📊 Statistics

- Analyst 1 Year Price Target:

$0.33

- Upside/Downside from Analyst Target:

42.86%

- Broker Call:

5

- Dividend Minimum 3 Year Yield:

-

- EPS Growth Range (1Y):

25-50%

- Net Income Growth Range (1Y):

25-50%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

2.74%

📅 SGX Earnings Announcements for CMOU

Keppel Pacific Oak US REIT (CMOU)

Market: SGX |

Currency: USD

Address: 1 HarbourFront Avenue

Keppel Pacific Oak US REIT (KORE) is a distinctive office REIT listed on the main board of the Singapore Exchange Securities Trading Limited (SGX-ST) on 9 November 2017. KORE leverages its focus on the fast-growing technology, advertising, media and information (TAMI), as well as medical and healthcare sectors across key growth markets in the United States (US), and aims to be the first choice US office S-REIT providing sustainable distributions and strong total returns for Unitholders. KORE invests in a diversified portfolio of income-producing commercial assets and real estate-related assets in key growth markets characterised by positive economic and office fundamentals that generally outpace the US national average, and the average of the gateway cities. These markets include the Super Sun Belt and 18-Hour Cities, which have and continue to see an accelerated influx of talent as part of The Great American Move. As at 30 June 2025, KORE's portfolio comprised a balanced mix of 13 freehold office buildings and business campuses across eight key growth markets driven by technology and innovation in the US. With a portfolio value of approximately US$1.3 billion and an aggregate net lettable area of approximately 4.8 million sf, these properties encompass a diversified high-quality tenant base in the growing and defensive sectors of TAMI, as well as medical and healthcare, which make up approximately 51% of KORE's portfolio by cash rental income. KORE is managed by Keppel Pacific Oak US REIT Management Pte. Ltd., which is jointly owned by two Sponsors, Keppel, a global asset manager and operator with strong expertise in sustainability-related solutions spanning the areas of infrastructure, real estate and connectivity, and KORE Pacific Advisors, an established commercial real estate investment manager in the US.

