📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

1.79%

- EPS Growth Range (1Y):

10-25%

- Net Income Growth Range (1Y):

10-25%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

1.79%

📅 SGX Earnings Announcements for HQU

Oiltek International Limited (HQU)

Market: SGX |

Currency: SGD

Address: Jalan Pasaran 23/5

Oiltek International Limited, an investment holding company, engages in the supply and provision of engineering design and commissioning of oil extraction equipment and plant in Asia, the United States, and Africa. It operates through three segments: Edible & Non-Edible Oil Refinery, Renewable Energy, and Product Sales and Trading. The company is involved in engineering, procurement, design, construction, and commissioning of edible and non-edible oil refining plants, downstream specialty products, processing plants, multi-feedstock biodiesel, enzymatic biodiesel, hydrogenated vegetable oil feedstock, winter fuel, and palm oil mill effluent biogas methane recovery plants; upgrading and retrofitting of existing facilities; and turnkey inside and outside-battery-limits infrastructure engineering, which comprises environmental solutions and integration into steam and power generation. It also engages in the sale of engineering components; and trading of specialty chemical products, as well as provision of agency and distributorship services. The company was founded in 1980 and is based in Shah Alam, Malaysia. Oiltek International Limited is a subsidiary of Koh Brothers Eco Engineering Limited.

