📊 Statistics

- Analyst 1 Year Price Target:

$1.46

- Upside/Downside from Analyst Target:

33.49%

- Broker Call:

3

- Dividend Minimum 3 Year Yield:

3.21%

- EPS Growth Range (1Y):

25-50%

- Net Income Growth Range (1Y):

25-50%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

3.75%

📅 SGX Earnings Announcements for TQ5

Frasers Property Limited (TQ5)

Market: SGX |

Currency: SGD

Address: 438 Alexandra Road

Frasers Property Limited, an investment holding company, develops, invests in, and manages a portfolio of real estate assets in Singapore, Australia, Europe, China, Thailand, and internationally. Its asset portfolio includes commercial and business parks, hospitality, industrial and logistics, and residential and retail properties; and owns and/or operates serviced apartments and hotels. The company acts as a sponsor of two real estate investment trusts (REITs) listed on the SGX-ST that comprises Frasers Centrepoint Trust, and Frasers Logistics & Commercial Trust focused on retail, commercial, and industrial properties; one stapled trust listed on the SGX-ST, such as Frasers Hospitality Trust focused on hospitality properties; and two REITs listed on the Stock Exchange of Thailand comprising Frasers Property (Thailand) Public Company Limited, a sponsor of Frasers Property Thailand Industrial Freehold & Leasehold REIT that focuses on industrial and logistics properties in Thailand, as well as Golden Ventures Leasehold Real Estate Investment Trust, which focuses on commercial properties. Frasers Property Limited was formerly known as Frasers Centrepoint Limited and changed its name to Frasers Property Limited in February 2018. Frasers Property Limited was incorporated in 1963 and is based in Singapore. Frasers Property Limited operates as a subsidiary of TCC Assets Limited.

