📊 Statistics

- Analyst 1 Year Price Target:

$2.16

- Upside/Downside from Analyst Target:

5.48%

- Broker Call:

4

- Dividend Minimum 3 Year Yield:

5.75%

- EPS Growth Range (1Y):

100-200%

- Net Income Growth Range (1Y):

100-200%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

2026-04-30

-

EPS Estimate:

0.03

💰 Dividend History

No dividend history available.

📅 SGX Earnings Announcements for ME8U

Mapletree Industrial Trust (ME8U)

Market: SGX |

Currency: SGD

Address: 10 Pasir Panjang Road

Mapletree Industrial Trust is a real estate investment trust (?REIT?) listed on the Main Board of Singapore Exchange. Its principal investment strategy is to invest in a diversified portfolio of income-producing real estate used primarily for industrial purposes in Singapore and income producing real estate used primarily as data centres worldwide beyond Singapore, as well as real estate-related assets. As of 30 September 2025, MIT's total assets under management were S$8.5 billion, which comprised 55 properties in North America (including 13 data centres held through the joint venture with Mapletree Investments Pte Ltd), 79 properties in Singapore and two properties in Japan. MIT's property portfolio includes Data Centres, Hi-Tech Buildings and Business Space and General Industrial Buildings. MIT is managed by Mapletree Industrial Trust Management Ltd. and sponsored by Mapletree Investments Pte Ltd.

