📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

2.88%

- EPS Growth Range (1Y):

10-25%

- Net Income Growth Range (1Y):

0-10%

- Revenue Growth Range (1Y):

10-25%

-

Upcoming Earnings Date:

2026-02-19

💰 Dividend History

Current year to date yield:

3.85%

Amount: -

Yield: -

Pay Date: 2003-06-06

Details:

2% LESS TAX

📅 SGX Earnings Announcements for I49

IFS Capital Limited (I49)

Market: SGX |

Currency: SGD

Address: No. 09-04 Singapore Post Centre

IFS Capital Limited, together with its subsidiaries, provides commercial, alternative, and structured finance services in Singapore, Thailand, Malaysia, and Indonesia. It operates in four segments: Credit Financing, Insurance, Private Equity and Other Investments, and Fund Management. The company offers factoring, accounts receivable financing, trade financing, asset-based financing loans, working capital, leasing, and hire purchase services, as well as credit financing and consumer loans; and issues performance bonds and guarantees, domestic maid insurance, property and casualty insurance, motor insurance, engineering insurance, and work injury compensation insurance, as well as holds equity securities and bonds under the regulated insurance fund. It is also involved in the provision of development capital in the form of convertible debt instruments and private equity investments; and fund management and venture capital investment activities. In addition, the company offers money lending, business debt receivable purchase, credit agency, direct financing, operating lease, and consumer financing services; and web portal and online loan marketplace services, as well as invests in private credit fund. IFS Capital Limited was incorporated in 1987 and is based in Singapore. IFS Capital Limited is a subsidiary of Phillip Assets Pte Ltd.

