📊 Statistics

- Analyst 1 Year Price Target:

$1.69

- Upside/Downside from Analyst Target:

14.27%

- Broker Call:

12

- Dividend Minimum 3 Year Yield:

5.02%

- EPS Growth Range (1Y):

10-25%

- Net Income Growth Range (1Y):

10-25%

- Revenue Growth Range (1Y):

10-25%

-

Upcoming Earnings Date:

2026-02-26

💰 Dividend History

Current year to date yield:

5.35%

📅 SGX Earnings Announcements for C52

ComfortDelGro Corporation Limited (C52)

Market: SGX |

Currency: SGD

Address: 1 Pasir Panjang Road

ComfortDelGro Corporation Limited, together with its subsidiaries, provides public transportation services in Singapore, the United Kingdom, Australia, China, and Malaysia. It operates through five segments: Public Transport, Taxi/PHV, Other Private Transport, Inspection and Testing Services, and Other Segments. The company offers bus and rail services to commuters; taxi and coach rental services; non-emergency transport services to patients; vehicular maintenance and repair services; and electric vehicle charging services, as well as sells diesel and petrol. It also offers motor vehicle inspection and testing services; non-vehicle testing, inspection, and consultancy services; taxi bureau, scheduled services, and driving schools; cars renting and leasing, crash repair, and insurance broking services, as well as automotive engineering services, bus stations, outdoor advertising, and logistics solutions. In addition, the company operates driving centres. The company was incorporated in 2003 and is headquartered in Singapore.

