📊 Statistics

- Analyst 1 Year Price Target:

$3.14

- Upside/Downside from Analyst Target:

-12.53%

- Broker Call:

2

- Dividend Minimum 3 Year Yield:

4.34%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

2026-02-19

💰 Dividend History

Current year to date yield:

4.57%

📅 SGX Earnings Announcements for F34

Wilmar International Limited (F34)

Market: SGX |

Currency: SGD

Address: Wilmar International

Wilmar International Limited, together with its subsidiaries, operates as an agribusiness company in the People's Republic of China, South East Asia, India, Europe, Australia, New Zealand, Africa, and internationally. It operates in four segments: Food Products, Feed and Industrial Products, Plantation and Sugar Milling, and Others. The Food Products segment engages in the processing, branding, and distribution of a range of edible food products, including vegetable oils, sugar, flour, rice, noodles, specialty fats, snacks, bakery, and dairy products; and ready-to-eat meals and central kitchen products. Its Feed and Industrial Products segment is involved in the processing, merchandising, and distribution of products, such as animal feeds, non-edible palm and lauric products, agricultural commodities, oleochemicals, gas oil, and biodiesel. The Plantation and Sugar Milling segment engages in oil palm plantation and sugar milling activities, as well as production of compound fertilizers. Its Others segment provides logistics and jetty port services; and involvement in investment activities. The company also offers specialty fats; vegetarian food; agricultural and technical advisory services; management consulting, investment, industrial estate, warehousing, seaport, and e-commerce services; plastic package and bleaching earth; ethanol; molasses and co-generated electricity; grains; and beverages. In addition, it engages in the trading of electricity/power design; undertaking and erection of turnkey projects; owning, chartering, brokering, and management of ships; and operation of finance and treasury centers. Wilmar International Limited was founded in 1991 and is headquartered in Singapore.

