📊 Statistics

- Analyst 1 Year Price Target:

$1.62

- Upside/Downside from Analyst Target:

5.41%

- Broker Call:

5

- Dividend Minimum 3 Year Yield:

7.22%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

2026-05-08

💰 Dividend History

Current year to date yield:

1.64%

📅 SGX Earnings Announcements for O5RU

AIMS APAC REIT (O5RU)

Market: SGX |

Currency: SGD

Address: One Raffles Place

Managed by the Manager, AIMS APAC REIT (?AA REIT?) is a real estate investment trust listed on the Mainboard of the SGX-ST since 2007. AA REIT was established with the principal investment objective of owning and investing in a diversified portfolio of high-quality income-producing industrial, logistics and business park real estate, located throughout the Asia Pacific region. The real estate assets are utilised for a variety of purposes, including but not limited to warehousing and distribution activities, business park activities and manufacturing activities. AA REIT's existing portfolio consists of 27 properties, of which 24 properties are located throughout Singapore, and 3 properties located in Australia, including a property located in Gold Coast, Queensland, a 49.0% interest in Optus Centre located in Macquarie Park, New South Wales and Woolworths HQ located in Bella Vista, New South Wales. AA REIT is an index constituent of several benchmark indices including the FTSE EPRA Nareit Global Developed Index, MSCI Singapore Small Cap Index, iEdge Singapore Next 50 Index and iEdge Singapore Next 50 Liquidity Weighted Index.

Show more

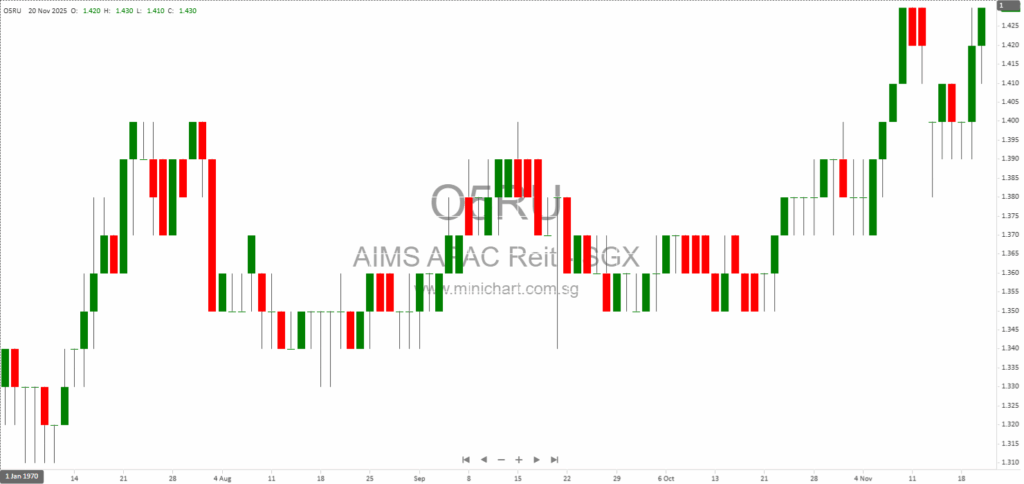

📈 AIMS APAC REIT Historical Chart

🧾 Recent Financial Statement Analysis

February 4, 2026

AIMS APAC REIT Delivers 2.5% YoY DPU Growth for 9M FY2026: Key Details for Investors AIMS APAC REIT Delivers 2.5% YoY DPU Growth for 9M FY2026: Key Details for Investors Strong Financial Performance and Distribution Growth AIMS APAC REIT (AA…

February 4, 2026

AIMS APAC REIT 3Q FY2026 Results: Key Investor Takeaways AIMS APAC REIT 3Q FY2026 Results: Strong Financials, Solid Leasing, and Prudent Capital Management Key Highlights from 9M FY2026 Financial Results Steady Revenue and Income Growth: Gross revenue for the first…

January 13, 2026

AIMS APAC REIT: Third Quarter 2025 Business Update Preview AIMS APAC REIT ("AA REIT"), a Mainboard-listed real estate investment trust on the Singapore Exchange, has announced that it will release its business update for the third quarter ended 31 December…