Show more

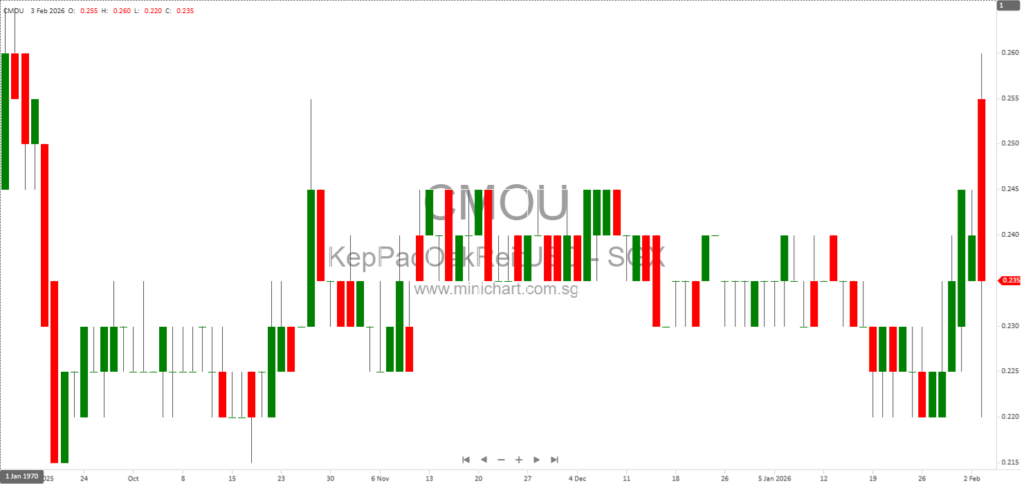

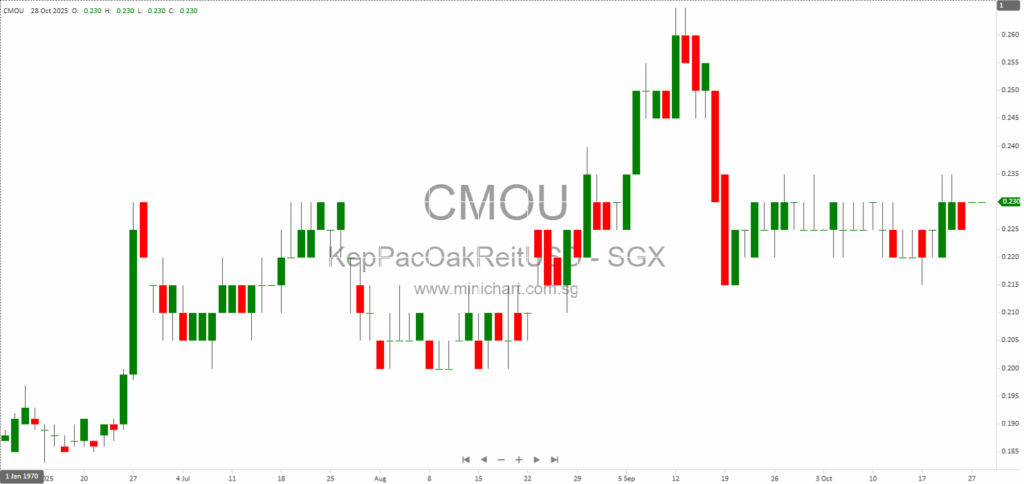

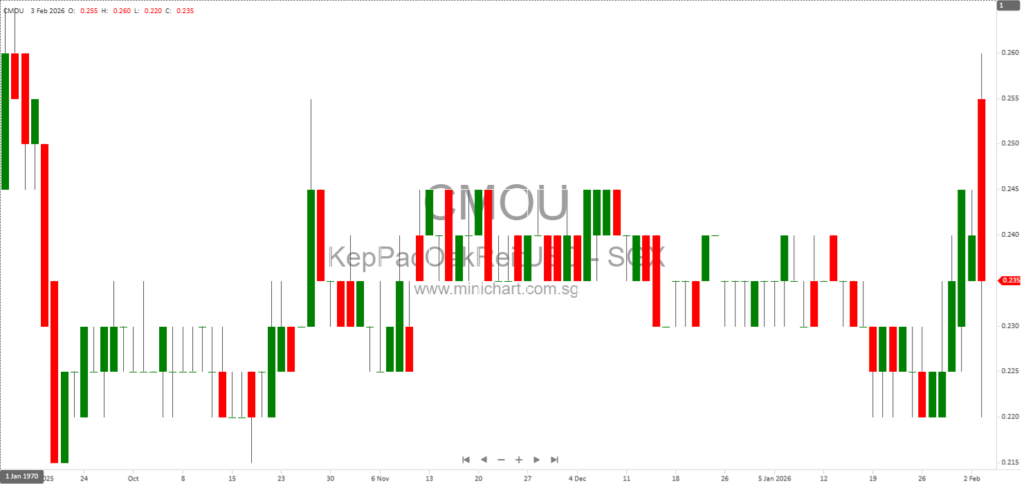

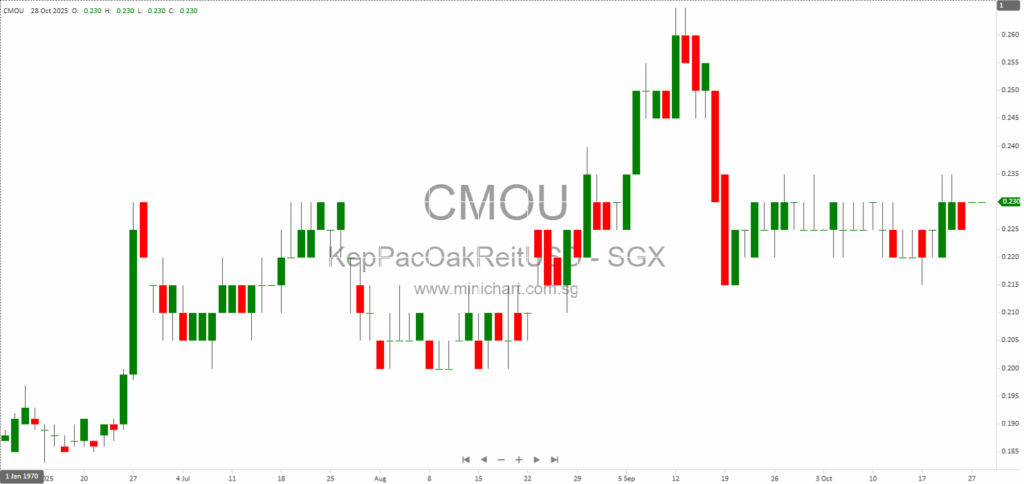

📈 Keppel Pacific Oak US REIT Historical Chart

🧾 Recent Financial Statement Analysis

February 3, 2026

Keppel Pacific Oak US REIT: Incorporation of New Subsidiary Keppel Pacific Oak US REIT Announces Incorporation of New Wholly-Owned Subsidiary Key Highlights New Subsidiary Established: Keppel Pacific Oak US REIT Management Pte. Ltd. ("KORE Manager"), as manager of Keppel Pacific…

February 3, 2026

Keppel Pacific Oak US REIT: Major Updates on Asset Manager & Substantial Unitholder Keppel Pacific Oak US REIT: Key Developments on US Asset Manager and Substantial Unitholder Summary of Key Points Termination of Advisory Agreement: Pacific Oak Strategic Opportunity REIT,…

February 2, 2026

Keppel Pacific Oak US REIT (KORE) FY2025 Financial Results Analysis Keppel Pacific Oak US REIT (KORE) has released its FY2025 financial results, offering insights into its operational performance, capital management, and portfolio strategy amid a recovering US office market. Below,…

October 28, 2025

Keppel Pacific Oak US REIT’s Early Refinancing and Surging Leasing Activity Signal Possible Turnaround for US Office S-REIT Keppel Pacific Oak US REIT’s Early Refinancing and Surging Leasing Activity Signal Possible Turnaround for US Office S-REIT Key Highlights for Investors…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: CMOU, Keppel Pacific Oak US REIT

February 3, 2026

