📊 Statistics

- Analyst 1 Year Price Target:

$9.71

- Upside/Downside from Analyst Target:

-3.02%

- Broker Call:

6

- Dividend Minimum 3 Year Yield:

2.19%

- EPS Growth Range (1Y):

10-25%

- Net Income Growth Range (1Y):

10-25%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

2026-02-26

💰 Dividend History

Current year to date yield:

2.19%

Amount: $0.040000

Yield: -

Pay Date: 2009-05-19

Details:

SGD 0.04

Amount: $0.088000

Yield: -

Pay Date: 2009-05-19

Details:

SGD 0.088

📅 SGX Earnings Announcements for S63

Singapore Technologies Engineering Ltd (S63)

Market: SGX |

Currency: SGD

Address: No. 07-01, ST Engineering Hub

Singapore Technologies Engineering Ltd operates as a technology, defence, and engineering company worldwide. The company provides cabin interiors and engineering solutions; turnkey solutions for composite panels; passenger-to-freighter conversion services; nacelles and aerostructures solutions; precision manufacturing services; unmanned aircraft system solutions; maintenance, repair, and overhaul (MRO) services for airframes, engines, and components; and aviation asset management services, including aircraft and engine leasing. It also offers integrated transport operations center; smart mobility solutions, including smart metro systems, smart rail MRO solutions, commercial and electric vehicles, fleet management systems, smart traffic systems, tolling and congestion pricing solutions, and mobility services, as well as AGIL Bus Rapid Transit, a future-ready mobility system that offers both rail and bus systems; smart security, lighting, water, and sensors; digital platforms; network and fiber infrastructure; AGIL Smart Energy Building solutions; and urban environment and satellite solutions. In addition, the company provides defense and security solutions for air, land, and sea; smart facilities; training and simulation systems; logistics and facilities management, advanced manufacturing, and critical infrastructure solutions; homeland security; maritime systems; cybersecurity, data science, analytics, and AI solutions; cloud and data orchestration services; digital healthcare services; advanced connectivity solutions; and business process outsourcing services. Further, it designs and delivers robust command, control, communications, computers, cybersecurity, intelligence, surveillance, and reconnaissance solutions; and Wing-in-Ground craft solutions. The company was founded in 1967 and is headquartered in Singapore.

