📊 Statistics

- Analyst 1 Year Price Target:

$14.87

- Upside/Downside from Analyst Target:

-9.56%

- Broker Call:

6

- Dividend Minimum 3 Year Yield:

4.85%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

2026-02-26

💰 Dividend History

Current year to date yield:

6.57%

📅 SGX Earnings Announcements for V03

Venture Corporation Limited (V03)

Market: SGX |

Currency: SGD

Address: 5006 Ang Mo Kio Avenue 5

Venture Corporation Limited, together with its subsidiaries, provides technology solutions, products, and services in Singapore, the Asia Pacific, and internationally. The company provides manufacturing, product design and development, engineering, and supply-chain management services. It is also involved in manufacturing and trading of electronic products, components, equipment, devices and instruments; wholesale of computer hardware and peripheral equipment; manufacture and repair of process control equipment and related products; customisation and logistic services; manufacture and sale of terminal units; develop and market colour imaging products for label printing; manufacturing and assembly of electronic and other computer products and peripheral; letting of factory building; and manufacturing of medical devices. In addition, the company provides engineering, customization, logistics, design solutions and services, information system development and support; and manufacturing and sale of sub- assemblies, printed circuit board assemblies for communication/networking equipment, and medical and scientific equipment/instrumentation, consumer electronics, measuring equipment, testing equipment, navigating and control equipment, optical instruments and equipment, plastic precision engineering components and mould, and plastic injection moulds and mouldings with secondary processes. Further, it engages in the research and experimental development on biotechnology, and life and medical science; repair of engineering and scientific instruments; design, development, manufacture, sales, installation and servicing of computers and related products; and provision of manufacturing services for original design. Venture Corporation Limited was incorporated in 1984 and is headquartered in Singapore.

Show more

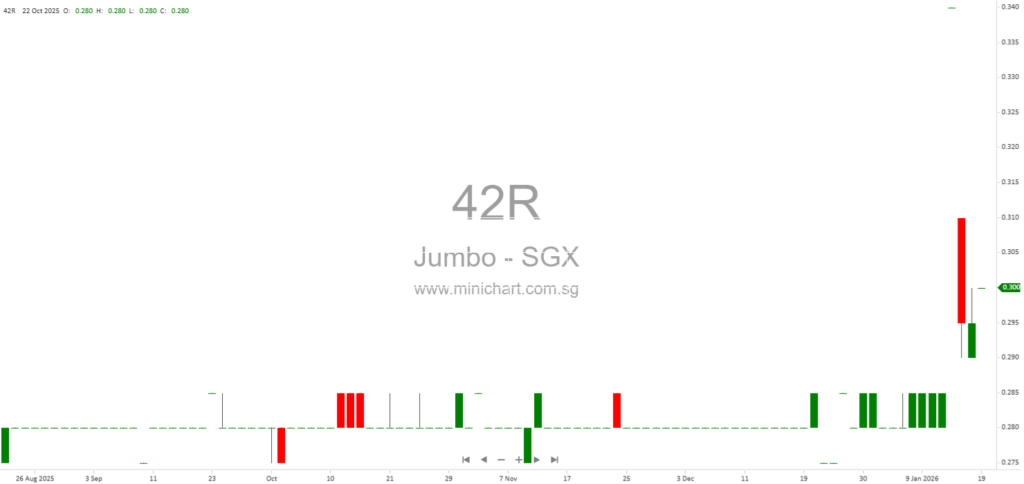

📈 Venture Corporation Limited Historical Chart

🧾 Recent Financial Statement Analysis

January 28, 2026

Aedge Group Limited Announces Joint Venture Incorporation – Key Details for Investors Aedge Group Limited Forms Strategic Joint Venture – What Investors Need to Know Overview Aedge Group Limited has announced the incorporation of a new subsidiary through a joint…

January 23, 2026

Aspen (Group) Holdings Limited Provides Update on Key Agreements and Joint Venture Aspen (Group) Holdings Limited Announces Further Extensions on Land Payment and Joint Venture Unconditional Date Key Developments Extension for Balance Cash Payment: Aspen (Group) Holdings Limited ("Aspen") has…

