 2016. Khong Guan Limited was incorporated in 1960 and is based in Singapore.

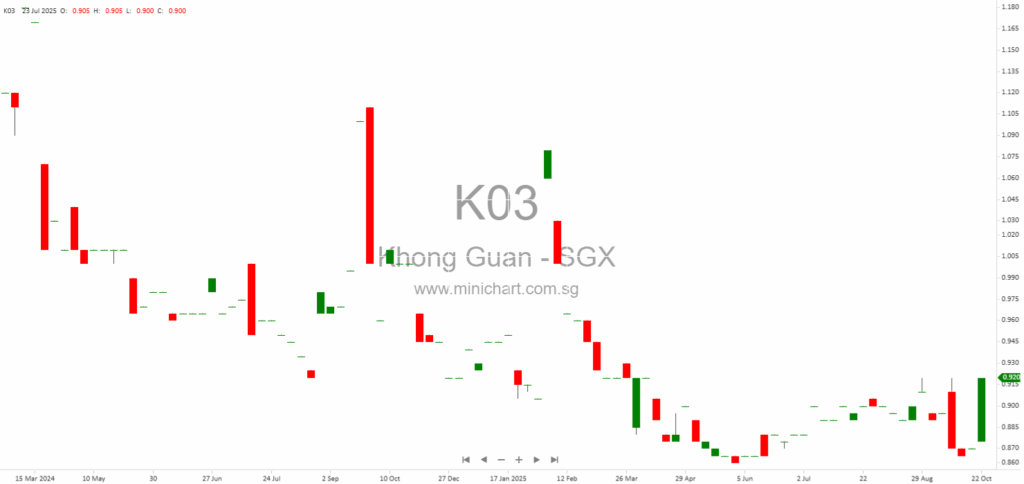

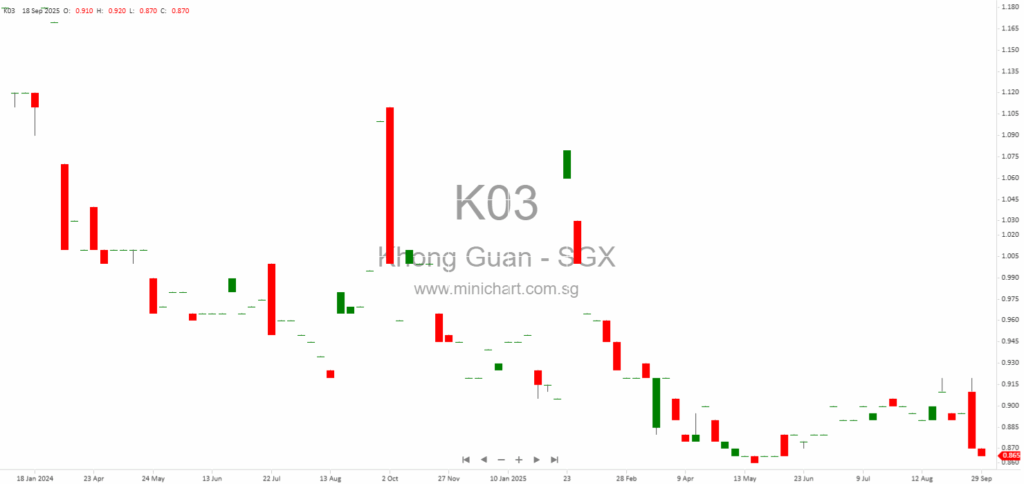

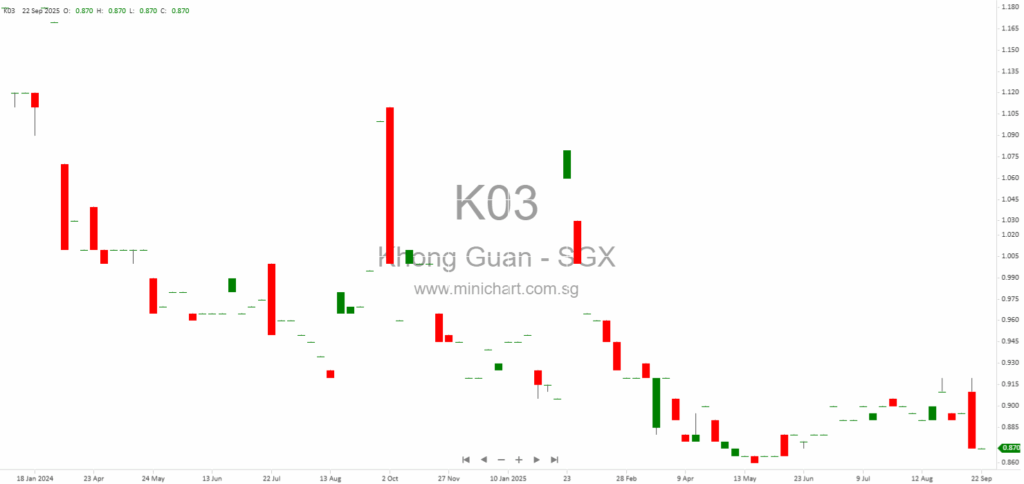

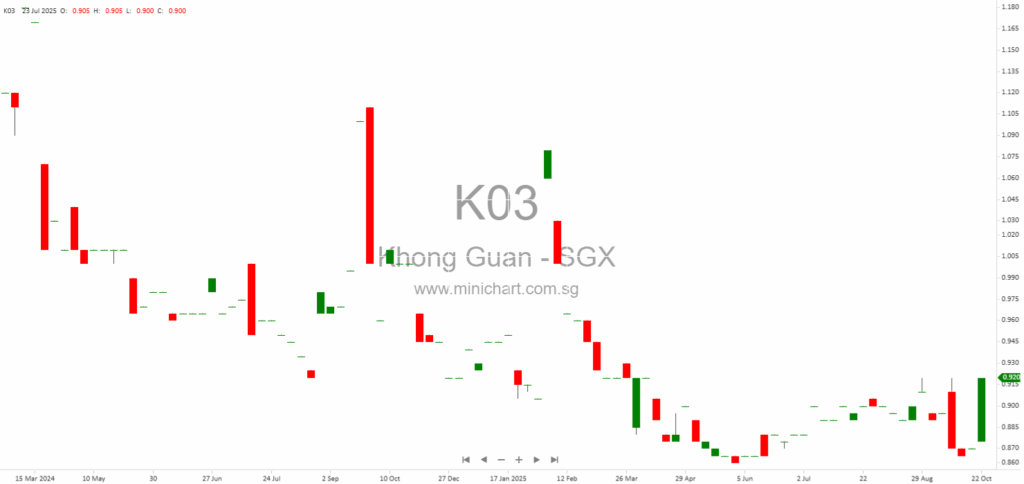

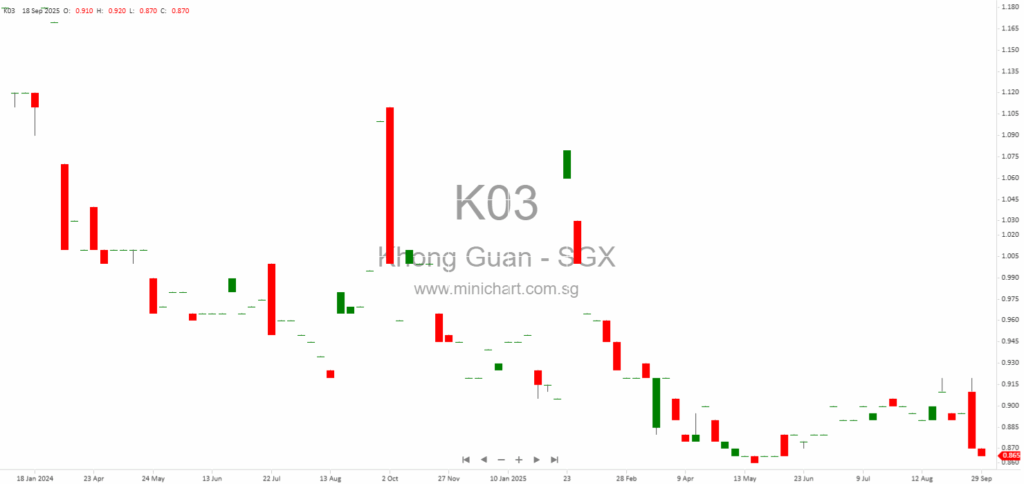

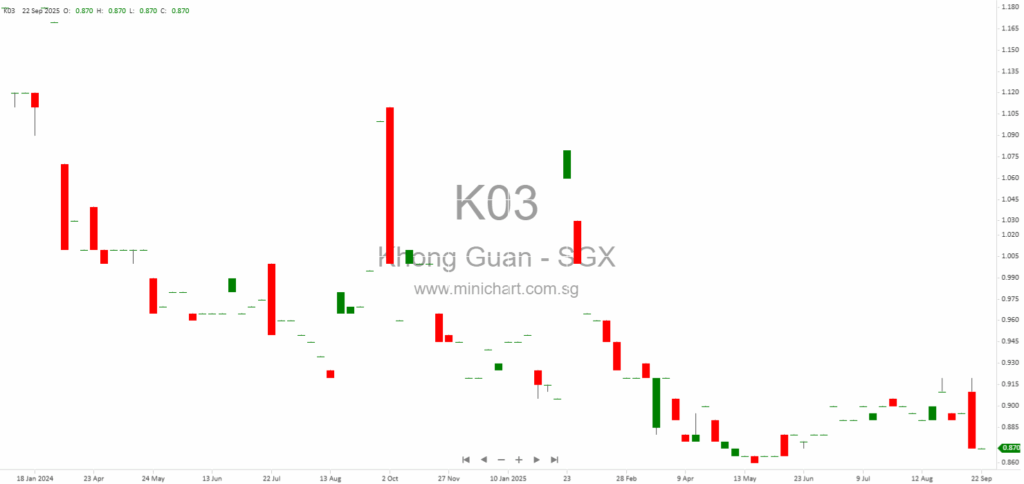

📈 Khong Guan Limited Historical Chart

🧾 Recent Financial Statement Analysis

December 27, 2025

Khong Guan Limited Holds 2025 AGM: Detailed Investor Update and Key Insights Introduction Khong Guan Limited ("KGL") convened its Annual General Meeting (AGM) on 27 November 2025, providing crucial operational updates and addressing shareholder concerns about performance, strategy, and governance.…

November 10, 2025

Khong Guan Limited: Analysis of Material Variances in FY2025 Audited Results Khong Guan Limited has released an announcement highlighting material variances between its audited and unaudited financial statements for the financial year ended 31 July 2025. The Board of Directors…

September 29, 2025

Khong Guan Limited FY2025 Financial Results: Cautious Optimism Amidst Market Challenges Khong Guan Limited, a Singapore-listed food manufacturing and trading group, released its results for the full year ended 31 July 2025. The group’s operations are primarily in Malaysia and…

September 22, 2025

