📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

4.52%

- EPS Growth Range (1Y):

10-25%

- Net Income Growth Range (1Y):

10-25%

- Revenue Growth Range (1Y):

25-50%

-

Upcoming Earnings Date:

2026-02-23

💰 Dividend History

Current year to date yield:

4.65%

Amount: $0.005000

Yield: 0.70%

Pay Date: 2018-11-07

Details:

AUD 0.005

Amount: $0.025000

Yield: 3.21%

Pay Date: 2018-06-07

Details:

DRP AUD 0.025

Amount: $0.005000

Yield: 0.68%

Pay Date: 2017-11-06

Details:

AUD 0.005

Amount: $0.025000

Yield: 3.36%

Pay Date: 2017-06-08

Details:

DRP AUD 0.025

Amount: $0.005000

Yield: 0.74%

Pay Date: 2016-11-03

Details:

DRP AUD 0.005

Amount: $0.002000

Yield: -

Pay Date: 2008-10-28

Details:

DRP AUD 0.002

📅 SGX Earnings Announcements for EH5

United Overseas Australia Ltd (EH5)

Market: SGX |

Currency: SGD

Address: Vertical Corporate Tower B

United Overseas Australia Ltd, together with its subsidiaries, engages in the development and resale of land and buildings in Malaysia, Singapore, Vietnam, and Australia. It operates in three segments: Land Development and Resale, Investment, and Others. The Land Development and Resale segment engages in the development, construction, and sale of residential and commercial properties. Its Investment segment holds various investment properties. The Others segment engages in the operation of hotels, food and beverage outlets, and car parks; and provision of facilities support, money lending, and management services. The company also offers property investment and management, as well as education, training, and related consultancy services; and operates medical healthcare centers that provide healthcare, medicinal, physiotherapy, acupuncture, dental consultancy and treatment, and other healthcare related services. In addition, it sells medicinal, pharmaceutical, healthcare, and beauty care products. United Overseas Australia Ltd was incorporated in 1987 and is headquartered in Kuala Lumpur, Malaysia.

Show more

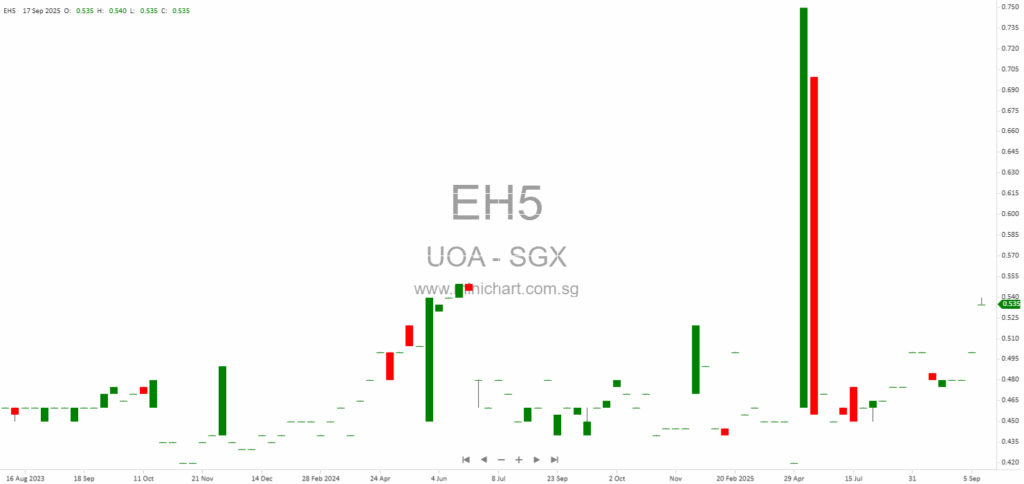

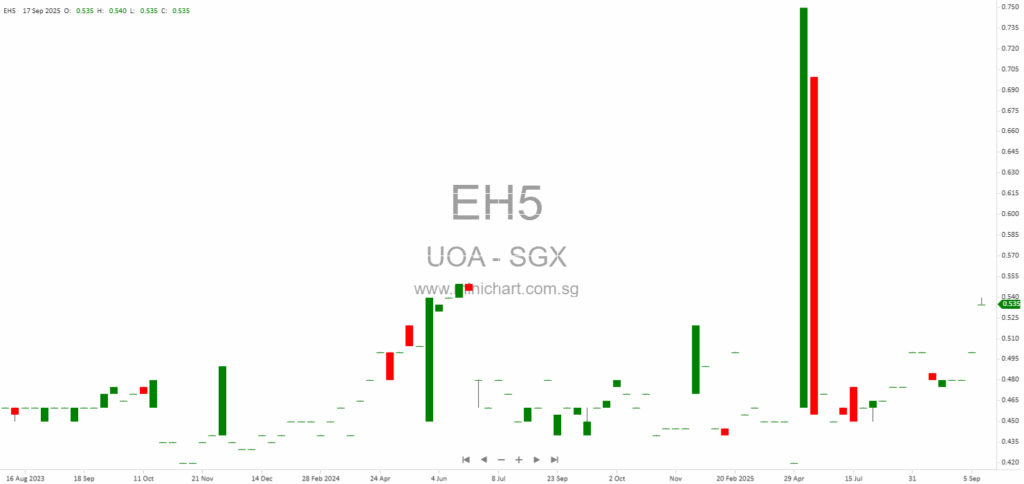

📈 United Overseas Australia Ltd Historical Chart

🧾 Recent Financial Statement Analysis

September 26, 2025

UOA Group Secures Prime Ho Chi Minh Land for Landmark Grade A Office Tower in US\$120M Expansion Key Highlights UOA Group’s wholly owned subsidiary, UOA Vietnam Pte Ltd (UOAV), has successfully completed the acquisition of 100% of VIAS Hong Ngoc…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: EH5, United Overseas Australia Ltd, UOA, UOA SP, UNITED OVERSEAS AUSTRALIA

September 26, 2025

UOA Group Secures Prime Ho Chi Minh Land for Landmark Grade A Office Tower in US\$120M Expansion Key Highlights UOA Group’s wholly owned subsidiary, UOA Vietnam Pte Ltd (UOAV), has successfully completed the acquisition of 100% of VIAS Hong Ngoc…