Keppel Pacific Oak US REIT: Incorporation of New Subsidiary Keppel Pacific Oak US REIT Announces Incorporation of New Wholly-Owned Subsidiary Key Highlights New Subsidiary Established: Keppel Pacific Oak US REIT Management Pte. Ltd. ("KORE Manager"), as manager of Keppel Pacific…

February 3, 2026

Keppel Pacific Oak US REIT: Major Updates on Asset Manager & Substantial Unitholder Keppel Pacific Oak US REIT: Key Developments on US Asset Manager and Substantial Unitholder Summary of Key Points Termination of Advisory Agreement: Pacific Oak Strategic Opportunity REIT,…

February 2, 2026

Keppel Pacific Oak US REIT (KORE) FY2025 Financial Results Analysis Keppel Pacific Oak US REIT (KORE) has released its FY2025 financial results, offering insights into its operational performance, capital management, and portfolio strategy amid a recovering US office market. Below,…

October 28, 2025

Keppel Pacific Oak US REIT’s Early Refinancing and Surging Leasing Activity Signal Possible Turnaround for US Office S-REIT Keppel Pacific Oak US REIT’s Early Refinancing and Surging Leasing Activity Signal Possible Turnaround for US Office S-REIT Key Highlights for Investors…

September 15, 2025

CGS International Securities Singapore Pte. Ltd. Date of Report: September 15, 2025 Bullish Reversal in Keppel Pacific Oak US REIT: Technical Analysis and Market Insights for Savvy Investors Market Recap: Geopolitical Headlines and Macro Trends Recent overnight developments have set…

February 4, 2025

Company Overview Keppel Pacific Oak US REIT (KORE) is a real estate investment trust that focuses on income-producing office properties across key growth markets in the United States. Its investment strategy is centered around cities known for innovation and technology,…