📊 Statistics

- Analyst 1 Year Price Target:

$0.74

- Upside/Downside from Analyst Target:

17.34%

- Broker Call:

9

- Dividend Minimum 3 Year Yield:

6.62%

- EPS Growth Range (1Y):

25-50%

- Net Income Growth Range (1Y):

25-50%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

0.82%

📅 SGX Earnings Announcements for JYEU

Lendlease Global Commercial REIT (JYEU)

Market: SGX |

Currency: SGD

Address: 2 Tanjong Katong Road, #05-01 PLQ 3

Listed on 2 October 2019, Lendlease Global Commercial REIT (Lendlease REIT) is established with the principal investment strategy of investing, directly or indirectly, in a diversified portfolio of stabilized income producing real estate assets located globally, which are used primarily for retail and/or office purposes. Its portfolio comprises leasehold properties in Singapore namely Jem (a suburban retail property) and 313 somerset (a prime retail property) as well as freehold interest in three Grade A commercial buildings in Milan. These four properties have a total net lettable area of approximately 2.0 million square feet, with an appraised value of S$3.76 billion4 as of 30 June 2025. Other investments include a stake in Parkway Parade (an office and retail property) and development of a multifunctional event space on a site adjacent to 313 somerset. Lendlease REIT is managed by Lendlease Global Commercial Trust Management Pte. Ltd., an indirect wholly owned subsidiary of Lendlease Corporation Limited. Its key objectives are to provide unitholders with regular and stable distributions, achieve long-term growth in distribution per unit and net asset value per unit, and maintain an appropriate capital structure.

