📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

2.23%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

7.75%

📅 SGX Earnings Announcements for 5SO

Duty Free International Limited (5SO)

Market: SGX |

Currency: SGD

Address: 138 Cecil Street

Duty Free International Limited, an investment holding company, operates as a duty-free retailer under the Zon brand in Malaysia. It operates in Trading of Duty Free Goods and Non-Dutiable Merchandise; and Investment Holding and Others segments. The company engages in the wholesale, distribution, and retail of duty free and non-dutiable merchandise, including imported duty-free beverages, tobacco products, chocolates and confectionery products, perfumery, cosmetics, and souvenirs. Its duty-free retail outlets are located in airports, ferry terminals, seaports, border towns, and tourist destinations. The company is also involved in property investment and management; resort development; cultivation of oil palm; wholesale of alcoholic beverages and soft drinks; sale of fresh fruit bunches; and parking operations. The company was founded in 1978 and is based in Singapore. Duty Free International Limited operates as a subsidiary of Atlan Holdings Bhd.

Show more

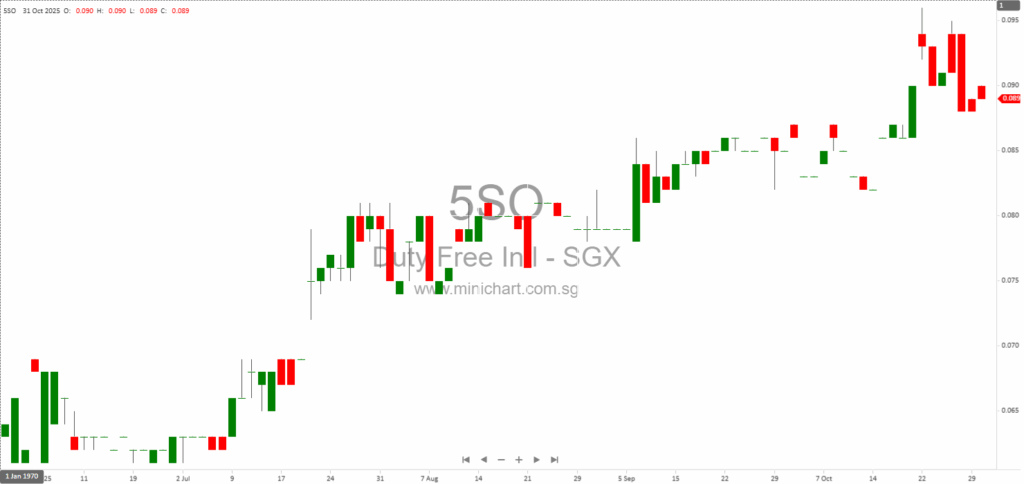

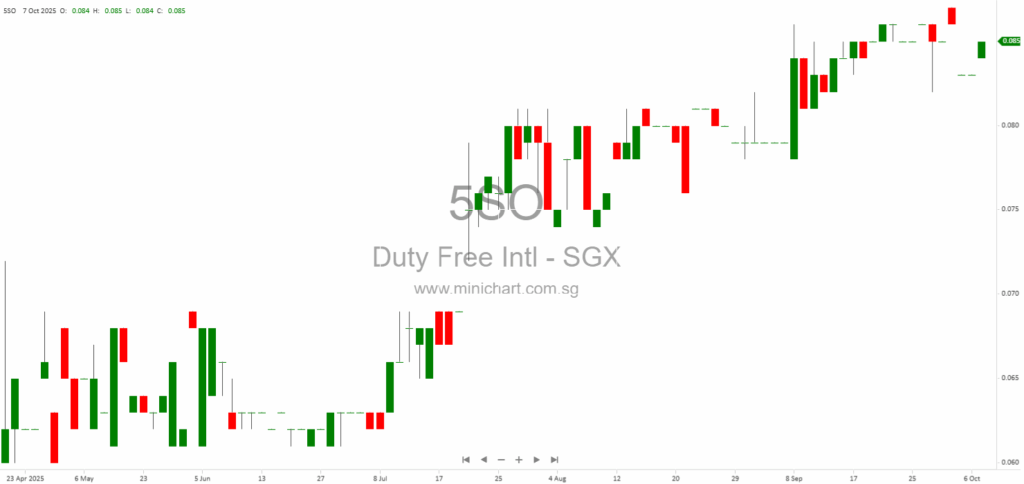

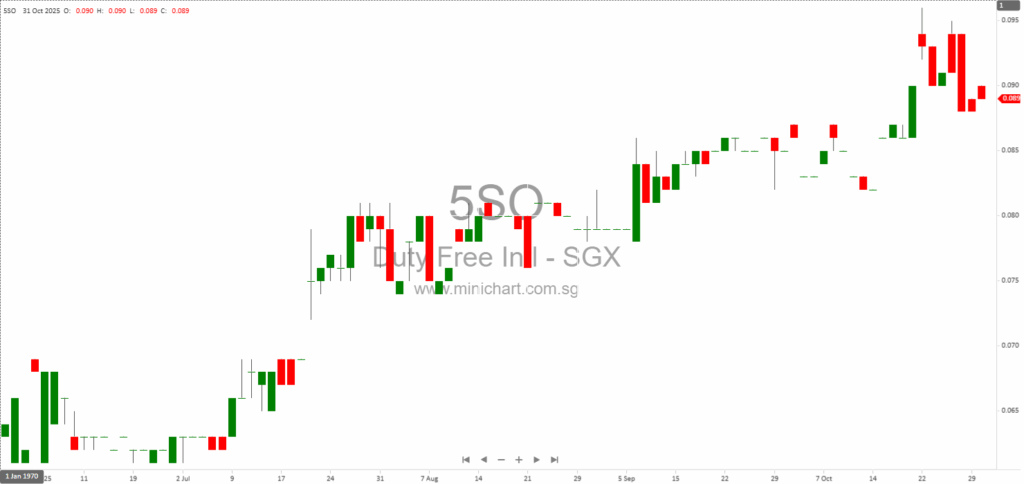

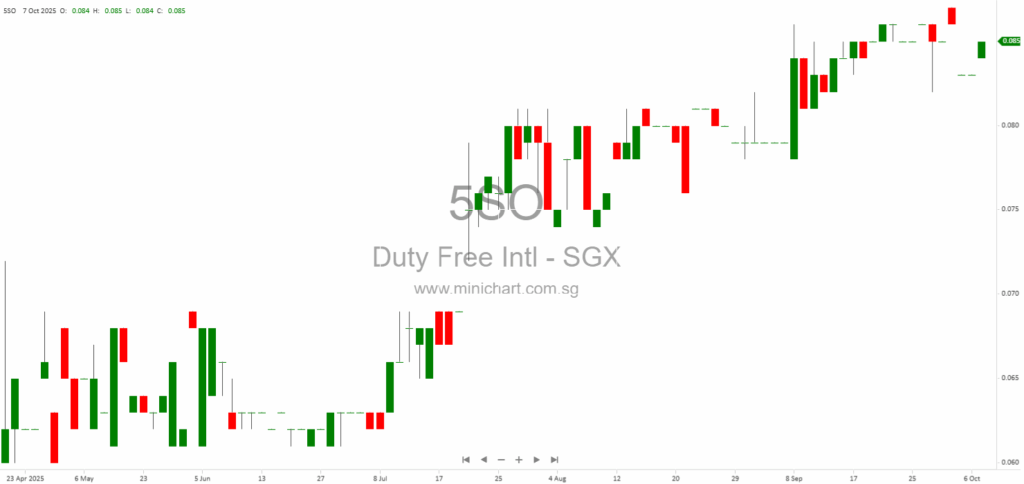

📈 Duty Free International Limited Historical Chart

🧾 Recent Financial Statement Analysis

January 13, 2026

Duty Free International Limited (DFIL): 3Q FY2026 and 9M FY2026 Financial Performance Review Duty Free International Limited (DFIL), a Singapore-listed company with core interests in duty-free retailing and, more recently, automotive component manufacturing, has released its condensed interim financial statements…

December 9, 2025

Duty Free International Limited: Extension of Conditional Period for Joint Development Agreement Duty Free International Limited Announces Extension of Conditional Period for Joint Development Agreement Key Highlights Joint Development Agreement (JDA): Duty Free International Limited (“DFIL”), through its wholly-owned subsidiary…

