📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

-

💰 Dividend History

No dividend history available.

📅 SGX Earnings Announcements for ENV

LS 2 Holdings Limited (ENV)

Market: SGX |

Currency: SGD

Address: No. 04-11, WCEGA Plaza

LS 2 Holdings Limited, an investment holding company, operates as an integrated environmental services provider in Singapore. The company offers cleaning services, including conservancy, school and facilities cleaning, housekeeping, road and beach cleaning, pandemic disinfection, and façade and F&B cleaning services, as well as waste management, pest control, and landscape care and maintenance services; and facilities management for buildings and offices. It also engages in design, manufacture, and repair of machinery and equipment to the cleaning industry; and digitalization and system integration solutions to environmental services industry. The company was founded in 1993 and is based in Singapore.

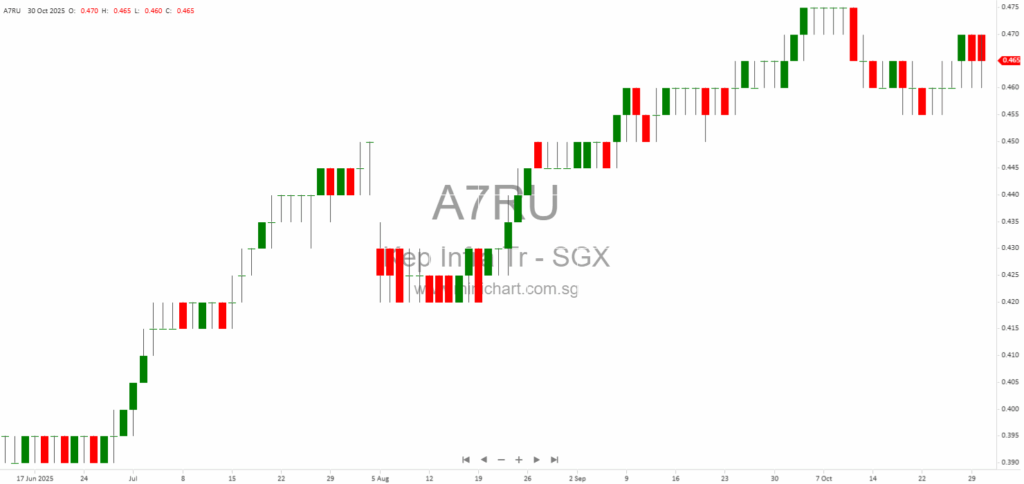

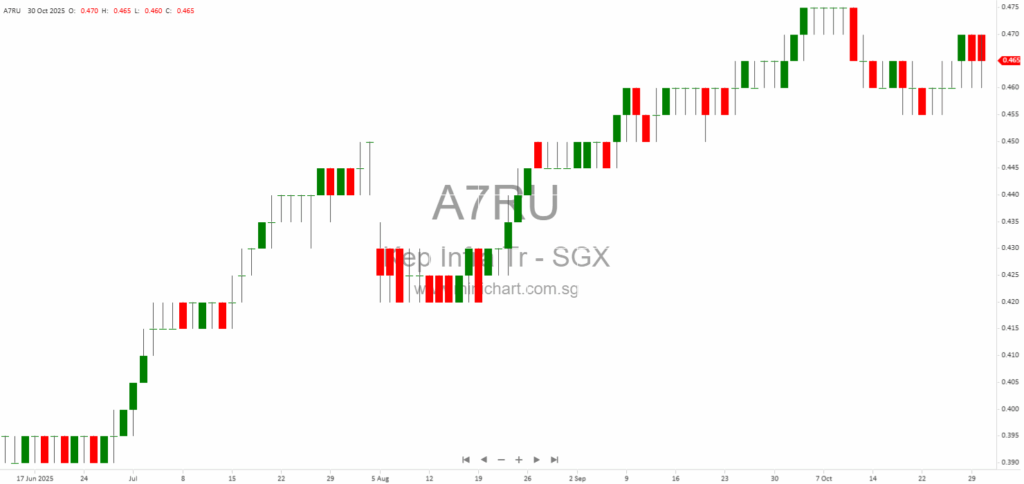

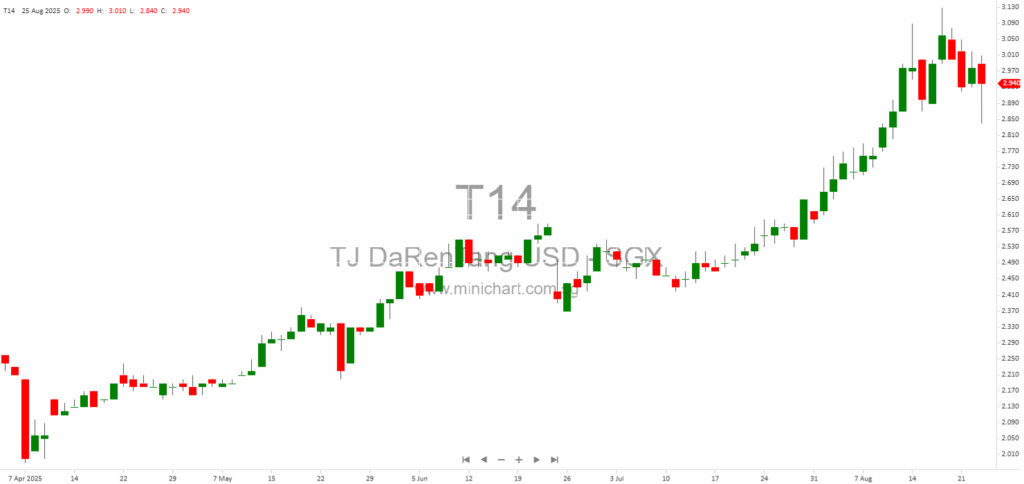

📈 LS 2 Holdings Limited Historical Chart

🧾 Recent Financial Statement Analysis

February 9, 2026

Sanli Environmental Limited Successfully Closes S\$5 Million 12M Series 002 CP on ADDX Exchange Sanli Environmental Limited Successfully Closes S\$5 Million 12M Series 002 CP on ADDX Exchange Key Highlights: Successful Fundraising: Sanli Environmental Limited has completed the offering of…

February 6, 2026

Envictus International Holdings Limited - AGM 2026 Detailed Report Envictus International Holdings Limited: 2026 Annual General Meeting Highlights Date: 23 January 2026 Venue: Holiday Inn Singapore Orchard City Centre Key Outcomes and Resolutions Passed Envictus International Holdings Limited held its…