January 22, 2026

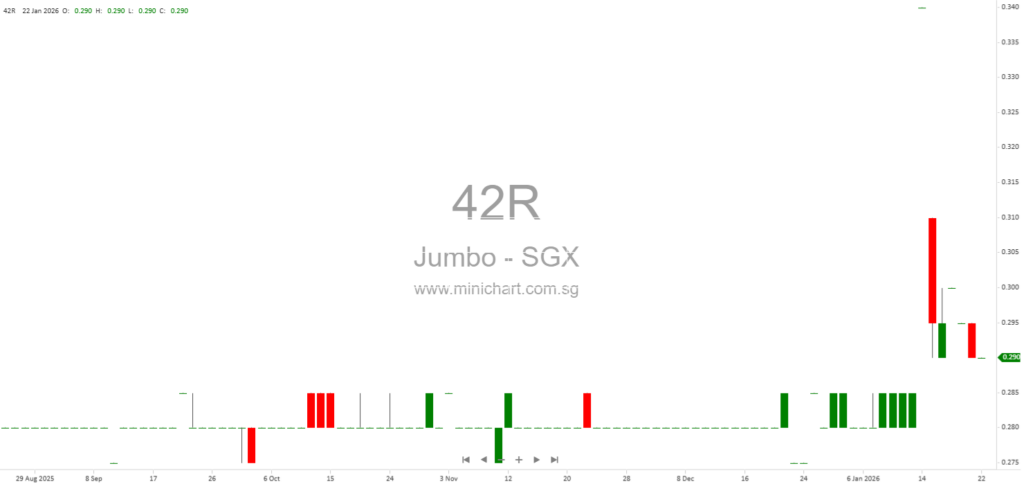

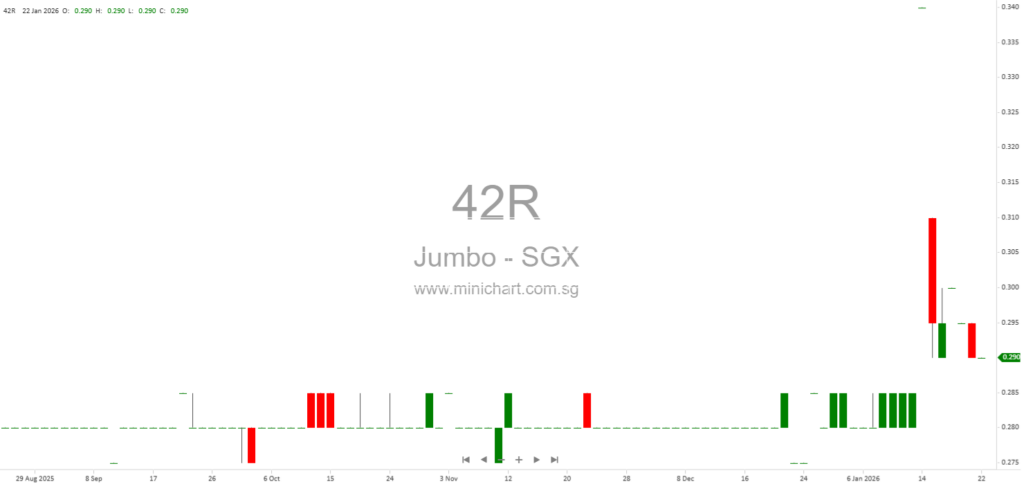

Jumbo Group Announces Strategic Joint Venture in Xi’an, China Jumbo Group Limited Announces Entry into Strategic Joint Venture in Xi’an, China Key Highlights from the Announcement Joint Venture Formation: Jumbo Group Limited (“Jumbo” or the “Company”), through its indirect wholly-owned…

January 21, 2026

Nanofilm Technologies Announces Striking-Off of Dormant Subsidiary Nanofilm Technologies International Limited: Striking-Off of Dormant Subsidiary Key Highlights from Recent Board Announcement Nanofilm Ventures Pte. Ltd. Struck Off: Nanofilm Technologies International Limited has announced the striking-off of its indirect wholly-owned subsidiary,…

