📊 Statistics

- Analyst 1 Year Price Target:

$80.74

- Upside/Downside from Analyst Target:

5.96%

- Broker Call:

9

- Dividend Minimum 3 Year Yield:

4.59%

- EPS Growth Range (1Y):

10-25%

- Net Income Growth Range (1Y):

10-25%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

2026-03-10

💰 Dividend History

Current year to date yield:

4.79%

📅 SGX Earnings Announcements for J36

Jardine Matheson Holdings Limited (J36)

Market: SGX |

Currency: USD

Address: Jardine House

Jardine Matheson Holdings Limited operates in motor vehicles and related operations, property investment and development, food retailing, health and beauty, home furnishings, engineering and construction, and transport businesses in China, Southeast Asia, and internationally. It is also involved in the restaurants and hotels, financial services, heavy equipment, mining, and agribusinesses. The company offers automotive and transport services, as well as invests in, develops, and manages residential, commercial, and mixed-use properties. It also operates 7-Eleven, IKEA, and other retailing businesses, as well as Pizza Hut and KFC franchise restaurants; and invests in and manages hotels, resorts, and residences, as well as engages in construction and energy, infrastructure and logistics, and information technology businesses. In addition, the company sells and services motor vehicles; invests in, owns, develops, and manages office and retail properties; operates outlets, including supermarkets, hypermarkets, health and beauty stores, and home furnishings stores. Further, it engages in the automotive dealership business. Additionally, the company invests in digital business, such as Halodoc, a healthtech online ecosystem; Sayurbox, an e-commerce grocery platform; Paxel, a technology-based logistics business; and OLX, a classified used car platform. Jardine Matheson Holdings Limited was founded in 1832 and is based in Hamilton, Bermuda.

