📊 Statistics

- Analyst 1 Year Price Target:

$0.35

- Upside/Downside from Analyst Target:

18.59%

- Broker Call:

2

- Dividend Minimum 3 Year Yield:

6.99%

- EPS Growth Range (1Y):

-

- Net Income Growth Range (1Y):

-

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

2026-02-24

💰 Dividend History

Current year to date yield:

9.10%

📅 SGX Earnings Announcements for UD1U

IREIT Global (UD1U)

Market: SGX |

Currency: SGD

Address: 1 Wallich Street

IREIT Global which was listed on 13 August 2014, is the first Singapore-listed real estate investment trust with the investment strategy of principally investing, directly or indirectly, in a portfolio of income-producing real estate in Europe which is or will be primarily used for office, retail, industrial (including logistics and business parks), hospitality, hospitality related and other accommodation and/or lodging purposes, as well as real estate-related assets. IREIT Global current portfolio comprises five freehold office properties in Germany, four freehold office properties in Spain and 44 retail properties in France. IREIT Global is managed by IREIT Global Group Pte. Ltd., which is jointly owned by Tikehau Capital and City Developments Limited. Tikehau Capital is a global alternative asset management group listed in France, while CDL is a leading global real estate company listed in Singapore.

Show more

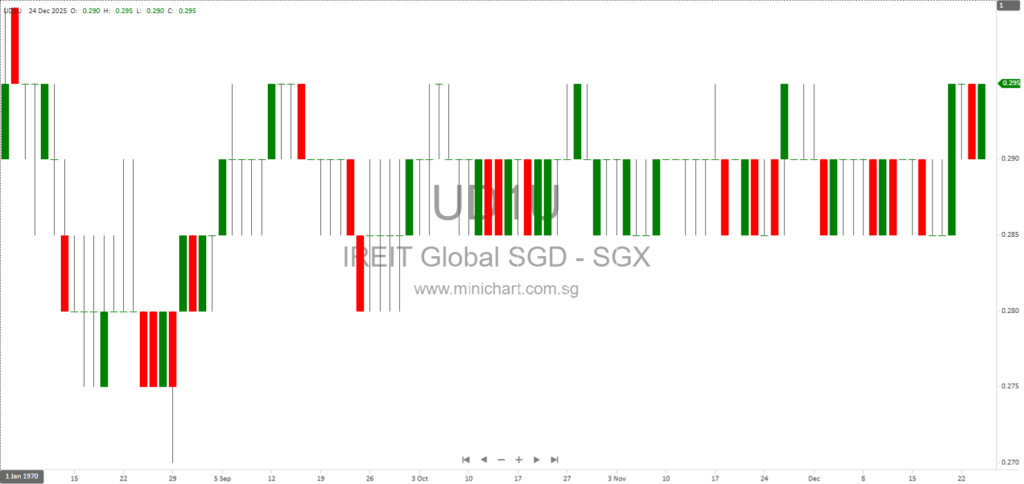

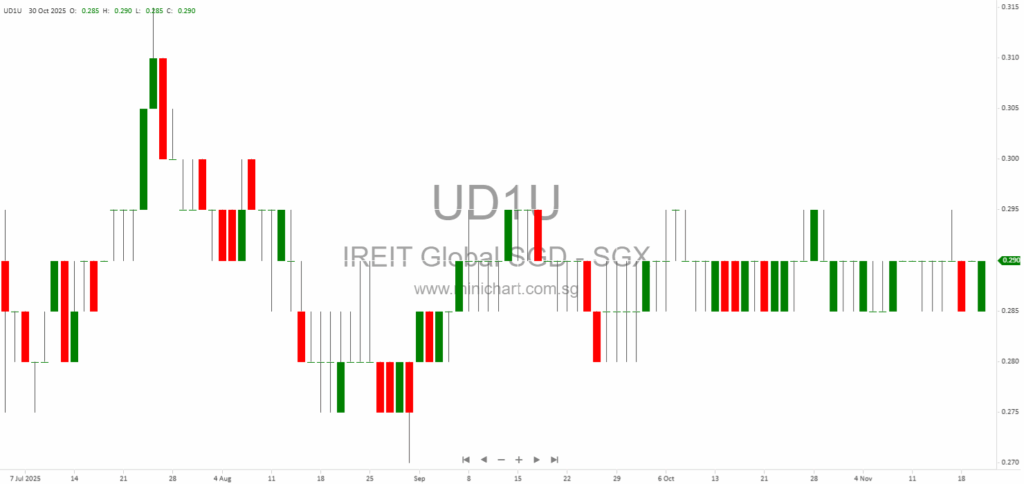

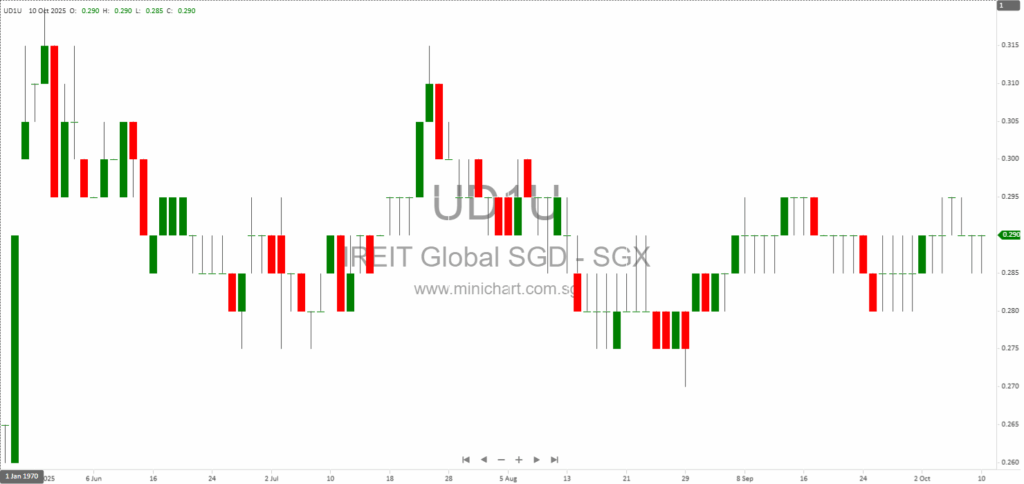

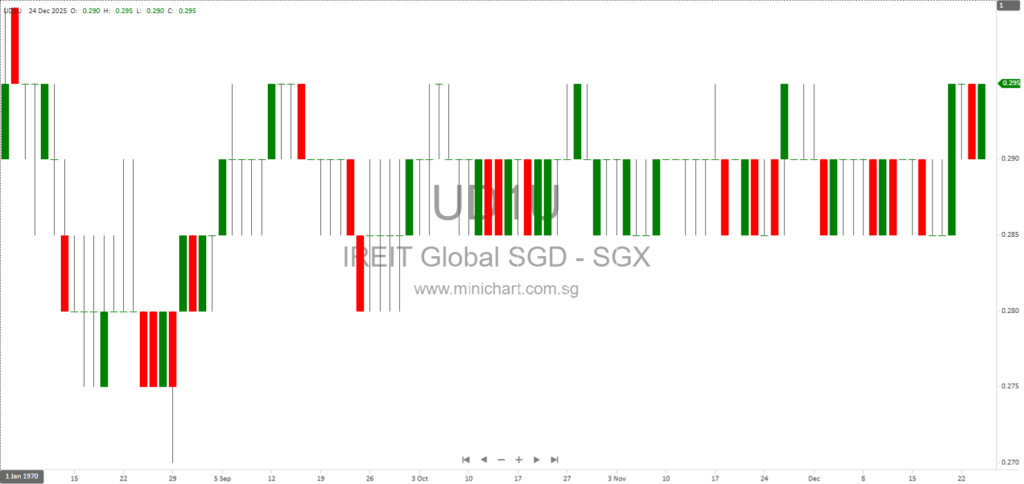

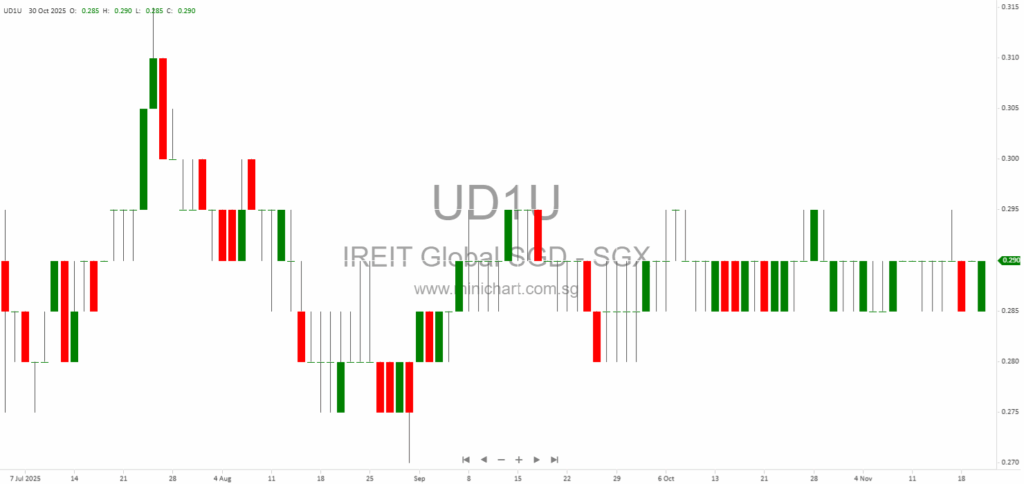

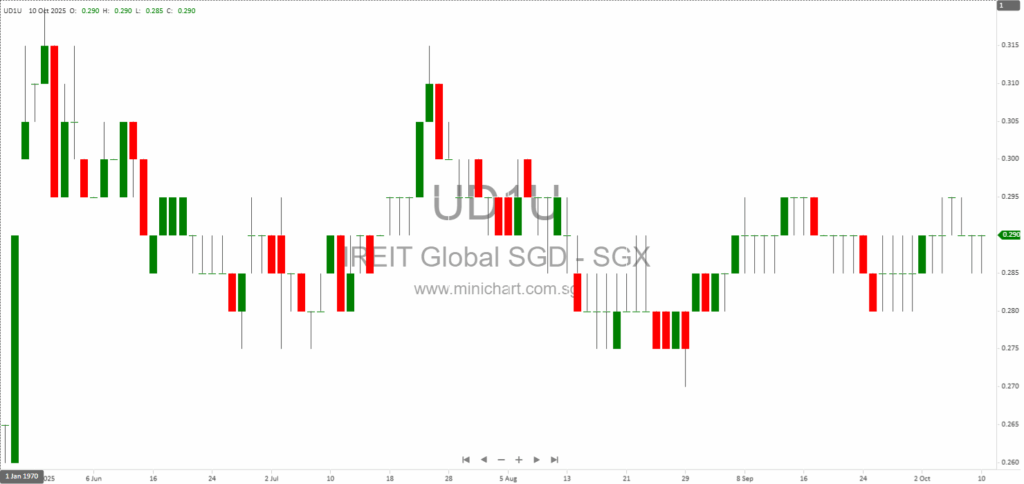

📈 IREIT Global Historical Chart

🧾 Recent Financial Statement Analysis

December 25, 2025

IREIT Global Secures €12.5 Million Loan Facility from CDL Subsidiary to Fund Berlin Campus Project Key Highlights from the Announcement New Loan Facility: IREIT Global, managed by IREIT Global Group Pte. Ltd., has announced that DBS Trustee Limited, acting as…

