📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

3.22%

- EPS Growth Range (1Y):

50-100%

- Net Income Growth Range (1Y):

50-100%

- Revenue Growth Range (1Y):

25-50%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

3.22%

Amount: $0.000000

Yield: -

Pay Date: 2025-09-19

Details:

Ratio: 1:1

Amount: $0.000000

Yield: -

Pay Date: 2021-10-14

Details:

Ratio: 4:1

📅 SGX Earnings Announcements for 5WJ

MoneyMax Financial Services Ltd. (5WJ)

Market: SGX |

Currency: SGD

Address: 7 Changi Business Park Vista

MoneyMax Financial Services Ltd., an investment holding company, operates as a financial service provider, retailer, and trader of luxury products in Singapore and Malaysia. It operates in four segments: Pawnbroking; Retail and Trading of Gold and Luxury Items; Secured Lending; and Others. The company offers pawnbroking; retail and trading of gold jewellery, timepieces, and bags; automotive financing; residential and commercial property financing; and motor, travel, home, and commercial insurance services. It also engages in property owning, money lending, finance leasing, and insurance agency activities. In addition, the company operates MoneyMax Online, an online platform to shop, sell, and appraise valuables; an online auction platform; and retail outlets. The company was incorporated in 2008 and is headquartered in Singapore. MoneyMax Financial Services Ltd. is a subsidiary of Money Farm Pte Ltd.

Show more

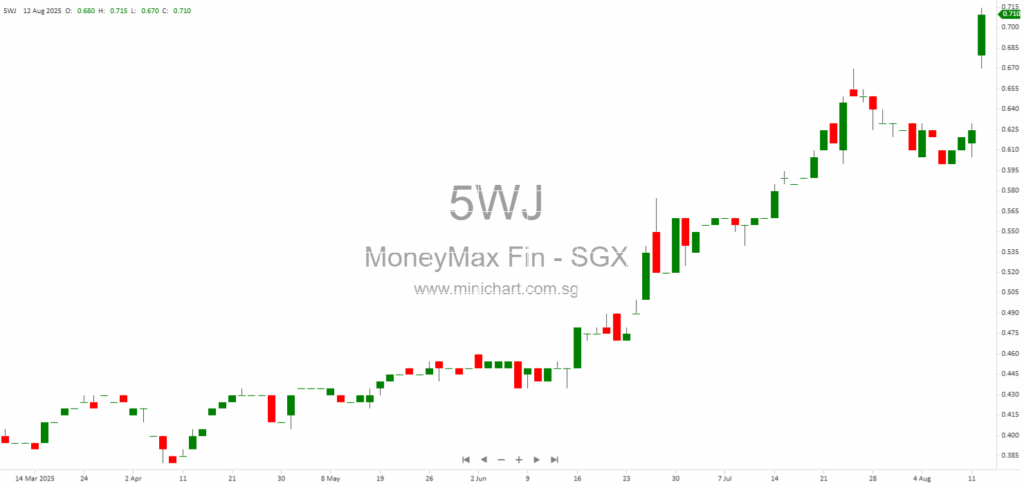

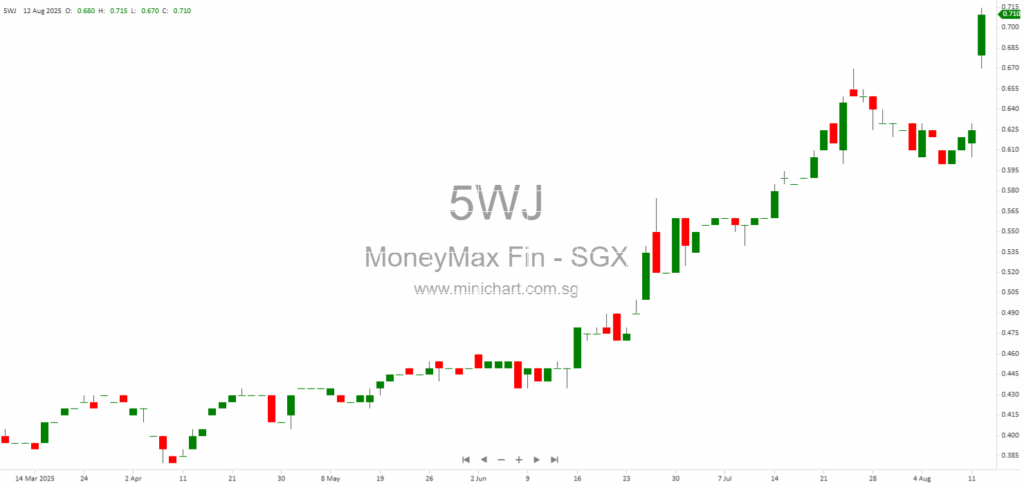

📈 MoneyMax Financial Services Ltd. Historical Chart

🧾 Recent Financial Statement Analysis

February 1, 2026

MoneyMax Financial Services Ltd.: Profit Guidance for FY2025 MoneyMax Financial Services Ltd. has released a profit guidance announcement for the six-month financial period (2H) and full year (FY) ended 31 December 2025. The company has provided preliminary insights into its…