January 12, 2026

AIMS APAC REIT Announces S\$150 Million 4.10% Perpetual Securities Issue: Detailed Analysis AIMS APAC REIT Announces S\$150 Million 4.10% Perpetual Securities Issue Key Highlights and Investor Considerations AIMS APAC REIT Management Limited, acting as the manager of AIMS APAC REIT…

January 7, 2026

AIMS APAC REIT Delivers Solid 1H FY2026 Performance, Reinforces Growth Strategy and Shareholder Value AIMS APAC REIT Delivers Solid 1H FY2026 Performance, Reinforces Growth Strategy and Shareholder Value Key Highlights from the Latest Financial Report Net Property Income (NPI): S\$68.4…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: O5RU, AIMS APAC REIT

February 6, 2026

Broker Name: Maybank Research Pte Ltd Date of Report: February 6, 2026 Excerpt from Maybank Research Pte Ltd report. Report Summary AIMS APAC REIT (AAREIT) reported a strong 9M26 performance with DPU rising 2.5% YoY, driven by resilient rental reversions,…

February 5, 2026

Broker Name: Lim & Tan Securities Date of Report: 5 February 2026 Excerpt from Lim & Tan Securities report. Report Summary Singapore’s FSSTI Index rose 0.4% to a 52-week high, outperforming other major indices. Tech stock weakness affected global markets,…

February 4, 2026

AIMS APAC REIT Delivers 2.5% YoY DPU Growth for 9M FY2026: Key Details for Investors AIMS APAC REIT Delivers 2.5% YoY DPU Growth for 9M FY2026: Key Details for Investors Strong Financial Performance and Distribution Growth AIMS APAC REIT (AA…

February 4, 2026

AIMS APAC REIT 3Q FY2026 Results: Key Investor Takeaways AIMS APAC REIT 3Q FY2026 Results: Strong Financials, Solid Leasing, and Prudent Capital Management Key Highlights from 9M FY2026 Financial Results Steady Revenue and Income Growth: Gross revenue for the first…

January 13, 2026

AIMS APAC REIT: Third Quarter 2025 Business Update Preview AIMS APAC REIT ("AA REIT"), a Mainboard-listed real estate investment trust on the Singapore Exchange, has announced that it will release its business update for the third quarter ended 31 December…

January 12, 2026

AIMS APAC REIT Announces S\$150 Million 4.10% Perpetual Securities Issue: Detailed Analysis AIMS APAC REIT Announces S\$150 Million 4.10% Perpetual Securities Issue Key Highlights and Investor Considerations AIMS APAC REIT Management Limited, acting as the manager of AIMS APAC REIT…

January 7, 2026

AIMS APAC REIT Delivers Solid 1H FY2026 Performance, Reinforces Growth Strategy and Shareholder Value AIMS APAC REIT Delivers Solid 1H FY2026 Performance, Reinforces Growth Strategy and Shareholder Value Key Highlights from the Latest Financial Report Net Property Income (NPI): S\$68.4…

November 20, 2025

AIMS APAC REIT Completes Strategic Acquisition of 2 Aljunied Avenue 1, Singapore AIMS APAC REIT Completes Strategic Acquisition of 2 Aljunied Avenue 1, Singapore Key Points from the Announcement Completion of Acquisition: AIMS APAC REIT (AA REIT) has officially completed…

November 7, 2025

Broker Name: Maybank Research Pte Ltd Date of Report: November 7, 2025 Excerpt from Maybank Research Pte Ltd report. Report Summary AIMS APAC REIT’s 2Q26 distribution per unit (DPU) rose 7.0% QoQ and 1.4% YoY, supported by positive rental reversion…

November 5, 2025

AIMS APAC REIT 1H FY2026 Financial Results: Resilience Amidst Moderating Growth AIMS APAC REIT (AA REIT) has released its 1H FY2026 financial results, demonstrating stable performance despite a more cautious economic environment. This article provides a deep dive into the…