Show more

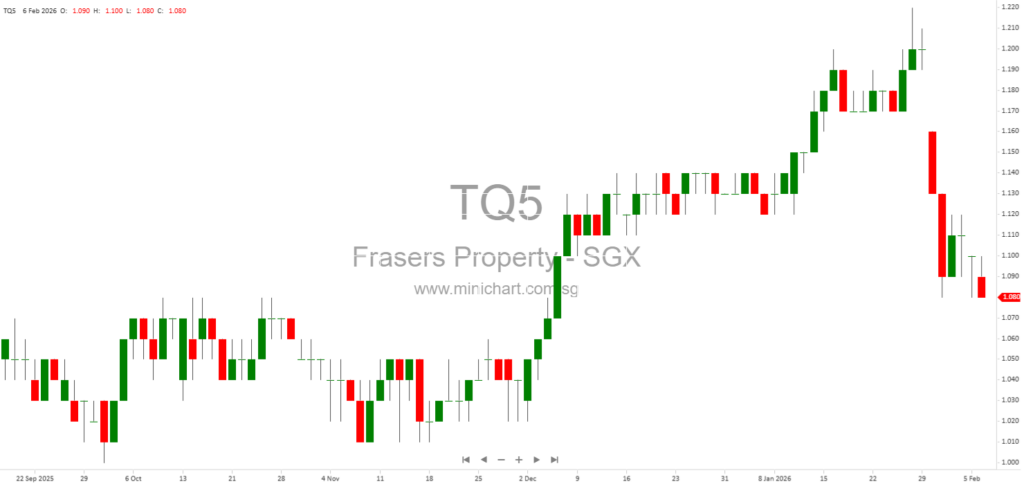

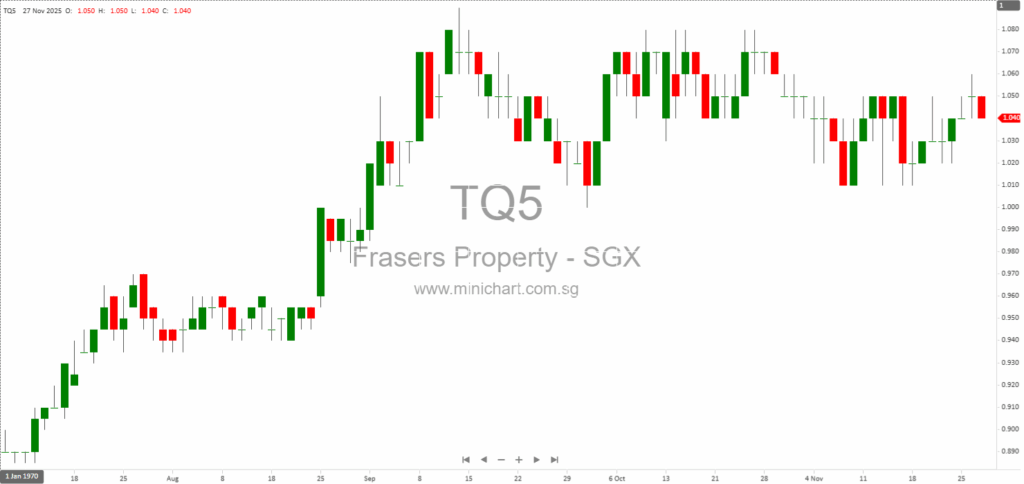

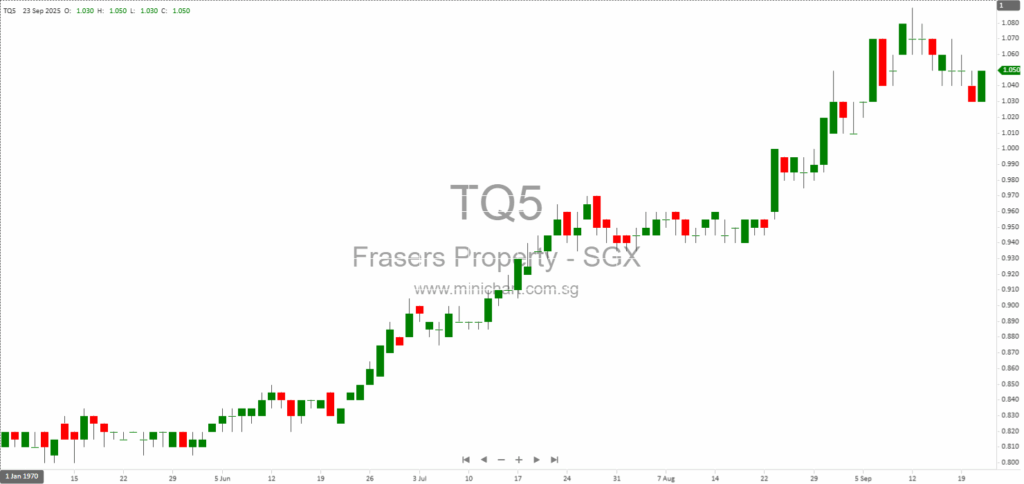

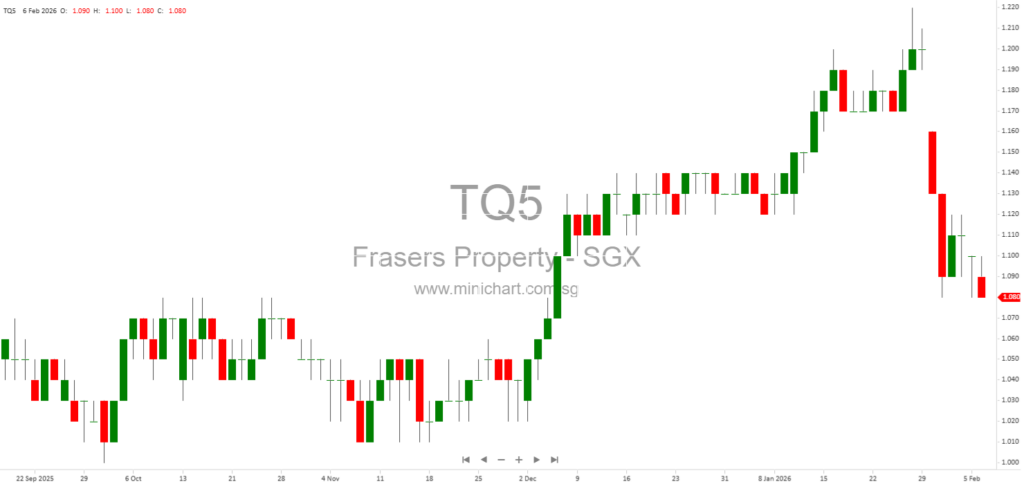

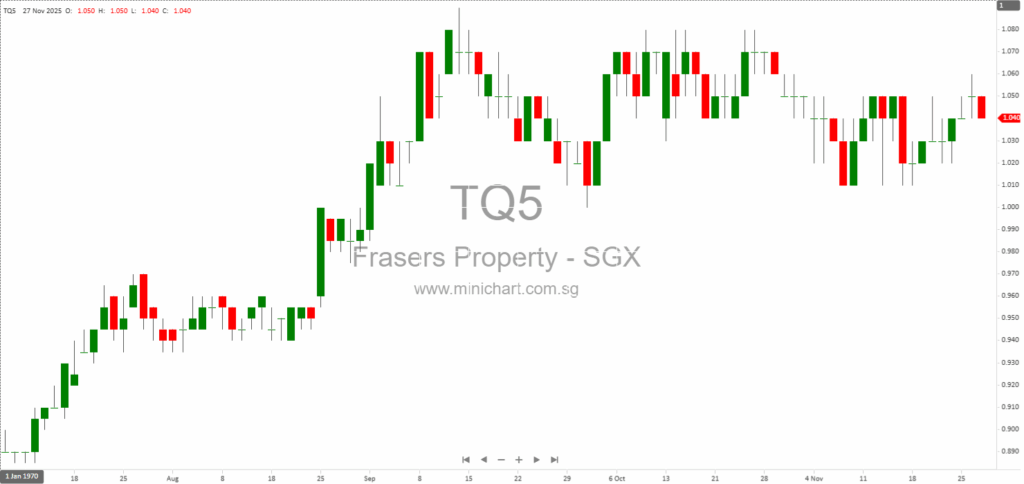

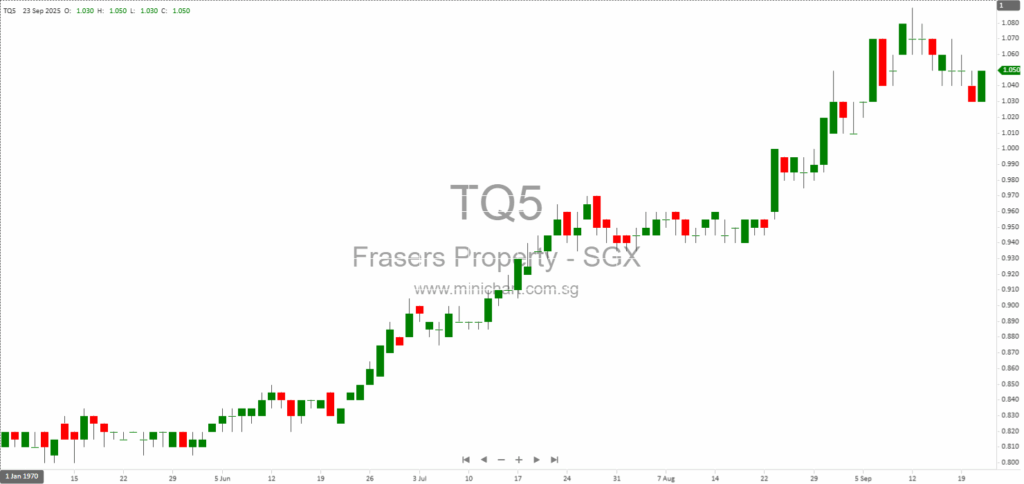

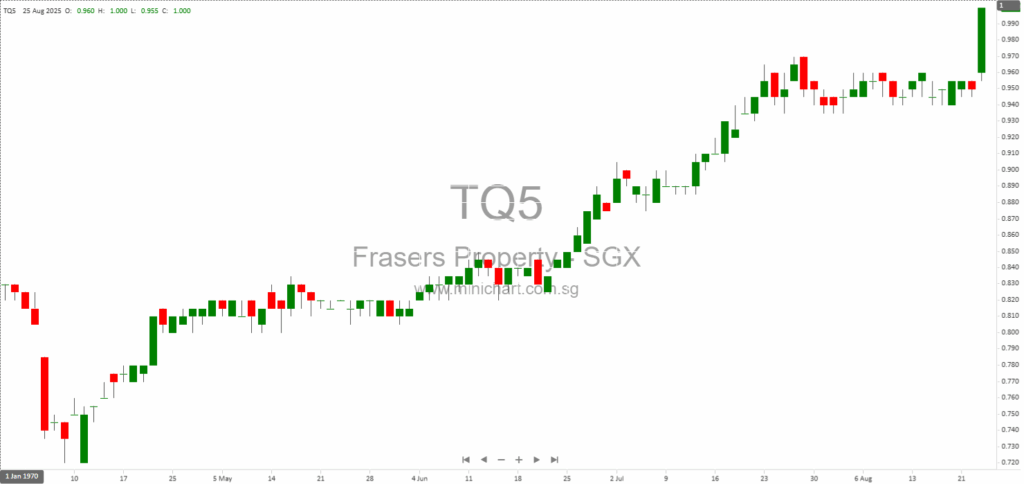

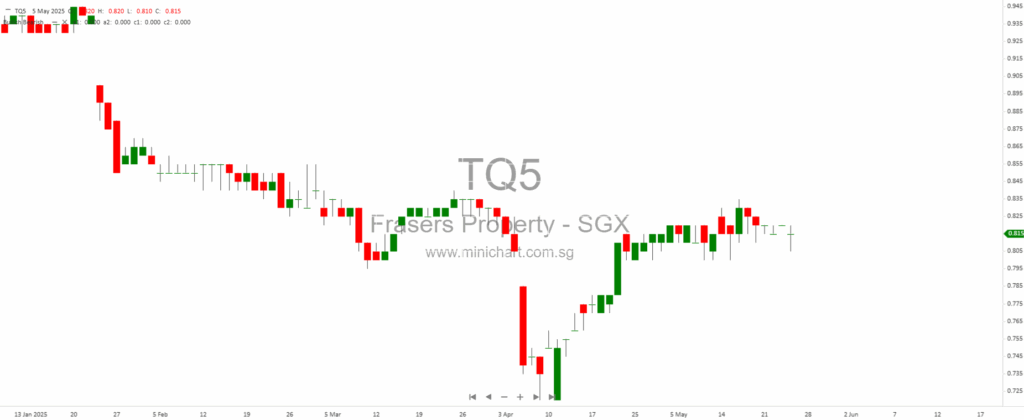

📈 Frasers Property Limited Historical Chart

🧾 Recent Financial Statement Analysis

February 6, 2026

Executive Summary Frasers Property Limited has released its business update for the three months ended 31 December 2025. The report demonstrates a continued focus on sustainable value creation, active capital management, and strategic development across multiple asset classes and geographies.…

