📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

1.08%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

2026-02-25

💰 Dividend History

Current year to date yield:

1.08%

📅 SGX Earnings Announcements for H15

Hotel Properties Limited (H15)

Market: SGX |

Currency: SGD

Address: 50 Cuscaden Road

Hotel Properties Limited, an investment holding company, owns, manages, and operates hotels in Singapore and internationally. It operates through Hotels, Properties, and Others segments. The company engages in the rental and sale of residential properties and commercial units; property development and project management activities; trading in quoted investments and share dealing; card service operations; and provision of administrative and information services. In addition, it owns and operates hotels under the Four Seasons Hotels & Resorts, COMO Hotels & Resorts, InterContinental Hotels Group, Six Senses Hotels & Resorts, Marriott International, Hard Rock Hotels, and Concorde Hotels & Resorts brands, as well as shopping galleries primarily in Singapore, Malaysia, Thailand, Indonesia, Maldives, Seychelles, Vanuatu, the United States, Bhutan, Tanzania, South Africa, Vietnam, the United Kingdom, Italy, and Sri Lanka. The company was incorporated in 1980 and is based in Singapore.

Show more

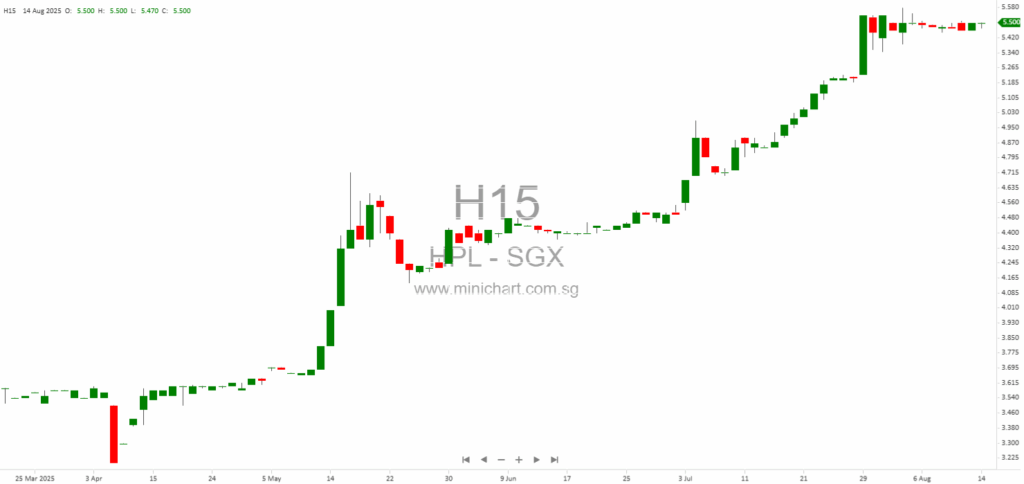

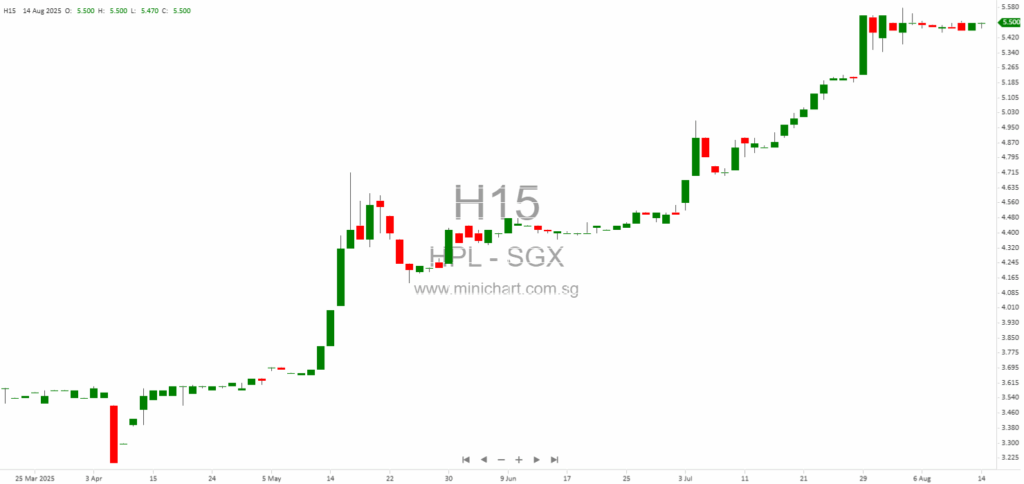

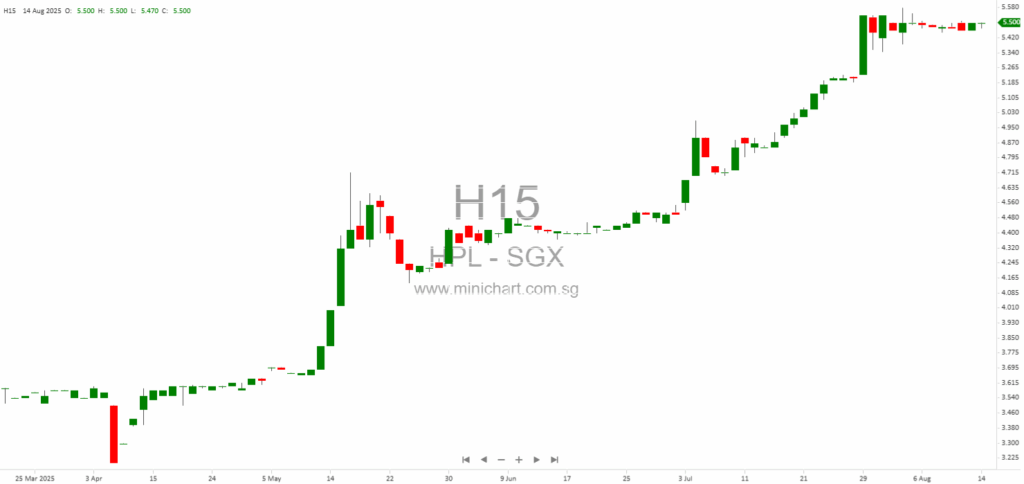

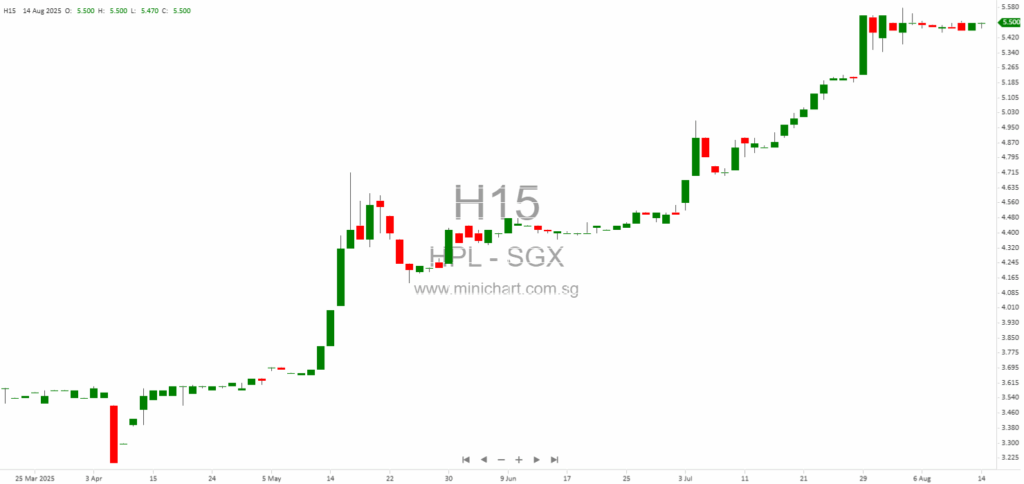

📈 Hotel Properties Limited Historical Chart

🧾 Recent Financial Statement Analysis

February 13, 2026

Hotel Properties Limited: FY2025 Profit Guidance and Outlook Analysis Hotel Properties Limited (“HPL”) has released its profit guidance for the financial year ended 31 December 2025. The announcement provides a preliminary overview of the Group’s expected financial performance, highlighting key…

December 31, 2025

Hotel Properties Limited Doubles Multicurrency Debt Issuance Programme to S\$2 Billion Hotel Properties Limited Doubles Multicurrency Debt Issuance Programme to S\$2 Billion Key Highlights Debt Programme Limit Increased: Hotel Properties Limited (“HPL” or "the Company") has raised its multicurrency debt…

December 12, 2025

The Place Holdings Announces Major Disposal of NVHPL Shares and Loans: Key Details for Investors The Place Holdings Announces Major Disposal of NVHPL Shares and Loans Overview The Place Holdings Limited (“Company”), a Singapore-listed company, has announced a major transaction…

August 14, 2025