January 20, 2026

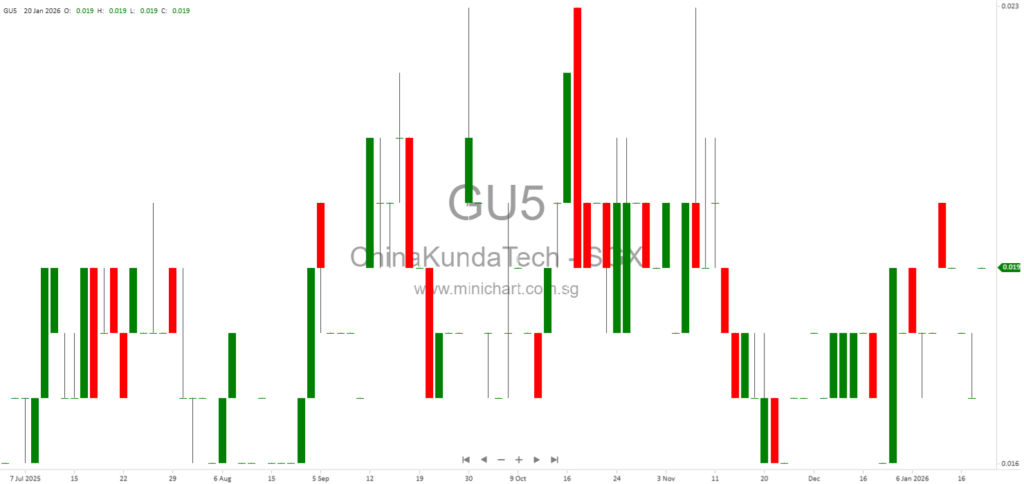

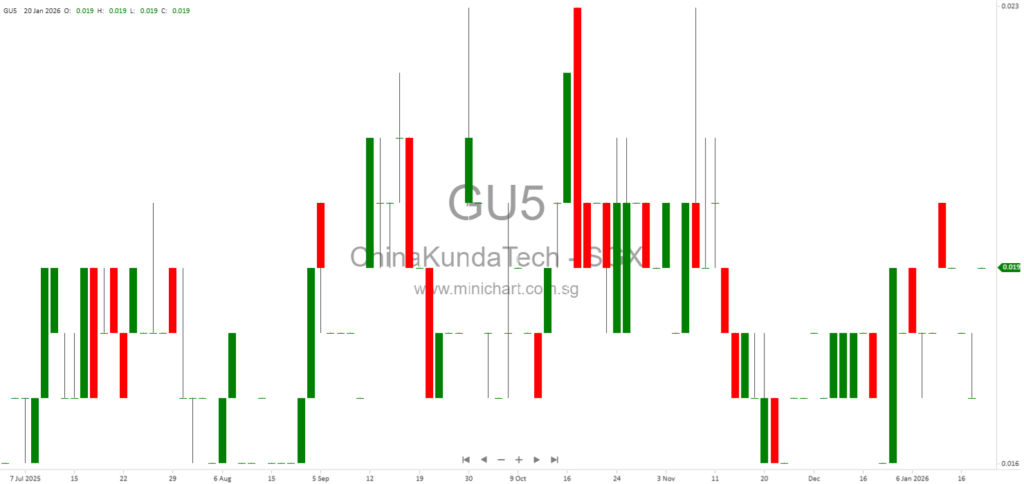

China Kunda Technology Holdings Announces Strategic Joint Venture Entry into Water Treatment Business China Kunda Technology Holdings Announces Strategic Joint Venture Entry into Water Treatment Business China Kunda Technology Holdings Limited has announced a significant strategic move that could reshape…

August 6, 2025

Venture Corporation Limited: 1H 2025 Financial Results Analysis Venture Corporation Limited has released its condensed consolidated financial statements for the half-year ended 30 June 2025. Below is an analysis of the key financial metrics, performance trends, and notable corporate actions…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: V03, Venture Corporation Limited, Venture, VMS SP, VENTURE CORP LTD, VENTURE CORP