December 26, 2025

Frasers Property Limited Announces Significant Capital Injections into BetterBe Marketplace Co., Ltd. Key Highlights Frasers Property Limited (“FPL”) is executing substantial capital injections into its joint venture company Must Be Company Limited (“JV Co”), which directly invests in BetterBe Marketplace…

November 27, 2025

Frasers Property Limited: 2025 Value Creation, Portfolio Moves, and Market Insights Frasers Property Limited: 2025 Value Creation, Portfolio Moves, and Market Insights Overview: Anchoring Growth and Value Continuity Frasers Property Limited continues to drive its integrated operating model with a…

November 13, 2025

Frasers Property Limited Announces Key Acquisitions, Divestments, and New Subsidiaries for H2 2025 Frasers Property Limited: Strategic Moves in Acquisitions, Divestments, and Subsidiary Incorporations for H2 2025 Executive Summary Frasers Property Limited (“Frasers Property” or “the Company”) has released a…

September 23, 2025

Frasers Property Completes Strategic Acquisition of Prime Yishun Strata Lots: What Investors Need to Know Key Points from the Announcement Frasers Property Limited (FPL) has successfully completed the acquisition of ten strata lots at 51 Yishun Central 1, Singapore 768794.…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: TQ5, Frasers Property Limited, Frasers Property, FPL SP, FRASERS PROPERTY LTD, FRASERS PROPERTY

