📊 Statistics

- Analyst 1 Year Price Target:

$2.62

- Upside/Downside from Analyst Target:

6.00%

- Broker Call:

19

- Dividend Minimum 3 Year Yield:

4.72%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

0-10%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

2026-08-05

💰 Dividend History

Current year to date yield:

1.87%

📅 SGX Earnings Announcements for C38U

CapitaLand Integrated Commercial Trust (C38U)

Market: SGX |

Currency: SGD

Address: 168 Robinson Road

CapitaLand Integrated Commercial Trust (CICT) is the first and largest real estate investment trust (REIT) listed on Singapore Exchange Securities Trading Limited (SGX-ST) with a market capitalisation of S$15.9 billion as at 30 June 2025. It debuted on SGX-ST as CapitaLand Mall Trust in July 2002 and was renamed CICT in November 2020 following the merger with CapitaLand Commercial Trust. CICT owns and invests in quality income-producing assets primarily used for commercial (including retail and/or office) purpose, located predominantly in Singapore. As the largest proxy for Singapore commercial real estate, CICT's portfolio comprises 21 properties in Singapore, two properties in Frankfurt, Germany, and three properties in Sydney, Australia with a total property value of S$25.9 billion based on valuations of its proportionate interests in the portfolio as at 31 December 2024. CICT is managed by CapitaLand Integrated Commercial Trust Management Limited, a wholly owned subsidiary of CapitaLand Investment Limited, a leading global real asset manager with a strong Asia foothold.

Show more

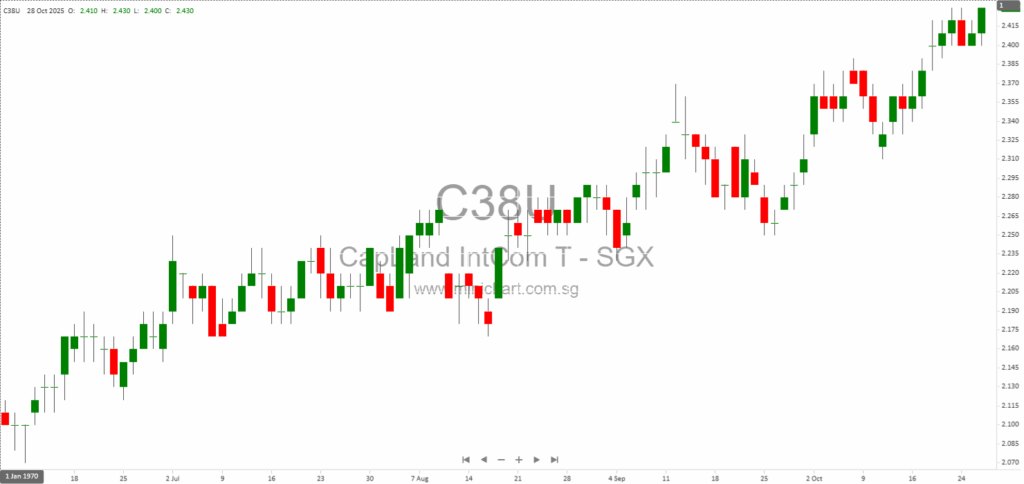

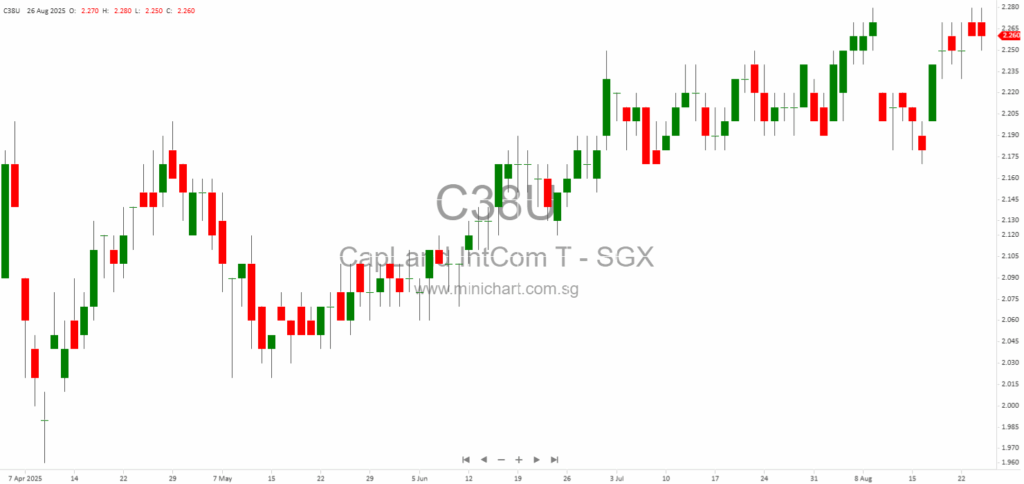

📈 CapitaLand Integrated Commercial Trust Historical Chart

🧾 Recent Financial Statement Analysis

February 5, 2026

CapitaLand Integrated Commercial Trust (CICT) FY2025 Financial Analysis CapitaLand Integrated Commercial Trust (CICT) has released its FY2025 financial results, demonstrating robust performance amidst a challenging macroeconomic environment. This article provides an in-depth analysis of the key financial metrics, historical trends,…

