📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

25-50%

- Net Income Growth Range (1Y):

25-50%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

2026-02-24

💰 Dividend History

Current year to date yield:

1.05%

Amount: $0.027400

Yield: 3.75%

Pay Date: 2018-09-27

Details:

SGD 0.0274

📅 SGX Earnings Announcements for BMGU

BHG Retail REIT (BMGU)

Market: SGX |

Currency: SGD

Address: 250 North Bridge Road

BHG Retail REIT is the first pure-play China Retail REIT sponsored by a leading China integrated retail group. The REIT was listed on the Main Board of the Singapore Exchange Securities Trading Limited on 11 December 2015. The principal investment strategy of BHG Retail REIT is to invest, directly or indirectly, in a diversified portfolio of income-producing real estate which is used primarily for retail purposes (whether either wholly or partially), as well as real estate-related assets in relation to the foregoing, with an initial focus on China. As at 30 June 2025, the REIT's portfolio comprises six retail properties, Beijing Wanliu (60%), Chengdu Konggang, Hefei Mengchenglu, Hefei Changjiangxilu, Xining Huayuan, Dalian Jinsanjiao located in Tier 1, Tier 2 and other cities of significant economic potential in China. The portfolio gross floor area of about 311,691 sqm, has a committed occupancy of 95.1% as at 30 June 2025. As at the latest date of valuation, total appraised value was approximately RMB 4,729 million. Under voluntary right of first refusal agreements, properties may potentially be offered to BHG Retail REIT as future pipeline assets.