February 6, 2026

Executive Summary Frasers Property Limited has released its business update for the three months ended 31 December 2025. The report demonstrates a continued focus on sustainable value creation, active capital management, and strategic development across multiple asset classes and geographies.…

December 26, 2025

Frasers Property Limited Announces Significant Capital Injections into BetterBe Marketplace Co., Ltd. Key Highlights Frasers Property Limited (“FPL”) is executing substantial capital injections into its joint venture company Must Be Company Limited (“JV Co”), which directly invests in BetterBe Marketplace…

December 8, 2025

Broker Name: PSPL Date of Report: December 8, 2025 Excerpt from PSPL report. Report Summary Frasers Property Limited (FPL) is focusing on capital recycling to unlock value and reduce net debt, with strategies such as selling assets to its listed…

December 3, 2025

Broker Name: CGS International Date of Report: December 2, 2025 Excerpt from CGS International report. Report Summary Frasers Property Limited (FPL) continues to focus on its strategy of creating, sustaining, and unlocking value, with 86% of FY25 profits before interest…

November 27, 2025

Frasers Property Limited: 2025 Value Creation, Portfolio Moves, and Market Insights Frasers Property Limited: 2025 Value Creation, Portfolio Moves, and Market Insights Overview: Anchoring Growth and Value Continuity Frasers Property Limited continues to drive its integrated operating model with a…

November 13, 2025

Frasers Property Limited Announces Key Acquisitions, Divestments, and New Subsidiaries for H2 2025 Frasers Property Limited: Strategic Moves in Acquisitions, Divestments, and Subsidiary Incorporations for H2 2025 Executive Summary Frasers Property Limited (“Frasers Property” or “the Company”) has released a…

September 23, 2025

Frasers Property Completes Strategic Acquisition of Prime Yishun Strata Lots: What Investors Need to Know Key Points from the Announcement Frasers Property Limited (FPL) has successfully completed the acquisition of ten strata lots at 51 Yishun Central 1, Singapore 768794.…

August 25, 2025

Frasers Property's Full Ownership of Yishun 10: Strategic Acquisition to Unlock Future Value Frasers Property Takes Full Control of Yishun 10 in S\$82.5 Million Strategic Acquisition: Major Move for Redevelopment Potential? Key Points from the Announcement Frasers Property Limited has…

May 27, 2025

Frasers Property’s (SGX:TQ5) second attempt to privatise Frasers Hospitality Trust (FHT) (SGX:ACV) may offer minority investors a financially reasonable exit — but it does little to solve the strategic conundrum faced by the property group itself. The proposed S$0.71 per…

May 15, 2025

Frasers Property Limited (FPL): Privatization Proposal and Strategic Analysis CGS International May 14, 2025 Frasers Property Limited: Privatization Proposal, Strategic Benefits, and Future Outlook Overview of the Privatization Proposal Frasers Property Ltd (FPL) has announced a proposal to privatize Frasers…

May 13, 2025

CGS International May 9, 2025 Frasers Property Limited (FPL SP): 1HFY25 Earnings Surpass Expectations, "Add" Rating Reaffirmed 1HFY25 Performance Overview Frasers Property Limited (FPL) reported a strong 1HFY25, with EPS reaching 3.5 Singapore cents, exceeding forecasts at 74.6% of the…

February 11, 2025

Deep Dive: Frasers Property Limited & Peer Analysis Deep Dive Analysis: Frasers Property Limited & Peer Companies Broker: CGS International | Date: February 10, 2025 Overview of the Report This report by CGS International provides a comprehensive financial analysis of…

November 18, 2024

In-Depth Analysis of Singapore Property Sector Companies In-Depth Analysis of Singapore Property Sector Companies Broker: CGS International | Date of Report: November 15, 2024 Frasers Property Limited: A Promising Prospect Frasers Property Limited (FPL) has reported a stronger operational performance…

November 14, 2024

Frasers Property Limited Financial Analysis – Net Profit Growth of 76.2% with 4.92% dividend yield. The company proposed a first and final dividend of 4.5 cents per share, consistent with the previous year, amounting to \$176.7 million. Revenue: \$4,215 million,…