📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

1.87%

📅 SGX Earnings Announcements for 540

Tung Lok Restaurants (2000) Ltd (540)

Market: SGX |

Currency: SGD

Address: 26 Tai Seng Street

Tung Lok Restaurants (2000) Ltd, together with its subsidiaries, owns, operates, and manages restaurants in Singapore, Indonesia, Japan, Vietnam, and the Philippines. It operates in four segments: Restaurant, Catering, Manufacturing, and Others. The company also manufactures fresh dim sum, rice dumplings, mooncakes, and Chinese New Year pastries and festive food under the HOME FIESTA brand. In addition, it engages in central kitchen support function business, as well as sells original equipment manufacturer products. Further, the company provides franchising and management consultancy services. It exports its products. Tung Lok Restaurants (2000) Ltd was founded in 1980 and is based in Singapore.

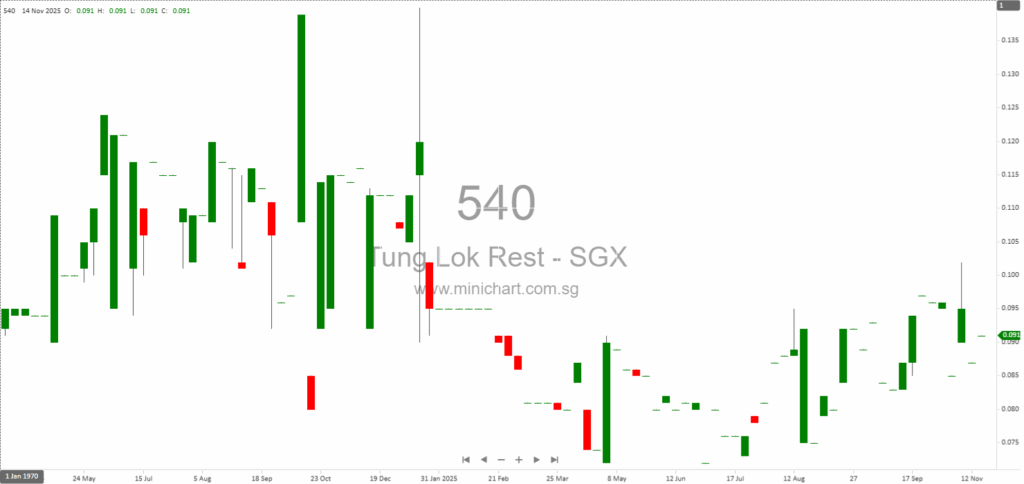

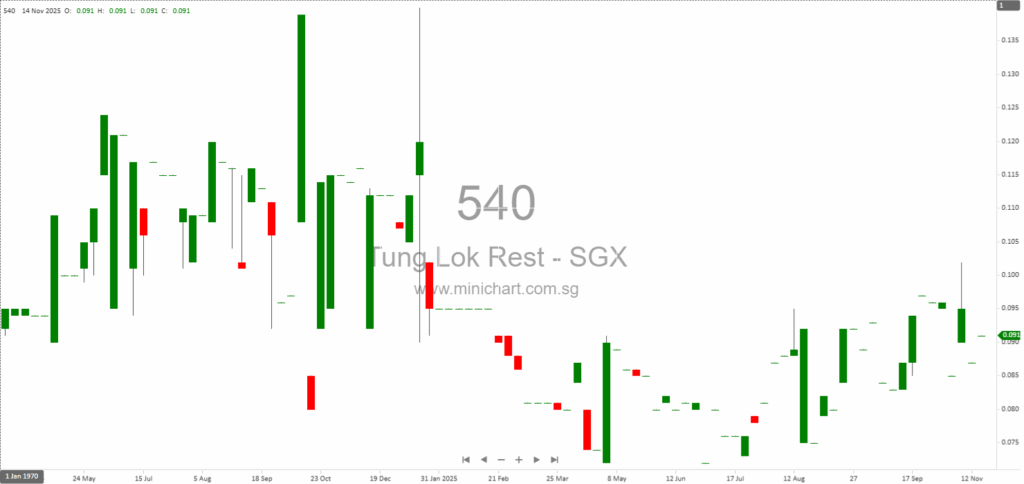

📈 Tung Lok Restaurants (2000) Ltd Historical Chart

🧾 Recent Financial Statement Analysis

February 6, 2026

Tung Lok Restaurants Strikes Off Dormant Joint Venture Company: What Investors Should Know Tung Lok Restaurants (2000) Ltd Strikes Off Dormant Joint Venture: Implications for Investors Key Highlights Striking-Off of Dormant JV: Tung Lok Restaurants (2000) Ltd has announced the…

November 15, 2025

Tung Lok Restaurants (2000) Ltd: HY26 Financial Review and Investment Analysis Tung Lok Restaurants (2000) Ltd, a Singapore-based F&B group, has released its unaudited condensed interim financial statements for the six months ending 30 September 2025 (HY26). This report provides…