October 31, 2025

Comprehensive Details for Investors Duty Free International Limited ("DFI"), a Singapore-listed company, has announced the successful completion of a strategically significant acquisition. This transaction sees DFI acquiring the entire issued and paid-up share capital of United Industries Holdings Sdn. Bhd.…

October 22, 2025

NIL Disclaimer: This article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities. Investors should conduct their own research or consult with a professional advisor before making investment decisions.…

October 7, 2025

Duty Free International Limited: 2Q FY2026 Financial Analysis & Investor Outlook Duty Free International Limited (“DFIL”), a Singapore-listed subsidiary of Atlan Holdings Bhd, has released its condensed interim financial statements for the six months ended 31 August 2025. This analysis…

October 9, 2024

Key Facts from the Report:Revenue: The company reported an increase in revenue for the 6-month period ending 31 August 2024, rising to RM75.5 million from RM70.0 million in the same period in 2023, representing a 7.9% increase.Profit/Loss: The company recorded…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: 5SO, Duty Free International Limited, Duty Free Intl, DFIL SP, DUTY FREE LTD, DUTY FREE

January 13, 2026

Duty Free International Limited (DFIL): 3Q FY2026 and 9M FY2026 Financial Performance Review Duty Free International Limited (DFIL), a Singapore-listed company with core interests in duty-free retailing and, more recently, automotive component manufacturing, has released its condensed interim financial statements…

December 9, 2025

Duty Free International Limited: Extension of Conditional Period for Joint Development Agreement Duty Free International Limited Announces Extension of Conditional Period for Joint Development Agreement Key Highlights Joint Development Agreement (JDA): Duty Free International Limited (“DFIL”), through its wholly-owned subsidiary…

October 31, 2025

Comprehensive Details for Investors Duty Free International Limited ("DFI"), a Singapore-listed company, has announced the successful completion of a strategically significant acquisition. This transaction sees DFI acquiring the entire issued and paid-up share capital of United Industries Holdings Sdn. Bhd.…

October 22, 2025

NIL Disclaimer: This article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any securities. Investors should conduct their own research or consult with a professional advisor before making investment decisions.…

October 7, 2025

Duty Free International Limited: 2Q FY2026 Financial Analysis & Investor Outlook Duty Free International Limited (“DFIL”), a Singapore-listed subsidiary of Atlan Holdings Bhd, has released its condensed interim financial statements for the six months ended 31 August 2025. This analysis…

July 29, 2025

CGS International July 29, 2025 Singapore Market Trendspotter: Duty Free International Rallies, Singapore Airlines Faces Downgrade Amid Trade and Earnings Frenzy Market Recap: All Eyes on Trade Truces, Dollar Surge, and Tech Earnings The week commenced with global markets at…

July 22, 2025

Broker Name: CGS International Date of Report: July 22, 2025 China Tourism Group Duty Free and Trip.com: Hong Kong Retail Trends, Technical Analysis, and Market Opportunities Market Recap: A Volatile Start to the Week Global equities entered a week marked…

July 22, 2025

Broker: CGS International Date of Report: July 22, 2025 China Tourism Group Duty Free and Trip.com: Technical Buy Signals, Market Trends, and Trade Setups for 2025 Market Recap: Corporate America, Tariff Risks, and Earnings in Focus The week kicked off…

March 13, 2025

Duty Free International's Johor Bahru Project Faces Hurdles: Land Registration Delays and Market Risks Duty Free International's Johor Bahru Project Faces Hurdles: Land Registration Delays and Market Risks Duty Free International Limited is facing questions from the Securities Investors Association…

January 13, 2025

Duty Free International Declares Second Interim Dividend for FY2025 Duty Free International Declares Second Interim Dividend for FY2025 Duty Free International Limited has announced a second interim dividend of SGD0.0055 per ordinary share for the financial year ending 28 February…

October 9, 2024

Key Facts from the Report:Revenue: The company reported an increase in revenue for the 6-month period ending 31 August 2024, rising to RM75.5 million from RM70.0 million in the same period in 2023, representing a 7.9% increase.Profit/Loss: The company recorded…