Show more

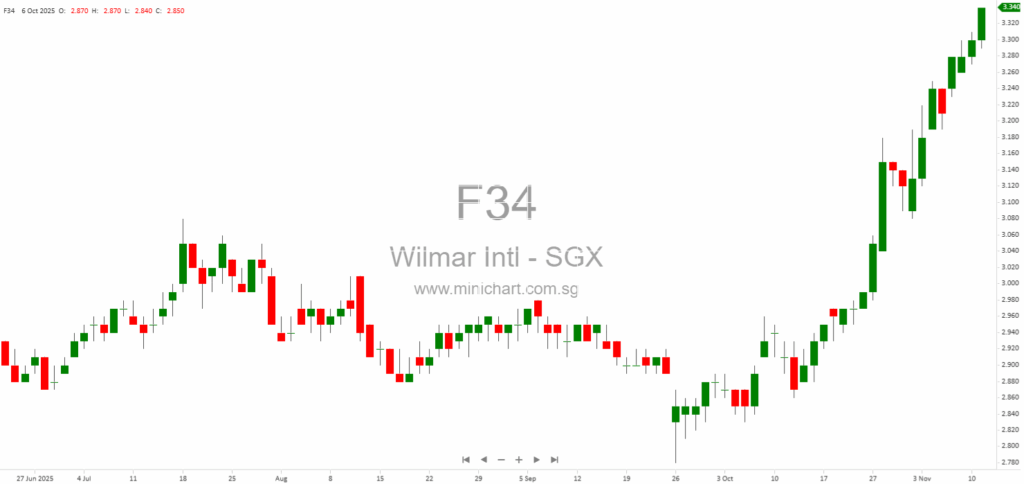

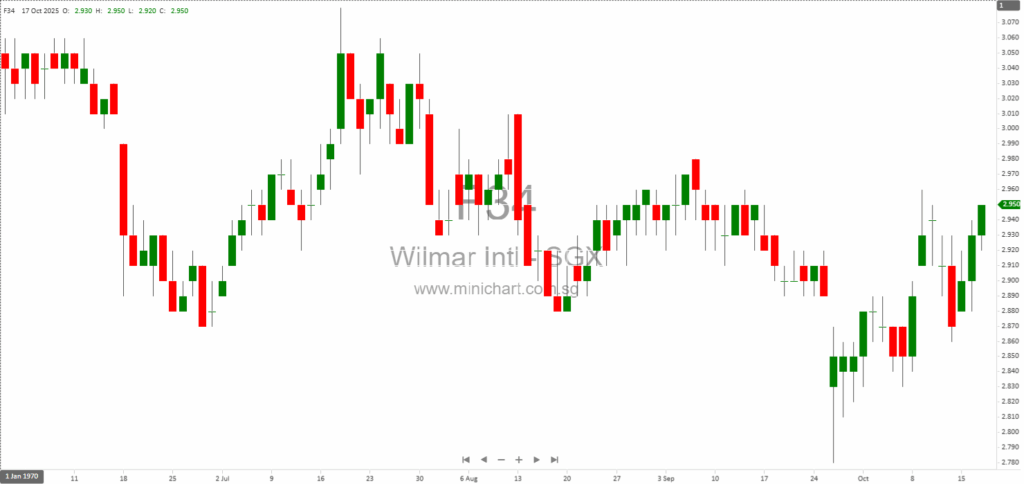

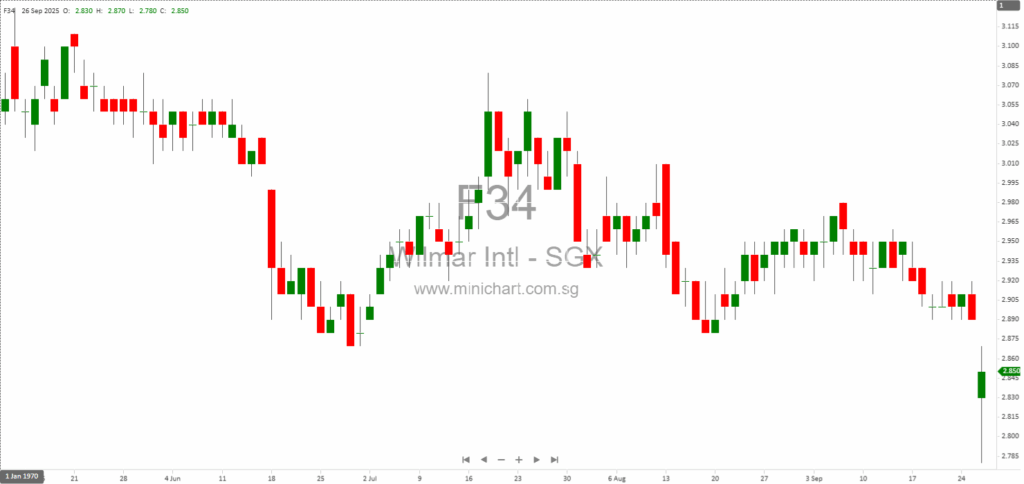

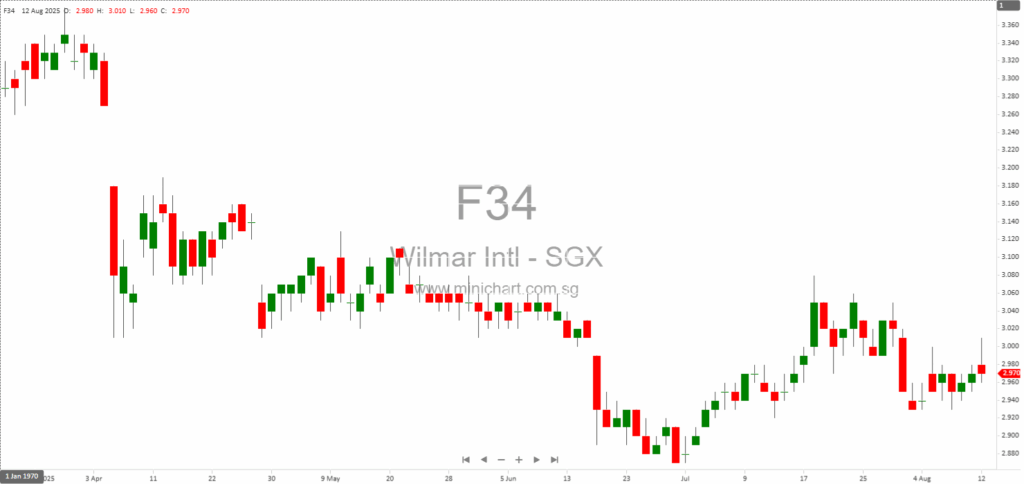

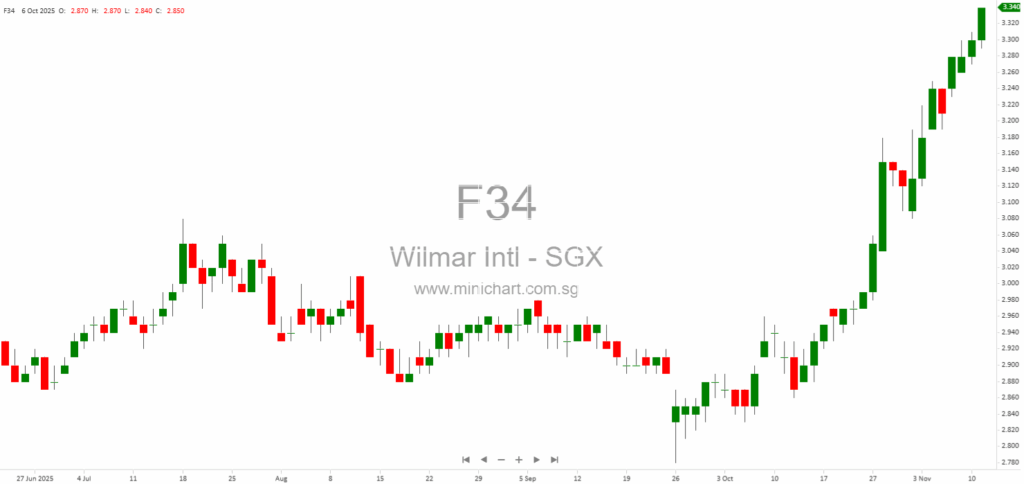

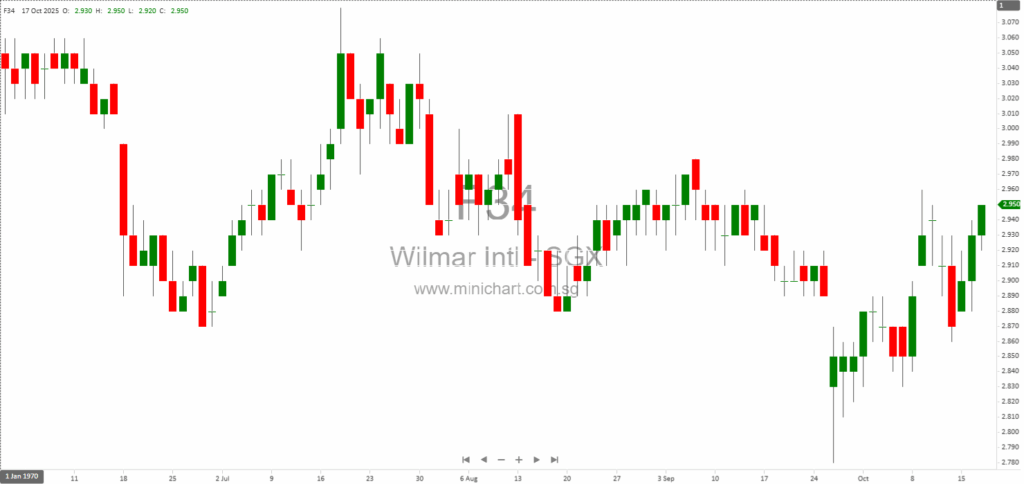

📈 Wilmar International Limited Historical Chart

🧾 Recent Financial Statement Analysis

November 11, 2025

Wilmar International to Acquire Additional Stake in AWL Agri Business Limited Wilmar International Announces Strategic Acquisition of 13% Stake in AWL Agri Business Limited Key Highlights of the Transaction Wilmar International Limited (Wilmar), via its wholly-owned subsidiary Lence Pte. Ltd.…

October 21, 2025

Wilmar Faces Legal Uncertainty in Indonesia: Sugar Import Scandal May Impact Shareholder Confidence Wilmar Faces Legal Uncertainty in Indonesia: Sugar Import Scandal May Impact Shareholder Confidence Key Points from Wilmar’s Announcement The General Manager of Wilmar’s Indonesian subsidiary, P.T. Duta…

September 26, 2025

Wilmar Faces Massive Fines After Indonesian Supreme Court Overturns Acquittal: What Investors Must Know Wilmar Faces Massive Fines After Indonesian Supreme Court Overturns Acquittal: What Investors Must Know Key Points in the Report Indonesian Supreme Court Decision: The Supreme Court…