Hotel Properties Limited (HPL) 1H 2025 Financial Results: Analysis & Key Takeaways Hotel Properties Limited (HPL), a Singapore-listed owner and manager of hotels and properties, has released its condensed interim financial statements for the half year ended June 30, 2025.…

August 14, 2025

Hotel Properties Limited Announces Strategic Subsidiary Moves, Liquidation, and Exit from Investment: What Retail Investors Should Watch Key Developments from HPL’s Latest Announcement Hotel Properties Limited (HPL), a prominent player in Singapore’s hospitality and property sector, has released a series…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: H15, Hotel Properties Limited, HPL, HPL SP, HOTEL PROPERTIES LTD, HOTEL PROPERTIES

February 13, 2026

Hotel Properties Limited: FY2025 Profit Guidance and Outlook Analysis Hotel Properties Limited (“HPL”) has released its profit guidance for the financial year ended 31 December 2025. The announcement provides a preliminary overview of the Group’s expected financial performance, highlighting key…

December 31, 2025

Hotel Properties Limited Doubles Multicurrency Debt Issuance Programme to S\$2 Billion Hotel Properties Limited Doubles Multicurrency Debt Issuance Programme to S\$2 Billion Key Highlights Debt Programme Limit Increased: Hotel Properties Limited (“HPL” or "the Company") has raised its multicurrency debt…

December 12, 2025

The Place Holdings Announces Major Disposal of NVHPL Shares and Loans: Key Details for Investors The Place Holdings Announces Major Disposal of NVHPL Shares and Loans Overview The Place Holdings Limited (“Company”), a Singapore-listed company, has announced a major transaction…

August 14, 2025

Hotel Properties Limited (HPL) 1H 2025 Financial Results: Analysis & Key Takeaways Hotel Properties Limited (HPL), a Singapore-listed owner and manager of hotels and properties, has released its condensed interim financial statements for the half year ended June 30, 2025.…

August 14, 2025

Hotel Properties Limited Announces Strategic Subsidiary Moves, Liquidation, and Exit from Investment: What Retail Investors Should Watch Key Developments from HPL’s Latest Announcement Hotel Properties Limited (HPL), a prominent player in Singapore’s hospitality and property sector, has released a series…

December 11, 2024

Orchard Road, Singapore’s iconic shopping belt, stands at a crossroads. While festive lights and luxury brands draw crowds, the area faces stiff competition from suburban malls, online shopping, and regional retail hubs. Embattled property tycoon Ong Beng Seng’s Hotel…