📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

2.22%

- EPS Growth Range (1Y):

100-200%

- Net Income Growth Range (1Y):

100-200%

- Revenue Growth Range (1Y):

10-25%

-

Upcoming Earnings Date:

2026-02-26

💰 Dividend History

Current year to date yield:

2.22%

📅 SGX Earnings Announcements for KJ5

BBR Holdings (S) Ltd (KJ5)

Market: SGX |

Currency: SGD

Address: BBR Building

BBR Holdings (S) Ltd, an investment holding company, engages in construction business in Singapore, Malaysia, and Thailand. It operates through five segments: Specialised Engineering, General Construction, Property Development, Green Technology, and Accommodation Business. The company is involved in the provision of design-and-build, general building construction, civil and structural engineering, and conservation and restoration services; specialized engineering services comprising piling and foundation systems, post-tensioning, stay cable systems, heavy lifting, bridge design and construction, maintenance repair and retrofitting, and prefabricated prefinished volumetric construction services. It also develops residential projects, as well as mixed commercial and residential development projects; and provides property management and consultancy services. In addition, the company engages in system integration and distribution of renewable energy; supply, installation, and leasing of solar panels and grid connected systems; and owns, develops, constructs, manages, and operates purpose-built accommodation assets, such as dormitories, purpose-built workers' accommodation, student accommodation, and other similar accommodation. Further, it provides prefabricated buildings assembly, bored piling works, renovation, and retro-fitting services; and operates as a building contractor, as well as project and contract manager for building and civil engineering works. BBR Holdings (S) Ltd was incorporated in 1993 and is headquartered in Singapore.