Show more

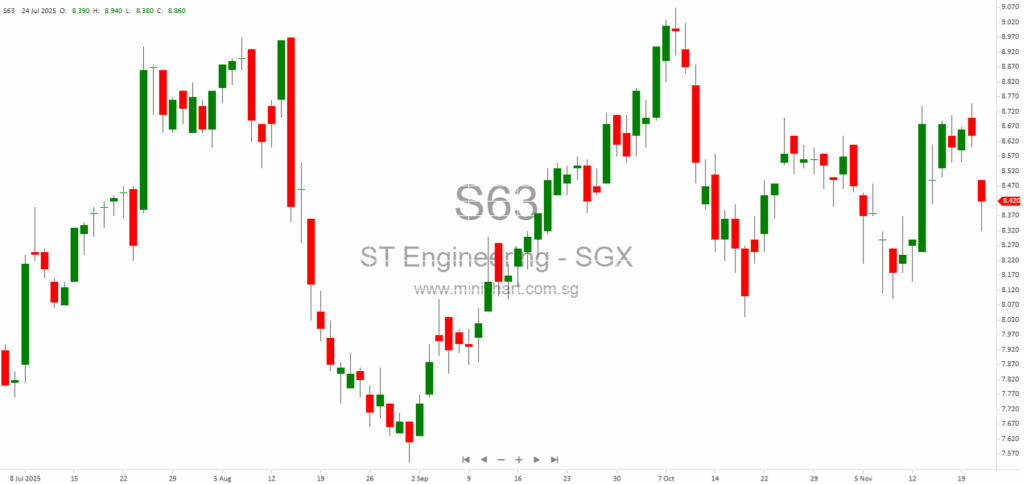

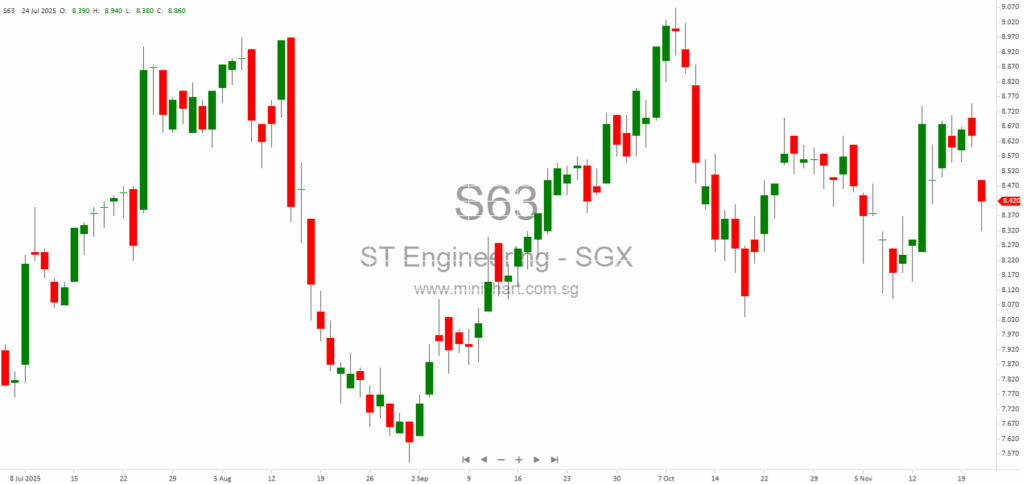

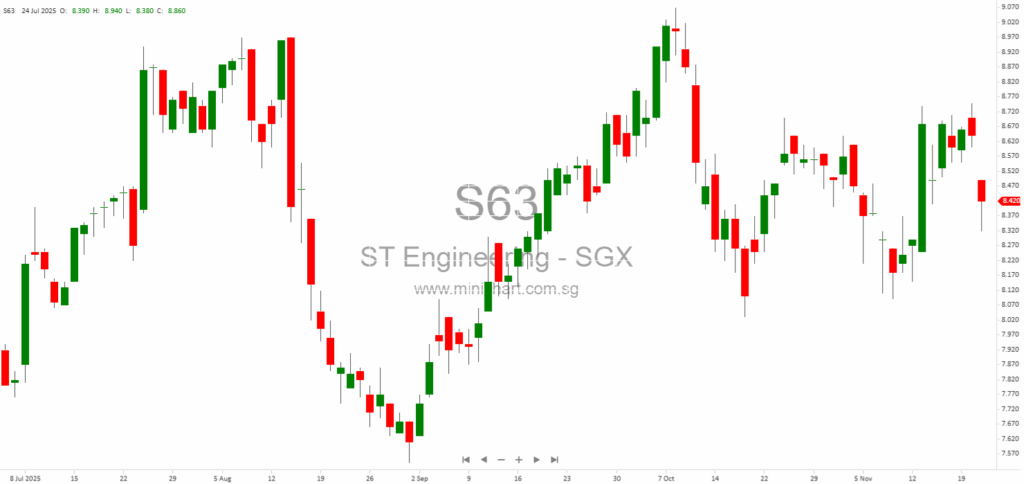

📈 Singapore Technologies Engineering Ltd Historical Chart

🧾 Recent Financial Statement Analysis

February 5, 2026

AcroMeta Group Announces Major Disposal of Subsidiary, Acro Harvest Engineering Pte. Ltd. AcroMeta Group Announces Major Disposal of Subsidiary, Acro Harvest Engineering Pte. Ltd. Key Highlights of the Announcement Binding Term Sheet Signed: AcroMeta Group Limited (“Company”) has entered into…

February 5, 2026

AcroMeta Announces Binding Term Sheet for Strategic Engineering Subsidiary Divestment AcroMeta Group Limited Announces Strategic Divestment of Engineering Subsidiary Key Highlights from the Announcement Binding Term Sheet Signed: AcroMeta Group Limited has signed a binding term sheet with an independent…

January 27, 2026

Highlights from the Announcement ST Engineering announced \$4.7 billion in new contract wins for Q4 2025, driving full-year contract awards to a record \$18.7 billion—a 49% year-on-year increase from 2024’s \$12.6 billion. The contract wins are distributed as follows: Commercial…

December 29, 2025

ST Engineering Completes Divestment of Shanghai Airframe MRO Joint Venture ST Engineering Completes Divestment of Shanghai Airframe MRO Joint Venture Key Points of the Report ST Engineering has officially completed the divestment of its entire 49% equity interest in Shanghai…

November 23, 2025

Summary of Key Points Singapore Technologies Engineering Ltd ("ST Engineering") has secured approval from the Singapore Exchange Securities Trading Limited (SGX-ST) to revise how it determines materiality for Interested Person Transactions (IPTs) starting financial year ending 31 December 2026 (FY2026).…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: S63, Singapore Technologies Engineering Ltd, ST Engineering, STE SP, SINGAPORE TECH ENGINEERING