January 28, 2026

Aedge Group Limited Announces Joint Venture Incorporation – Key Details for Investors Aedge Group Limited Forms Strategic Joint Venture – What Investors Need to Know Overview Aedge Group Limited has announced the incorporation of a new subsidiary through a joint…

January 23, 2026

Aspen (Group) Holdings Limited Provides Update on Key Agreements and Joint Venture Aspen (Group) Holdings Limited Announces Further Extensions on Land Payment and Joint Venture Unconditional Date Key Developments Extension for Balance Cash Payment: Aspen (Group) Holdings Limited ("Aspen") has…

January 22, 2026

Jumbo Group Announces Strategic Joint Venture in Xi’an, China Jumbo Group Limited Announces Entry into Strategic Joint Venture in Xi’an, China Key Highlights from the Announcement Joint Venture Formation: Jumbo Group Limited (“Jumbo” or the “Company”), through its indirect wholly-owned…

January 21, 2026

Nanofilm Technologies Announces Striking-Off of Dormant Subsidiary Nanofilm Technologies International Limited: Striking-Off of Dormant Subsidiary Key Highlights from Recent Board Announcement Nanofilm Ventures Pte. Ltd. Struck Off: Nanofilm Technologies International Limited has announced the striking-off of its indirect wholly-owned subsidiary,…

January 20, 2026

China Kunda Technology Holdings Announces Strategic Joint Venture Entry into Water Treatment Business China Kunda Technology Holdings Announces Strategic Joint Venture Entry into Water Treatment Business China Kunda Technology Holdings Limited has announced a significant strategic move that could reshape…

January 19, 2026

Jumbo Group Announces Major Joint Venture for Property Acquisition Jumbo Group Announces Joint Venture to Acquire Strategic Property at 26 Tai Seng Street Key Details of the Transaction Jumbo Group Limited (“Jumbo” or the “Company”), a leading F&B operator in…

January 14, 2026

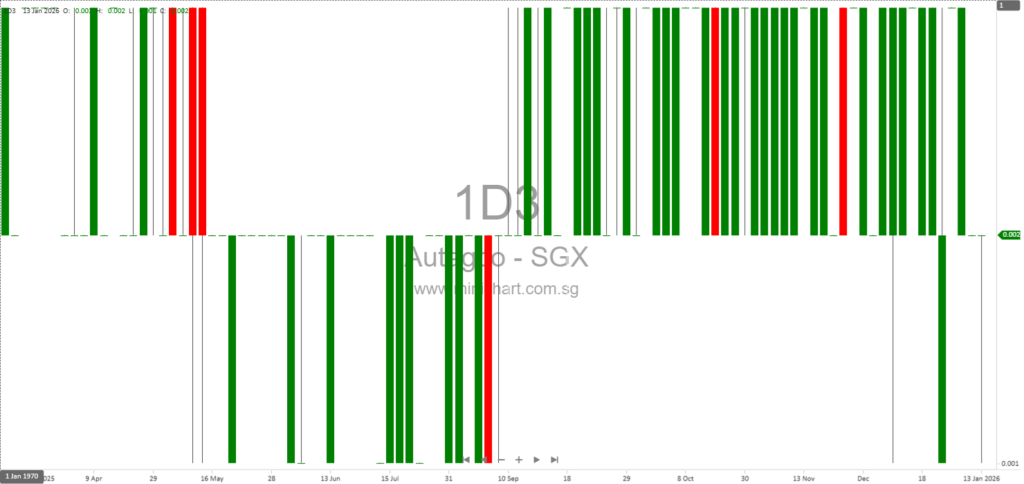

Autagco Ltd. Extends Deadline for Definitive Agreements in Strategic Joint Venture with r+ Pte. Ltd. Autagco Ltd. Announces Extension of Deadline for Major Hospitality Joint Venture Key Points from the Latest Announcement Extension Granted: Autagco Ltd. and r+ Pte. Ltd.…

