📊 Statistics

- Analyst 1 Year Price Target:

$1.41

- Upside/Downside from Analyst Target:

8.65%

- Broker Call:

7

- Dividend Minimum 3 Year Yield:

5.97%

- EPS Growth Range (1Y):

100-200%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

2026-07-29

💰 Dividend History

Current year to date yield:

3.00%

📅 SGX Earnings Announcements for CY6U

CapitaLand India Trust (CY6U)

Market: SGX |

Currency: SGD

Address: 168 Robinson Road

CapitaLand India Trust (CLINT) was listed on the Singapore Exchange Securities Trading Limited (SGX-ST) in August 2007 as the first Indian property trust in Asia. Its principal objective is to own income-producing real estate used primarily as business space in India. CLINT may also develop and acquire land or uncompleted developments primarily to be used as business space, with the objective of holding the properties upon completion. As at 30 June 2025, CLINT's assets under management stood at S$3.7 billion. CLINT's portfolio includes 10 world-class IT business parks, three industrial facilities, one logistics park, and four data centre developments in India, with total completed floor area of 22.7 million square feet spread across Bangalore, Chennai, Hyderabad, Pune, and Mumbai. CLINT is focused on capitalising on the fast-growing IT industry and logistics/industrial asset classes in India, as well as proactively diversifying into other asset classes such as data centres. CLINT is structured as a business trust, offering stable income distributions similar to a real estate investment trust. CLINT focuses on enhancing shareholder value by actively managing existing properties, developing vacant land in its portfolio, and acquiring new properties. CLINT is managed by CapitaLand India Trust Management Pte. Ltd.. The Trustee-Manager is a wholly owned subsidiary of Singapore-listed CapitaLand Investment Limited, a leading global real asset manager with a strong Asia foothold.