Show more

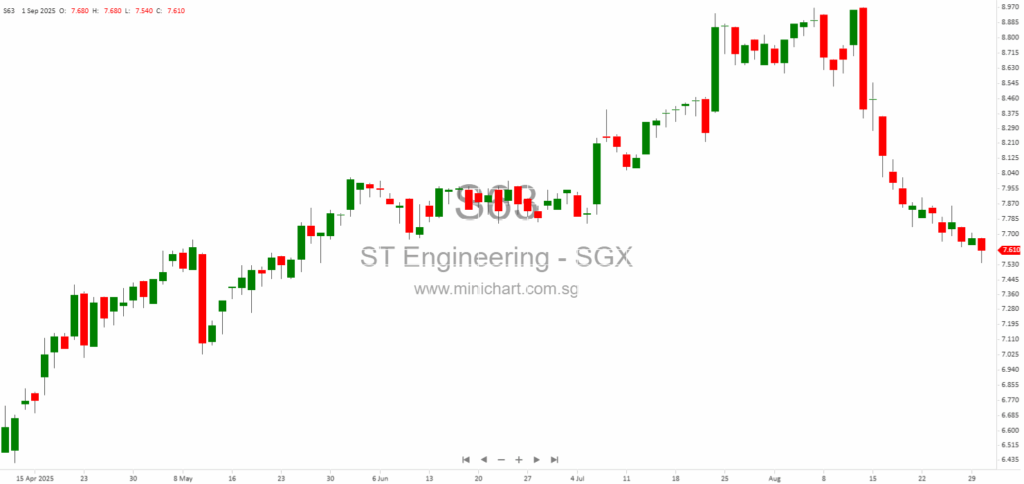

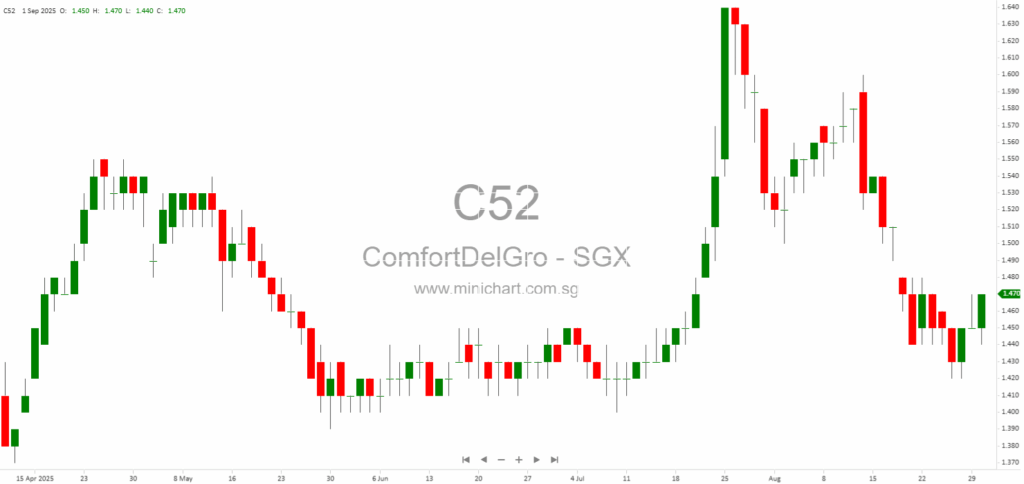

📈 ComfortDelGro Corporation Limited Historical Chart

🧾 Recent Financial Statement Analysis

November 20, 2025

ComfortDelGro Announces Senior Leadership Changes to Drive Global Mobility Growth ComfortDelGro Announces Senior Leadership Changes to Drive Global Mobility Growth Date: 20 November 2025 ComfortDelGro Corporation Limited, a leading multi-modal transport operator, has unveiled a series of significant senior leadership…

September 1, 2025

ST Engineering Sells 46.5% Stake in CityCab for S\$116.3 Million: What Retail Investors Need to Know Key Highlights from the Divestment Announcement ST Engineering (SGX: S63) has divested its entire 46.5% stake in CityCab Pte Ltd to ComfortDelGro Corporation Limited…

September 1, 2025

ComfortDelGro Takes Full Control of CityCab: What Retail Investors Need to Know ComfortDelGro Takes Full Control of CityCab in S\$116.3 Million Deal: What Retail Investors Need to Know Key Highlights ComfortDelGro Corporation Limited (CDG) has acquired the remaining 46.5% stake…

August 13, 2025

ComfortDelGro Announces Strategic Subsidiary Moves, Major UK Restructuring, and New European Joint Venture: What Retail Investors Need to Know Key Highlights from ComfortDelGro’s Latest Corporate Update New Subsidiary in Singapore Focused on Advertising Expansion of UK Transport Business via New…

November 15, 2024

ComfortDelGro's Strategic Moves and Financial Growth: A Closer Look ComfortDelGro's Strategic Moves and Financial Growth: A Closer Look ComfortDelGro Corporation Limited has announced its financial results for the third quarter of 2024, revealing significant growth and strategic developments that could…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: C52, ComfortDelGro Corporation Limited, ComfortDelGro, CD SP, COMFORTDELGRO CORP LTD, COMFORTDELGRO CORP

November 20, 2025

ComfortDelGro Announces Senior Leadership Changes to Drive Global Mobility Growth ComfortDelGro Announces Senior Leadership Changes to Drive Global Mobility Growth Date: 20 November 2025 ComfortDelGro Corporation Limited, a leading multi-modal transport operator, has unveiled a series of significant senior leadership…

November 14, 2025

Broker Name: OCBC Investment Research Date of Report: 14 November 2025 Excerpt from OCBC Investment Research report. Report Summary: US equity markets saw their largest decline in a month due to concerns about delayed economic data, slower interest rate cuts,…

November 14, 2025

Broker Name: OCBC Investment Research Date of Report: 14 November 2025 Excerpt from OCBC Investment Research report. Report Summary Global equity markets declined, led by steep falls in US indices due to concerns over delayed economic data, slower interest rate…

November 14, 2025

Broker Name: Maybank Research Pte Ltd Date of Report: 13 November 2025 Excerpt from Maybank Research Pte Ltd report. OCBC Bank: Strong 9M25 core earnings beat expectations, driven by group synergies and resilient credit growth. Dividend momentum is expected to…

