📊 Statistics

- Analyst 1 Year Price Target:

$0.99

- Upside/Downside from Analyst Target:

11.68%

- Broker Call:

4

- Dividend Minimum 3 Year Yield:

4.67%

- EPS Growth Range (1Y):

0-10%

- Net Income Growth Range (1Y):

0-10%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

4.67%

Amount: -

Yield: -

Pay Date: 2018-12-11

Details:

HKD 0.05

Amount: -

Yield: -

Pay Date: 2018-08-13

Details:

HKD 0.15

Amount: -

Yield: -

Pay Date: 2018-08-13

Details:

HKD 0.05

📅 SGX Earnings Announcements for BN2

Valuetronics Holdings Limited (BN2)

Market: SGX |

Currency: SGD

Address: Technology Park

Valuetronics Holdings Limited, an investment holding company, provides integrated electronics manufacturing services (EMS) in the United States, the People's Republic of China, Canada, Poland, Hong Kong, the Netherlands, Indonesia, France, Taiwan, South Korea, Germany, and internationally. It operates through two segments, Consumer Electronics; and Industrial and Commercial Electronics. The company offers engineering services comprising mechanical design services, including industrial design, rapid prototyping (SLA, FDM), motion mechanisms, and packaging design, as well as plastic and metal parts, and enclosures; plastic tool design services consisting of 2D/3D design, mold flow analysis, and plastic and over-mold parts; electronics, RF, and software design; regulatory compliance engineering and testing; and product test development services, such as design-for-test, in-circuit-test, custom functional test, and in-house test fixtures design and fabrication. It also provides manufacturing services comprising plastic tool fabrication and injection molding; printed circuit board assemblies; sub-assemblies and complete box build; reliability engineering and testing; quality systems; materials procurement; and program management. In addition, the company offers supply chain support services, including in-house logistics to manage shipment of products to final destinations; product customization and drop shipment; spare parts inventory and shipment; and direct fulfillment programs. Further, it provides trading and business services; and holds properties. The company serves multinational and mid-size companies in the automotive, telecommunications and networking, industrial, commercial, energy saving, and consumer fields. Valuetronics Holdings Limited was founded in 1992 and is headquartered in Sha Tin, Hong Kong.