Show more

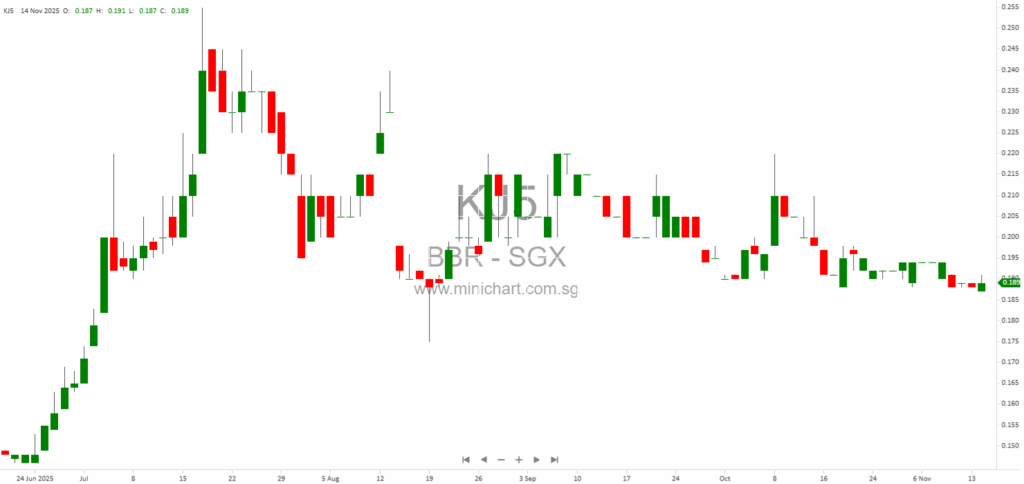

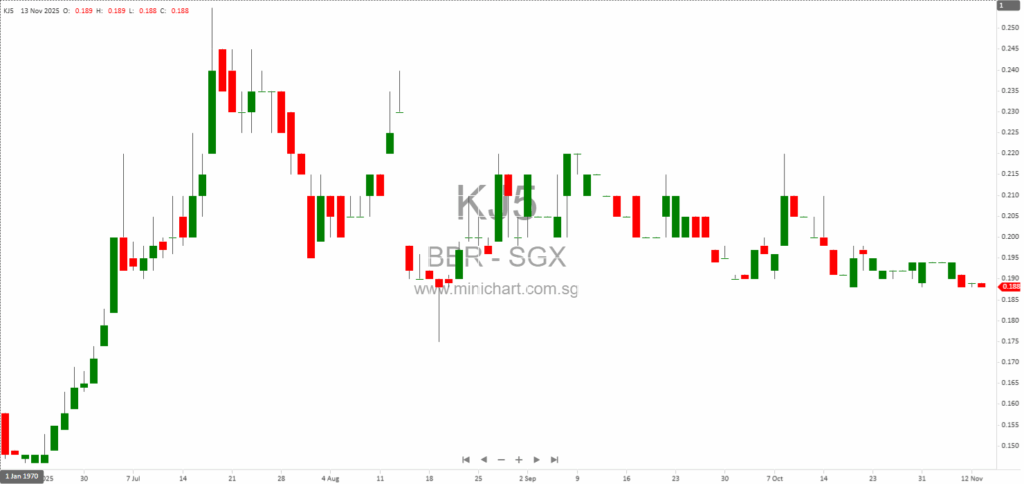

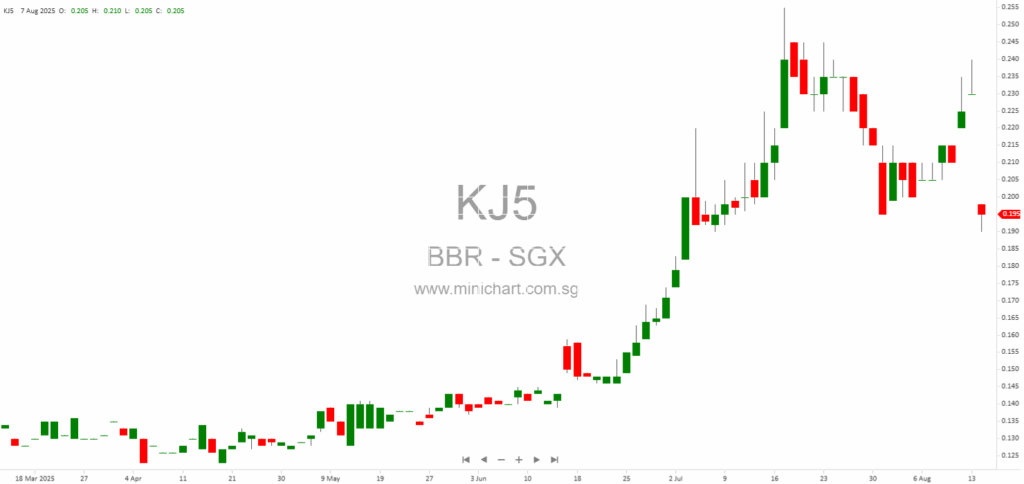

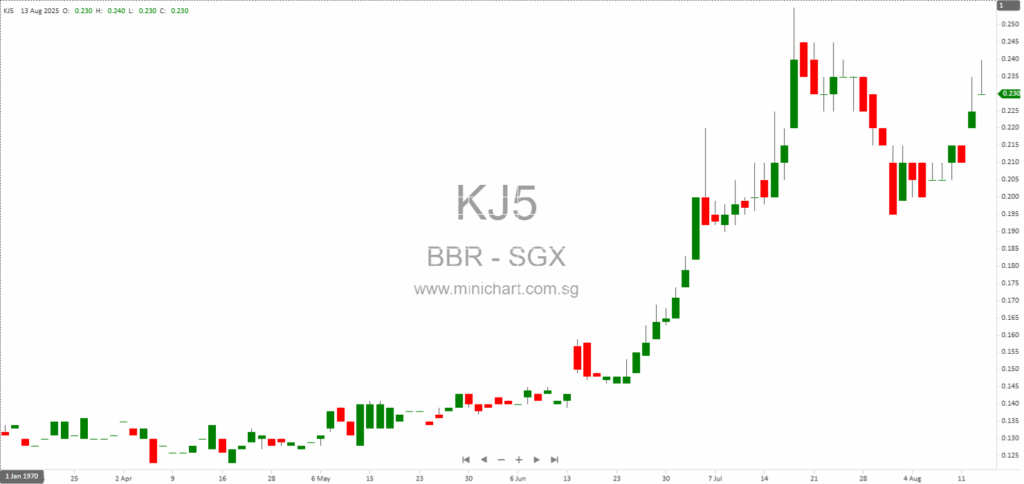

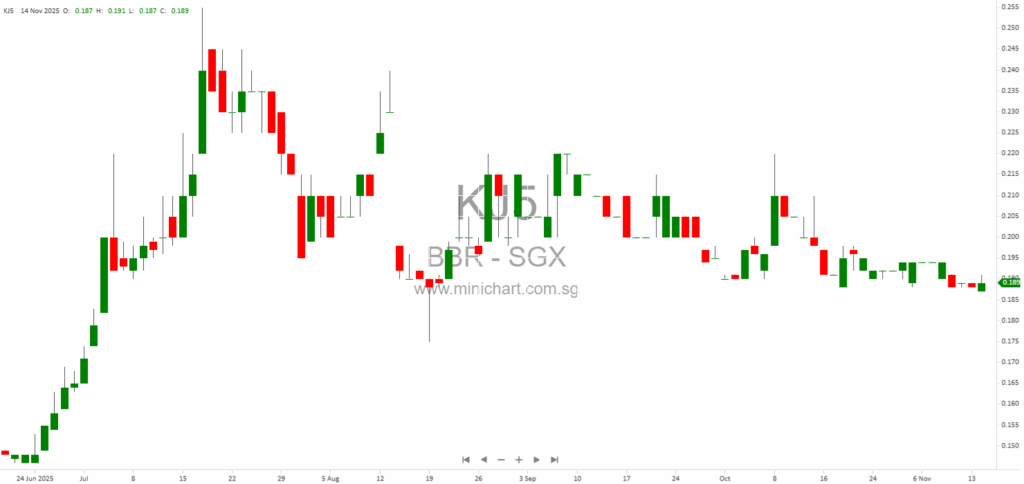

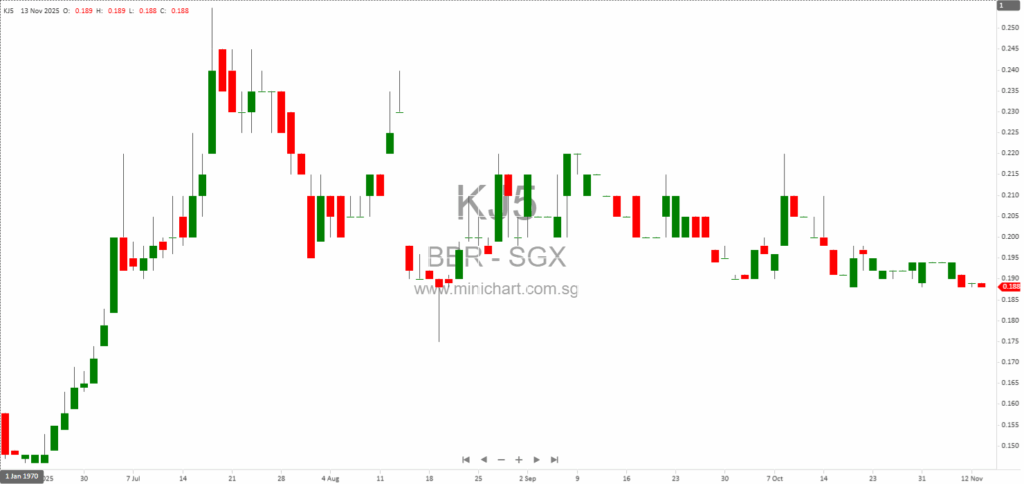

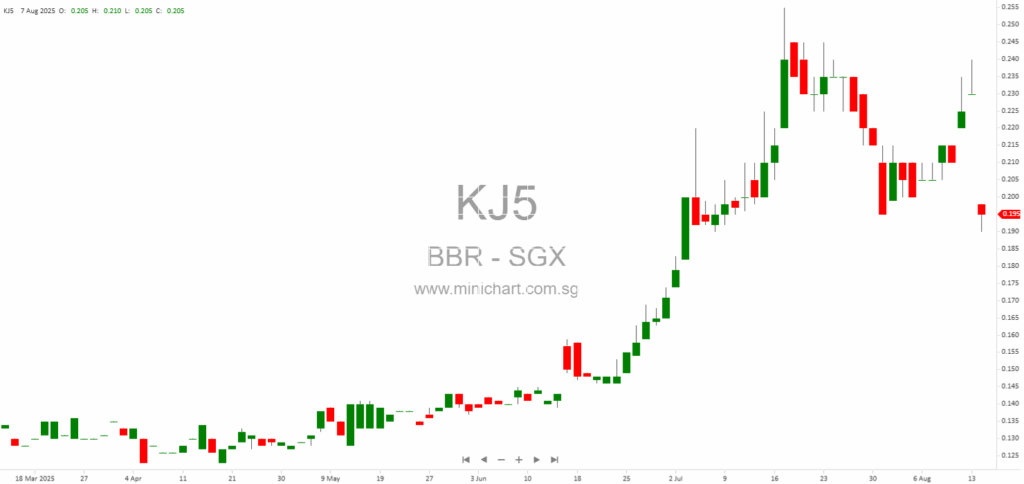

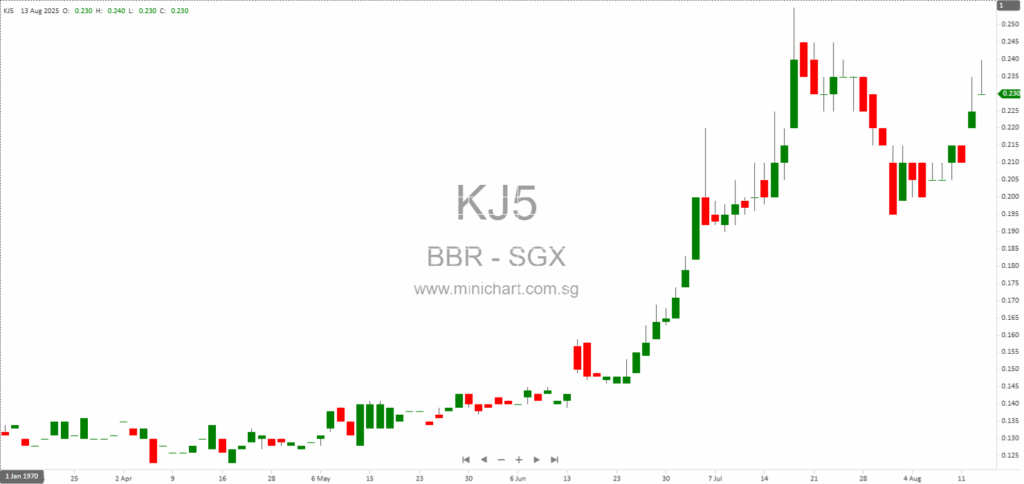

📈 BBR Holdings (S) Ltd Historical Chart

🧾 Recent Financial Statement Analysis

November 14, 2025

BBR Holdings (S) Ltd Issues Corrigendum on Senai Property Disposal Announcement BBR Holdings (S) Ltd Issues Corrigendum on Senai, Johor Property Disposal Key Points from the Corrigendum Correction to Estimated Net Proceeds: BBR Holdings (S) Ltd has issued a correction…

November 13, 2025

Key Highlights Disposal of Freehold Industrial Property: BBR Construction Systems (M) Sdn. Bhd., a wholly-owned subsidiary of BBR Holdings (S) Ltd, has entered into a conditional sale and purchase agreement to divest its freehold land and factory building in Senai,…

August 14, 2025

BBR Holdings Expands with New Singapore Subsidiary: What Investors Need to Know BBR Holdings Expands with New Singapore Subsidiary: What Investors Need to Know Key Points from the Latest Announcement BBR Holdings (S) Ltd has announced the incorporation of a…

