📊 Statistics

- Analyst 1 Year Price Target:

$1.57

- Upside/Downside from Analyst Target:

9.24%

- Broker Call:

17

- Dividend Minimum 3 Year Yield:

5.68%

- EPS Growth Range (1Y):

50-100%

- Net Income Growth Range (1Y):

50-100%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

2026-04-23

-

EPS Estimate:

0.02

💰 Dividend History

Current year to date yield:

14.04%

📅 SGX Earnings Announcements for N2IU

Mapletree Pan Asia Commercial Trust (N2IU)

Market: SGX |

Currency: SGD

Address: 10 Pasir Panjang Road

Mapletree Pan Asia Commercial Trust (?MPACT?) is a real estate investment trust (?REIT?) positioned to be the proxy to key gateway markets of Asia. Listed on the Singapore Exchange Securities Limited on 27 April 2011, it made its public market debut as Mapletree Commercial Trust and was subsequently renamed MPACT on 3 August 2022 following the merger with Mapletree North Asia Commercial Trust. Its principal investment objective is to invest on a long-term basis, directly or indirectly, in a diversified portfolio of income-producing real estate used primarily for office and/or retail purposes, as well as real estate-related assets, in the key gateway markets of Asia (including but not limited to Singapore, Hong Kong, China, Japan and South Korea). MPACT's portfolio comprises 15 commercial properties across five key gateway markets of Asia ? four in Singapore, one in Hong Kong, two in China, seven in Japan and one in South Korea. They have a total lettable area of 10.4 million square feet independently valued at S$15.9 billion.