Show more

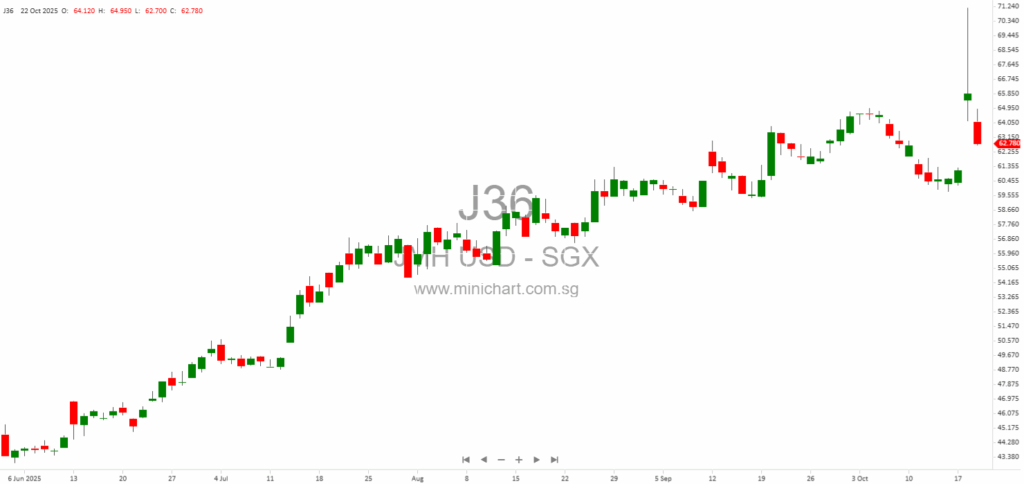

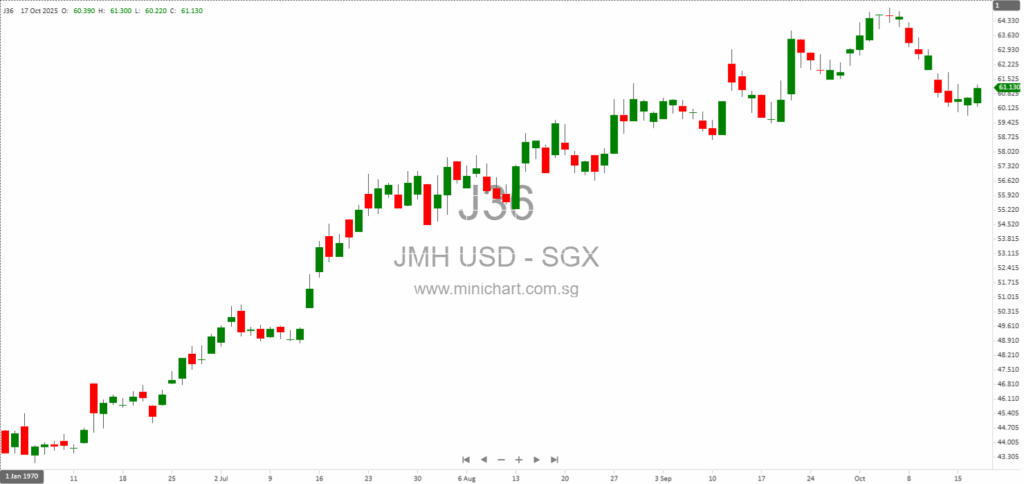

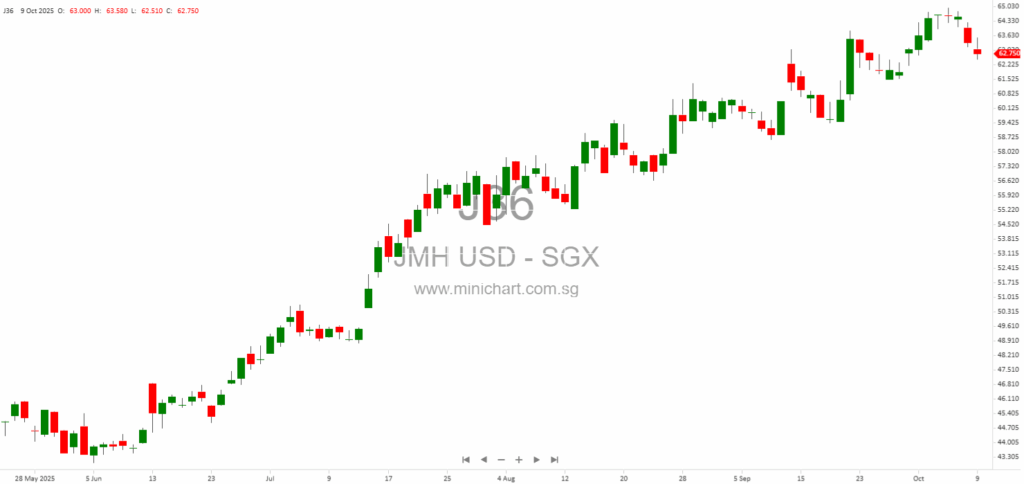

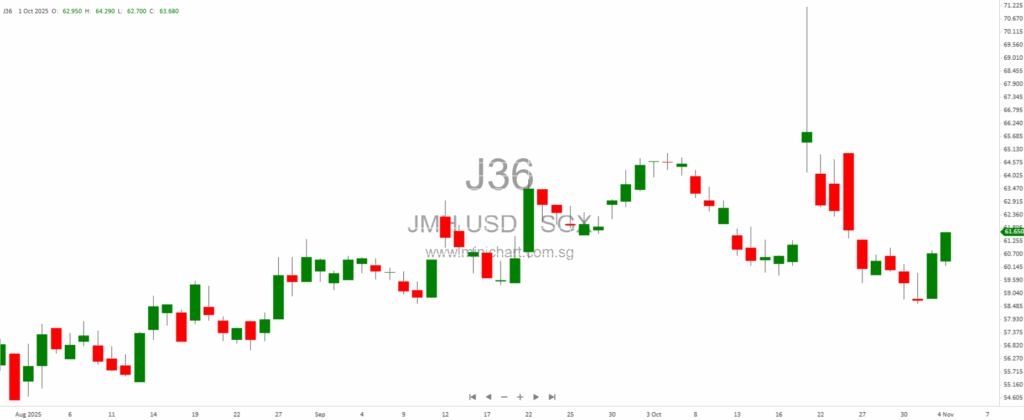

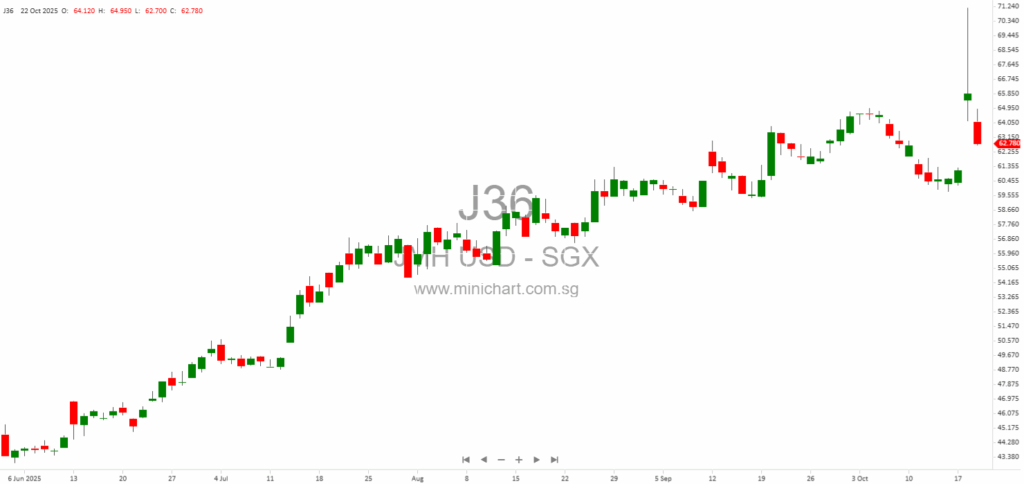

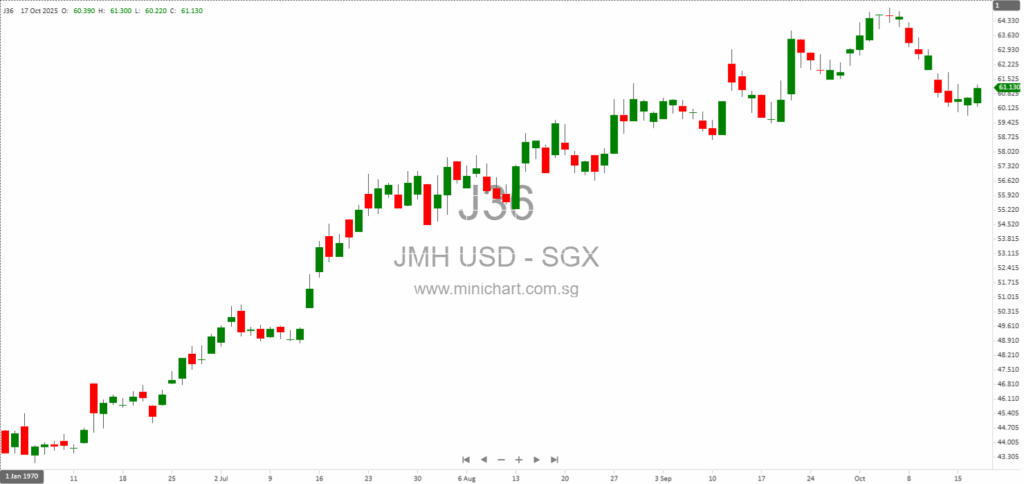

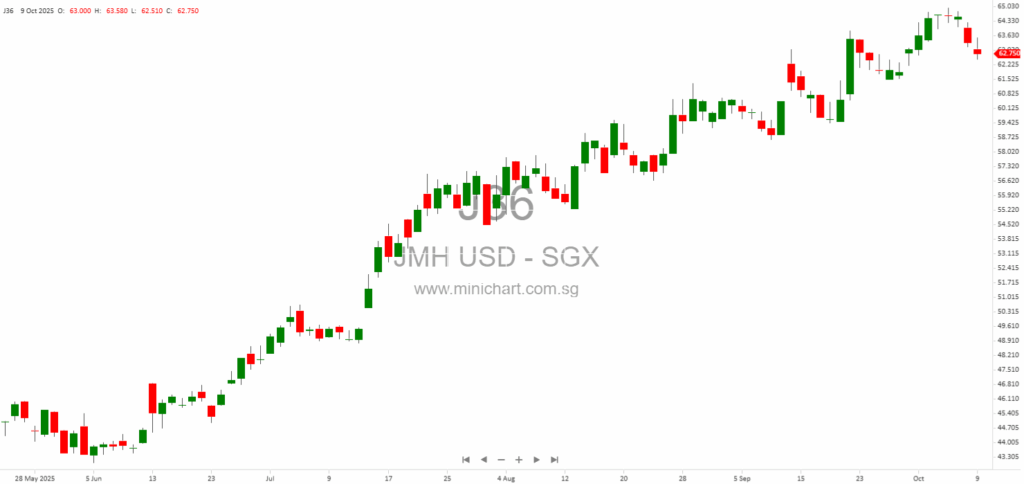

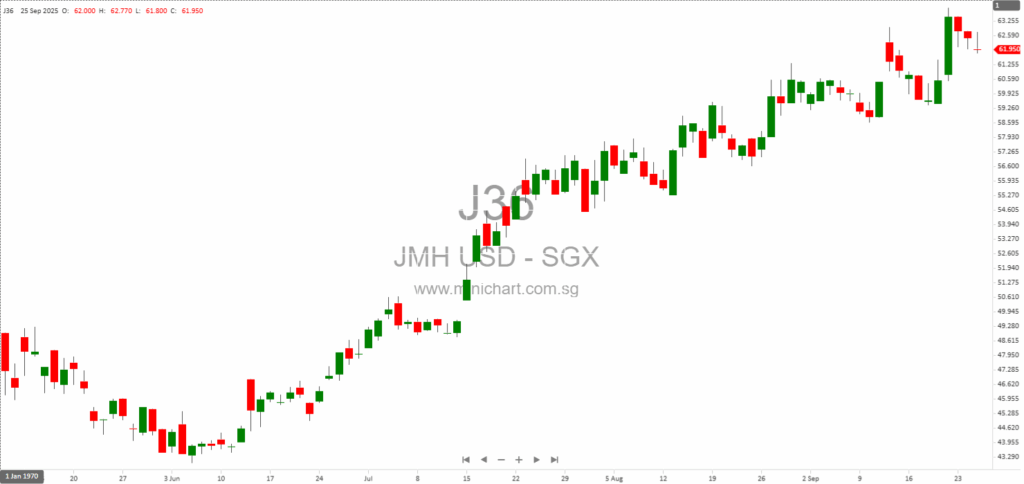

📈 Jardine Matheson Holdings Limited Historical Chart

🧾 Recent Financial Statement Analysis

January 30, 2026

Key Points from the Regulatory Notification Director Share Transaction: Jardine Matheson Holdings Limited has disclosed a significant share acquisition by Director Lincoln Pan. Transaction Date: The acquisitions occurred on January 28, 2026. Volume and Price: A total of 13,800 ordinary…

January 27, 2026

Overview Jardine Matheson Holdings Limited has released a formal notification regarding significant share acquisitions made by Lincoln Pan, a Director of the company. The transactions, disclosed in accordance with Financial Conduct Authority requirements in the United Kingdom, provide insight into…

January 21, 2026

Jardine Matheson Holdings Director Acquires 13,600 Shares – Key Details for Investors Jardine Matheson Holdings Director Acquires 13,600 Shares – Key Details for Investors Key Points from the Official Notification Director Involved: Lincoln Pan, a Director of Jardine Matheson Holdings…