Show more

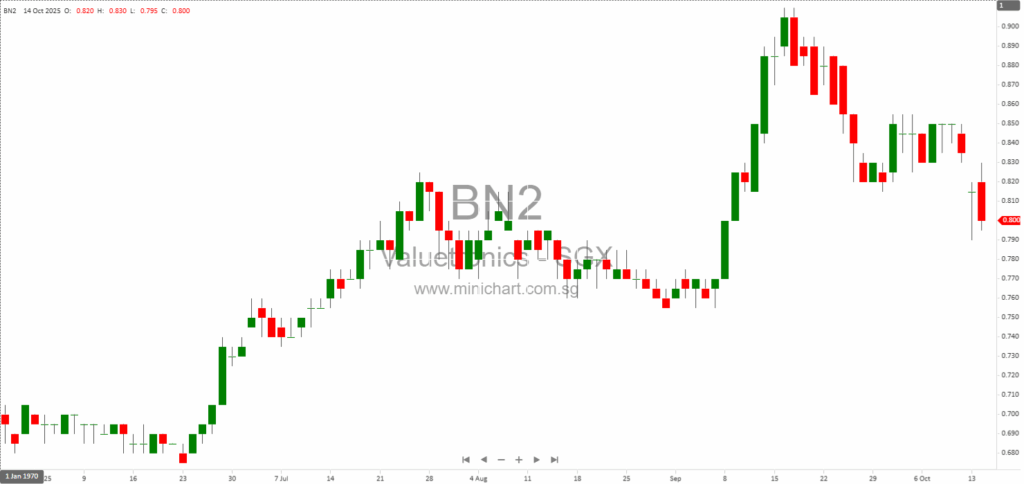

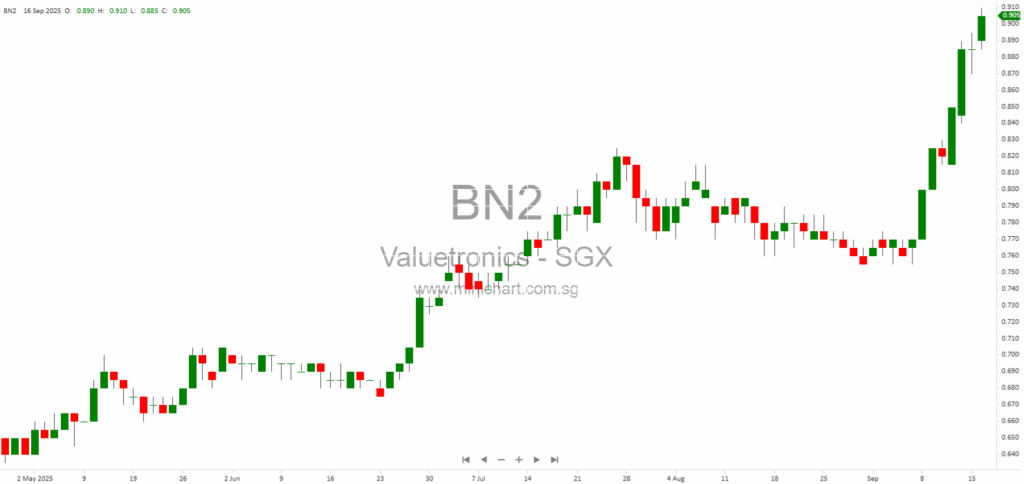

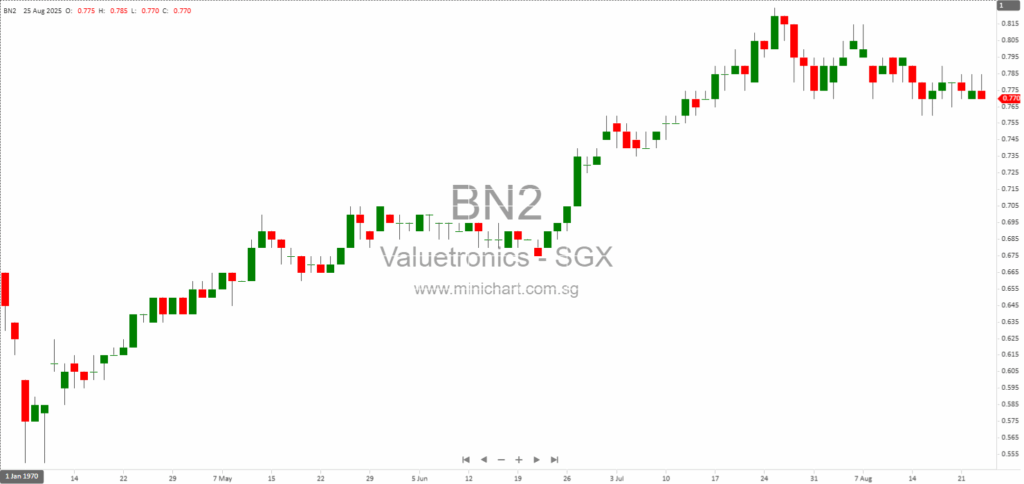

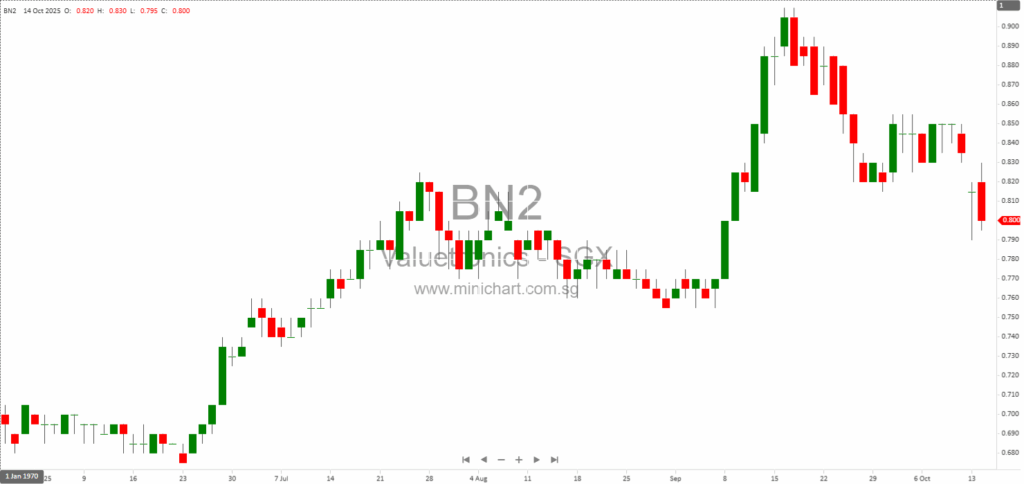

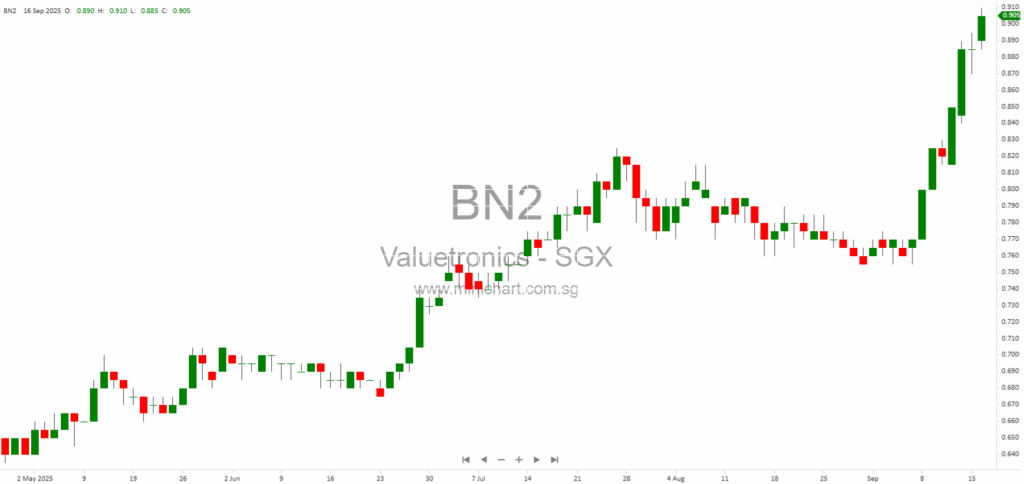

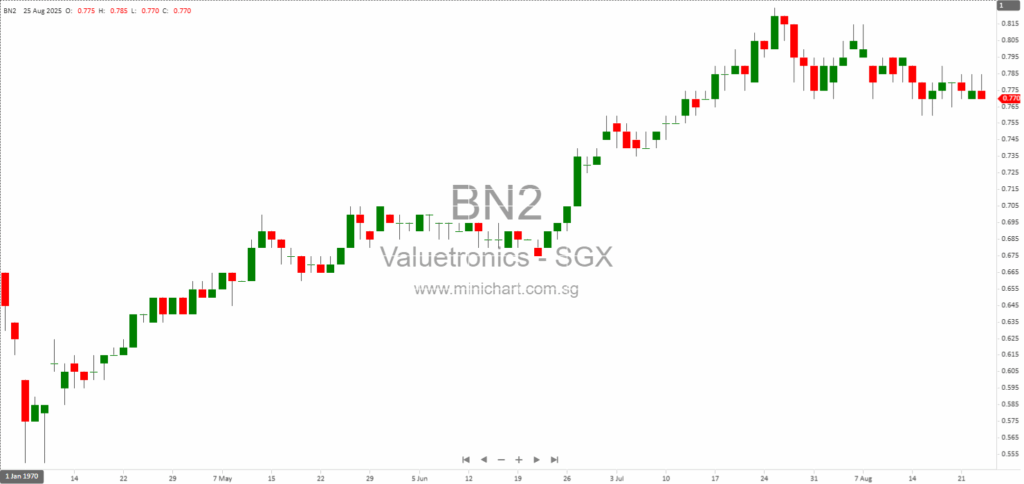

📈 Valuetronics Holdings Limited Historical Chart

🧾 Recent Financial Statement Analysis

October 14, 2025

Valuetronics Loses Control of Trio AI in Major Share Subscription Deal: What Investors Need to Know Valuetronics Loses Control of Trio AI in Major Share Subscription Deal: What Investors Need to Know Key Points from the Announcement Completion of Share…

