📊 Statistics

- Analyst 1 Year Price Target:

$0.86

- Upside/Downside from Analyst Target:

-1.66%

- Broker Call:

3

- Dividend Minimum 3 Year Yield:

4.73%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

31.86%

📅 SGX Earnings Announcements for J85

CDL Hospitality Trusts (J85)

Market: SGX |

Currency: SGD

Address: 390 Havelock Road

CDL Hospitality Trusts (?CDLHT?) is one of Asia's leading hospitality trusts with assets under management of about S$3.5 billion as at 30 September 2025. CDLHT is a stapled group comprising CDL Hospitality Real Estate Investment Trust (?H-REIT?), a real estate investment trust, and CDL Hospitality Business Trust (?HBT?), a business trust. CDLHT was listed on the Singapore Exchange Securities Trading Limited on 19 July 2006. M&C REIT Management Limited is the manager of H-REIT, the first hotel real estate investment trust in Singapore, and M&C Business Trust Management Limited is the trustee-manager of HBT.

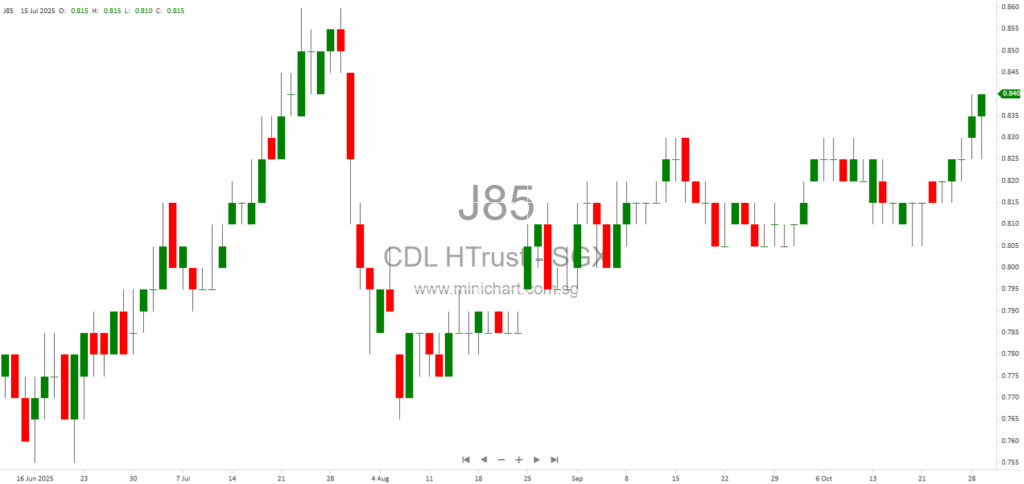

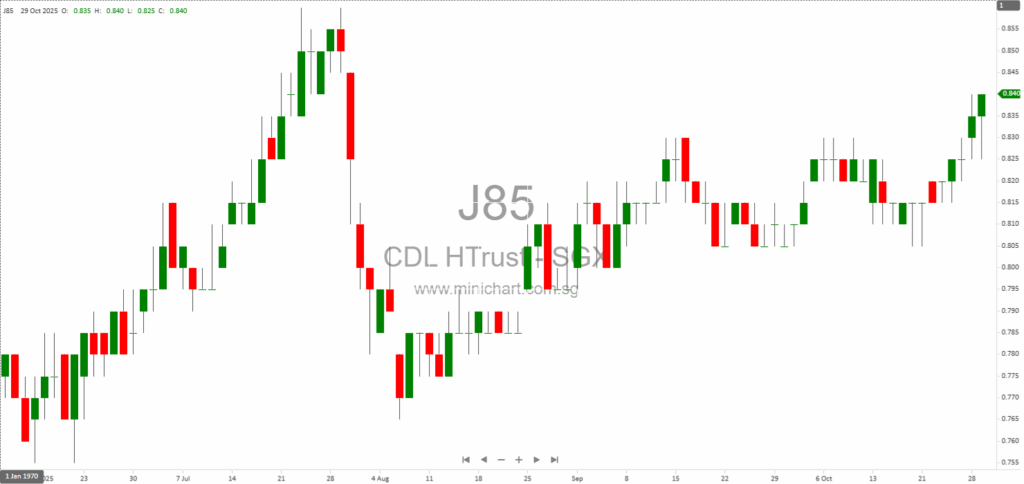

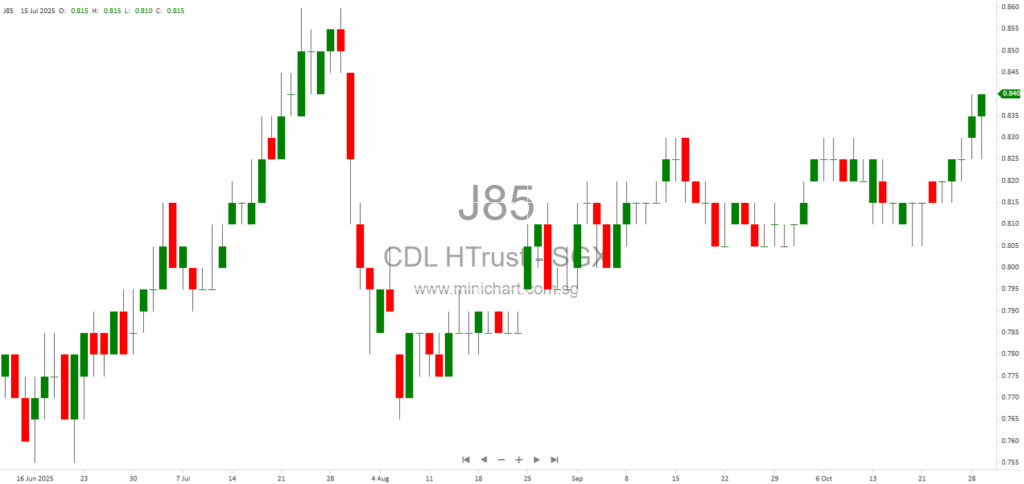

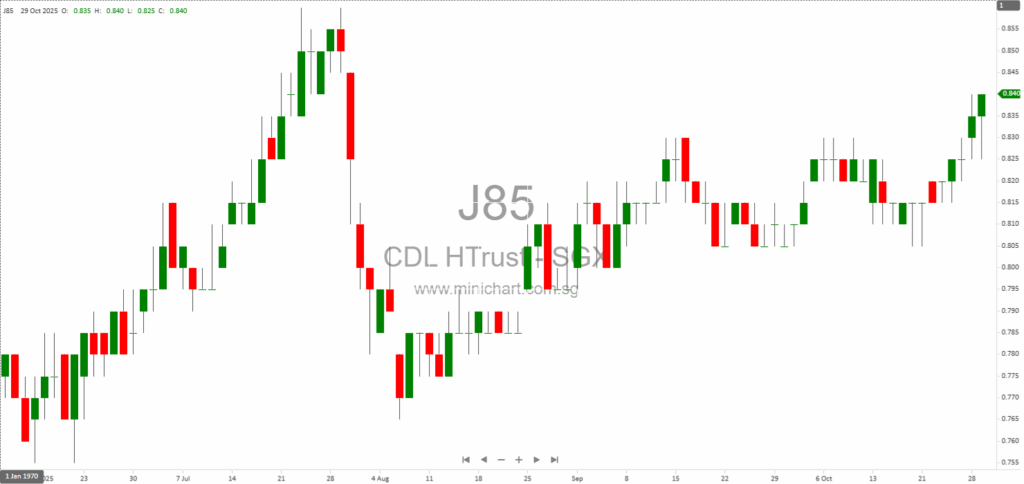

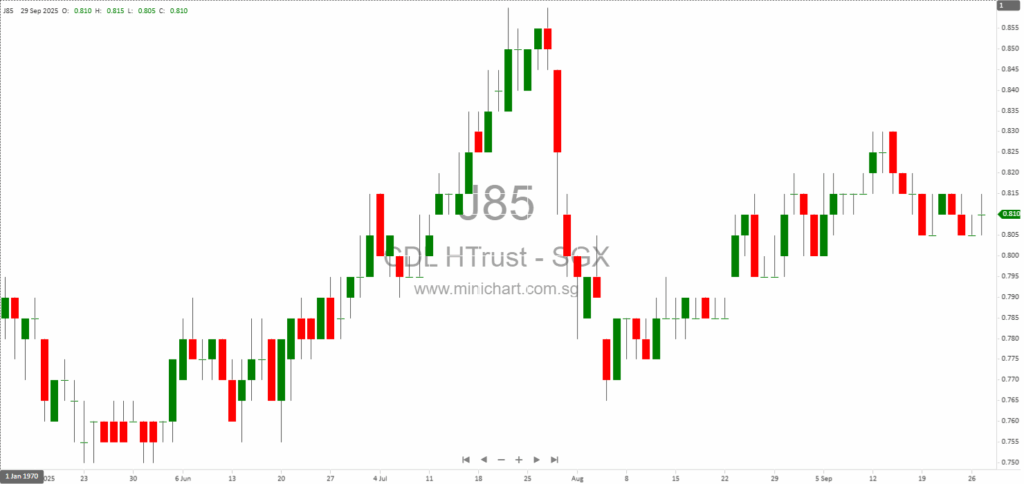

📈 CDL Hospitality Trusts Historical Chart

🧾 Recent Financial Statement Analysis

January 30, 2026

CDL Hospitality Trusts (CDLHT) FY2025 Financial Analysis: Navigating Challenges and Opportunities CDL Hospitality Trusts (CDLHT), comprising CDL Hospitality Real Estate Investment Trust (H-REIT) and CDL Hospitality Business Trust (HBT), has released its condensed interim financial statements for the six months…

