📊 Statistics

- Analyst 1 Year Price Target:

$1.27

- Upside/Downside from Analyst Target:

25.91%

- Broker Call:

7

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

-

- Net Income Growth Range (1Y):

-

- Revenue Growth Range (1Y):

-

-

Upcoming Earnings Date:

-

💰 Dividend History

No dividend history available.

📅 SGX Earnings Announcements for NTDU

| Date of Broadcast |

Title |

Financial Year Ended |

NTT DC REIT (NTDU)

Market: SGX |

Currency: SGD

Address:

Listed on the Main Board of the Singapore Exchange Securities Trading Limited on 14 July 2025, NTT DC REIT is a Singapore real estate investment trust established with the principal investment strategy of investing, directly or indirectly, in a diversified portfolio of stabilised income-producing real estate assets located globally that are used primarily for data center purposes, as well as assets necessary to support the digital economy. NTT DC REIT’s key objectives are to provide unitholders with regular and stable distributions and to achieve long-term growth in distribution per unit and net asset value per unit, while maintaining an appropriate capital structure. The Sponsor of NTT DC REIT is NTT Limited, which is part of the NTT Group, a major global IT services and telecommunications group with a leading global data center (GDC) business. NTT Limited is a wholly-owned subsidiary of NTT DATA, Inc., which is in turn 55% held by NTT Data Group Corporation and 45% held by NTT, Inc. The NTT Group, through its global data center business NTT GDC, is the third largest data center provider globally (excluding China). It has a footprint of over 2,200 MW of IT power in operation and under construction, and a portfolio of 133 buildings across 91 data center sites across the Americas, Europe, the Middle East and Africa and Asia-Pacific.