January 14, 2026

CapitaLand Integrated Commercial Trust Announces S\$428 Million Sale of Bukit Panjang Plaza Strata Lots CapitaLand Integrated Commercial Trust Announces S\$428 Million Sale of Bukit Panjang Plaza Strata Lots Key Transaction Details Sale Announcement: CapitaLand Integrated Commercial Trust (CICT), managed by…

January 14, 2026

CICT Consortium Secures Hougang Central Mixed-Use Site: Major Expansion and Value Creation CICT Consortium Secures Hougang Central Mixed-Use Site: Major Expansion and Value Creation Key Highlights for Investors CapitaLand Integrated Commercial Trust (CICT), together with CapitaLand Development (CLD) and UOL,…

January 14, 2026

CapitaLand Integrated Commercial Trust Wins Hougang Central Mixed-Use Site CapitaLand Integrated Commercial Trust (CICT) Secures Landmark Mixed-Use Site at Hougang Central Key Highlights of the Announcement Successful Joint Tender: CICT, through a consortium with CapitaLand Group (CLG) and a UOL…

January 14, 2026

CICT Secures Hougang Central Mixed-Use Site in S\$1.5 Billion Landmark Deal CICT Secures Hougang Central Mixed-Use Site in S\$1.5 Billion Landmark Deal Key Highlights for Investors Major Acquisition: CapitaLand Integrated Commercial Trust (CICT), through a consortium with CapitaLand Group (CLG)…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: C38U, CapitaLand Integrated Commercial Trust

February 5, 2026

CapitaLand Integrated Commercial Trust (CICT) FY2025 Financial Analysis CapitaLand Integrated Commercial Trust (CICT) has released its FY2025 financial results, demonstrating robust performance amidst a challenging macroeconomic environment. This article provides an in-depth analysis of the key financial metrics, historical trends,…

January 14, 2026

CapitaLand Integrated Commercial Trust Announces S\$428 Million Sale of Bukit Panjang Plaza Strata Lots CapitaLand Integrated Commercial Trust Announces S\$428 Million Sale of Bukit Panjang Plaza Strata Lots Key Transaction Details Sale Announcement: CapitaLand Integrated Commercial Trust (CICT), managed by…

January 14, 2026

CICT Consortium Secures Hougang Central Mixed-Use Site: Major Expansion and Value Creation CICT Consortium Secures Hougang Central Mixed-Use Site: Major Expansion and Value Creation Key Highlights for Investors CapitaLand Integrated Commercial Trust (CICT), together with CapitaLand Development (CLD) and UOL,…

January 14, 2026

CapitaLand Integrated Commercial Trust Wins Hougang Central Mixed-Use Site CapitaLand Integrated Commercial Trust (CICT) Secures Landmark Mixed-Use Site at Hougang Central Key Highlights of the Announcement Successful Joint Tender: CICT, through a consortium with CapitaLand Group (CLG) and a UOL…

January 14, 2026

CICT Secures Hougang Central Mixed-Use Site in S\$1.5 Billion Landmark Deal CICT Secures Hougang Central Mixed-Use Site in S\$1.5 Billion Landmark Deal Key Highlights for Investors Major Acquisition: CapitaLand Integrated Commercial Trust (CICT), through a consortium with CapitaLand Group (CLG)…

January 6, 2026

CapitaLand Integrated Commercial Trust 3Q 2025 Financial Report: In-Depth Investor Analysis CapitaLand Integrated Commercial Trust (CICT) 3Q 2025 Financial Report: Key Developments and Investment Impact Overview CapitaLand Integrated Commercial Trust (CICT), Singapore’s largest REIT and a proxy for the nation’s…

November 3, 2025

Broker Name: Maybank Research Pte Ltd Date of Report: October 28, 2025 Excerpt from Maybank Research Pte Ltd report. CapitaLand Integrated Commercial Trust (CICT) delivered a stable performance in 3Q, with high portfolio occupancy (97.2%), healthy rental reversions, and steady…

November 3, 2025

Broker Name: OCBC Investment Research Date of Report: 28 October 2025 Excerpt from OCBC Investment Research report. Report Summary CapitaLand Integrated Commercial Trust (CICT) remains the largest S-REIT in Singapore, with strong performance in both retail and office portfolios, achieving…

October 28, 2025

CapitaLand Integrated Commercial Trust Delivers Resilient 3Q 2025 Results, Completes CapitaSpring Acquisition and Launches Strategic Asset Enhancements CapitaLand Integrated Commercial Trust Delivers Resilient 3Q 2025 Results, Completes CapitaSpring Acquisition and Launches Strategic Asset Enhancements Strong Financial Performance Amid Strategic Portfolio…

August 26, 2025

CapitaLand Integrated Commercial Trust Acquires Full Ownership of CapitaSpring Office & Retail: What Investors Need to Know Key Highlights: CapitaLand Integrated Commercial Trust (CICT) has completed the acquisition of the remaining 55% interest in Glory Office Trust. Glory Office Trust…