September 15, 2025

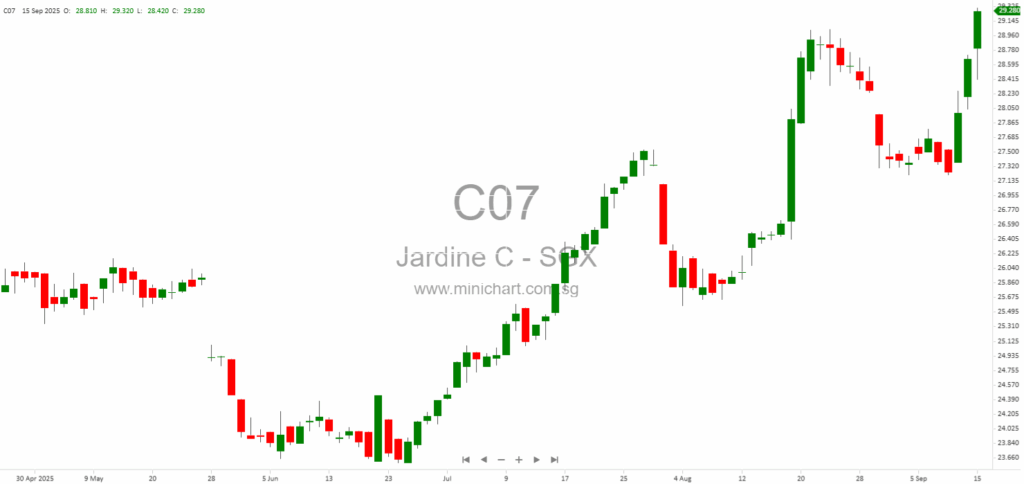

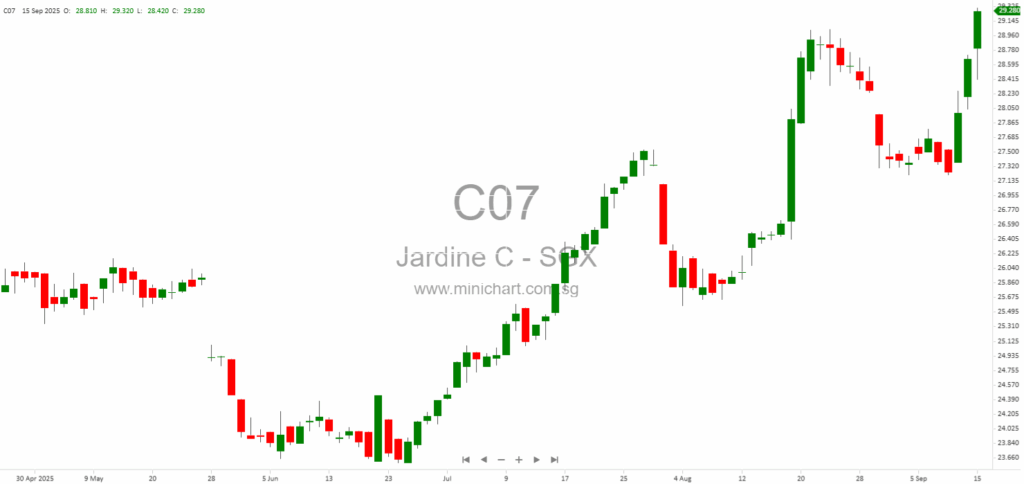

Jardine Cycle & Carriage Makes \$540 Million Move into Indonesian Gold Mining: What Investors Must Know Jardine Cycle & Carriage Makes \$540 Million Move into Indonesian Gold Mining: What Investors Must Know Key Points at a Glance Major acquisition announced:…

November 4, 2024

Tung Lok Restaurants (2000) Ltd: An In-depth Financial Analysis - Net Loss of S\$2.6 million Tung Lok Restaurants (2000) Ltd: An In-depth Financial Analysis - Net Loss of S\$2.6 million Business Description Tung Lok Restaurants (2000) Ltd is a limited…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: 540, Tung Lok Restaurants (2000) Ltd, Tung Lok Rest, TUNG SP, TUNG LOK RESTAURANTS 2000, TUNG LOK RESTAURANTS(2000)

February 12, 2026

Broker Name: DBS Date of Report: June 2024 (inferred from context and timing of announcement) Excerpt from DBS report: Report Summary CAREIT has obtained approval to add 540 beds to its Westlite Ubi property, increasing capacity from 1,650 to 2,190…

February 12, 2026

Broker Name: DBS Excerpt from DBS report Report Summary CAREIT has received approval to develop an additional 6-storey block at Westlite Ubi, increasing bed capacity by 540 (from 1650 to 2190). Development work starts in 2Q26, taking 1.5 years, with…

February 6, 2026

Tung Lok Restaurants Strikes Off Dormant Joint Venture Company: What Investors Should Know Tung Lok Restaurants (2000) Ltd Strikes Off Dormant Joint Venture: Implications for Investors Key Highlights Striking-Off of Dormant JV: Tung Lok Restaurants (2000) Ltd has announced the…

November 15, 2025

Tung Lok Restaurants (2000) Ltd: HY26 Financial Review and Investment Analysis Tung Lok Restaurants (2000) Ltd, a Singapore-based F&B group, has released its unaudited condensed interim financial statements for the six months ending 30 September 2025 (HY26). This report provides…

September 15, 2025

Jardine Cycle & Carriage Makes \$540 Million Move into Indonesian Gold Mining: What Investors Must Know Jardine Cycle & Carriage Makes \$540 Million Move into Indonesian Gold Mining: What Investors Must Know Key Points at a Glance Major acquisition announced:…

November 4, 2024

Tung Lok Restaurants (2000) Ltd: An In-depth Financial Analysis - Net Loss of S\$2.6 million Tung Lok Restaurants (2000) Ltd: An In-depth Financial Analysis - Net Loss of S\$2.6 million Business Description Tung Lok Restaurants (2000) Ltd is a limited…