Khong Guan Limited: FY2025 Profit Guidance and Outlook Khong Guan Limited has issued a profit guidance announcement for the financial year ended 31 July 2025 (FY2025). The company expects to report a net loss for FY2025, citing several operational challenges…

November 13, 2024

Financial Analysis of Khong Guan Limited Financial Analysis of Khong Guan Limited Business Description Khong Guan Limited is primarily engaged in investment holding and general trading. The company's operations include the trading of wheat flour, rolled oats, other edible products…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: K03, Khong Guan Limited, Khong Guan, KGL SP, KHONG GUAN LTD, KHONG GUAN

December 27, 2025

Khong Guan Limited Holds 2025 AGM: Detailed Investor Update and Key Insights Introduction Khong Guan Limited ("KGL") convened its Annual General Meeting (AGM) on 27 November 2025, providing crucial operational updates and addressing shareholder concerns about performance, strategy, and governance.…

November 10, 2025

Khong Guan Limited: Analysis of Material Variances in FY2025 Audited Results Khong Guan Limited has released an announcement highlighting material variances between its audited and unaudited financial statements for the financial year ended 31 July 2025. The Board of Directors…

September 29, 2025

Khong Guan Limited FY2025 Financial Results: Cautious Optimism Amidst Market Challenges Khong Guan Limited, a Singapore-listed food manufacturing and trading group, released its results for the full year ended 31 July 2025. The group’s operations are primarily in Malaysia and…

September 22, 2025

Khong Guan Limited: FY2025 Profit Guidance and Outlook Khong Guan Limited has issued a profit guidance announcement for the financial year ended 31 July 2025 (FY2025). The company expects to report a net loss for FY2025, citing several operational challenges…

November 13, 2024

Financial Analysis of Khong Guan Limited Financial Analysis of Khong Guan Limited Business Description Khong Guan Limited is primarily engaged in investment holding and general trading. The company's operations include the trading of wheat flour, rolled oats, other edible products…

November 13, 2024

Khong Guan Limited: Analysis of Financial Performance and Investment Recommendations Khong Guan Limited: Analysis of Financial Performance and Investment Recommendations Business Description Khong Guan Limited is engaged in the trading of wheat flour and other edible products, and investment holding.…

September 28, 2024

1. Key Facts from the Report:Reporting Period: This report covers the six months and full year ended on 31 July 2024.Financial Overview:Revenue: Decreased by 2% to $70.16 million from $71.92 million in the previous year.Net Loss: The Group reported a…