January 25, 2026

MoneyMax Financial Services Receives Approval-In-Principle for Main Board Transfer MoneyMax Financial Services Receives Approval-In-Principle for Main Board Transfer Date: 26 January 2026 Key Highlights Approval-in-Principle (AIP) Received: MoneyMax Financial Services Ltd. has secured the approval-in-principle from the Singapore Exchange Securities…

January 14, 2026

MoneyMax Financial Services Proposes Main Board Transfer on SGX MoneyMax Financial Services Ltd. Proposes Strategic Transfer to SGX Main Board Key Highlights of the Announcement Intention to Transfer Listing: MoneyMax Financial Services Ltd. ("MoneyMax" or the "Company") has officially announced…

August 12, 2025

MoneyMax Financial Services Ltd: 1H-2025 Financial Analysis & Investor Insights MoneyMax Financial Services Ltd. continues its trajectory as a leading integrated financial services provider, retailer, and trader of luxury products in Southeast Asia. The company operates one of the largest…

April 11, 2025

MoneyMax Financial Services Ltd.'s AGM: What You Need to Know MoneyMax Financial Services Ltd. (the "Company") has announced its upcoming Annual General Meeting (AGM) to be held on April 25, 2025, at 9:30 a.m. at 7 Changi Business Park Vista,…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: 5WJ, MoneyMax Financial Services Ltd., MoneyMax Fin, MMFS SP, MONEYMAX FINANCIAL SERVICE L, MONEYMAX FINANCIAL SERVICES

February 1, 2026

MoneyMax Financial Services Ltd.: Profit Guidance for FY2025 MoneyMax Financial Services Ltd. has released a profit guidance announcement for the six-month financial period (2H) and full year (FY) ended 31 December 2025. The company has provided preliminary insights into its…

January 25, 2026

MoneyMax Financial Services Receives Approval-In-Principle for Main Board Transfer MoneyMax Financial Services Receives Approval-In-Principle for Main Board Transfer Date: 26 January 2026 Key Highlights Approval-in-Principle (AIP) Received: MoneyMax Financial Services Ltd. has secured the approval-in-principle from the Singapore Exchange Securities…

January 14, 2026

MoneyMax Financial Services Proposes Main Board Transfer on SGX MoneyMax Financial Services Ltd. Proposes Strategic Transfer to SGX Main Board Key Highlights of the Announcement Intention to Transfer Listing: MoneyMax Financial Services Ltd. ("MoneyMax" or the "Company") has officially announced…

August 21, 2025

CGS International August 21, 2025 Bullish Momentum in Singapore Equities: In-Depth Analysis of MoneyMax Financial Services and Marco Polo Marine Market Overview: Retail and Marine Sectors in Focus The Singapore equity landscape is witnessing notable trends amid a backdrop of…

August 21, 2025

CGS International Securities Singapore Pte. Ltd. Date of Report: August 21, 2025 Singapore Retail Research: Bullish Trends & Strategic Moves in Retail, Marine, and Financial Sectors Market Overview: Uncertainty in Global Retail Amid Tariff Pressures Recent mixed sales and profit…

August 12, 2025

MoneyMax Financial Services Ltd: 1H-2025 Financial Analysis & Investor Insights MoneyMax Financial Services Ltd. continues its trajectory as a leading integrated financial services provider, retailer, and trader of luxury products in Southeast Asia. The company operates one of the largest…

April 11, 2025

MoneyMax Financial Services Ltd.'s AGM: What You Need to Know MoneyMax Financial Services Ltd. (the "Company") has announced its upcoming Annual General Meeting (AGM) to be held on April 25, 2025, at 9:30 a.m. at 7 Changi Business Park Vista,…

September 6, 2024

Neratel, Ennoconn Corporation, MoneyMax Financial Services, Wing Tai Holdings, Stamford Land Corporation, Indofood Agri Resources 📡 Neratel - Strong Acquisition Play Recommendation: Hold or Sell in the Open Market Target Price: S$0.075 Broker: Lim & Tan Securities Date of Recommendation:…