📊 Statistics

- Analyst 1 Year Price Target:

$0.72

- Upside/Downside from Analyst Target:

2.13%

- Broker Call:

2

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

100-200%

- Net Income Growth Range (1Y):

100-200%

- Revenue Growth Range (1Y):

50-100%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

4.44%

📅 SGX Earnings Announcements for LCC

| Date of Broadcast |

Title |

Financial Year Ended |

LCC (LCC)

Market: SGX |

Currency: SGD

Address:

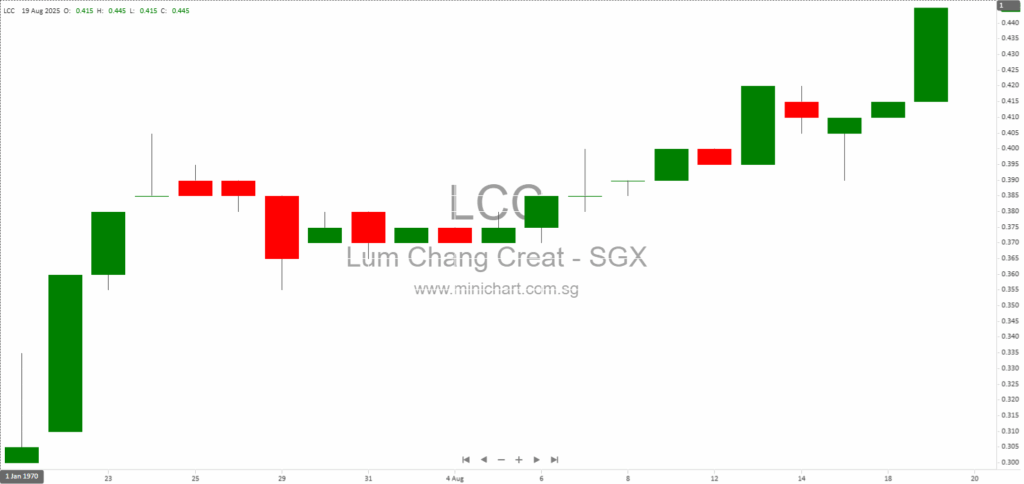

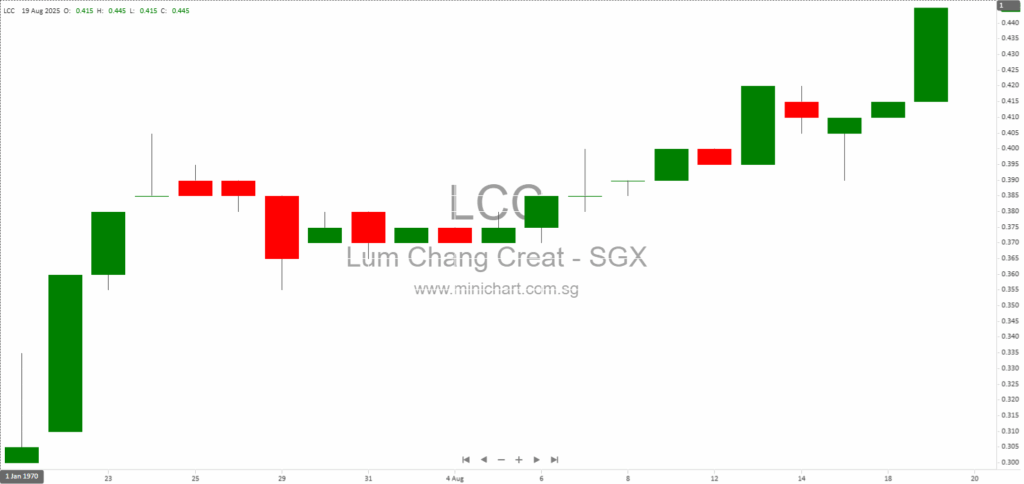

📈 LCC Historical Chart

🧾 Recent Financial Statement Analysis

January 15, 2026

Lum Chang Creations Limited: 1HFY26 Profit Guidance Analysis Lum Chang Creations Limited has issued a profit guidance for the half year ended 31 December 2025 (1HFY26), providing shareholders and investors with an early indication of the Group’s financial performance prior…