Show more

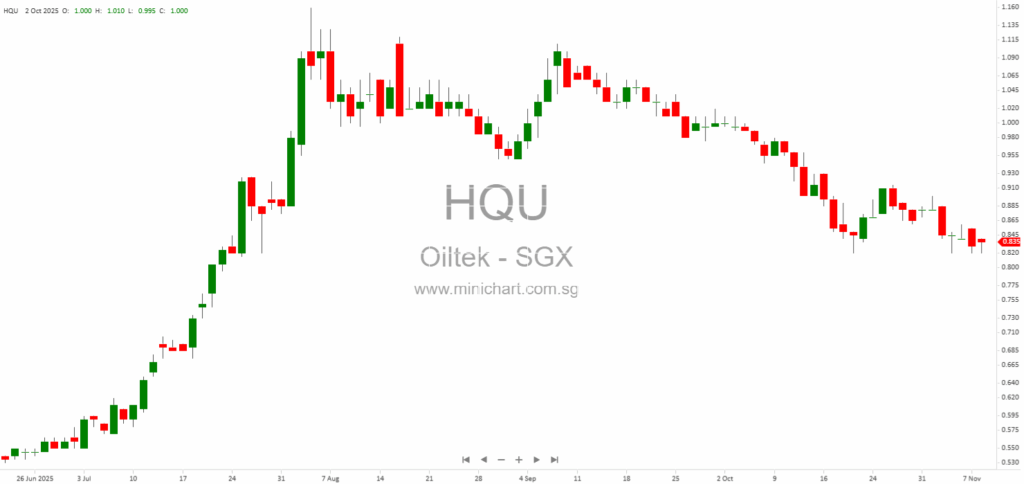

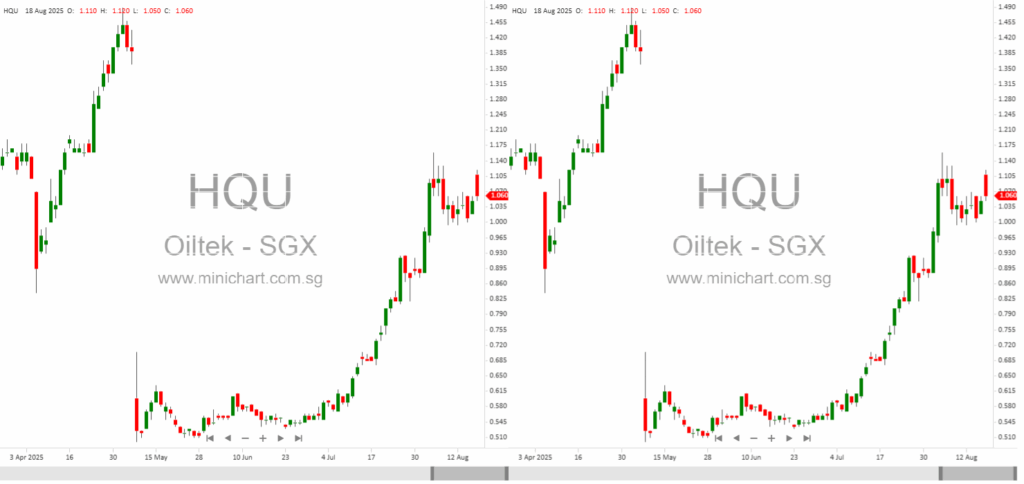

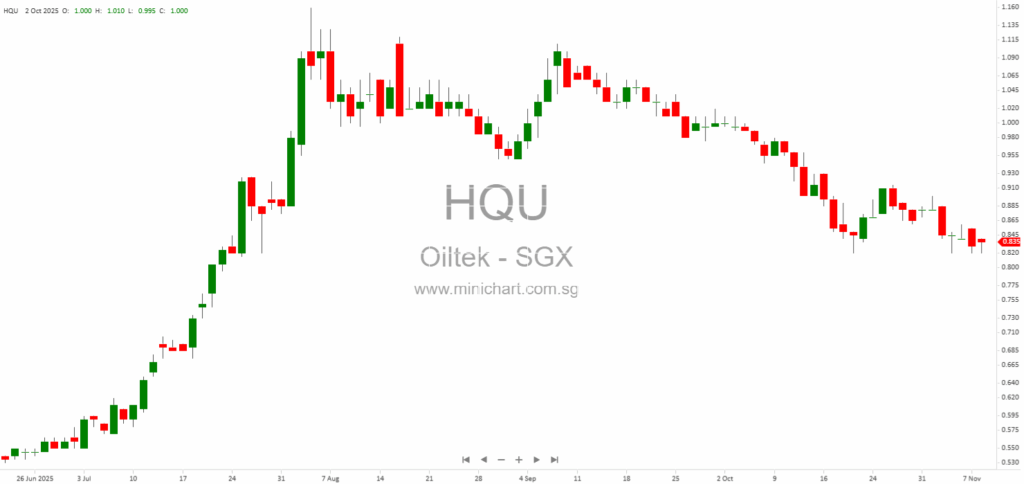

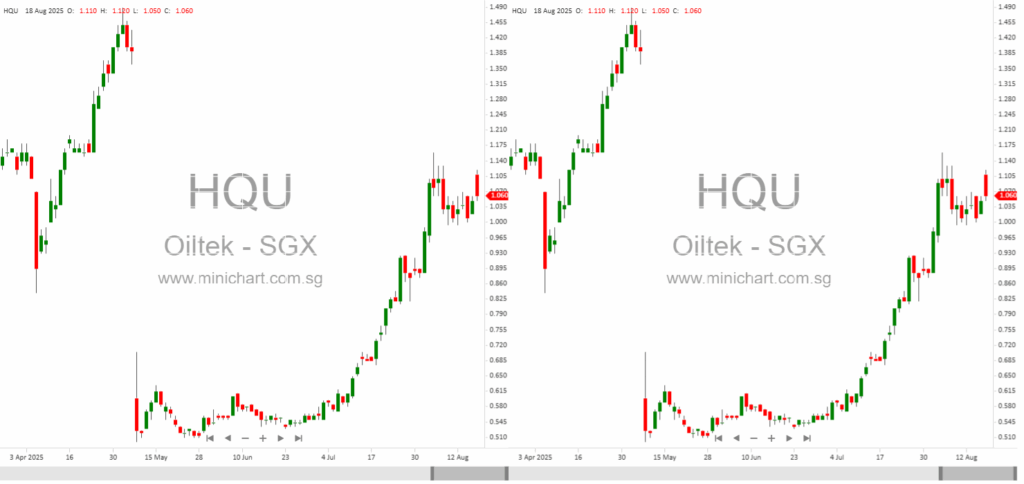

📈 Oiltek International Limited Historical Chart

🧾 Recent Financial Statement Analysis

February 10, 2026

Oiltek International Limited: FY2025 Financial Review and Investor Analysis Oiltek International Limited, a Singapore-listed engineering solutions provider for the fats & oils and renewable energy sectors, released its condensed interim financial statements for the six months and full year ended…