Show more

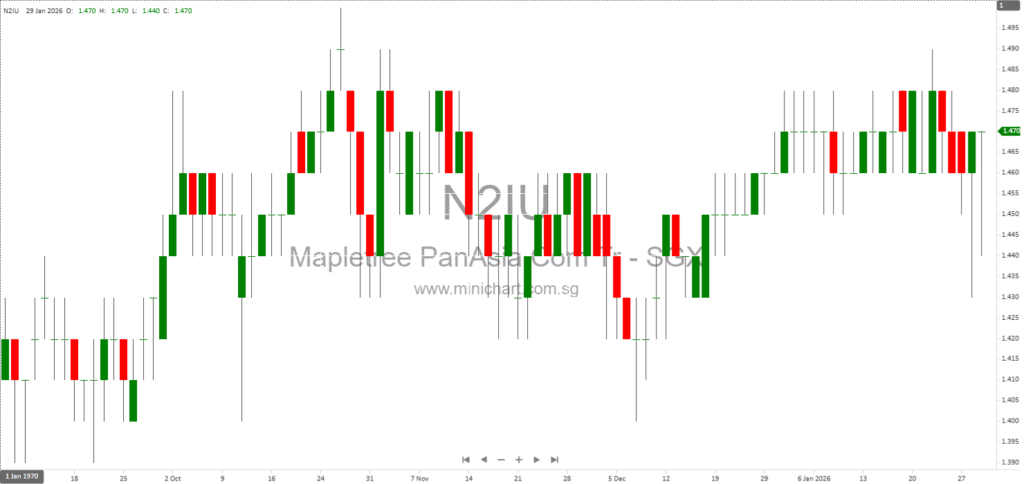

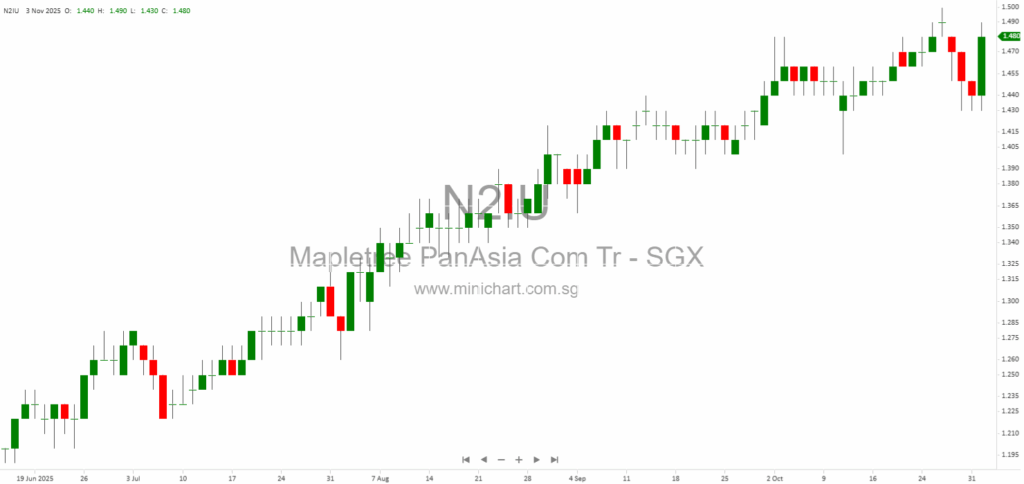

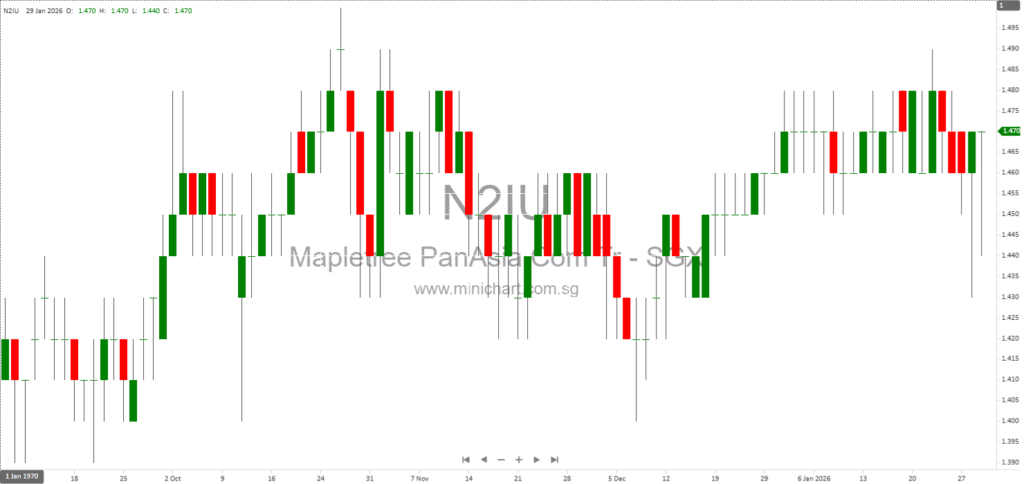

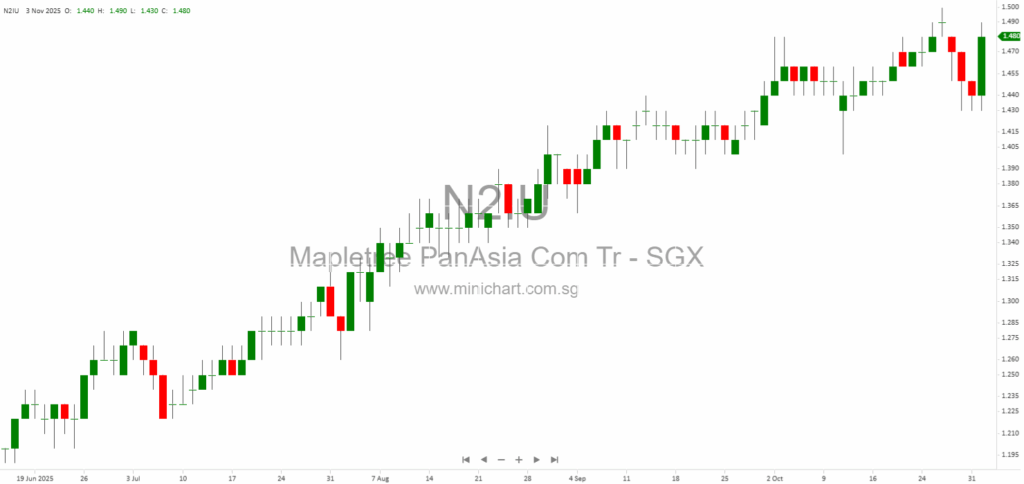

📈 Mapletree Pan Asia Commercial Trust Historical Chart

🧾 Recent Financial Statement Analysis

February 6, 2026

Mapletree Pan Asia Commercial Trust (MPACT) Q3 and YTD FY25/26 Investor Update – Key Developments and Strategic Focus Mapletree Pan Asia Commercial Trust (MPACT) Q3 and YTD FY25/26 Investor Update – Key Developments and Strategic Focus Overview: Stability and Scale…

January 29, 2026

Mapletree Pan Asia Commercial Trust (MPACT): 3Q & YTD FY25/26 Financial Review Mapletree Pan Asia Commercial Trust (MPACT) released its financial results for the third quarter and year-to-date period of FY25/26, providing investors with a comprehensive update on its operational…

