📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

2.97%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

2.97%

📅 SGX Earnings Announcements for TCU

Credit Bureau Asia Limited (TCU)

Market: SGX |

Currency: SGD

Address: 6 Shenton Way

Credit Bureau Asia Limited, an investment holding company, provides credit and risk information solutions in Singapore, Malaysia, Cambodia, and Myanmar. It operates through two segments: Financial Institution Data and Non-Financial Institution Data segments. The Financial Institution Data segment offers access to credit information on individual consumers or registered business entities, which are generated from up-to-date credit information contributed by subscribing members; and credit scoring, data analytics, credit monitoring services, and client-specific tailored solutions. The Non-Financial Institution Data segment offers a range of business information and risk management services, sales and marketing solutions, commercial insights, and other services. It also provides litigation and other databases; consulting and related services; portfolio and litigation monitoring and membership subscription; credit information services and receivables management services; and software consultancy and data processing services. The company serves financial institutions, multinational corporations, telecommunication companies, government bodies and public agencies, local enterprises, and individuals. Credit Bureau Asia Limited was founded in 1993 and is based in Singapore.

Show more

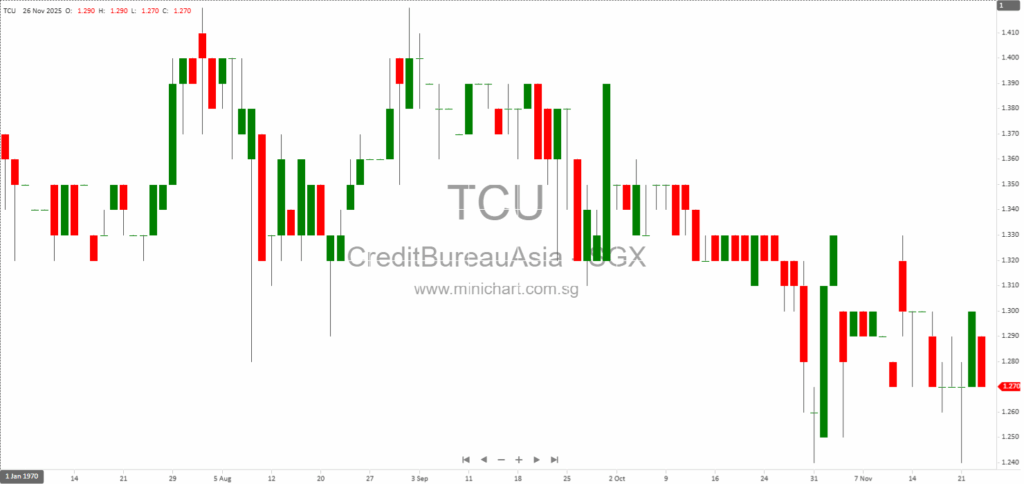

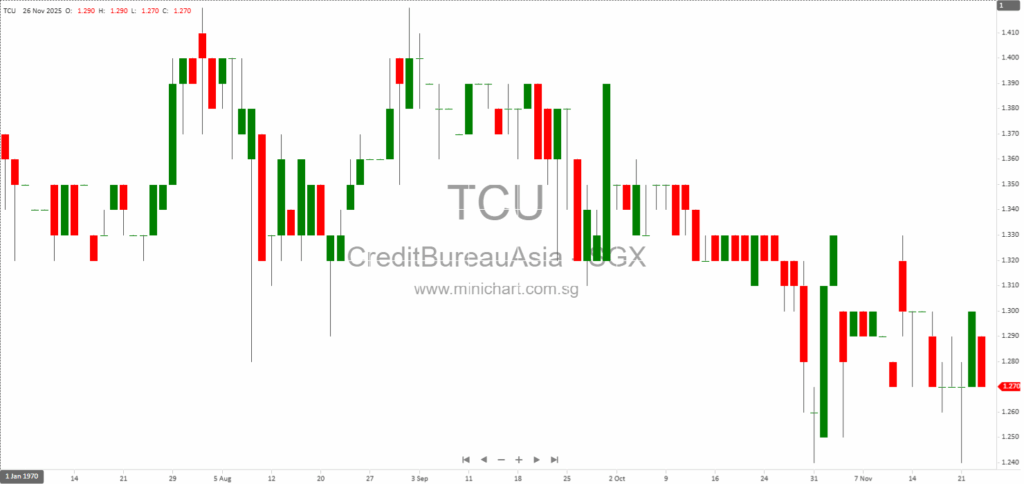

📈 Credit Bureau Asia Limited Historical Chart

🧾 Recent Financial Statement Analysis

November 26, 2025

Credit Bureau Asia and Credit Bureau Singapore in Joint Venture Talks Credit Bureau Asia Engages Credit Bureau Singapore for Strategic Joint Venture Discussions Overview and Key Developments Credit Bureau Asia Limited (CBA), a prominent SGX Mainboard-listed entity and a leader…

April 14, 2025

Credit Bureau Asia Limited Responds to SIAS Queries: What's Next for the Company? In a recent announcement, Credit Bureau Asia Limited (the "Company") responded to queries from the Securities Investors Association Singapore ("SIAS") regarding its annual report for the financial…

April 14, 2025

Credit Bureau Asia Limited's AGM Raises Questions on Licensing, Business Operations, and Dividend Payout Credit Bureau Asia Limited (TCU) recently held its Annual General Meeting (AGM), where several key issues were raised by shareholders. The company, which operates in the…