November 10, 2025

Oiltek International Limited 3Q2025 and 9M2025 Business Update: Detailed Investor Report Oiltek International Limited Delivers Strong Profit Growth Despite Revenue Dip in 3Q2025 and 9M2025 Key Financial Performance Highlights Profit Growth Amid Revenue Decline: Despite a notable decrease in revenue,…

August 18, 2025

Oiltek International Secures RM74.3 Million in New Contracts, Lifts Order Book to RM398.2 Million: What Retail Investors Need to Know Oiltek International Secures RM74.3 Million in New Contracts, Lifts Order Book to RM398.2 Million: What Retail Investors Need to Know…

December 23, 2024

Oiltek International Secures New Malaysian Contracts Boosting Order Book Oiltek International Secures New Malaysian Contracts Boosting Order Book Oiltek International Limited, an SGX Catalist-listed company specializing in integrated process technology and renewable energy solutions, has announced significant contract wins in…

November 19, 2024

Oiltek International's Impressive Growth and Promising Outlook Oiltek International's Impressive Growth and Promising Outlook Oiltek International Limited has reported a substantial increase in its financial performance for the three months ended 30 September 2024 (3Q2024) and nine months ended 30…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: HQU, Oiltek International Limited, Oiltek, OTEK SP, OILTEK LTD, OILTEK

February 12, 2026

Broker Name: Lim & Tan Securities Date of Report: 12 February 2026 Excerpt from Lim & Tan Securities report. Singapore stock market (FSSTI) is up 7.3% year-to-date, with markets stabilizing after global uncertainties and showing signs of recovery, especially in…

February 10, 2026

Oiltek International Limited: FY2025 Financial Review and Investor Analysis Oiltek International Limited, a Singapore-listed engineering solutions provider for the fats & oils and renewable energy sectors, released its condensed interim financial statements for the six months and full year ended…

November 10, 2025

Oiltek International Limited 3Q2025 and 9M2025 Business Update: Detailed Investor Report Oiltek International Limited Delivers Strong Profit Growth Despite Revenue Dip in 3Q2025 and 9M2025 Key Financial Performance Highlights Profit Growth Amid Revenue Decline: Despite a notable decrease in revenue,…

September 10, 2025

Broker: Lim & Tan Securities Date of Report: 10 September 2025 Singapore Market Outlook September 2025: Key Stock Picks, Sector Trends, and Dividend Insights Market Overview: Singapore and Global Indices Performance The Singapore market continues to show resilience, with the…

August 18, 2025

Singapore Construction & Engineering Stocks Shine: NSL Turns Profitable, BRC Asia Wins Changi T5, Oiltek Expands Overseas SGX:N02.SI:NSL Ltd NSL Ltd reported a strong turnaround for its 18-month period ended 30 June 2025. Group revenue surged 56% to S$465.9 million,…

August 18, 2025

Oiltek International Secures RM74.3 Million in New Contracts, Lifts Order Book to RM398.2 Million: What Retail Investors Need to Know Oiltek International Secures RM74.3 Million in New Contracts, Lifts Order Book to RM398.2 Million: What Retail Investors Need to Know…

August 1, 2025

CGS International July 31, 2025 Oiltek International’s Earnings Surge: Margin Expansion, Order Book Strength, and Upgraded Prospects Fuel Bullish Outlook Strong 1H25 Performance: Margin Expansion Drives Earnings Beat Oiltek International Ltd, a leading integrated process technology and renewable energy solutions…

July 21, 2025

Markets Heat Up: ST Engineering Debt Boost, Keppel DC REIT Rallies, Oiltek Eyes Bursa, Citi Upgrades, and Big M&A Buzz Markets Heat Up: ST Engineering Debt Boost, Keppel DC REIT Rallies, Oiltek Eyes Bursa, Citi Upgrades, and Big M&A Buzz…

July 7, 2025

Broker: CGS International Date of Report: July 7, 2025 Oiltek International and Alibaba: Key Investment Trends and Technical Analysis for 2025 Market Overview: Global Trade Tensions and Economic Outlook Global financial markets remain on edge as investors await clarity on…

July 3, 2025

Lim & Tan Securities Date of Report: 3 July 2025 Singapore Market Update: Key Stock Picks, Sector Trends, and Market Insights for July 2025 Market Overview: Indices, Commodities, and Interest Rates Singapore’s FSSTI Index closed at 4,010.8, up 0.5% for…