February 5, 2026

AcroMeta Group Announces Major Disposal of Subsidiary, Acro Harvest Engineering Pte. Ltd. AcroMeta Group Announces Major Disposal of Subsidiary, Acro Harvest Engineering Pte. Ltd. Key Highlights of the Announcement Binding Term Sheet Signed: AcroMeta Group Limited (“Company”) has entered into…

February 5, 2026

AcroMeta Announces Binding Term Sheet for Strategic Engineering Subsidiary Divestment AcroMeta Group Limited Announces Strategic Divestment of Engineering Subsidiary Key Highlights from the Announcement Binding Term Sheet Signed: AcroMeta Group Limited has signed a binding term sheet with an independent…

January 28, 2026

Broker Name: DBS Date of Report: Inferred as early 2025 (latest company data cited is FY25) Excerpt from DBS report. Report Summary A severe US winter storm is causing temporary disruptions in energy supply and air travel; DBS remains constructive…

January 27, 2026

Highlights from the Announcement ST Engineering announced \$4.7 billion in new contract wins for Q4 2025, driving full-year contract awards to a record \$18.7 billion—a 49% year-on-year increase from 2024’s \$12.6 billion. The contract wins are distributed as follows: Commercial…

January 27, 2026

Broker Name: CGS InternationalDate of Report: January 26, 2026 Excerpt from CGS International report. Report Summary ST Engineering (STE) secured a significant contract from Singapore’s Ministry of Defence for Terrex s5 Infantry Fighting Vehicles, estimated at S\$1–2bn, boosting its order…

January 27, 2026

Broker Name: CGS International Date of Report: January 26, 2026 Excerpt from CGS International report. ST Engineering (STE) secured a significant S\$1bn–S\$2bn contract from Singapore’s Ministry of Defence for its next-generation Terrex s5 Infantry Fighting Vehicles, boosting its order book…

January 22, 2026

Broker Name: OCBC Group Research Date of Report: 21 January 2026 Excerpt from OCBC Group Research report. Report Summary ST Engineering Ltd (STE) is well-positioned for growth, benefiting from the global defence spending upcycle, resilient core business performance, and a…

December 29, 2025

ST Engineering Completes Divestment of Shanghai Airframe MRO Joint Venture ST Engineering Completes Divestment of Shanghai Airframe MRO Joint Venture Key Points of the Report ST Engineering has officially completed the divestment of its entire 49% equity interest in Shanghai…

November 23, 2025

Summary of Key Points Singapore Technologies Engineering Ltd ("ST Engineering") has secured approval from the Singapore Exchange Securities Trading Limited (SGX-ST) to revise how it determines materiality for Interested Person Transactions (IPTs) starting financial year ending 31 December 2026 (FY2026).…

November 23, 2025

ST Engineering Receives SGX Approval for Alternative Materiality Measure for Interested Person Transactions ST Engineering Receives SGX Approval for Alternative Materiality Measure for Interested Person Transactions Key Points from the Announcement Singapore Technologies Engineering Ltd ("ST Engineering") has announced a…

November 20, 2025

Broker Name: Not explicitly stated in the document (inferred: likely a major financial institution or brokerage covering Singapore equities) Date of Report: After 30 September 2025 (based on order book data and forward-looking commentary) Excerpt from {broker} report. Report Summary…

October 3, 2025

Broker Name: CGS International Date of Report: October 3, 2025 Excerpt from CGS International report. ST Engineering Ltd (STE) remains in a strong uptrend, with bullish technical indicators supporting further upside; key target prices are set up to S\$14.09. Keppel…

May 27, 2025

CGS International May 27, 2025 Trendspotter's Insights: SATS Ltd Bottoming Up and Pan-United Corp Ltd Volume Growth Key Overnight Market Recap European stocks and US equity futures experienced gains following President Donald Trump's extension of a deadline on euro area…

May 13, 2025

Maybank Research Pte Ltd May 12, 2025 ST Engineering: Growth Intact, Monitor Tariffs ST Engineering (STE SP) is navigating a landscape of robust defense tailwinds and potential tariff headwinds. This report provides an in-depth analysis of STE's recent performance, strategic…

October 3, 2024

Date of ReportOctober 3, 2024Broker NameCGS International SecuritiesCompany OverviewSingapore Technologies Engineering Ltd (ST Engineering) is a global technology, defence, and engineering group. The company leverages technology and innovation to address challenges and improve lives through its diverse portfolio, which spans…

March 26, 2024

An appreciated gem