Show more

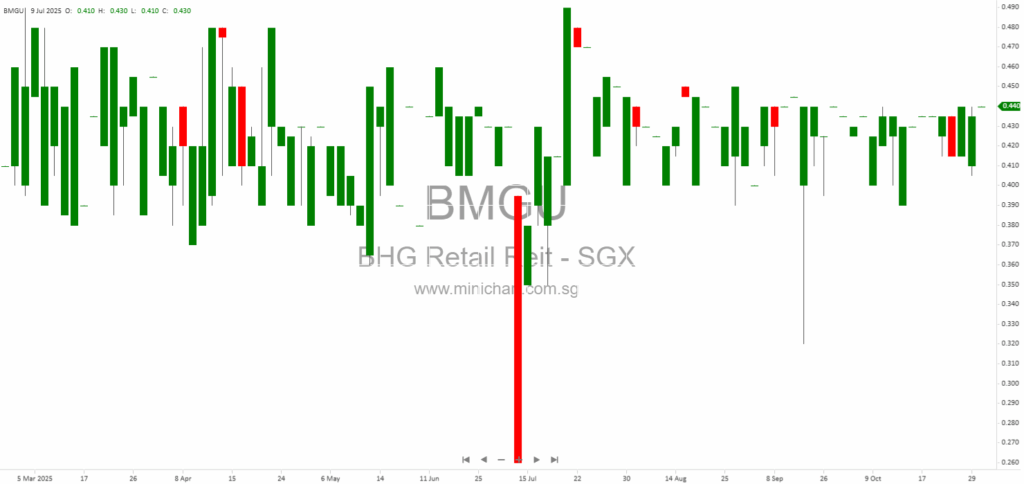

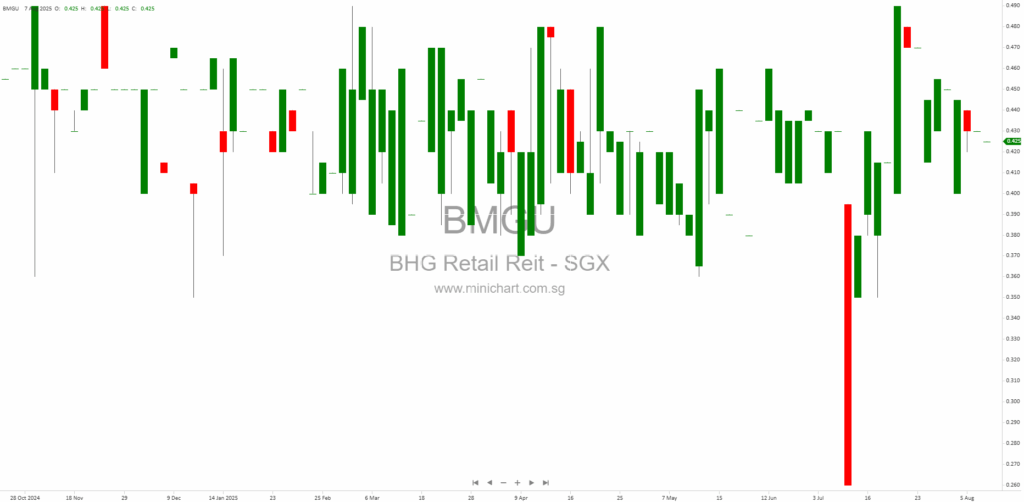

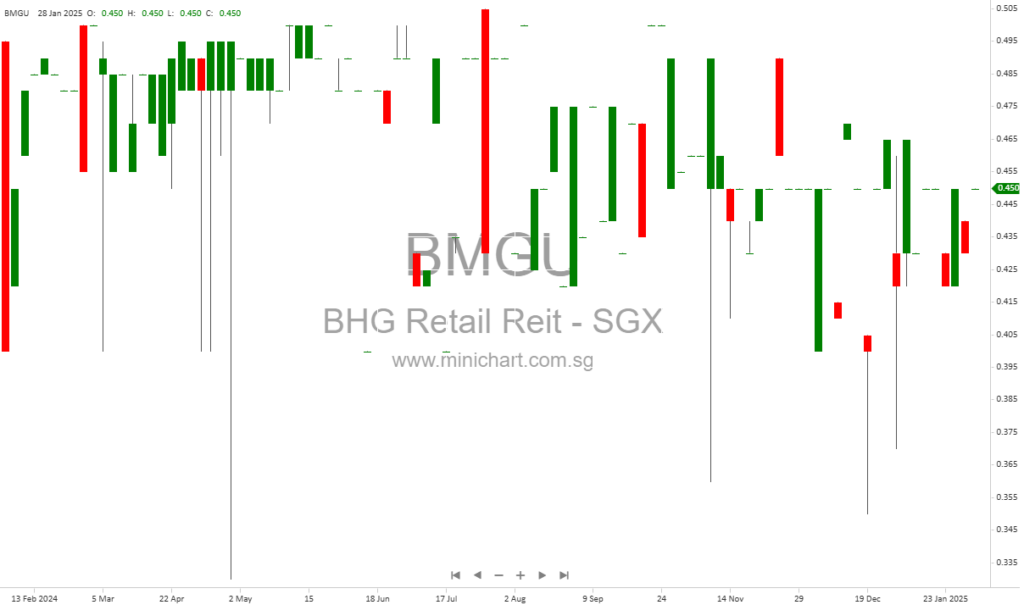

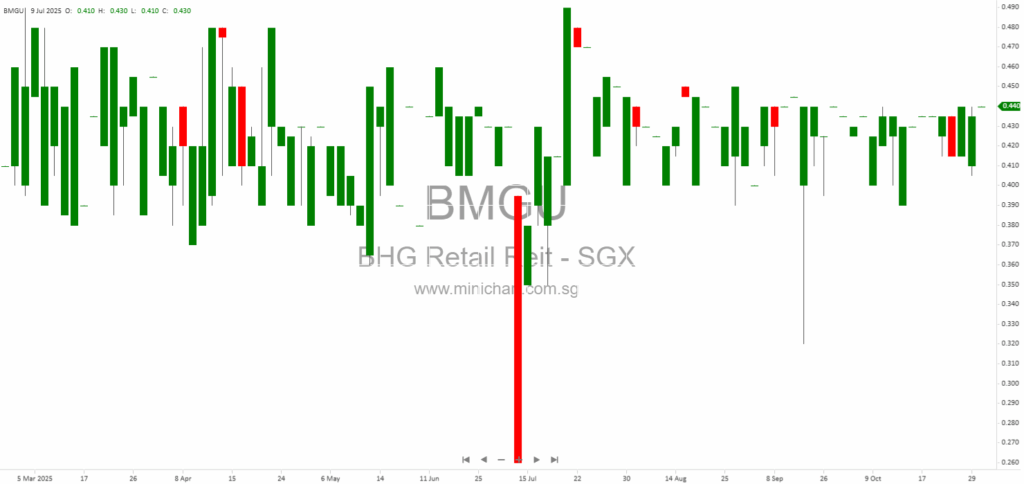

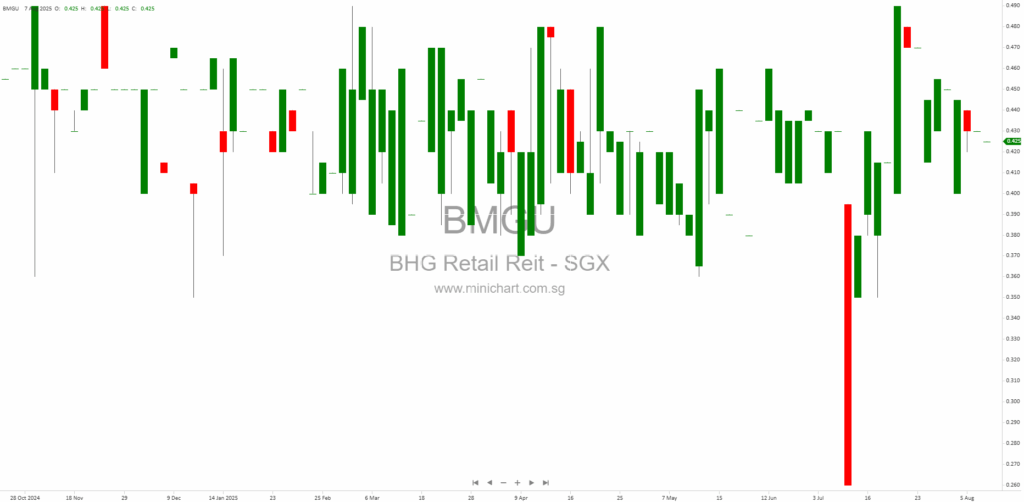

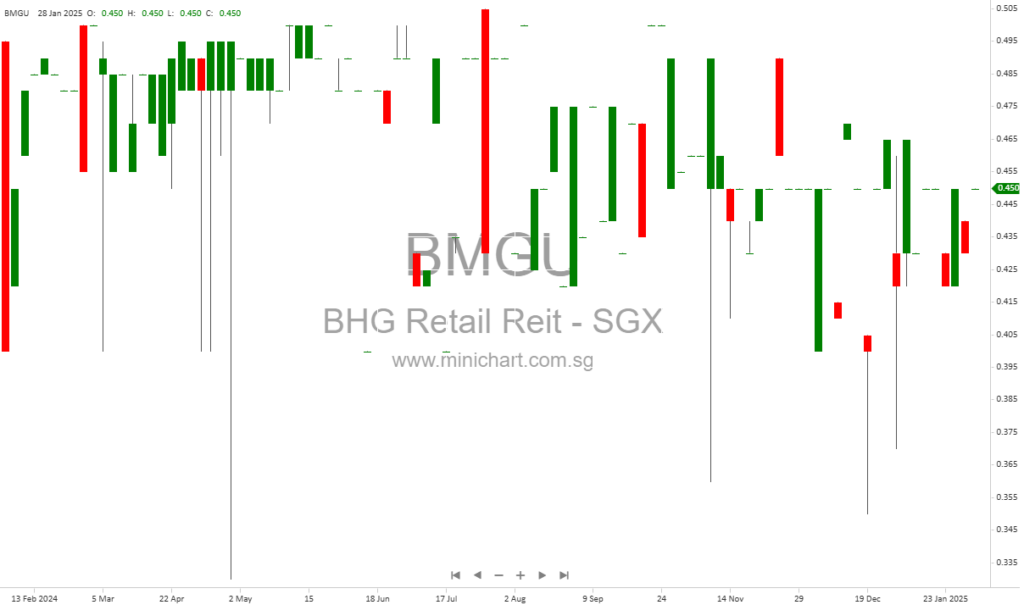

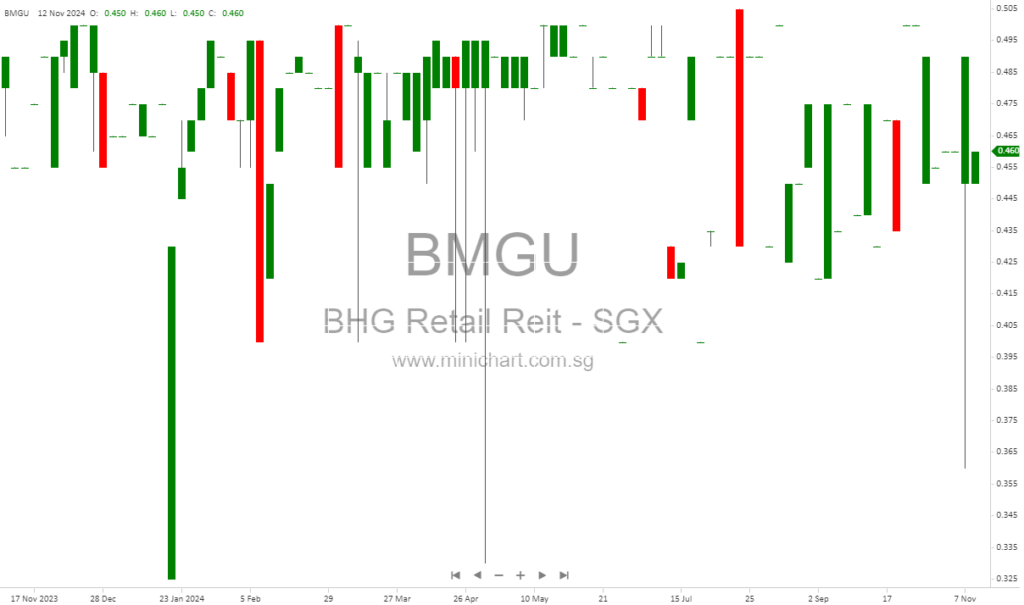

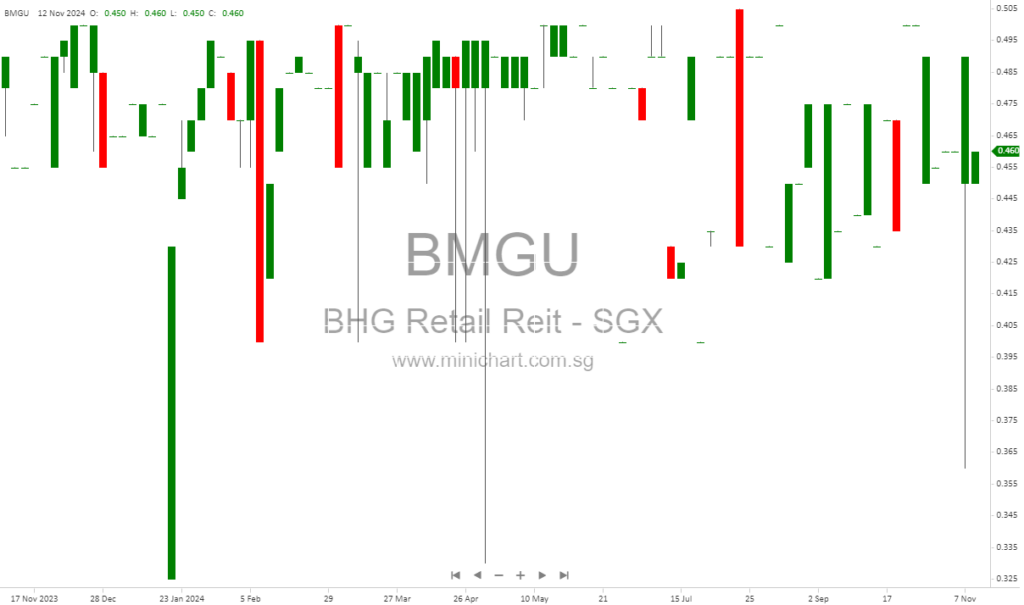

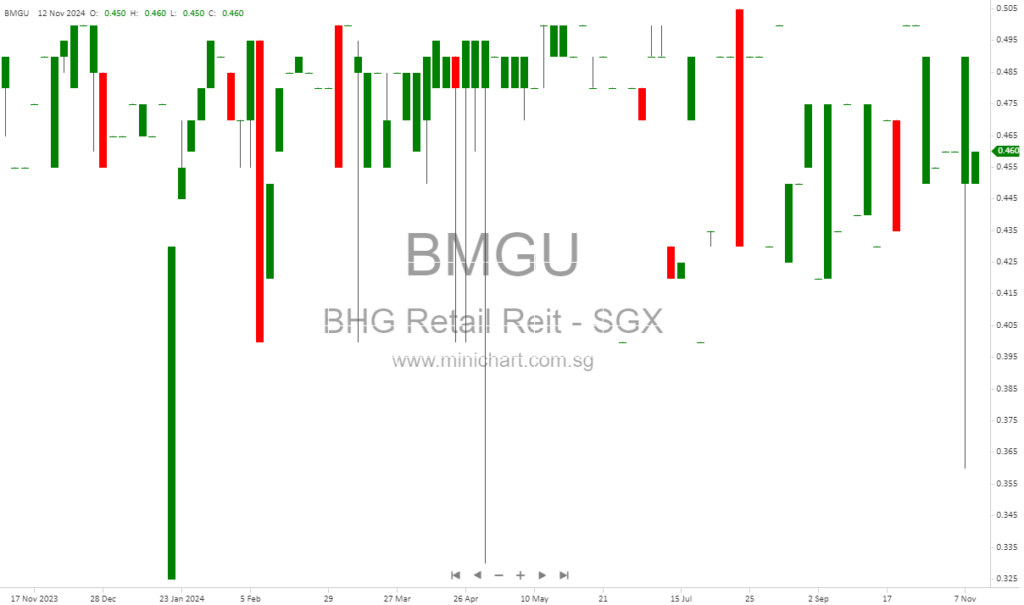

📈 BHG Retail REIT Historical Chart

🧾 Recent Financial Statement Analysis

February 13, 2026

BHG Retail REIT: Notification of Upcoming Financial Results Release BHG Retail REIT, managed by BHG Retail Trust Management Pte. Ltd., has announced the scheduled release date for its unaudited financial results for the full year ended 31 December 2025. The…

November 11, 2025

BHG Retail REIT 3Q 2025 Business Update: Key Highlights and Investor Insights BHG Retail REIT 3Q 2025 Business Update: Detailed Analysis for Investors Overview BHG Retail REIT’s 3Q 2025 business update provides investors with a comprehensive look at its financial…