February 5, 2026

Sanli Environmental Limited – Entry into Joint Venture for Changi NEWater Factory 3 Project Sanli Environmental Limited Announces Strategic Joint Venture for Major Water Infrastructure Project Key Points from the Joint Venture Announcement Joint Venture Formation: Sanli Environmental Limited, through…

January 20, 2026

Sanli Environmental Launches S\$3-5 Million 12-Month Commercial Paper via ADDX Sanli Environmental Launches Second Series of 12-Month Commercial Paper on ADDX Digital Securities Platform Key Highlights for Investors Sanli Environmental Limited has announced the launch of its second series of…

January 19, 2026

Envictus International Holdings Announces Proposed Acquisition of Selangor Factory & Warehouse Envictus International Holdings Announces Proposed Acquisition of Factory and Warehouse in Selangor, Malaysia Key Highlights Major Asset Acquisition: Envictus International Holdings Limited ("Envictus" or "the Company") announced its indirect…

October 30, 2025

Keppel Infrastructure Trust's Strategic Dive into Subsea Digital Infrastructure: What Investors Need to Know About the US\$91.7 Million Global Marine Group Acquisition Keppel Infrastructure Trust’s Strategic Dive into Subsea Digital Infrastructure: What Investors Need to Know About the US\$91.7 Million…

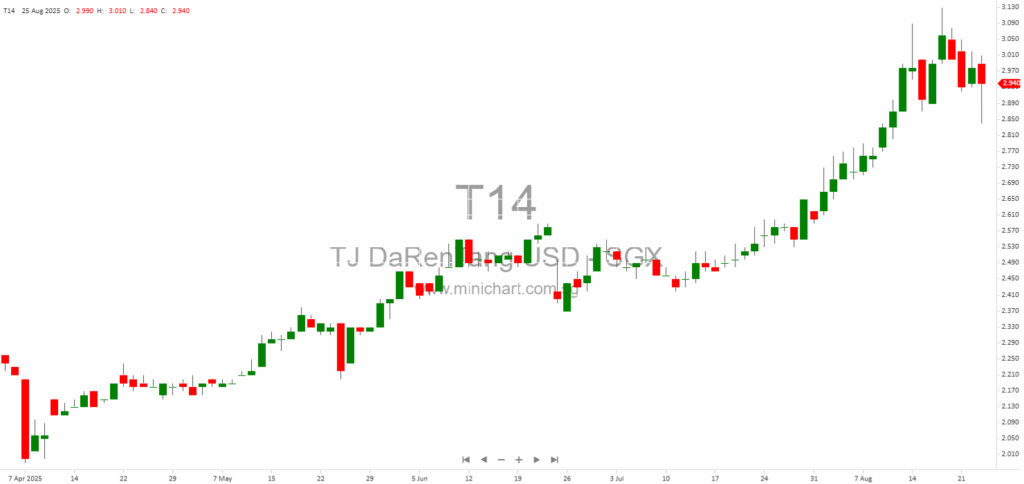

August 25, 2025

Tianjin Pharmaceutical Da Ren Tang Group Unveils Robust 2024 Results and 2025 Action Plan: Strong Dividend Policy, Product Innovation & Governance Overhaul Signal Potential Upside Tianjin Pharmaceutical Da Ren Tang Group Unveils Robust 2024 Results and 2025 Action Plan: Strong…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: ENV, LS 2 Holdings Limited, LS 2 Holdings, LSHL SP, LS 2 HOLDINGS LTD, LS 2