September 16, 2025

Valuetronics Dilutes Stake in Trio AI as Yee Hop Joins JV: Major Ownership Shift and Board Changes Ahead Valuetronics Dilutes Stake in Trio AI as Yee Hop Joins JV: Major Ownership Shift and Board Changes Ahead Key Highlights for Investors:…

August 25, 2025

Valuetronics AGM 2025: Special Dividends, AI Ambitions, and Vietnam Expansion Signal Strategic Pivot Valuetronics AGM 2025: Special Dividends, AI Ambitions, and Vietnam Expansion Signal Strategic Pivot Valuetronics Holdings Limited convened its Annual General Meeting (AGM) on 28 July 2025, delivering…

November 13, 2024

Valuetronics Holdings Financial Analysis - Net Profit Growth of 10.2% Valuetronics Holdings Financial Analysis - Net Profit Growth of 10.2% Business Description Valuetronics Holdings Limited is an integrated Electronics Manufacturing Services (EMS) provider established in 1992 in Hong Kong. The…

November 13, 2024

Valuetronics Holdings Limited: 10% Net Profit Growth - Financial Analysis and Investment Recommendation Valuetronics Holdings Limited: 10% Net Profit Growth - Financial Analysis and Investment Recommendation Business Description Valuetronics Holdings Limited is a vertically integrated Electronics Manufacturing Services (EMS) provider.…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: BN2, Valuetronics Holdings Limited, Valuetronics, VALUE SP, VALUETRONICS HOLDINGS LTD, VALUETRONICS

October 14, 2025

Valuetronics Loses Control of Trio AI in Major Share Subscription Deal: What Investors Need to Know Valuetronics Loses Control of Trio AI in Major Share Subscription Deal: What Investors Need to Know Key Points from the Announcement Completion of Share…

September 16, 2025

Valuetronics Dilutes Stake in Trio AI as Yee Hop Joins JV: Major Ownership Shift and Board Changes Ahead Valuetronics Dilutes Stake in Trio AI as Yee Hop Joins JV: Major Ownership Shift and Board Changes Ahead Key Highlights for Investors:…

August 25, 2025

Valuetronics AGM 2025: Special Dividends, AI Ambitions, and Vietnam Expansion Signal Strategic Pivot Valuetronics AGM 2025: Special Dividends, AI Ambitions, and Vietnam Expansion Signal Strategic Pivot Valuetronics Holdings Limited convened its Annual General Meeting (AGM) on 28 July 2025, delivering…

July 9, 2025

Lim & Tan Securities 9 July 2025 Singapore Market Outlook July 2025: Key Stocks, Sector Trends, and Dividend Highlights Singapore Straits Times Index Hits 52-Week High Amid Global Volatility The Singapore Straits Times Index (FSSTI) closed at a 52-week high…

May 29, 2025

Lim & Tan Securities 29 May 2025 Singapore Market Insights: Seatrium Upgrade, Valuetronics' Strong FY2025, and Fund Flow Analysis Financial Markets Overview The FSSTI Index closed at 3,911.9, up 0.4%, with MTD and YTD gains of 2.1% and 3.3% respectively.…

May 28, 2025

Broker Name: CGS International Date of Report: May 28, 2025 Trendspotter: Bullish Trends in Valuetronics Holdings Ltd and Pan-United Corp Ltd Global Market Recap Bonds experienced a worldwide rally following indications from Japan that it intends to stabilize its debt…

November 13, 2024

Valuetronics Holdings Financial Analysis - Net Profit Growth of 10.2% Valuetronics Holdings Financial Analysis - Net Profit Growth of 10.2% Business Description Valuetronics Holdings Limited is an integrated Electronics Manufacturing Services (EMS) provider established in 1992 in Hong Kong. The…

November 13, 2024

Valuetronics Holdings Limited: 10% Net Profit Growth - Financial Analysis and Investment Recommendation Valuetronics Holdings Limited: 10% Net Profit Growth - Financial Analysis and Investment Recommendation Business Description Valuetronics Holdings Limited is a vertically integrated Electronics Manufacturing Services (EMS) provider.…

November 13, 2024

Valuetronics 1H FY2025 Financial Analysis: Net Profit Up 10.2% Valuetronics 1H FY2025 Financial Analysis: Net Profit Up 10.2% Business Description Valuetronics Holdings Limited is a leading integrated Electronics Manufacturing Services (EMS) provider. The company offers a comprehensive range of services…