Show more

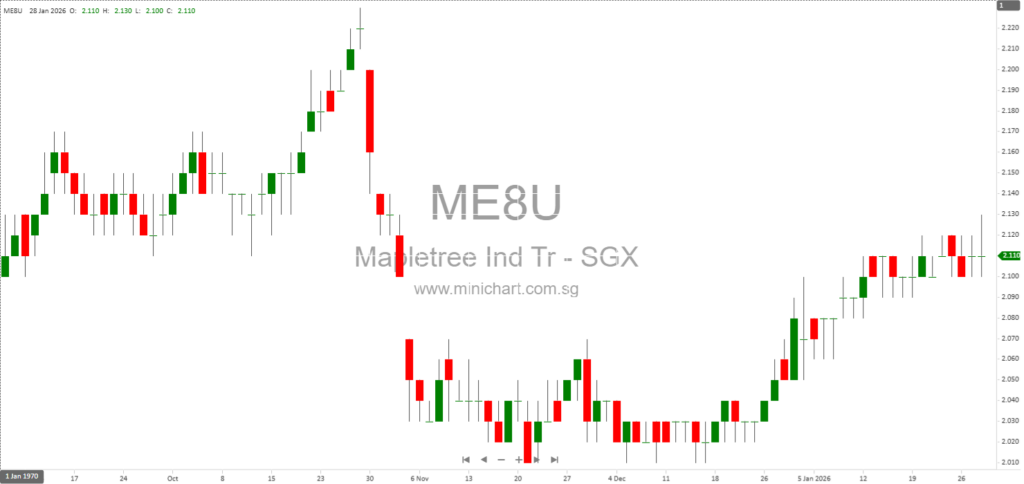

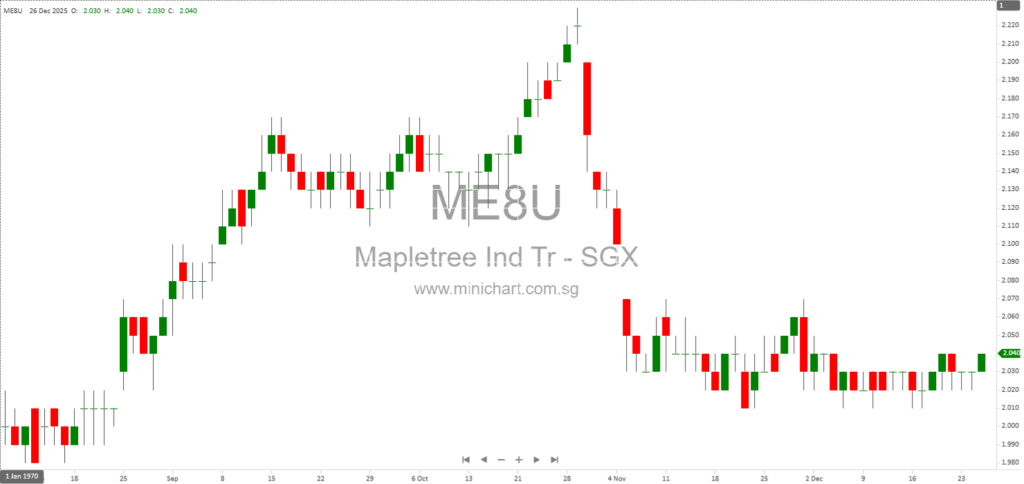

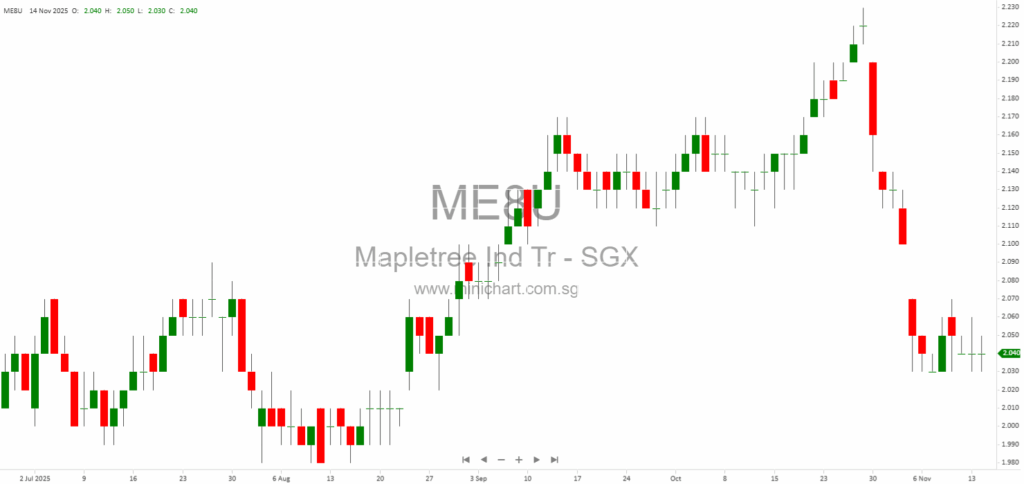

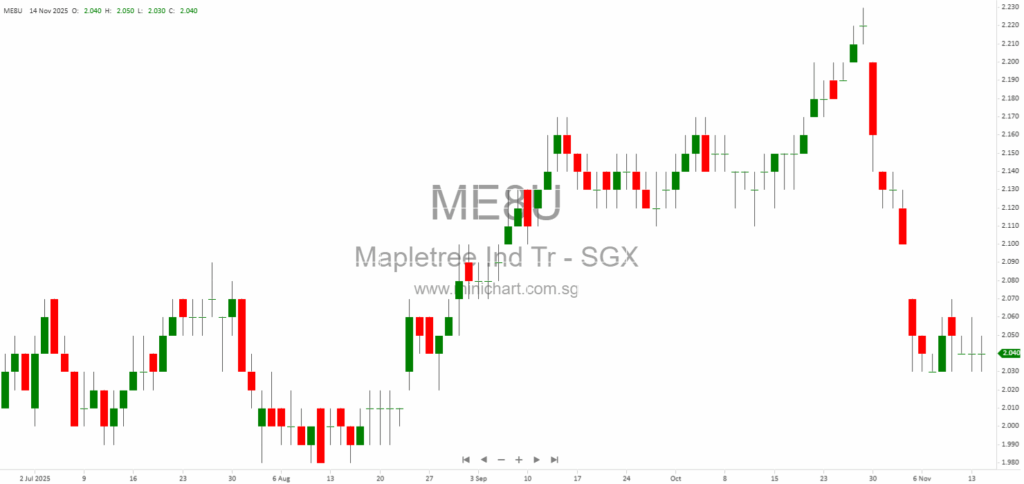

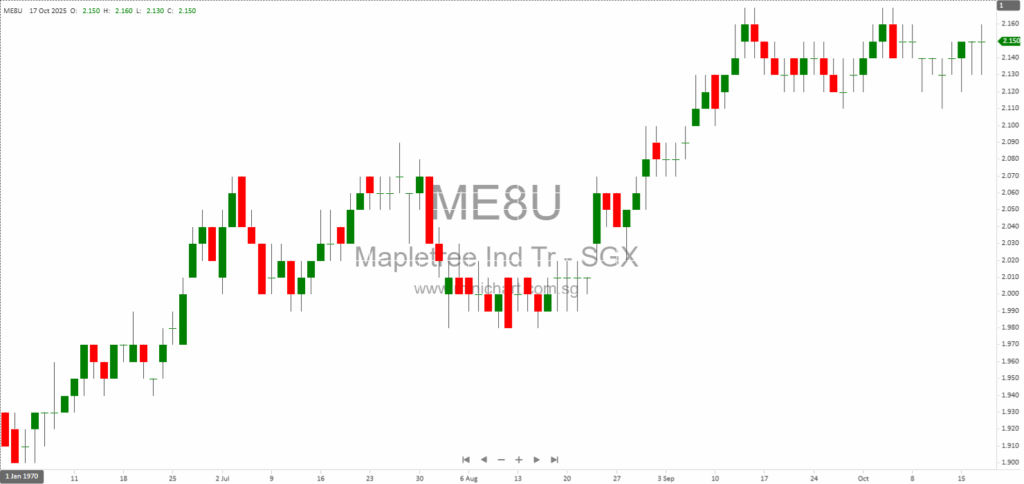

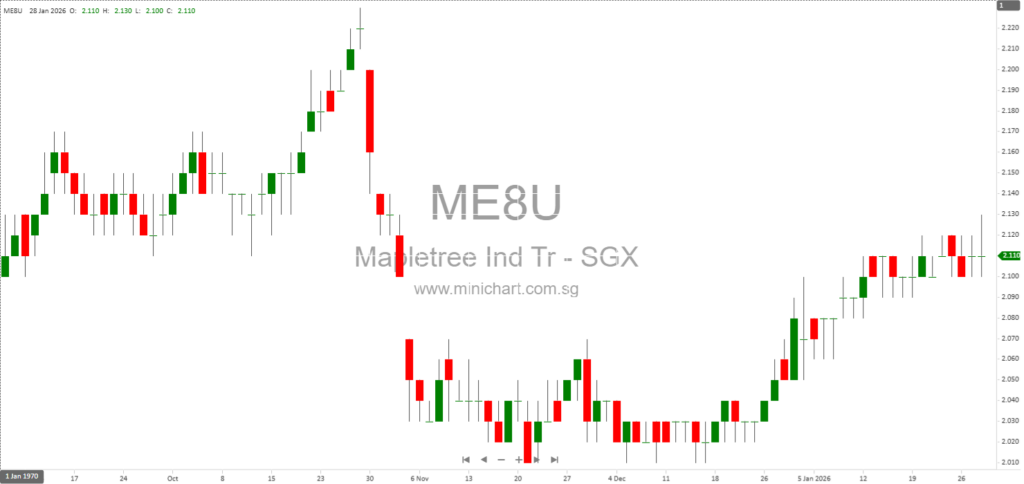

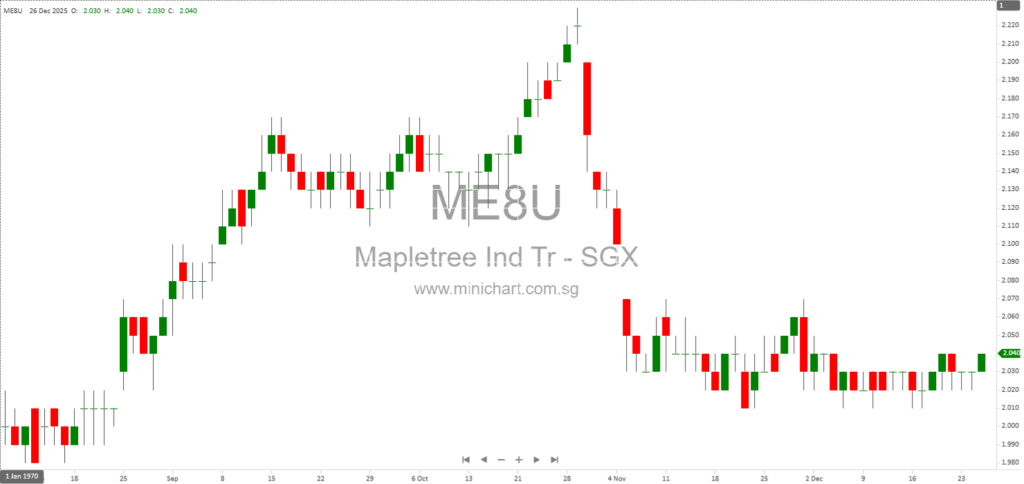