Show more

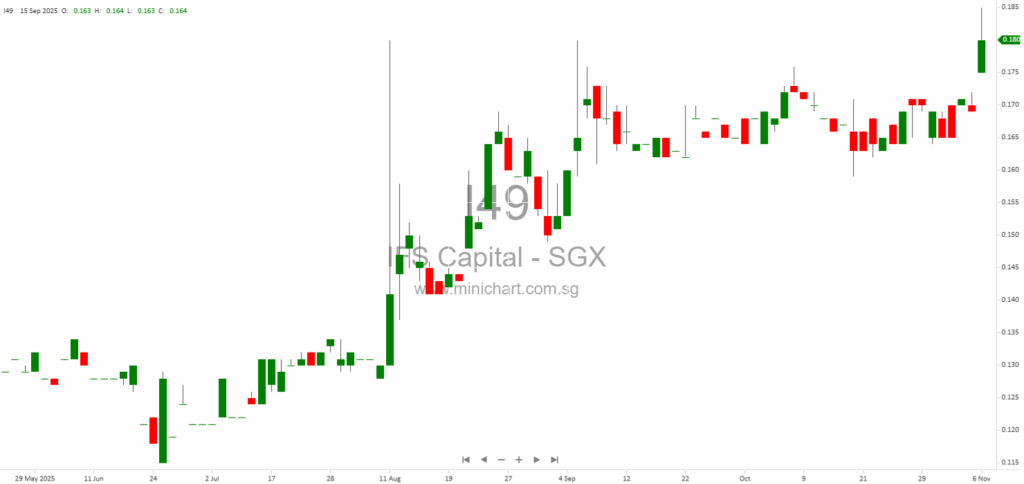

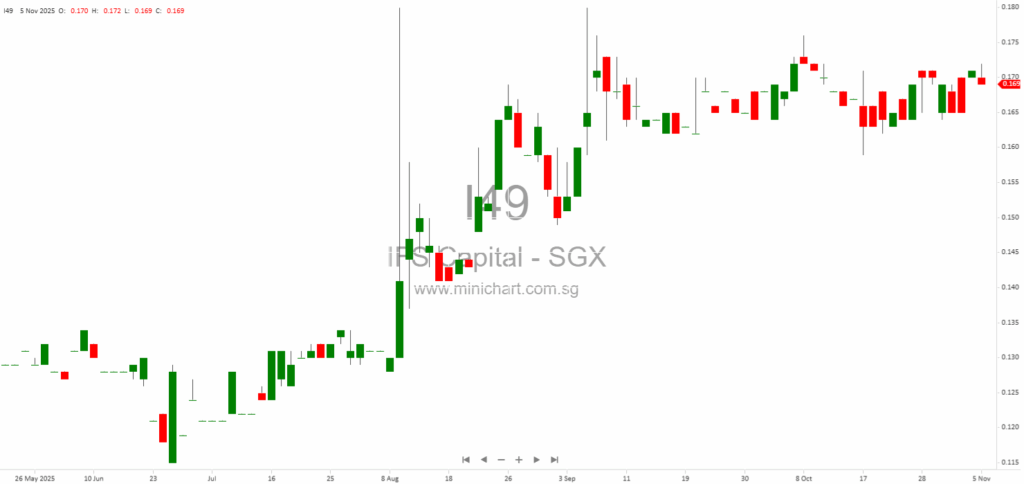

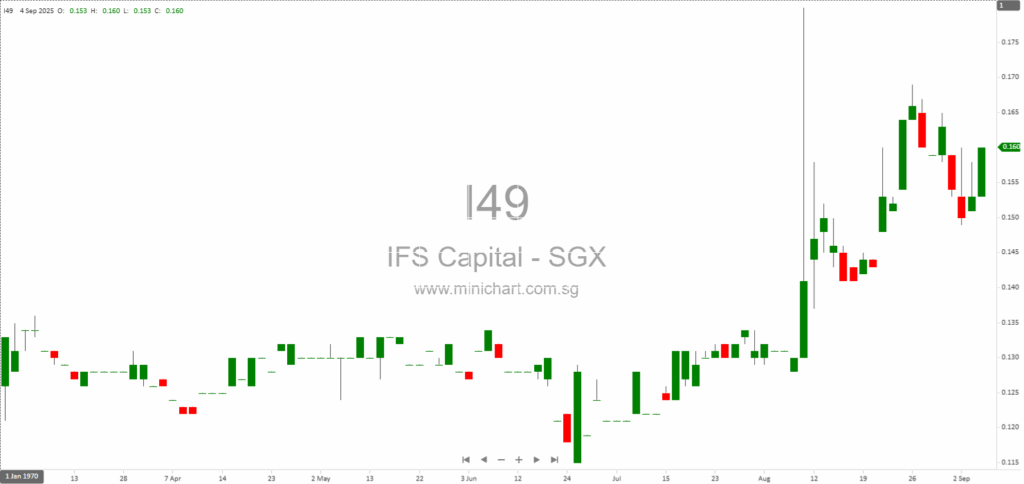

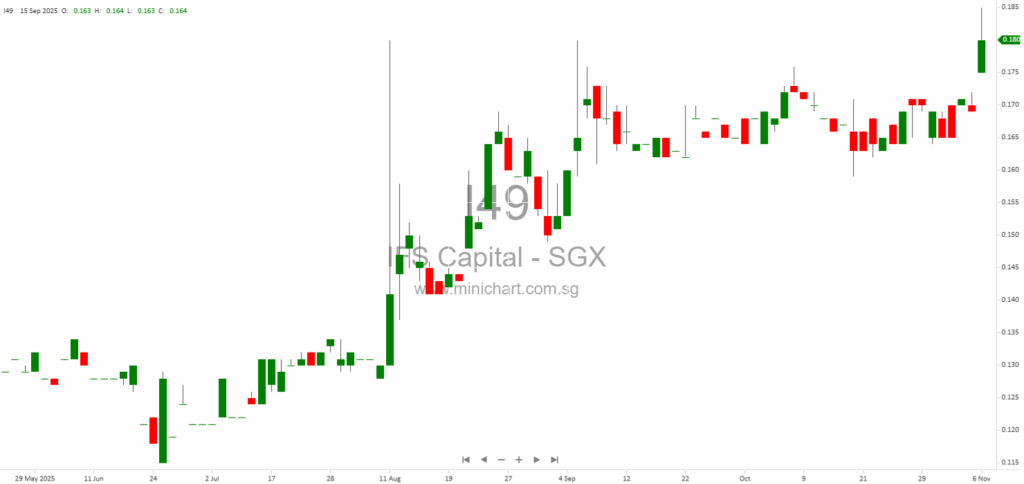

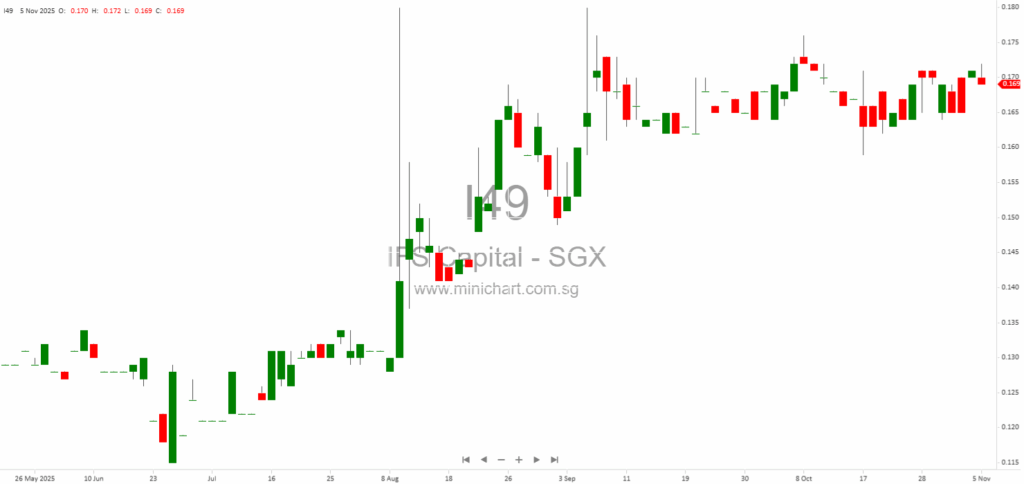

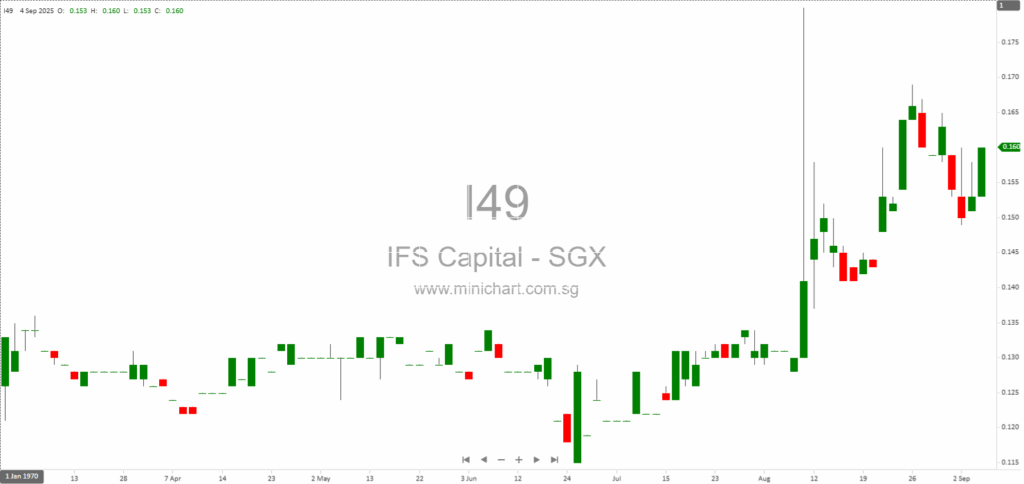

📈 IFS Capital Limited Historical Chart

🧾 Recent Financial Statement Analysis

February 13, 2026

IFS Capital Limited Incorporates Wholly-Owned Subsidiary in Hong Kong IFS Capital Limited Announces Strategic Expansion with New Hong Kong Subsidiary IFS Capital Limited (SGX: I49), a leading Singapore-based financial services group, is making a significant step in its regional expansion…

November 6, 2025

IFS Capital (Thailand) Q3 2025 Financial Results: Detailed Investor Report IFS Capital (Thailand) Q3 2025 Results: Profit Down Amid Higher Credit Losses, Cash Position Strong Key Financial Highlights for Investors Net profit for Q3 2025: THB 45.4 million, up 34%…

November 5, 2025

IFS Capital Recognized as a Top Fintech Company for 2026: Implications for Investors IFS Capital Recognized as a Top Fintech Company for 2026: Implications for Investors Key Points for Investors IFS Capital Limited has been named among Singapore’s Top Fintech…

September 4, 2025

IFS Capital Teams Up with Japanese Giant to Funnel Billions into Asian SMEs: A Game-Changer for Shareholders? IFS Capital Teams Up with Japanese Giant to Funnel Billions into Asian SMEs: A Game-Changer for Shareholders? Key Highlights from the Announcement IFS…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: I49, IFS Capital Limited, IFS Capital, IFS SP, IFS CAPITAL LTD, IFS CAPITAL