August 7, 2025

BHG Retail REIT 1H 2025 Financial Results Analysis BHG Retail REIT released its 1H 2025 results on August 7, 2025, providing investors with a comprehensive view of its operational and financial performance. The REIT, which manages a portfolio of six…

March 3, 2025

Award-Winning ESG Leadership Propels BHG Retail REIT’s Market Appeal Award-Winning ESG Leadership Propels BHG Retail REIT’s Market Appeal BHG Retail REIT has made headlines after clinching three major awards at The Global CSR & ESG Awards 2025. The REIT was…

February 12, 2025

Analysis of BHG Retail REIT Financial Results for FY 2024 Analysis of BHG Retail REIT Financial Results for FY 2024 Key Facts and Business Description Report Date: 12 February 2025 Financial Year: Ended 31 December 2024 Core Business Operations: BHG…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: BMGU, BHG Retail REIT

February 13, 2026

BHG Retail REIT: Notification of Upcoming Financial Results Release BHG Retail REIT, managed by BHG Retail Trust Management Pte. Ltd., has announced the scheduled release date for its unaudited financial results for the full year ended 31 December 2025. The…

November 11, 2025

BHG Retail REIT 3Q 2025 Business Update: Key Highlights and Investor Insights BHG Retail REIT 3Q 2025 Business Update: Detailed Analysis for Investors Overview BHG Retail REIT’s 3Q 2025 business update provides investors with a comprehensive look at its financial…

August 7, 2025

BHG Retail REIT 1H 2025 Financial Results Analysis BHG Retail REIT released its 1H 2025 results on August 7, 2025, providing investors with a comprehensive view of its operational and financial performance. The REIT, which manages a portfolio of six…

March 3, 2025

Award-Winning ESG Leadership Propels BHG Retail REIT’s Market Appeal Award-Winning ESG Leadership Propels BHG Retail REIT’s Market Appeal BHG Retail REIT has made headlines after clinching three major awards at The Global CSR & ESG Awards 2025. The REIT was…

February 12, 2025

Analysis of BHG Retail REIT Financial Results for FY 2024 Analysis of BHG Retail REIT Financial Results for FY 2024 Key Facts and Business Description Report Date: 12 February 2025 Financial Year: Ended 31 December 2024 Core Business Operations: BHG…

November 14, 2024

BHG Retail REIT: Remarkable 3Q 2024 Performance and Strategic Growth Plans BHG Retail REIT: Remarkable 3Q 2024 Performance and Strategic Growth Plans BHG Retail REIT has delivered a strong performance in the third quarter of 2024, demonstrating resilience and strategic…

November 13, 2024

BHG Retail REIT's Optimistic 3Q 2024 Update and Future Growth Plans BHG Retail REIT's Optimistic 3Q 2024 Update and Future Growth Plans BHG Retail REIT has released its business update for the third quarter of 2024, showcasing a solid performance…

November 13, 2024

BHG Retail REIT Sees Stable Performance Amid Market Challenges BHG Retail REIT Sees Stable Performance Amid Market Challenges BHG Retail REIT has provided a business update for the third quarter of 2024, showcasing a committed occupancy rate of 96.6% across…