August 12, 2025

Wilmar International’s Bold Expansion and Strategic Reshuffling: What Retail Investors Need to Watch in 2025 Wilmar International’s Bold Expansion and Strategic Reshuffling: What Retail Investors Need to Watch in 2025 Wilmar International Limited has published its latest report on changes…

October 30, 2024

Wilmar International Limited – 3Q2024 Financial Analysis for InvestorsReport Date: 30 October 2024Reporting Period: Quarter ended 30 September 20241. Business DescriptionCore Operations:Wilmar International Limited operates in the agribusiness sector, with a primary focus on tropical oils, oilseeds, and grains. The…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: F34, Wilmar International Limited, Wilmar Intl, WIL SP, WILMAR LTD, WILMAR

January 23, 2026

Broker Name: CGS International Date of Report: January 23, 2026 Excerpt from CGS International report. Singapore's MSCI Index: The MSCI Singapore Free Index is showing mild corrective downside at 460.00, but weak selling pressure signals an upcoming bullish move, with…

November 14, 2025

Broker Name: Maybank Research Pte Ltd Date of Report: 13 November 2025 Excerpt from Maybank Research Pte Ltd report. OCBC Bank: Strong 9M25 core earnings beat expectations, driven by group synergies and resilient credit growth. Dividend momentum is expected to…

November 11, 2025

Wilmar International to Acquire Additional Stake in AWL Agri Business Limited Wilmar International Announces Strategic Acquisition of 13% Stake in AWL Agri Business Limited Key Highlights of the Transaction Wilmar International Limited (Wilmar), via its wholly-owned subsidiary Lence Pte. Ltd.…

November 3, 2025

Broker: CGS International Date of Report: October 31, 2025 Excerpt from CGS International report. Report Summary Wilmar International's core operations are improving, supported by higher sales volumes, stronger soybean crushing margins in China, and firmer crude palm oil (CPO) prices.…

November 3, 2025

Broker Name: Maybank Research Pte Ltd Date of Report: November 2, 2025 Excerpt from Maybank Research Pte Ltd report. Report Summary Wilmar International delivered resilient operational results, with 9M25 revenue up 7% year-on-year and core net income up 16%, supported…

October 21, 2025

Broker Name: Lim & Tan Securities Date of Report: 21 October 2025 Excerpt from Lim & Tan Securities report. Report Summary Jardine Matheson is moving to privatise Mandarin Oriental through a cash takeover at US\$3.35 per share, valuing the hotel…

October 21, 2025

Wilmar Faces Legal Uncertainty in Indonesia: Sugar Import Scandal May Impact Shareholder Confidence Wilmar Faces Legal Uncertainty in Indonesia: Sugar Import Scandal May Impact Shareholder Confidence Key Points from Wilmar’s Announcement The General Manager of Wilmar’s Indonesian subsidiary, P.T. Duta…

October 13, 2025

Broker Name: CGS International Date of Report: October 9, 2025 Excerpt from CGS International report. Report Summary Gold prices have surged past \$4,000 an ounce, driven by economic uncertainties, geopolitical tensions, and strong demand from central banks and investors. The…

October 13, 2025

Broker: CGS International Date of Report: October 9, 2025 Excerpt from CGS International report. Report Summary Wilmar International Ltd’s share price has dropped 13% from its March 2025 peak, which the broker believes has already priced in the negative impact…

October 9, 2025

CGS International, October 8, 2025 Excerpt from CGS International report. Report Summary CGS International upgrades Wilmar International to "Add" with a target price of S\$3.30, citing that most of the negative impact from the Indonesian Supreme Court's US\$709m fine has…

April 28, 2025

Broker Name: CGS International Date of Report: April 21, 2025 Wilmar International Downgraded to Hold Amid Indonesian Uncertainty Summary CGS International has downgraded Wilmar International (WIL) from "Add" to "Hold," citing increased uncertainty in the Indonesian market. Despite an expected…

February 23, 2025

Wilmar International (WIL SP): Anticipating A Better Year From China; Upgrade To BUY WHAT’S NEW Wilmar International (WIL SP) is poised for a better year in 2025, driven by positive trends emerging from China. The company’s core net profit is…

October 30, 2024

Wilmar International Limited – 3Q2024 Financial Analysis for InvestorsReport Date: 30 October 2024Reporting Period: Quarter ended 30 September 20241. Business DescriptionCore Operations:Wilmar International Limited operates in the agribusiness sector, with a primary focus on tropical oils, oilseeds, and grains. The…