Show more

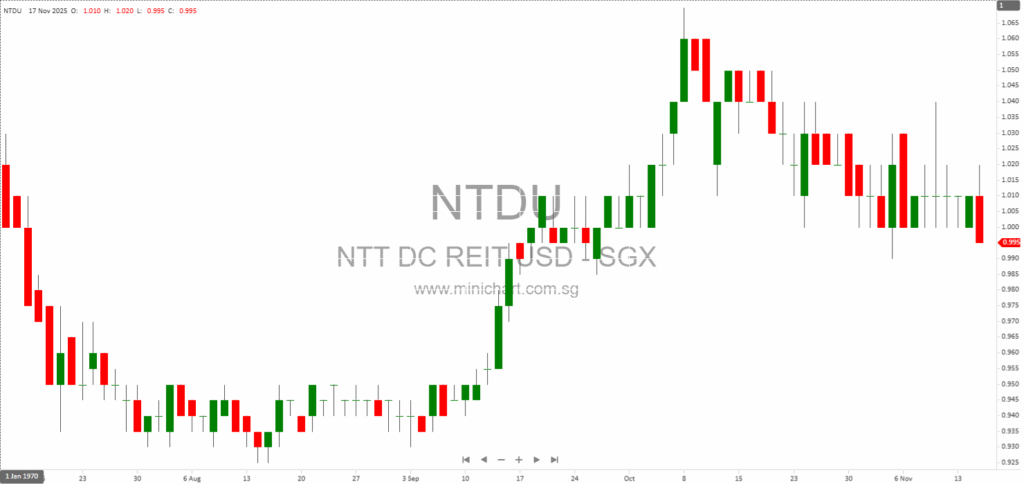

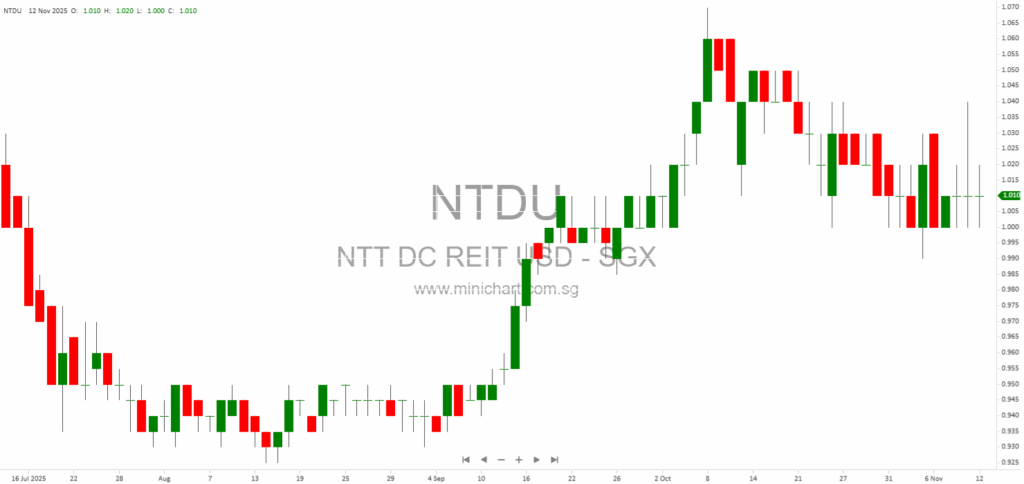

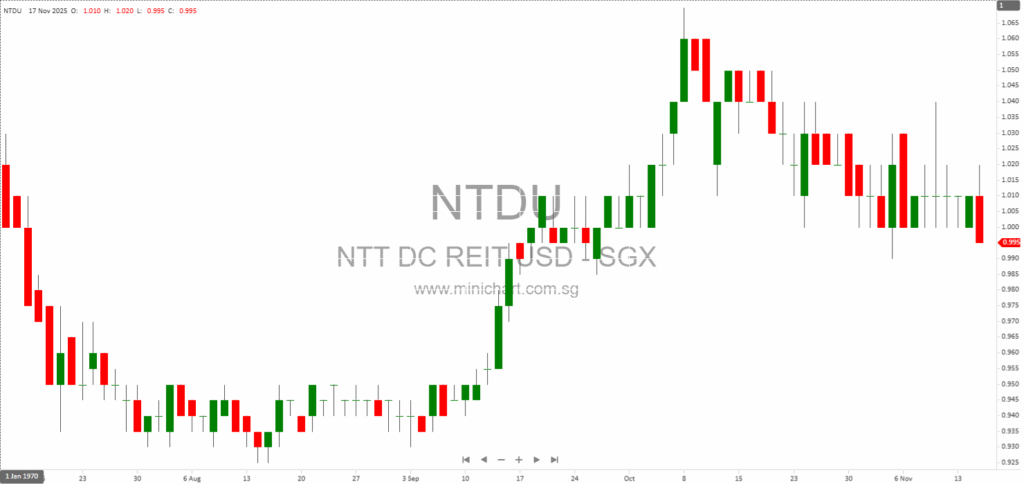

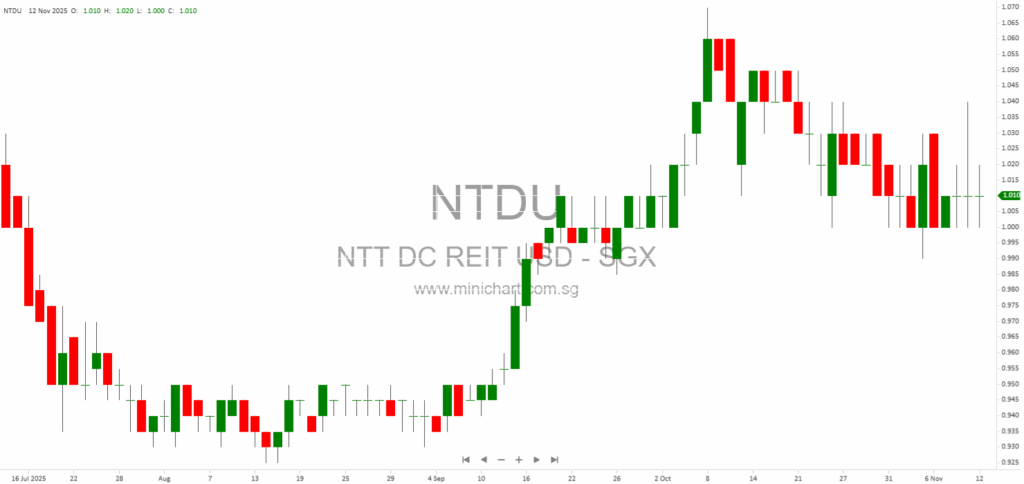

📈 NTT DC REIT Historical Chart

🧾 Recent Financial Statement Analysis

November 17, 2025

NTT DC REIT 1H FY25/26 Financial Review: Solid Start and Prudent Growth NTT DC REIT, a newly listed data center real estate investment trust, presented its maiden half-yearly results for FY25/26 (period ended 30 September 2025). The REIT, with a…

November 13, 2025

NTT DC REIT 1H FY25/26 Financial Results: Analysis and Investor Insights NTT DC REIT, a data center real estate investment trust with a global footprint across the US, EMEA, and APAC, has released its financial results for the first half…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: NTDU, NTT DC REIT

December 18, 2025

Real assets emerged as one of the strongest global performers in 2025, with Asia-Pacific markets standing out despite challenges from shifting monetary policy, inflation, energy-transition demands and geopolitical risk, according to the Asia Pacific Real Assets Association’s TrendWatch report. The…

November 17, 2025

NTT DC REIT 1H FY25/26 Financial Review: Solid Start and Prudent Growth NTT DC REIT, a newly listed data center real estate investment trust, presented its maiden half-yearly results for FY25/26 (period ended 30 September 2025). The REIT, with a…

November 13, 2025

NTT DC REIT 1H FY25/26 Financial Results: Analysis and Investor Insights NTT DC REIT, a data center real estate investment trust with a global footprint across the US, EMEA, and APAC, has released its financial results for the first half…

July 8, 2025

Lim & Tan Securities Date of Report: 8 July 2025 Singapore Market Insights: CAO’s Legal Win, NTT DC REIT’s Landmark IPO, and Key Investment Flows Overview of Major Market Indices and Financial Markets Singapore’s FSSTI Index closed at 4,031.9, marking…

July 8, 2025

NTT DC REIT IPO Overview NTT DC REIT IPO Details Purpose of IPO NTT is spinning off six data centres (valued at approximately USD 1.57 billion) into a REIT to raise up to USD 864 million. Proceeds will support capital…