Show more

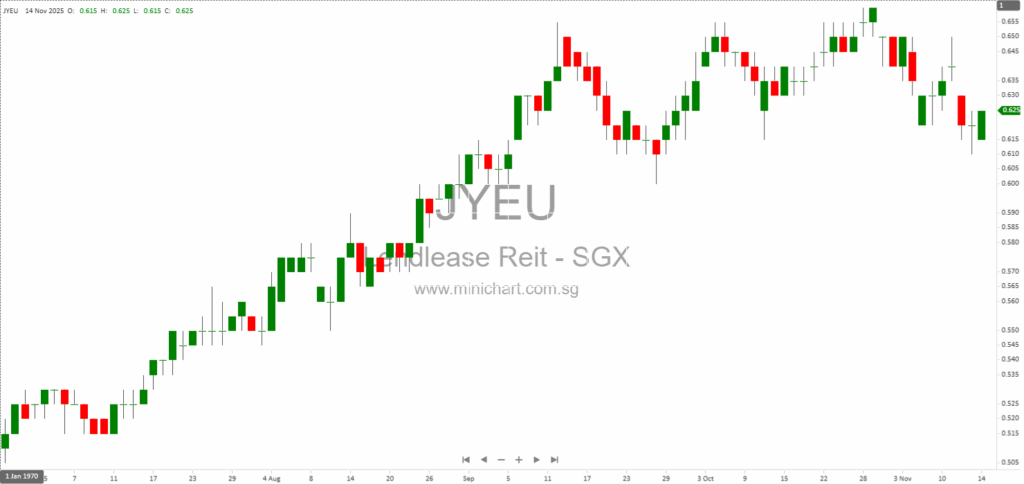

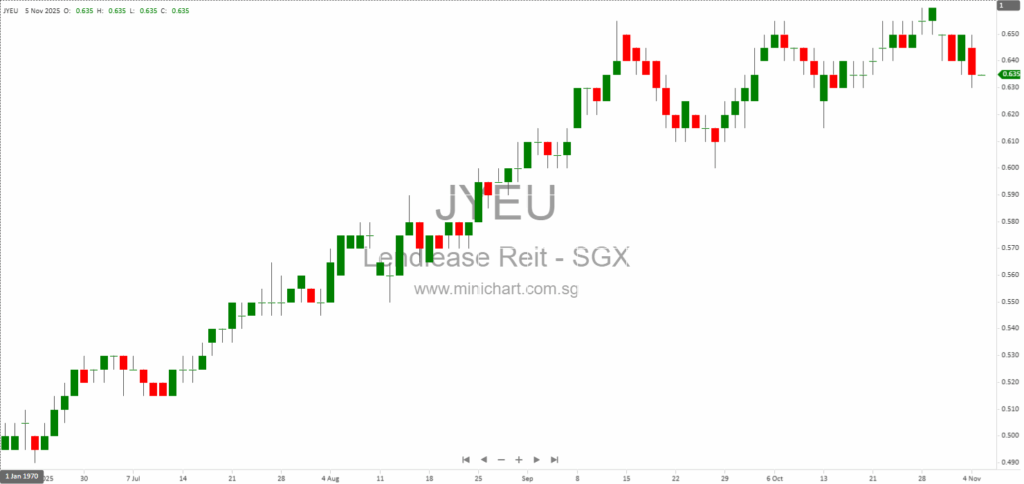

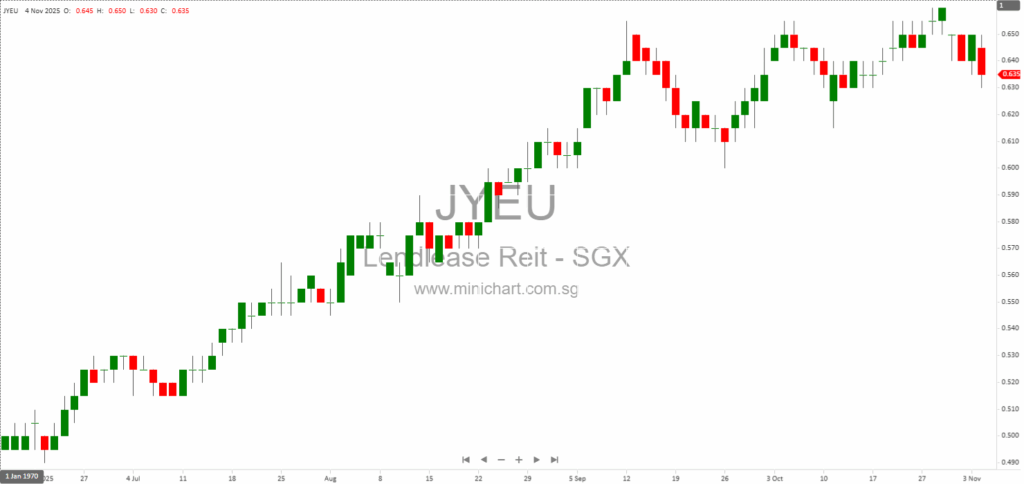

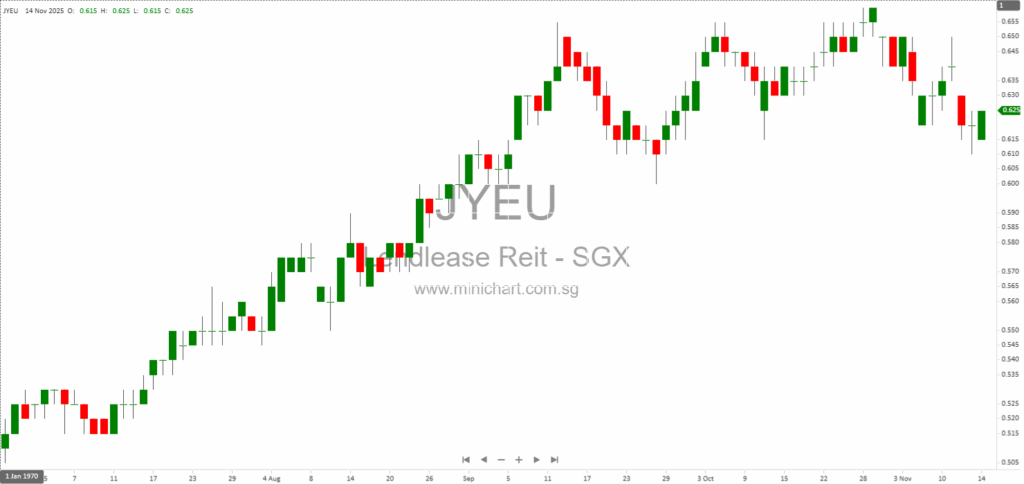

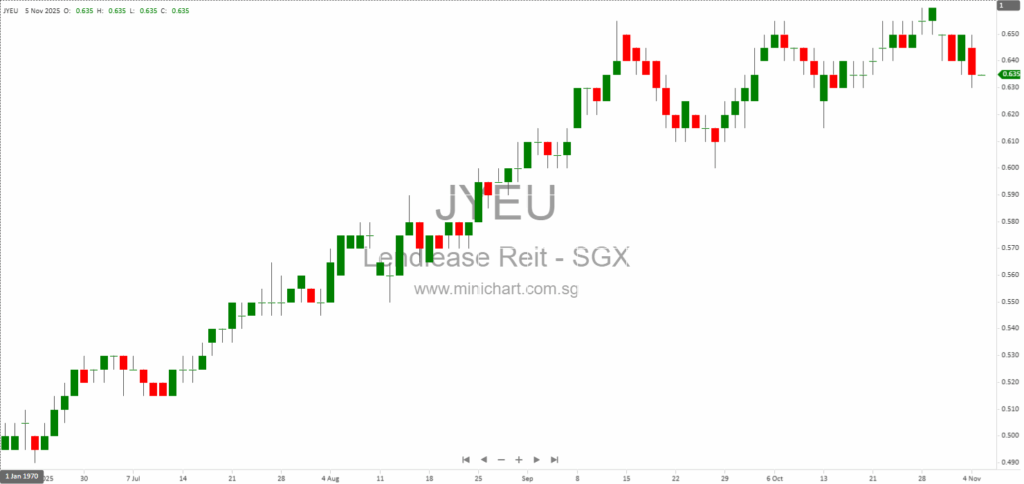

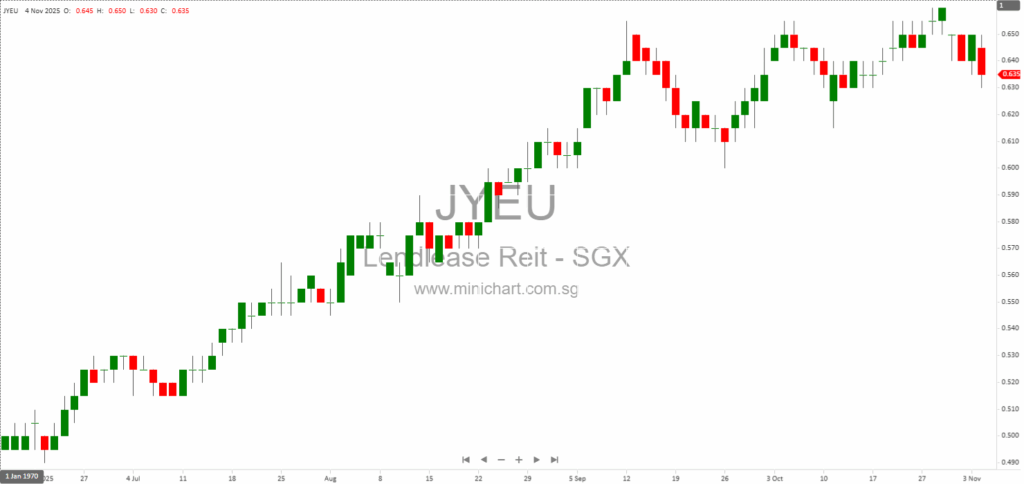

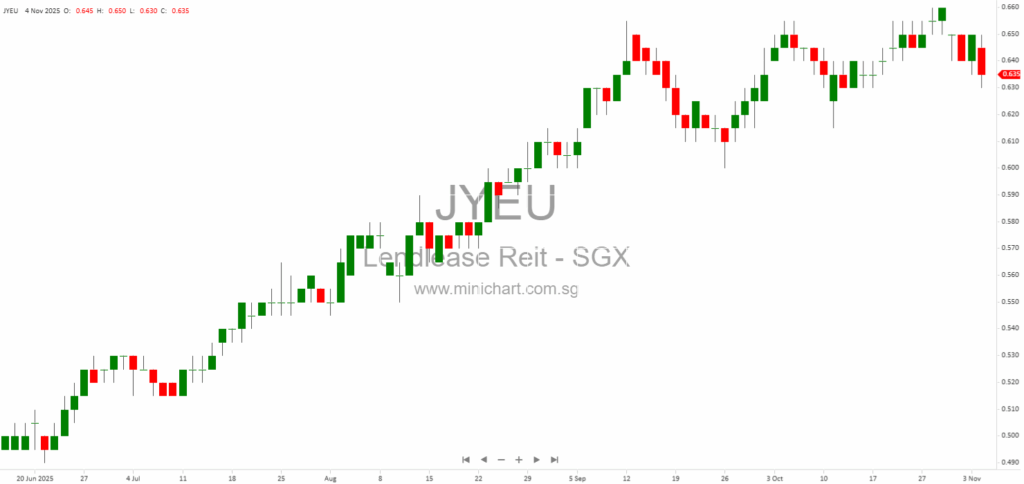

📈 Lendlease Global Commercial REIT Historical Chart

🧾 Recent Financial Statement Analysis

February 14, 2026

Lendlease Global Commercial REIT: 1H FY2026 Financial Analysis and Investor Outlook Lendlease Global Commercial REIT (Lendlease REIT) released its 1H FY2026 financial results, highlighting a period of active portfolio management, resilient operational performance, and steps toward sustainable growth. This article…

December 11, 2025

Lendlease Global Commercial REIT Announces Entry Into New Credit Facilities Lendlease Global Commercial REIT Secures Up to S\$150 Million in New Revolving Credit Facilities Key Highlights Lendlease Global Commercial REIT (LREIT) has entered into two uncommitted revolving credit facilities totaling…