November 21, 2025

Overview IREIT Global, a pure-play Western Europe-focused real estate investment trust (REIT), released its 3Q2025 business update with significant developments across its portfolio, capital management, and strategic repositioning projects. Its portfolio spans Germany, France, and Spain, comprising 53 properties valued…

October 10, 2025

IREIT Global Secures €220 Million in Debt Refinancing, Extends German Portfolio Loan Maturity to 2029: What Investors Need to Know Key Points IREIT Global completes €200 million refinancing for its German Portfolio, extending loan maturity from January 2026 to July…

November 14, 2024

IREIT Global Shows Resilient Performance Amidst European Market Shifts IREIT Global Shows Resilient Performance Amidst European Market Shifts In its 3Q2024 business update, IREIT Global has demonstrated a stable performance and strategic foresight in navigating the Western European real estate…

November 13, 2024

IREIT Global Reports Stable 3Q2024 Performance Despite Challenges in Spanish Portfolio IREIT Global Reports Stable 3Q2024 Performance Despite Challenges in Spanish Portfolio IREIT Global has released its 3Q2024 business update, showcasing a stable performance with a continued focus on maintaining…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: UD1U, IREIT Global

December 25, 2025

IREIT Global Secures €12.5 Million Loan Facility from CDL Subsidiary to Fund Berlin Campus Project Key Highlights from the Announcement New Loan Facility: IREIT Global, managed by IREIT Global Group Pte. Ltd., has announced that DBS Trustee Limited, acting as…

November 21, 2025

Overview IREIT Global, a pure-play Western Europe-focused real estate investment trust (REIT), released its 3Q2025 business update with significant developments across its portfolio, capital management, and strategic repositioning projects. Its portfolio spans Germany, France, and Spain, comprising 53 properties valued…

October 10, 2025

IREIT Global Secures €220 Million in Debt Refinancing, Extends German Portfolio Loan Maturity to 2029: What Investors Need to Know Key Points IREIT Global completes €200 million refinancing for its German Portfolio, extending loan maturity from January 2026 to July…

July 24, 2025

Broker: CGS International Date of Report: July 24, 2025 Singapore Market Trendspotter: IREIT Global Signals Upside, Elite UK REIT Demonstrates Resilience Market Overview: Optimism Rises Amid Global Trade Progress The global equity markets surged on the back of record-breaking performances,…

May 28, 2025

CGS International May 28, 2025 IREIT Global: A Potential Bottoming Up Opportunity and Pan-United Corp Ltd Volume Growth and Favourable Project Mix Global Market Overview Bonds experienced a worldwide rally following Japan's indication of stabilizing its debt market after a…

November 14, 2024

IREIT Global Shows Resilient Performance Amidst European Market Shifts IREIT Global Shows Resilient Performance Amidst European Market Shifts In its 3Q2024 business update, IREIT Global has demonstrated a stable performance and strategic foresight in navigating the Western European real estate…

November 13, 2024

IREIT Global Reports Stable 3Q2024 Performance Despite Challenges in Spanish Portfolio IREIT Global Reports Stable 3Q2024 Performance Despite Challenges in Spanish Portfolio IREIT Global has released its 3Q2024 business update, showcasing a stable performance with a continued focus on maintaining…

November 12, 2024

IREIT Global: Resilient Performance Amidst Market Fluctuations IREIT Global: Resilient Performance Amidst Market Fluctuations IREIT Global has released its 3Q2024 business update, highlighting a stable performance despite some challenges in the Spanish portfolio. The company continues to focus on maintaining…

November 12, 2024

IREIT Global Eyes Expansion Amidst Resilient Performance IREIT Global Eyes Expansion Amidst Resilient Performance IREIT Global has released its 3Q2024 business update, highlighting key performance metrics and future strategic plans that could potentially sway investor sentiment and share values. Key…

September 25, 2024

iREITs (IREIT Global) IREIT Global, a real estate investment trust (REIT), recently reported strong financial performance, driven by its diversified portfolio and strategic asset management. Financial Performance (1H2024): Gross revenue for the first half of 2024 increased by 28.8% year-on-year…