Show more

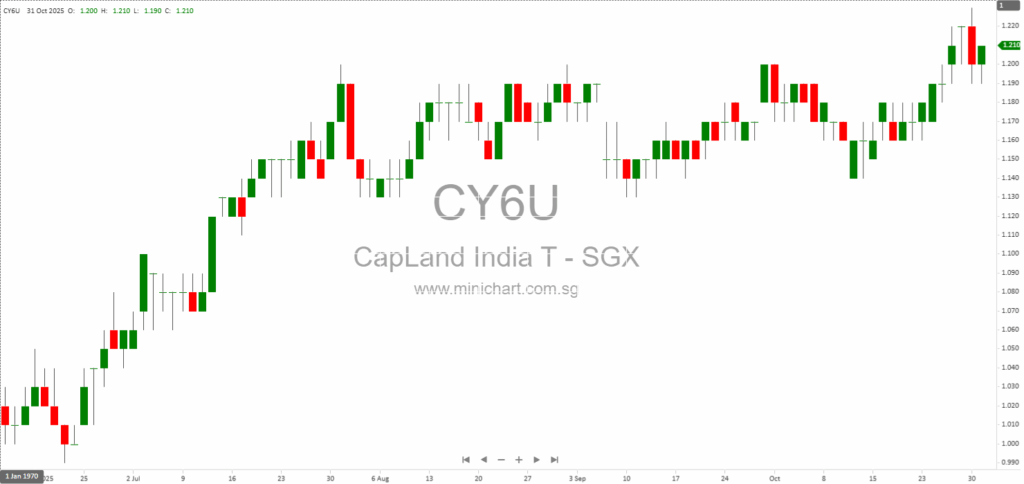

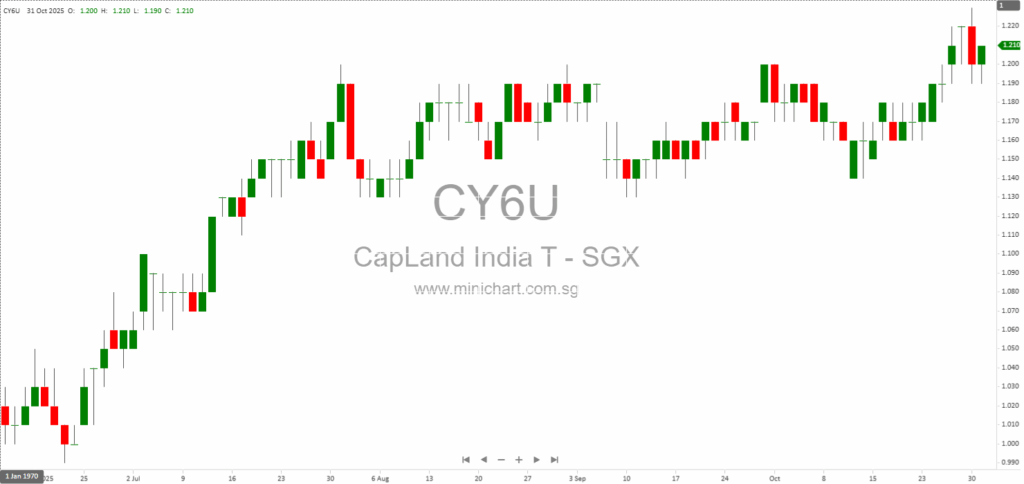

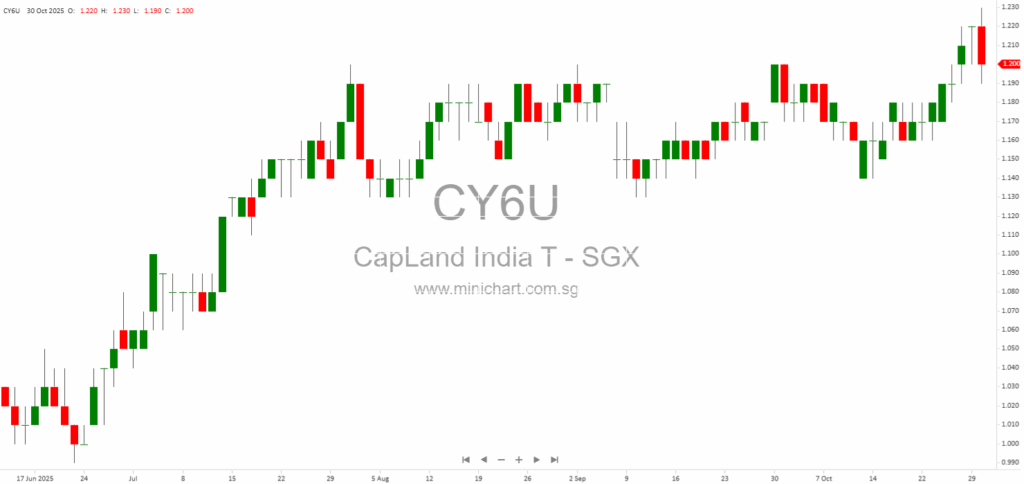

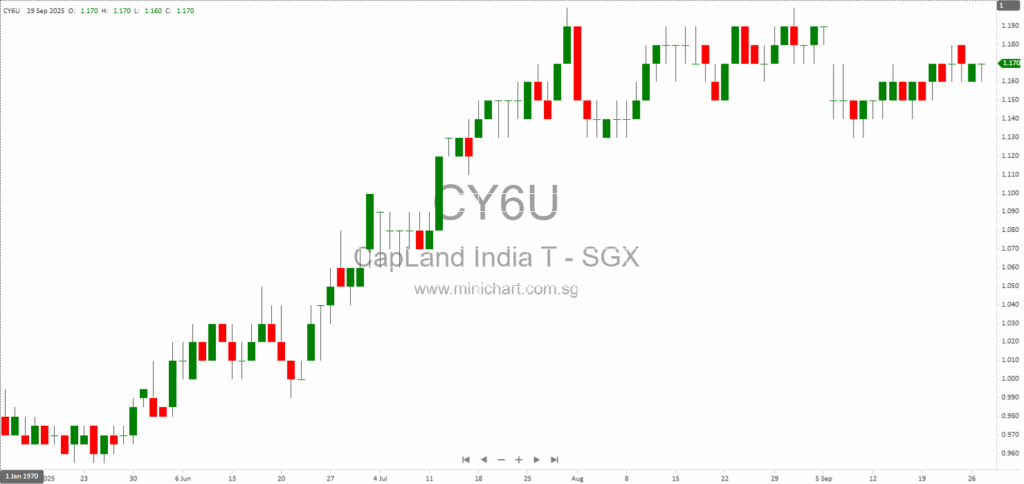

📈 CapitaLand India Trust Historical Chart

🧾 Recent Financial Statement Analysis

February 2, 2026

CapitaLand India Trust Announces Acquisition of Indian Subsidiary CapitaLand India Trust Announces Acquisition of Indian Subsidiary Key Announcement Pursuant to SGX Rule 706A CapitaLand India Trust Management Pte. Ltd. ("CLINTMPL"), the trustee-manager of CapitaLand India Trust ("CLINT"), has released a…