February 9, 2026

Sanli Environmental Limited Successfully Closes S\$5 Million 12M Series 002 CP on ADDX Exchange Sanli Environmental Limited Successfully Closes S\$5 Million 12M Series 002 CP on ADDX Exchange Key Highlights: Successful Fundraising: Sanli Environmental Limited has completed the offering of…

February 6, 2026

Envictus International Holdings Limited - AGM 2026 Detailed Report Envictus International Holdings Limited: 2026 Annual General Meeting Highlights Date: 23 January 2026 Venue: Holiday Inn Singapore Orchard City Centre Key Outcomes and Resolutions Passed Envictus International Holdings Limited held its…

February 5, 2026

Sanli Environmental Limited – Entry into Joint Venture for Changi NEWater Factory 3 Project Sanli Environmental Limited Announces Strategic Joint Venture for Major Water Infrastructure Project Key Points from the Joint Venture Announcement Joint Venture Formation: Sanli Environmental Limited, through…

January 24, 2026

One Gasmaster Holdings IPO: Comprehensive Investor Analysis One Gasmaster Holdings Berhad Date of Prospectus: 12 January 2026 One Gasmaster Holdings IPO: Unlocking Growth in Malaysia’s Environmental & Industrial Hygiene Solutions Sector One Gasmaster Holdings Berhad (“One Gasmaster Holdings”, symbol: not…

January 23, 2026

Broker Name: Maybank Research Pte Ltd Date of Report: January 22, 2026 Excerpt from Maybank Research Pte Ltd report. Sanli Environmental (SANLI SP) is rated BUY; the target price is SGD0.45, reflecting confidence in record profits over the next few…

January 20, 2026

Sanli Environmental Launches S\$3-5 Million 12-Month Commercial Paper via ADDX Sanli Environmental Launches Second Series of 12-Month Commercial Paper on ADDX Digital Securities Platform Key Highlights for Investors Sanli Environmental Limited has announced the launch of its second series of…

January 19, 2026

Envictus International Holdings Announces Proposed Acquisition of Selangor Factory & Warehouse Envictus International Holdings Announces Proposed Acquisition of Factory and Warehouse in Selangor, Malaysia Key Highlights Major Asset Acquisition: Envictus International Holdings Limited ("Envictus" or "the Company") announced its indirect…

January 16, 2026

Envictus International Holdings: Key Updates from AGM Q&A Envictus International Holdings: In-Depth Review of Strategic Direction and Board Changes Envictus International Holdings Limited has issued a detailed response to questions from the Securities Investors Association (Singapore) ahead of its upcoming…

January 14, 2026

Shanaya Limited Announces Binding Term Sheet for 60% Acquisition of Hup Lee Leong Enviro Pte Ltd Shanaya Limited Announces Strategic Acquisition: 60% Stake in Hup Lee Leong Enviro Pte Ltd Key Highlights Binding Term Sheet Signed: Shanaya Limited, through its…

January 11, 2026

MiniMax Group Inc. IPO Analysis: Subscription, Allotment, Financials & Investment Outlook MiniMax Group Inc. Date of Prospectus: December 31, 2025 MiniMax Group Inc. IPO: Record-Breaking Demand, High-Profile Investors, and a Transformative Tech Listing for 2026 MiniMax Group Inc. launches one…

January 11, 2026

GigaDevice Semiconductor Inc. Hong Kong IPO: Key Analysis and Investor Guide GigaDevice Semiconductor Inc. Date of Prospectus: December 31, 2025 GigaDevice Semiconductor Inc. Launches Landmark Hong Kong IPO: Critical Insights for Investors GigaDevice Semiconductor Inc., a leading Chinese semiconductor company,…

January 5, 2026

Sanli Environmental Limited Receives Liquidated Damages Letter Sanli Environmental Limited Receives Potential Liquidated Damages Letter: Key Details for Investors Sanli Environmental Limited ("Sanli" or "the Company") has issued a significant announcement that may have implications for shareholders and the Company's…

January 2, 2026

Broker Name: DBS Date of Report: (Date not specified in the provided excerpt; inferred to be after 31 Dec 2025 valuation date. Please refer to the full report for the exact date.) Excerpt from DBS report. Report Summary CapitaLand India…

October 30, 2025

Keppel Infrastructure Trust's Strategic Dive into Subsea Digital Infrastructure: What Investors Need to Know About the US\$91.7 Million Global Marine Group Acquisition Keppel Infrastructure Trust’s Strategic Dive into Subsea Digital Infrastructure: What Investors Need to Know About the US\$91.7 Million…

August 25, 2025

Tianjin Pharmaceutical Da Ren Tang Group Unveils Robust 2024 Results and 2025 Action Plan: Strong Dividend Policy, Product Innovation & Governance Overhaul Signal Potential Upside Tianjin Pharmaceutical Da Ren Tang Group Unveils Robust 2024 Results and 2025 Action Plan: Strong…