December 31, 2025

Mapletree Pan Asia Commercial Trust (MPACT): Third Quarter FY2025/2026 Financial Release Announcement MPACT Management Ltd., the manager of Mapletree Pan Asia Commercial Trust ("MPACT"), has announced the upcoming release of its financial results for the third quarter of the financial…

December 10, 2025

Mapletree Pan Asia Commercial Trust Announces Divestment of Festival Walk Tower Office Component Mapletree Pan Asia Commercial Trust Announces Divestment of Festival Walk Tower Office Component Key Highlights Divestment Deal: Mapletree Pan Asia Commercial Trust (“MPACT”), managed by MPACT Management…

November 3, 2025

Mapletree Pan Asia Commercial Trust Delivers Resilient Performance Amid Overseas Headwinds, Eyes Portfolio Optimisation Mapletree Pan Asia Commercial Trust Delivers Resilient Performance Amid Overseas Headwinds, Eyes Portfolio Optimisation Key Highlights from MPACT’s 2Q and 1H FY25/26 Results Robust Singapore Performance…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: N2IU, Mapletree Pan Asia Commercial Trust

February 6, 2026

Mapletree Pan Asia Commercial Trust (MPACT) Q3 and YTD FY25/26 Investor Update – Key Developments and Strategic Focus Mapletree Pan Asia Commercial Trust (MPACT) Q3 and YTD FY25/26 Investor Update – Key Developments and Strategic Focus Overview: Stability and Scale…

February 4, 2026

Broker Name: CGS International Date of Report: February 2, 2026 Excerpt from CGS International report. Report Summary Mapletree Pan Asia Commercial Trust (MPACT) delivered steady 3Q/9MFY26 results, with Singapore retail assets such as VivoCity outperforming through higher occupancy and strong…

February 3, 2026

Broker Name: CGS International Date of Report: February 2, 2026 Excerpt from CGS International report. Report Summary Mapletree Pan Asia Commercial Trust (MPACT) reported a 3Q/9MFY26 DPU of 2.05/6.07 Scts, in line with forecasts, supported by strong Singapore portfolio performance,…

February 3, 2026

Broker Name: CGS International Date of Report: February 2, 2026 Excerpt from CGS International report. Mapletree Pan Asia Commercial Trust (MPACT) reported resilient 3Q/9MFY26 results, with Singapore assets (especially VivoCity) showing strong performance through positive rental reversions, full occupancy, and…

February 2, 2026

Broker Name: Maybank Research Pte Ltd Date of Report: February 2, 2026 Excerpt from Maybank Research Pte Ltd report. Report Summary Mapletree Pan Asia Commercial Trust (MPACT) delivered stable 3Q25 results, with a 2.5% YoY increase in DPU, but 9M…

January 29, 2026

Mapletree Pan Asia Commercial Trust (MPACT): 3Q & YTD FY25/26 Financial Review Mapletree Pan Asia Commercial Trust (MPACT) released its financial results for the third quarter and year-to-date period of FY25/26, providing investors with a comprehensive update on its operational…

December 31, 2025

Mapletree Pan Asia Commercial Trust (MPACT): Third Quarter FY2025/2026 Financial Release Announcement MPACT Management Ltd., the manager of Mapletree Pan Asia Commercial Trust ("MPACT"), has announced the upcoming release of its financial results for the third quarter of the financial…

December 12, 2025

Broker Name: CGS International Date of Report: December 11, 2025 Excerpt from CGS International report. Report Summary Mapletree Pan Asia Commercial Trust (MPACT) announced the sale of the office component of Festival Walk in Hong Kong for S\$328.1 million, in…

December 10, 2025

Mapletree Pan Asia Commercial Trust Announces Divestment of Festival Walk Tower Office Component Mapletree Pan Asia Commercial Trust Announces Divestment of Festival Walk Tower Office Component Key Highlights Divestment Deal: Mapletree Pan Asia Commercial Trust (“MPACT”), managed by MPACT Management…

November 3, 2025

Mapletree Pan Asia Commercial Trust Delivers Resilient Performance Amid Overseas Headwinds, Eyes Portfolio Optimisation Mapletree Pan Asia Commercial Trust Delivers Resilient Performance Amid Overseas Headwinds, Eyes Portfolio Optimisation Key Highlights from MPACT’s 2Q and 1H FY25/26 Results Robust Singapore Performance…