January 12, 2026

Rex International Holding Announces Proposed Acquisition of Shares in Renewable Ventures Nordic AB by Monarch Marine Holding Ltd Rex International Holding Proposes Strategic Share Acquisition in Renewable Ventures Nordic AB Key Points from the Announcement Proposed Transaction Structure: Rex International…

January 12, 2026

SDAI Limited Forms Joint Venture with Hubei Qiai Group to Expand Moxibustion Market in ASEAN SDAI Limited Forms Joint Venture with Hubei Qiai Group to Expand Moxibustion Market in ASEAN Comprehensive Details of the Joint Venture Agreement and Strategic Implications…

January 7, 2026

Tien Wah Press Holdings Berhad Announces Strategic Data Centre Venture Tien Wah Press Holdings Berhad Announces Strategic Data Centre Venture in Petaling Jaya Key Points of the Proposed Venture Joint Venture Formation: Lum Chang Tien Wah Property Sdn. Bhd. (“LCTWP”),…

October 1, 2025

Broker Name: CGS International Date of Report: August 7, 2025 Excerpt from CGS International report. Report Summary Yangzijiang Shipbuilding Holdings Ltd is showing strong bullish momentum, with technical indicators supporting further upside. The stock remains in an uptrend, confirmed by…

August 7, 2025

Broker: CGS International Date of Report: August 6, 2025 Venture Corporation Delivers Resilient 1H25 Results, Surprises with Special Dividend Amid Industry Headwinds Overview: Venture Corporation Exceeds Expectations Despite Market Challenges Venture Corporation, a leading Singapore-based tech manufacturing services provider, reported…

August 6, 2025

Venture Corporation Limited: 1H 2025 Financial Results Analysis Venture Corporation Limited has released its condensed consolidated financial statements for the half-year ended 30 June 2025. Below is an analysis of the key financial metrics, performance trends, and notable corporate actions…

May 15, 2025

CGS International May 14, 2025 Venture Corporation: Navigating a Challenging FY25F with Strategic Resilience 1Q25 Performance Overview: Revenue Dip Offset by Robust Profit Margins Venture Corporation's 1Q25 revenue experienced a decline of 7% quarter-over-quarter (qoq) and 8% year-over-year (yoy), landing…

April 8, 2025

Venture Corporation: Weathering the Trade War Storm CGS International | April 8, 2025 The tech manufacturing landscape has been rocked by the escalating trade tensions between the US and China, and Venture Corporation finds itself navigating these turbulent waters. This…

February 24, 2025

Comprehensive Analysis of Market Performance and Company Insights Broker: Lim & Tan Securities Date: 24 February 2025 Market Overview The financial markets have exhibited mixed performances recently, with the FSSTI Index closing at 3,927.5, reflecting a slight decline of 0.2%…

February 11, 2025

Deep Dive Analysis of Venture Corporation and Peer Companies In-Depth Financial Analysis of Venture Corporation and Its Competitors Broker Name: CGS International Date: February 10, 2025 Venture Corporation: A Resilient Contender in Tech Manufacturing Venture Corporation, one of Singapore’s leading…

November 11, 2024

Venture Corporation: Navigating Weaker Demand Venture Corporation reported a disappointing 9M24 performance with revenue at S\$2,073.9m, witnessing a year-on-year decline of 9.4%. This figure accounted for 68.1% of CGS International's forecast and 67.3% of Bloomberg consensus for FY24. Net profit…

September 27, 2024

Date: 27 September 2024 Broker: Lim & Tan Securities Award Recognition Venture Corporation Limited, priced at $14.16 as of 27 September 2024, received the prestigious Supplier Excellence Award at Lam Research Corporation’s 2024 ceremony. The award recognized nine companies from…

September 13, 2024

Venture Corp: Current Price: S$13.79 Target Price: S$14.70 Stop-Loss Price: S$13.53 Recommendation: Trading Buy Investment Thesis: Venture Corp has formed a possible bottom at S$13.23, with a potential hammer candlestick pattern signaling a reversal. The stock's relative strength index (RSI)…