November 14, 2025

Broker Name: Maybank Research Pte Ltd Date of Report: November 12, 2025 Excerpt from Maybank Research Pte Ltd report. ComfortDelGro’s 3Q25 net profit rose 22% YoY to SGD70.4m, mainly boosted by a SGD19m gain from depot sales in Victoria, and…

November 14, 2025

Broker Name: OCBC Investment Research Date of Report: 13 November 2025 Excerpt from OCBC Investment Research report. Report Summary: ComfortDelGro (CD) reported a 15.4% year-on-year increase in 9M25 profit after tax and minority interests (PATMI) to SGD176.4m, but core PATMI…

September 22, 2025

Lim & Tan Securities Pte Ltd Date of Report: 22 September 2025 Singapore Market Insights: ComfortDelGro's Strategic Moves, SGX’s Next 50 Index Launch, and Key Sector Trends Market Overview: FSSTI and Global Indices Performance Singapore’s FSSTI index continues its upward…

September 17, 2025

Maybank Research Pte Ltd 17 September 2025 Singapore Market Watch: Key Equity Insights and News for Investors – Food Empire, Sea Ltd, Keppel, ComfortDelGro, Great Eastern, and ValueMax in Focus Top Equity Ideas: Food Empire Holdings and Sea Ltd Food…

September 2, 2025

Lim & Tan Securities Date of Report: 2 September 2025 Singapore Market Insights September 2025: ComfortDelGro Acquisition, Oxley’s Turnaround & Key Institutional Trends Executive Summary: Market Overview and Key Indices Singapore’s stock market continues its upward momentum in 2025, with…

September 2, 2025

Lim & Tan Securities Date of Report: 2 September 2025 Singapore Markets: Key Developments, Company Analysis, and Institutional Fund Flows – September 2025 Overview of Singapore and Global Financial Markets The Singapore market has demonstrated resilience and growth, with the…

May 21, 2025

OCBC Investment Research 15 May 2025 ComfortDelGro Corporation: Resilient Growth, Strategic Expansion, and Strong Dividends in 2025 Investment Overview: ComfortDelGro’s Defensive Strength and Growth Trajectory ComfortDelGro Corporation (CD), a global leader in land transport, is demonstrating robust, defensive earnings with…

May 15, 2025

Maybank Research Pte Ltd May 15, 2025 ComfortDelGro: A Matter of Timing - Expect Sequential Growth ComfortDelGro (CD SP) Investment Overview ComfortDelGro (CD SP) is analyzed with a Buy rating and a target price (TP) of SGD 1.64, indicating an…

May 15, 2025

Maybank Research Pte Ltd May 15, 2025 ComfortDelGro (CD SP): A Matter of Timing - Expect Sequential Growth 1Q25 Performance and Outlook ComfortDelGro's (CD SP) 1Q25 core PATMI reached SGD51.2m, marking a 51.9% YoY increase. This performance represents approximately 22%…

May 15, 2025

CGS International May 14, 2025 ComfortDelGro: Acquisitions Bearing Fruit, Attractive Dividend Yield ComfortDelGro 1Q25 Performance: Core Net Profit Surges ComfortDelGro (CD) reported a 19% year-over-year increase in core net profit for 1Q25, primarily driven by strong contributions from its UK…

March 7, 2025

Trendspotter: Bullish Continuation and Promising Prospects Ahead Singapore Retail Research | March 7, 2025 ComfortDelGro Corp Ltd - Bullish Continuation Back in the Picture ComfortDelGro Corporation Limited is a provider of land transportation services, offering bus, taxi, rail, car rental…

February 28, 2025

Executive Summary This detailed analysis of ComfortDelGro Corporation—a leading global transportation conglomerate based in Singapore—covers its robust business performance, strategic growth pillars, and forward-looking plans. Rated as a BUY with a current price at SGD 1.41 and an estimated fair…