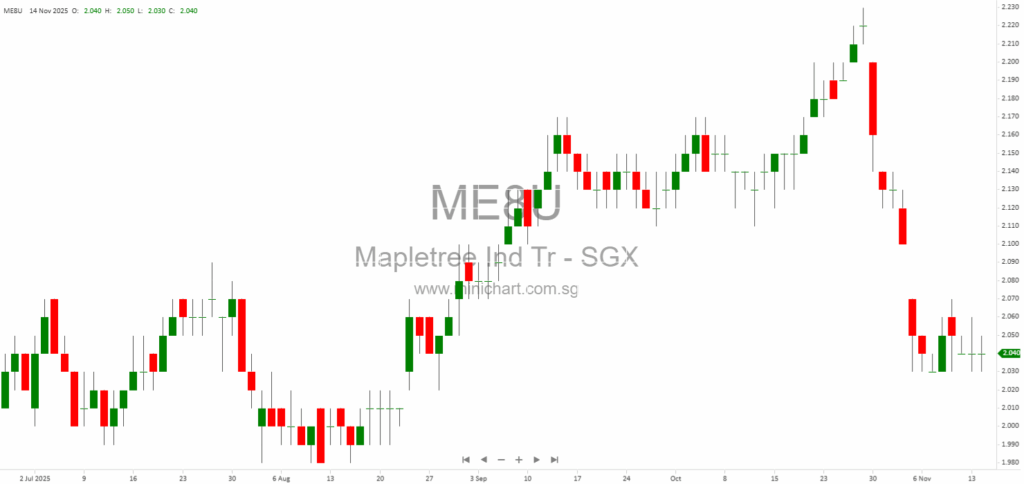

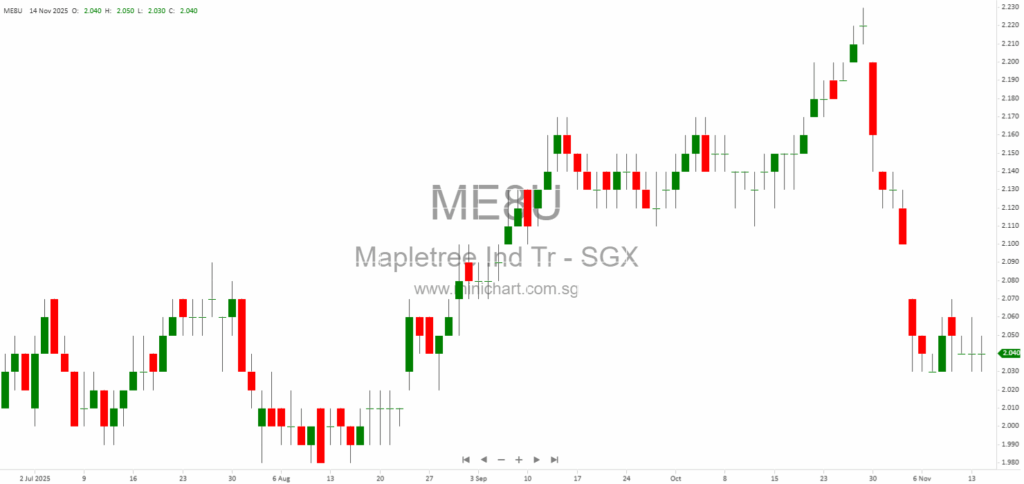

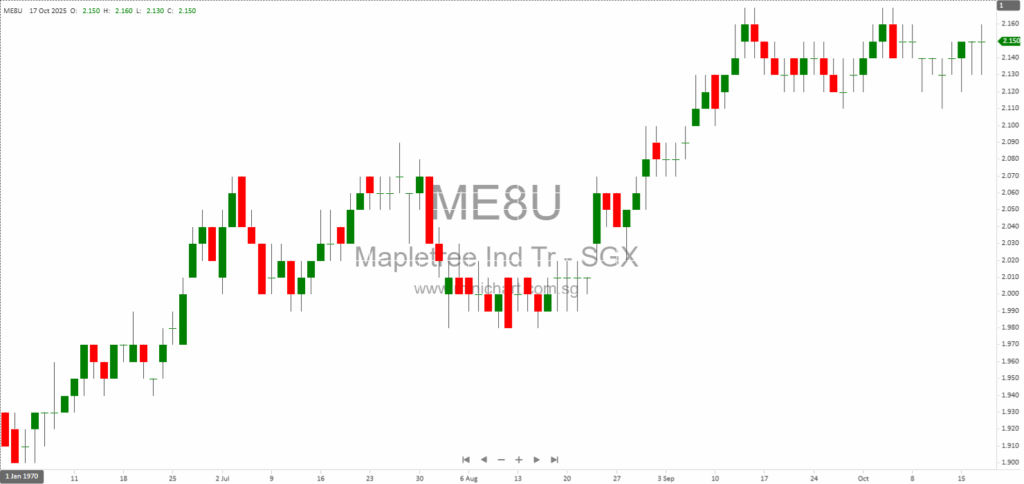

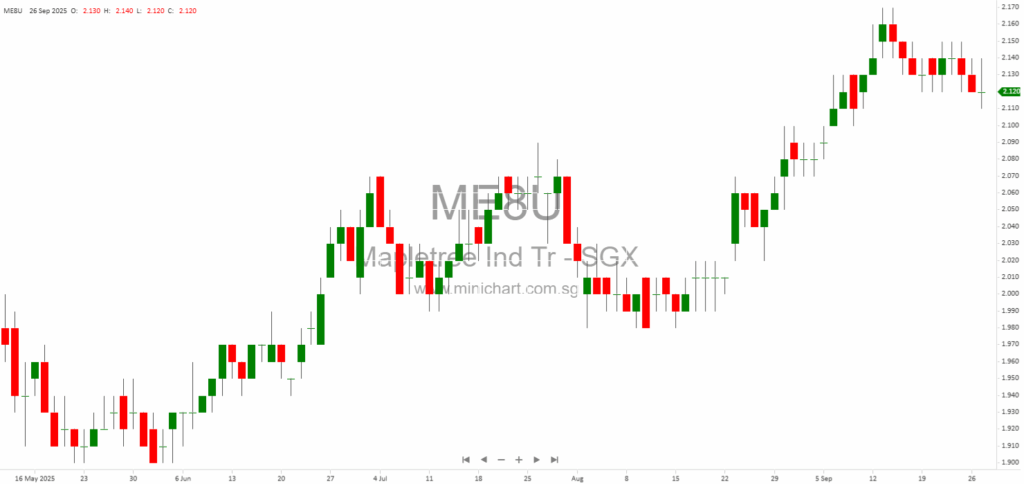

📈 Mapletree Industrial Trust Historical Chart

🧾 Recent Financial Statement Analysis

January 28, 2026

Mapletree Industrial Trust (MIT) 3QFY25/26 Financial Review: Navigating Headwinds with Strategic Flexibility Mapletree Industrial Trust (MIT) has released its third quarter FY25/26 results, offering insights into its operational resilience and strategic responses amidst a challenging macroeconomic environment. Below, we present…

December 27, 2025

Mapletree Industrial Trust: Q3 2025/2026 Earnings Announcement Preview Mapletree Industrial Trust Management Ltd. (“MIT”) has released an announcement regarding the upcoming disclosure of the financial results for the third quarter of the financial year 2025/2026, ending 31 December 2025. The…