November 14, 2025

Key Points from the Announcement Issue of New Units: Lendlease Global Commercial REIT (“Lendlease REIT”) has announced the successful issuance of 465,117,000 new units via a private placement. Issue Price: The new units are issued at an attractive price of…

November 6, 2025

Lendlease Global Commercial REIT: Successful Upsized Private Placement to Fund Major Acquisition Lendlease Global Commercial REIT Completes Upsized Private Placement to Fund Major Acquisition Key Highlights for Investors Private placement upsized to S\$280 million from the initial S\$270 million due…

November 5, 2025

Lendlease REIT Launches Major S\$270 Million Private Placement to Fund Strategic Acquisition and Strengthen Balance Sheet Lendlease REIT Launches Major S\$270 Million Private Placement to Fund Strategic Acquisition and Strengthen Balance Sheet Key Takeaways for Investors: Potential Share Price Catalyst…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: JYEU, Lendlease Global Commercial REIT

February 14, 2026

Lendlease Global Commercial REIT: 1H FY2026 Financial Analysis and Investor Outlook Lendlease Global Commercial REIT (Lendlease REIT) released its 1H FY2026 financial results, highlighting a period of active portfolio management, resilient operational performance, and steps toward sustainable growth. This article…

December 11, 2025

Lendlease Global Commercial REIT Announces Entry Into New Credit Facilities Lendlease Global Commercial REIT Secures Up to S\$150 Million in New Revolving Credit Facilities Key Highlights Lendlease Global Commercial REIT (LREIT) has entered into two uncommitted revolving credit facilities totaling…

November 14, 2025

Key Points from the Announcement Issue of New Units: Lendlease Global Commercial REIT (“Lendlease REIT”) has announced the successful issuance of 465,117,000 new units via a private placement. Issue Price: The new units are issued at an attractive price of…

November 7, 2025

Broker Name: CGS International Securities Date of Report: November 5, 2025 Excerpt from CGS International Securities report. Report Summary Lendlease Global Commercial REIT (LREIT) proposed to acquire a 70% stake in PLQ Mall for S\$885m, expanding its Singapore retail exposure…

November 6, 2025

Lendlease Global Commercial REIT: Successful Upsized Private Placement to Fund Major Acquisition Lendlease Global Commercial REIT Completes Upsized Private Placement to Fund Major Acquisition Key Highlights for Investors Private placement upsized to S\$280 million from the initial S\$270 million due…

November 5, 2025

Lendlease REIT Launches Major S\$270 Million Private Placement to Fund Strategic Acquisition and Strengthen Balance Sheet Lendlease REIT Launches Major S\$270 Million Private Placement to Fund Strategic Acquisition and Strengthen Balance Sheet Key Takeaways for Investors: Potential Share Price Catalyst…

November 5, 2025

Lendlease REIT’s Strategic S\$885 Million PLQ Mall Acquisition: Game-Changer for Singapore Retail Exposure and Unitholder Returns Lendlease REIT’s Strategic S\$885 Million PLQ Mall Acquisition: Game-Changer for Singapore Retail Exposure and Unitholder Returns Singapore, 5 November 2025 — Lendlease Global Commercial…

November 3, 2025

Broker Name: Maybank Research Pte Ltd Date of Report: November 3, 2025 Excerpt from Maybank Research Pte Ltd report. Report Summary Lendlease Global Comm REIT (LREIT) is actively optimizing its portfolio, focusing on improving debt metrics, asset recycling, and emphasizing…

October 31, 2025

Lendlease REIT’s Strategic Jem Office Divestment and Strong Operational Results Signal Resilient Growth Ahead Lendlease REIT’s Strategic Jem Office Divestment and Strong Operational Results Signal Resilient Growth Ahead Key Highlights for Investors Jem Office Divestment Nears Completion: Expected by 12…

October 31, 2025

Lendlease Global Commercial REIT’s Strategic Jem Office Divestment, Positive Rental Reversion, and Capital Optimisation Set To Reshape Portfolio in FY2026 Lendlease Global Commercial REIT’s Strategic Jem Office Divestment, Positive Rental Reversion, and Capital Optimisation Set To Reshape Portfolio in FY2026…

September 6, 2024

Everest Medicines Ltd (HKG: 1952), Lendlease Global Commercial REIT (SGX: JYEU) 💊 Everest Medicines Ltd (HKG: 1952) - Riding the Wave of Technical Momentum Recommendation: BUY Target Prices: HKD 28.30, HKD 33.10, HKD 36.00, HKD 40.40 Stop Loss: HKD 13.45…