January 16, 2026

Jardine Matheson Holdings: Director Share Transactions Notification - January 2026 Jardine Matheson Holdings: Director Share Transactions Notification - January 2026 Key Points from the Report Jardine Matheson Holdings Limited has announced significant share transactions involving two of its Directors: Adam…

December 31, 2025

Mandarin Oriental International Limited: Key Updates on Acquisition, OCB Sale, and Shareholder Impacts Mandarin Oriental International Limited: Major Developments in Acquisition and OCB Sale Overview Mandarin Oriental International Limited ("Mandarin Oriental") has released a significant update regarding its recommended cash…

December 10, 2025

Jardine Matheson Holdings: Director and Senior Executive Share Acquisitions Jardine Matheson Holdings: Director and Senior Executive Acquire Significant Shares Key Points from the Report Two senior figures at Jardine Matheson Holdings Limited have made substantial acquisitions of company shares. The…

November 14, 2025

Jardine Matheson Directors Conduct Significant Share Transactions Jardine Matheson Directors Conduct Significant Share Transactions Jardine Matheson Holdings Limited has issued mandatory notifications regarding substantial share transactions involving its directors, Ben Keswick and John Witt. These activities involve the exercise of…

October 22, 2025

Jardine Matheson Director Transfers Over 2 Million Shares to Family: What Does This Mean for Investors? Jardine Matheson Director Transfers Over 2 Million Shares to Family: What Does This Mean for Investors? Key Points from the Notification Director Ben Keswick…

October 17, 2025

Jardine Matheson Executives and Family Acquire Massive Stake in Scrip Dividend—Is a Strategic Shift Underway? Jardine Matheson Executives and Family Acquire Massive Stake in Scrip Dividend—Is a Strategic Shift Underway? London, 17 October 2025 — In a significant development for…

October 9, 2025

Jardine Matheson Announces Scrip Dividend Share Listing: What Investors Need to Know Jardine Matheson Announces Scrip Dividend Share Listing: Key Details and Impact for Investors Highlights from the Latest Jardine Matheson Holdings Notification 809,878 new ordinary shares to be listed…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: J36, Jardine Matheson Holdings Limited, JM SP, JARDINE MATHESON HOLDINGS, JARDINE MATHESON