November 14, 2025

Mapletree Industrial Trust: Disclosure of Key Loan Facility Terms Mapletree Industrial Trust: Key Disclosure on New Loan Facility Terms Overview Mapletree Industrial Trust Management Ltd. ("the Manager"), manager of Mapletree Industrial Trust (MIT), has announced the execution of a new…

November 14, 2025

Mapletree Industrial Trust Reports 2Q & 1H FY25/26 Financial Results: Portfolio Rejuvenation, Strategic Divestments, and Market Outlook Mapletree Industrial Trust Delivers 2Q & 1H FY25/26 Results: Strategic Moves and Market Headwinds in Focus Key Highlights Net property income (NPI) for…

October 21, 2025

Mapletree Industrial Trust Extends Property Management Deals with Related Parties: What Investors Should Know Key Points from Mapletree Industrial Trust’s Latest Property Manager Announcement Extension of Property Management Contracts: MIT has announced the renewal and extension of its property management…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: ME8U, Mapletree Industrial Trust

January 28, 2026

Mapletree Industrial Trust (MIT) 3QFY25/26 Financial Review: Navigating Headwinds with Strategic Flexibility Mapletree Industrial Trust (MIT) has released its third quarter FY25/26 results, offering insights into its operational resilience and strategic responses amidst a challenging macroeconomic environment. Below, we present…

December 27, 2025

Mapletree Industrial Trust: Q3 2025/2026 Earnings Announcement Preview Mapletree Industrial Trust Management Ltd. (“MIT”) has released an announcement regarding the upcoming disclosure of the financial results for the third quarter of the financial year 2025/2026, ending 31 December 2025. The…

November 14, 2025

Mapletree Industrial Trust: Disclosure of Key Loan Facility Terms Mapletree Industrial Trust: Key Disclosure on New Loan Facility Terms Overview Mapletree Industrial Trust Management Ltd. ("the Manager"), manager of Mapletree Industrial Trust (MIT), has announced the execution of a new…

November 14, 2025

Mapletree Industrial Trust Reports 2Q & 1H FY25/26 Financial Results: Portfolio Rejuvenation, Strategic Divestments, and Market Outlook Mapletree Industrial Trust Delivers 2Q & 1H FY25/26 Results: Strategic Moves and Market Headwinds in Focus Key Highlights Net property income (NPI) for…

November 3, 2025

Broker Name: Lim & Tan Securities Date of Report: 31 October 2025 Excerpt from Lim & Tan Securities report. Report Summary: Singapore’s FSSTI Index has risen 17.2% year-to-date, with Keppel and Mapletree Industrial Trust (MIT) featured as key highlights. Keppel…

November 3, 2025

Broker Name: CGS International Date of Report: October 30, 2025 Excerpt from CGS International report. Report Summary Mapletree Industrial Trust (MINT) reported 2Q/1HFY3/26 results in line with expectations. DPU (Distribution Per Unit) declined year-on-year mainly due to higher interest costs…

November 3, 2025

Broker Name: Maybank Research Pte Ltd Date of Report: October 31, 2025 Excerpt from Maybank Research Pte Ltd report. Report Summary Mapletree Industrial Trust (MINT) is downgraded to HOLD with a new target price of SGD2.10 due to limited upside,…

November 3, 2025

Broker Name: OCBC Investment Research Date of Report: 30 October 2025 Excerpt from OCBC Investment Research report. Report Summary Mapletree Industrial Trust’s (MINT) 2QFY26 distribution per unit (DPU) fell 5.6% year-on-year to 3.18 Singapore cents, in line with expectations, due…

October 21, 2025

Mapletree Industrial Trust Extends Property Management Deals with Related Parties: What Investors Should Know Key Points from Mapletree Industrial Trust’s Latest Property Manager Announcement Extension of Property Management Contracts: MIT has announced the renewal and extension of its property management…

September 29, 2025

Mapletree Industrial Trust: Upcoming Financial Results Release and Investor Considerations Mapletree Industrial Trust Management Ltd. (“MIT”) has announced the upcoming release of its financial results for the Second Quarter and First Half of Financial Year 2025/2026, ending 30 September 2025.…