January 30, 2026

CDL Hospitality Trusts (CDLHT) FY 2025 Financial Analysis and Outlook CDL Hospitality Trusts (CDLHT), a leading hospitality REIT in Asia, reported its 2H and full-year FY 2025 financial results amidst a dynamic global hospitality market. This analysis reviews key metrics,…

December 29, 2025

CDL Hospitality Trusts: Scheduled Financial Results Release and Investor Guidance CDL Hospitality Trusts, a stapled group comprising CDL Hospitality Real Estate Investment Trust (H-REIT) and CDL Hospitality Business Trust (HBT), has released an announcement pertaining to the scheduled date for…

October 30, 2025

CDL Hospitality Trusts 3Q 2025 Report: Portfolio Growth, Asset Enhancements, and Strategic Moves Set Stage for Share Price Impact CDL Hospitality Trusts 3Q 2025 Report: Portfolio Growth, Asset Enhancements, and Strategic Moves Set Stage for Share Price Impact Executive Summary…

October 30, 2025

CDL Hospitality Trusts 3Q 2025: Asset Enhancement, UK Expansion, and Strategic Positioning Signal Turning Point for Stapled Securities CDL Hospitality Trusts 3Q 2025: Asset Enhancement, UK Expansion, and Strategic Positioning Signal Turning Point for Stapled Securities Executive Summary CDL Hospitality…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: J85, CDL Hospitality Trusts

February 2, 2026

Broker Name: DBS Date of Report: Inferred to be after November 2025, referencing FY25 results and forward-looking statements to 2026. Excerpt from DBS report. Report Summary CDL Hospitality Trusts (CDLHT) reported a 9% year-on-year drop in distributable income to SGD60.9…

February 2, 2026

Broker Name: Maybank Research Pte Ltd Date of Report: February 2, 2026 Excerpt from Maybank Research Pte Ltd report. Report Summary CDL Hospitality Trusts (CDREIT SP) is showing signs of stabilisation, with improved operational performance and a positive outlook for…

January 30, 2026

CDL Hospitality Trusts (CDLHT) FY2025 Financial Analysis: Navigating Challenges and Opportunities CDL Hospitality Trusts (CDLHT), comprising CDL Hospitality Real Estate Investment Trust (H-REIT) and CDL Hospitality Business Trust (HBT), has released its condensed interim financial statements for the six months…

January 30, 2026

CDL Hospitality Trusts (CDLHT) FY 2025 Financial Analysis and Outlook CDL Hospitality Trusts (CDLHT), a leading hospitality REIT in Asia, reported its 2H and full-year FY 2025 financial results amidst a dynamic global hospitality market. This analysis reviews key metrics,…

December 29, 2025

CDL Hospitality Trusts: Scheduled Financial Results Release and Investor Guidance CDL Hospitality Trusts, a stapled group comprising CDL Hospitality Real Estate Investment Trust (H-REIT) and CDL Hospitality Business Trust (HBT), has released an announcement pertaining to the scheduled date for…

October 30, 2025

CDL Hospitality Trusts 3Q 2025 Report: Portfolio Growth, Asset Enhancements, and Strategic Moves Set Stage for Share Price Impact CDL Hospitality Trusts 3Q 2025 Report: Portfolio Growth, Asset Enhancements, and Strategic Moves Set Stage for Share Price Impact Executive Summary…

October 30, 2025

CDL Hospitality Trusts 3Q 2025: Asset Enhancement, UK Expansion, and Strategic Positioning Signal Turning Point for Stapled Securities CDL Hospitality Trusts 3Q 2025: Asset Enhancement, UK Expansion, and Strategic Positioning Signal Turning Point for Stapled Securities Executive Summary CDL Hospitality…

September 29, 2025

CDL Hospitality Trusts Sets Q3 & 9M 2025 Operational Update – Key Dates and Vital Investor Risks Revealed CDL Hospitality Trusts Announces Key Date for Q3 & Nine-Month 2025 Operational Update – What Investors Must Know Highlights from the Announcement…

August 4, 2025

Broker: Maybank Research Pte Ltd Date of Report: July 31, 2025 CDL Hospitality Trusts Faces Challenging Climate: DPU Slumps Amid Renovations and Rising Costs Overview: CDL Hospitality Trusts Under Pressure with DPU Down 21% CDL Hospitality Trusts (CDREIT SP), a…

July 18, 2025

Broker: CGS International Date of Report: July 18, 2025 Singapore Market Insight: Bullish Signals for CDL Hospitality Trusts and Fresh Momentum for Food Empire Holdings Market Overview: Resilient US Data Lifts Global Sentiment Global equities advanced as robust US retail…