February 13, 2026

IFS Capital Limited Incorporates Wholly-Owned Subsidiary in Hong Kong IFS Capital Limited Announces Strategic Expansion with New Hong Kong Subsidiary IFS Capital Limited (SGX: I49), a leading Singapore-based financial services group, is making a significant step in its regional expansion…

November 6, 2025

IFS Capital (Thailand) Q3 2025 Financial Results: Detailed Investor Report IFS Capital (Thailand) Q3 2025 Results: Profit Down Amid Higher Credit Losses, Cash Position Strong Key Financial Highlights for Investors Net profit for Q3 2025: THB 45.4 million, up 34%…

November 5, 2025

IFS Capital Recognized as a Top Fintech Company for 2026: Implications for Investors IFS Capital Recognized as a Top Fintech Company for 2026: Implications for Investors Key Points for Investors IFS Capital Limited has been named among Singapore’s Top Fintech…

October 8, 2025

Broker Name: CGS International Date of Report: October 8, 2025 Excerpt from CGS International report. AI Investment Frenzy: Recent massive investments and partnerships between Nvidia, OpenAI, and AMD are fueling concerns of a possible AI bubble, as these circular business…

September 4, 2025

IFS Capital Teams Up with Japanese Giant to Funnel Billions into Asian SMEs: A Game-Changer for Shareholders? IFS Capital Teams Up with Japanese Giant to Funnel Billions into Asian SMEs: A Game-Changer for Shareholders? Key Highlights from the Announcement IFS…