January 30, 2026

Key Points from the Regulatory Notification Director Share Transaction: Jardine Matheson Holdings Limited has disclosed a significant share acquisition by Director Lincoln Pan. Transaction Date: The acquisitions occurred on January 28, 2026. Volume and Price: A total of 13,800 ordinary…

January 27, 2026

Overview Jardine Matheson Holdings Limited has released a formal notification regarding significant share acquisitions made by Lincoln Pan, a Director of the company. The transactions, disclosed in accordance with Financial Conduct Authority requirements in the United Kingdom, provide insight into…

January 21, 2026

Jardine Matheson Holdings Director Acquires 13,600 Shares – Key Details for Investors Jardine Matheson Holdings Director Acquires 13,600 Shares – Key Details for Investors Key Points from the Official Notification Director Involved: Lincoln Pan, a Director of Jardine Matheson Holdings…

January 16, 2026

Jardine Matheson Holdings: Director Share Transactions Notification - January 2026 Jardine Matheson Holdings: Director Share Transactions Notification - January 2026 Key Points from the Report Jardine Matheson Holdings Limited has announced significant share transactions involving two of its Directors: Adam…

December 31, 2025

Mandarin Oriental International Limited: Key Updates on Acquisition, OCB Sale, and Shareholder Impacts Mandarin Oriental International Limited: Major Developments in Acquisition and OCB Sale Overview Mandarin Oriental International Limited ("Mandarin Oriental") has released a significant update regarding its recommended cash…

December 11, 2025

Jardine Matheson Director Acquires Shares – Detailed Transaction Disclosure Jardine Matheson Director Lincoln Pan Acquires 14,800 Shares – Transaction Details Disclosed Key Highlights for Investors Director Transaction: Lincoln Pan, a Director of Jardine Matheson Holdings Limited, has acquired a significant…

December 10, 2025

Jardine Matheson Holdings: Director and Senior Executive Share Acquisitions Jardine Matheson Holdings: Director and Senior Executive Acquire Significant Shares Key Points from the Report Two senior figures at Jardine Matheson Holdings Limited have made substantial acquisitions of company shares. The…

November 14, 2025

Jardine Matheson Directors Conduct Significant Share Transactions Jardine Matheson Directors Conduct Significant Share Transactions Jardine Matheson Holdings Limited has issued mandatory notifications regarding substantial share transactions involving its directors, Ben Keswick and John Witt. These activities involve the exercise of…

November 4, 2025

Jardine Matheson launches US$250 million share buyback programme London-listed conglomerate Jardine Matheson (J36 +1.33%) announced on Monday (Nov 3) that it plans to repurchase up to US$250 million worth of its shares under a proposed buyback programme. The group, which…

October 22, 2025

Jardine Matheson Director Transfers Over 2 Million Shares to Family: What Does This Mean for Investors? Jardine Matheson Director Transfers Over 2 Million Shares to Family: What Does This Mean for Investors? Key Points from the Notification Director Ben Keswick…

October 17, 2025

Jardine Matheson Executives and Family Acquire Massive Stake in Scrip Dividend—Is a Strategic Shift Underway? Jardine Matheson Executives and Family Acquire Massive Stake in Scrip Dividend—Is a Strategic Shift Underway? London, 17 October 2025 — In a significant development for…

October 9, 2025

Jardine Matheson Announces Scrip Dividend Share Listing: What Investors Need to Know Jardine Matheson Announces Scrip Dividend Share Listing: Key Details and Impact for Investors Highlights from the Latest Jardine Matheson Holdings Notification 809,878 new ordinary shares to be listed…

September 25, 2025

Jardine Matheson Share Option Plans: What Investors Need to Know from the Latest Block Listing Return Jardine Matheson Share Option Plans: What Investors Need to Know from the Latest Block Listing Return Key Takeaways from Jardine Matheson Holdings' Block Listing…

July 2, 2025

Broker Name: CGS International Date of Report: April 22, 2025 Jardine Matheson and Wilmar International: In-Depth Analysis and Technical Outlook for Singapore’s Market Leaders Market Recap: Global Volatility and Safe-Haven Surge The global financial markets experienced heightened volatility as US…

April 28, 2025

CGS International April 22, 2025 Jardine Matheson Holdings Ltd: Technical Buy - Reversion to the Upside Key Takeaways from Overnight Recap US assets experienced a selloff following President Trump's criticism of Jerome Powell, impacting stocks, the dollar, and longer-dated Treasuries.…