February 1, 2026

CapitaLand India Trust (CLINT): FY 2025 Financial Analysis & Investor Insights CapitaLand India Trust (CLINT) delivered a resilient performance in FY 2025, navigating a dynamic Indian real estate market and executing capital management strategies to enhance value for unitholders. Below,…

January 6, 2026

Key Highlights and Price-Sensitive Developments Record Portfolio Expansion: CLINT’s portfolio floor area has grown over 5 times since IPO, reaching 21.7 million sq ft of completed assets and 4.6 million sq ft of development potential. The Trust has achieved a…

December 31, 2025

CapitaLand India Trust Announces Strategic Divestment of Data Centre Assets and Formation of Joint Venture CapitaLand India Trust Announces Strategic Divestment of Data Centre Assets and Formation of Joint Venture Key Highlights of the Announcement CapitaLand India Trust (CLINT), through…

October 31, 2025

CapitaLand India Trust Announces Major Board Changes: Retirement of Key Director and Updated Committee Structures Key Takeaways for Investors Retirement of Sanjeev Durjhati Prasad Dasgupta: Non-Executive Non-Independent Director to retire effective 1 November 2025. Complete Overhaul of Board and Committees:…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: CY6U, CapitaLand India Trust

February 2, 2026

CapitaLand India Trust Announces Acquisition of Indian Subsidiary CapitaLand India Trust Announces Acquisition of Indian Subsidiary Key Announcement Pursuant to SGX Rule 706A CapitaLand India Trust Management Pte. Ltd. ("CLINTMPL"), the trustee-manager of CapitaLand India Trust ("CLINT"), has released a…

February 1, 2026

CapitaLand India Trust (CLINT): FY 2025 Financial Analysis & Investor Insights CapitaLand India Trust (CLINT) delivered a resilient performance in FY 2025, navigating a dynamic Indian real estate market and executing capital management strategies to enhance value for unitholders. Below,…

January 6, 2026

Key Highlights and Price-Sensitive Developments Record Portfolio Expansion: CLINT’s portfolio floor area has grown over 5 times since IPO, reaching 21.7 million sq ft of completed assets and 4.6 million sq ft of development potential. The Trust has achieved a…

January 2, 2026

Broker Name: DBS Date of Report: (Date not specified in the provided excerpt; inferred to be after 31 Dec 2025 valuation date. Please refer to the full report for the exact date.) Excerpt from DBS report. Report Summary CapitaLand India…

December 31, 2025

CapitaLand India Trust Announces Strategic Divestment of Data Centre Assets and Formation of Joint Venture CapitaLand India Trust Announces Strategic Divestment of Data Centre Assets and Formation of Joint Venture Key Highlights of the Announcement CapitaLand India Trust (CLINT), through…

November 3, 2025

Broker Name: OCBC Investment Research Date of Report: 31 October 2025 Excerpt from OCBC Investment Research report. Report Summary CapitaLand India Trust (CLINT) delivered a solid 3Q25, with total property income and net property income rising 10% year-on-year, supported by…

October 31, 2025

CapitaLand India Trust Announces Major Board Changes: Retirement of Key Director and Updated Committee Structures Key Takeaways for Investors Retirement of Sanjeev Durjhati Prasad Dasgupta: Non-Executive Non-Independent Director to retire effective 1 November 2025. Complete Overhaul of Board and Committees:…

October 31, 2025

CapitaLand India Trust Delivers Robust 3Q 2025 Results: Strategic Divestments, Data Centre Expansion and Strong Rental Growth Signal Further Upside CapitaLand India Trust Delivers Robust 3Q 2025 Results: Strategic Divestments, Data Centre Expansion and Strong Rental Growth Signal Further Upside…

October 3, 2025

Broker Name: DBS Group Research Date of Report: 29 September 2025 Excerpt from DBS Group Research report. Report Summary CapitaLand India Trust (CLINT) is one of the fastest growing Singapore REITs, with a projected 3-year DPU CAGR of 7.5% driven…

September 29, 2025

CapitaLand India Trust Completes Major Divestment: What Investors Must Know About the INR11 Billion Asset Sale CapitaLand India Trust Completes Major INR11 Billion Divestment: Key Insights for Investors Overview of the Transaction CapitaLand India Trust (CLINT), managed by CapitaLand India…