November 24, 2025

Lum Chang Creations Secures S\$63.4 Million in Dual Contract Wins: Order Book and Revenue Visibility Strengthened Lum Chang Creations Secures S\$63.4 Million in Major Contract Wins, Significantly Extending Revenue Visibility to 2028 Key Developments That May Impact Shareholder Value Lum…

November 24, 2025

Lum Chang Creations Limited Secures Two Major Contracts Worth Over S\$63 Million Lum Chang Creations Limited Secures Two Major Contracts Worth Over S\$63 Million Singapore, 24 November 2025 — Lum Chang Creations Limited (“Lum Chang” or the “Company”), through its…

August 20, 2025

Lum Chang Creations Limited: FY2025 Positive Profit Guidance Analysis Lum Chang Creations Limited has released an announcement providing a positive profit guidance for the financial year ended 30 June 2025 (FY2025). The Board expects a significant improvement in profit before…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: LCC, Lum Chang Creat, LUCC SP, LUM CHANG CREATIONS LTD, LUM CHANG CREATIONS

January 15, 2026

Lum Chang Creations Limited: 1HFY26 Profit Guidance Analysis Lum Chang Creations Limited has issued a profit guidance for the half year ended 31 December 2025 (1HFY26), providing shareholders and investors with an early indication of the Group’s financial performance prior…

January 9, 2026

Broker Name: CGS International Securities Date of Report: January 7, 2026 Excerpt from CGS International Securities report. Report Summary Lum Chang Creations (LUCC) secured S\$63.4m in new contract wins, bringing its orderbook to S\$160m and meeting 45% of the FY26…

January 8, 2026

Broker Name: CGS International Date of Report: January 7, 2026 Excerpt from CGS International report. Report Summary Lum Chang Creations (LUCC) secured S\$63.4m in new contracts, raising its orderbook to S\$160m and covering 45% of FY26 order win assumptions. Revenue…

January 7, 2026

Broker Name: CGS International Securities Date of Report: January 7, 2026 Excerpt from CGS International Securities report Report Summary: Lum Chang Creations (LUCC) secured S\$63.4m in new contracts, raising its orderbook to S\$160m and supporting revenue visibility into FY28. Revenue…

November 24, 2025

Lum Chang Creations Secures S\$63.4 Million in Dual Contract Wins: Order Book and Revenue Visibility Strengthened Lum Chang Creations Secures S\$63.4 Million in Major Contract Wins, Significantly Extending Revenue Visibility to 2028 Key Developments That May Impact Shareholder Value Lum…

November 24, 2025

Lum Chang Creations Limited Secures Two Major Contracts Worth Over S\$63 Million Lum Chang Creations Limited Secures Two Major Contracts Worth Over S\$63 Million Singapore, 24 November 2025 — Lum Chang Creations Limited (“Lum Chang” or the “Company”), through its…

September 2, 2025

Broker Name: CGS International Date of Report: September 2, 2025 Singapore’s Lum Chang Creations: Riding Conservation Tailwinds with Robust Growth and Dividend Prospects Introduction: Lum Chang Creations Surges Ahead in Singapore’s Property Development Sector Lum Chang Creations (LUCC), a specialist…

September 2, 2025

CGS International Date of Report: September 2, 2025 Lum Chang Creations: Riding Singapore’s Conservation Boom with Strong Earnings and Dividend Growth Executive Summary: Robust Growth, Margin Expansion, and Strong Order Book Support LUCC Outlook Lum Chang Creations (LUCC), a leading…

August 20, 2025

Lim & Tan Securities Date of Report: 20 August 2025 Singapore Market Outlook August 2025: Standout Stock Picks, Sector Trends, and Institutional Fund Flow Analysis Market Overview: Mixed Global Performance and Sector Rotation Singapore’s Straits Times Index (FSSTI) continued to…

August 20, 2025

Lum Chang Creations Limited: FY2025 Positive Profit Guidance Analysis Lum Chang Creations Limited has released an announcement providing a positive profit guidance for the financial year ended 30 June 2025 (FY2025). The Board expects a significant improvement in profit before…

October 3, 2024

Date: October 2, 2024Broker: Maybank Investment Bank BerhadOverviewKLCCP Stapled Group (KLCCSS MK) is a major player in the Malaysia REIT sector, with a strong focus on office and retail properties. It is recognized for its stable earnings, driven by long-term…