August 14, 2025

BBR Holdings (S) Ltd: 1H2025 Financial Results Analysis BBR Holdings (S) Ltd released its condensed interim financial statements for the six months ended 30 June 2025. This review analyses the Group's financial performance, highlights key metrics, and discusses material developments…

April 10, 2025

BBR Holdings (S) Ltd Announces Record Date and Dividend Payment Date: What You Need to Know BBR HOLDINGS (S) LTD DECLARES DIVIDEND AND SETS RECORD DATE BBR Holdings (S) Ltd, a Singapore-incorporated company, has announced that the Transfer Books and…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: KJ5, BBR Holdings (S) Ltd, BBR, BBR SP, BBR HOLDINGS (S) LTD, BBR(S)

November 14, 2025

BBR Holdings (S) Ltd Issues Corrigendum on Senai Property Disposal Announcement BBR Holdings (S) Ltd Issues Corrigendum on Senai, Johor Property Disposal Key Points from the Corrigendum Correction to Estimated Net Proceeds: BBR Holdings (S) Ltd has issued a correction…

November 13, 2025

Key Highlights Disposal of Freehold Industrial Property: BBR Construction Systems (M) Sdn. Bhd., a wholly-owned subsidiary of BBR Holdings (S) Ltd, has entered into a conditional sale and purchase agreement to divest its freehold land and factory building in Senai,…

August 14, 2025

BBR Holdings Expands with New Singapore Subsidiary: What Investors Need to Know BBR Holdings Expands with New Singapore Subsidiary: What Investors Need to Know Key Points from the Latest Announcement BBR Holdings (S) Ltd has announced the incorporation of a…

August 14, 2025

BBR Holdings (S) Ltd: 1H2025 Financial Results Analysis BBR Holdings (S) Ltd released its condensed interim financial statements for the six months ended 30 June 2025. This review analyses the Group's financial performance, highlights key metrics, and discusses material developments…

April 10, 2025

BBR Holdings (S) Ltd Announces Record Date and Dividend Payment Date: What You Need to Know BBR HOLDINGS (S) LTD DECLARES DIVIDEND AND SETS RECORD DATE BBR Holdings (S) Ltd, a Singapore-incorporated company, has announced that the Transfer Books and…

November 6, 2024

Bank Rakyat Indonesia: Expecting Slower Growth - Comprehensive Analysis Bank Rakyat Indonesia: Expecting Slower Growth - Comprehensive Analysis Broker Name: Maybank Sekuritas Indonesia Date: November 5, 2024 Introduction Bank Rakyat Indonesia (BBRI) is facing a period of slower growth. This…