April 13, 2025

Credit Bureau Asia Limited Responds to SIAS Queries, Shares Insights on Business Operations and Future Plans In a recent announcement, Credit Bureau Asia Limited (the “Company”) addressed queries from the Securities Investors Association Singapore (“SIAS”) regarding its annual report for…

April 13, 2025

Credit Bureau Asia Limited Faces Questions on Licensing, Business Operations, and Governance Credit Bureau Asia Limited (TCU) is set to face scrutiny from shareholders on various aspects of its business operations, licensing, and governance at its upcoming meeting on April…

April 12, 2025

Credit Bureau Asia Limited Responds to SIAS Queries, Shares Insights on Business Operations and Future Plans Credit Bureau Asia Limited (the “Company”) recently addressed queries from the Securities Investors Association Singapore (“SIAS”) regarding its annual report for the financial year…

April 12, 2025

Credit Bureau Asia Limited Faces Shareholder Queries Over Licensing, Business Operations, and Governance Credit Bureau Asia Limited (TCU) is set to address shareholder concerns over its licensing, business operations, and governance at its upcoming annual general meeting (AGM) on April…

April 12, 2025

Credit Bureau Asia Limited (TCU) Under Scrutiny: Key Questions from Shareholders In a recent announcement, Credit Bureau Asia Limited (TCU) faced scrutiny from shareholders regarding several key aspects of its business operations and future strategies. The company, which operates in…

April 12, 2025

Credit Bureau Asia Limited Faces Shareholder Queries Over Licensing, Business Operations, and Governance Credit Bureau Asia Limited (TCU) is set to address shareholder concerns over its licensing, business operations, and governance at its upcoming annual general meeting (AGM) on April…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: TCU, Credit Bureau Asia Limited, CreditBureauAsia, CBA SP, CREDIT BUREAU ASIA LTD, CREDIT BUREAU ASIA

November 26, 2025

Credit Bureau Asia and Credit Bureau Singapore in Joint Venture Talks Credit Bureau Asia Engages Credit Bureau Singapore for Strategic Joint Venture Discussions Overview and Key Developments Credit Bureau Asia Limited (CBA), a prominent SGX Mainboard-listed entity and a leader…

April 14, 2025

Credit Bureau Asia Limited Responds to SIAS Queries: What's Next for the Company? In a recent announcement, Credit Bureau Asia Limited (the "Company") responded to queries from the Securities Investors Association Singapore ("SIAS") regarding its annual report for the financial…

April 14, 2025

Credit Bureau Asia Limited's AGM Raises Questions on Licensing, Business Operations, and Dividend Payout Credit Bureau Asia Limited (TCU) recently held its Annual General Meeting (AGM), where several key issues were raised by shareholders. The company, which operates in the…

April 13, 2025

Credit Bureau Asia Limited Responds to SIAS Queries, Shares Insights on Business Operations and Future Plans In a recent announcement, Credit Bureau Asia Limited (the “Company”) addressed queries from the Securities Investors Association Singapore (“SIAS”) regarding its annual report for…

April 13, 2025

Credit Bureau Asia Limited Faces Questions on Licensing, Business Operations, and Governance Credit Bureau Asia Limited (TCU) is set to face scrutiny from shareholders on various aspects of its business operations, licensing, and governance at its upcoming meeting on April…

April 12, 2025

Credit Bureau Asia Limited Responds to SIAS Queries, Shares Insights on Business Operations and Future Plans Credit Bureau Asia Limited (the “Company”) recently addressed queries from the Securities Investors Association Singapore (“SIAS”) regarding its annual report for the financial year…

April 12, 2025

Credit Bureau Asia Limited Faces Shareholder Queries Over Licensing, Business Operations, and Governance Credit Bureau Asia Limited (TCU) is set to address shareholder concerns over its licensing, business operations, and governance at its upcoming annual general meeting (AGM) on April…

April 12, 2025

Credit Bureau Asia Limited Responds to SIAS Queries: Key Updates and Insights Credit Bureau Asia Limited (the "Company") has responded to queries from the Securities Investors Association Singapore ("SIAS") regarding its annual report for the financial year ended 31 December…

April 12, 2025

Credit Bureau Asia Limited (TCU) Under Scrutiny: Key Questions from Shareholders In a recent announcement, Credit Bureau Asia Limited (TCU) faced scrutiny from shareholders regarding several key aspects of its business operations and future strategies. The company, which operates in…

April 12, 2025

Credit Bureau Asia Limited Responds to SIAS Queries: Key Updates and Insights Credit Bureau Asia Limited Responds to SIAS Queries: A Deep Dive into Operational and Financial Matters In a recent announcement, Credit Bureau Asia Limited (the “Company”) addressed several…

April 12, 2025

Credit Bureau Asia Limited Faces Shareholder Queries Over Licensing, Business Operations, and Governance Credit Bureau Asia Limited (TCU) is set to address shareholder concerns over its licensing, business operations, and governance at its upcoming annual general meeting (AGM) on April…

April 11, 2025

Credit Bureau Asia Limited (TCU) Under Scrutiny: Key Issues Raised at Upcoming AGM Credit Bureau Asia's AGM Raises Questions on Licensing, Business Operations, and Governance In a recent announcement, Credit Bureau Asia Limited (TCU) revealed that its subsidiary, Credit Bureau…

February 26, 2025

Deep Dive Analysis of Credit Bureau Asia Ltd and Peer Comparisons Deep Dive Analysis of Credit Bureau Asia Ltd and Peer Comparisons Broker: CGS International Securities Singapore Pte. Ltd. Date of Report: February 25, 2025 Introduction This comprehensive report provides…