📊 Statistics

- Analyst 1 Year Price Target:

$1.09

- Upside/Downside from Analyst Target:

8.60%

- Broker Call:

16

- Dividend Minimum 3 Year Yield:

5.90%

- EPS Growth Range (1Y):

25-50%

- Net Income Growth Range (1Y):

25-50%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

6.65%

📅 SGX Earnings Announcements for BUOU

Frasers Logistics & Commercial Trust (BUOU)

Market: SGX |

Currency: SGD

Address: 438 Alexandra Road

Frasers Logistics & Commercial Trust (?FLCT?) is a Singapore-listed real estate investment trust with a portfolio comprising 114 industrial and commercial properties, worth approximately S$6.8 billion, diversified across five major developed markets ? Australia, Germany, Singapore, the United Kingdom and the Netherlands. FLCT was listed on the Mainboard of Singapore Exchange Securities Trading Limited (?SGX-ST?) on 20 June 2016 as Frasers Logistics & Industrial Trust and was subsequently renamed Frasers Logistics & Commercial Trust on 29 April 2020 following the completion of a merger with Frasers Commercial Trust. FLCT's investment strategy is to invest globally in a diversified portfolio of income-producing properties used predominantly for logistics or industrial purposes located globally, or commercial purposes (comprising primarily CBD office space) or business park purposes (comprising primarily non-CBD office space and/or research and development space) located in the Asia-Pacific region or in Europe (including the United Kingdom). FLCT is sponsored by Frasers Property Limited. FLCT is a constituent of the FTSE EPRA Nareit Global Real Estate Index Series (Global Developed Index), Straits Times Index and Global Property Research (GPR) 250.

Show more

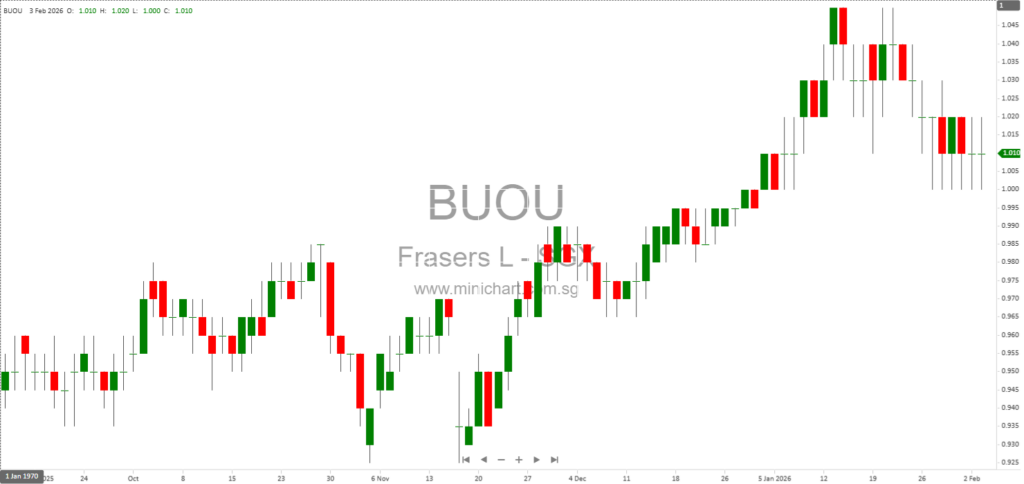

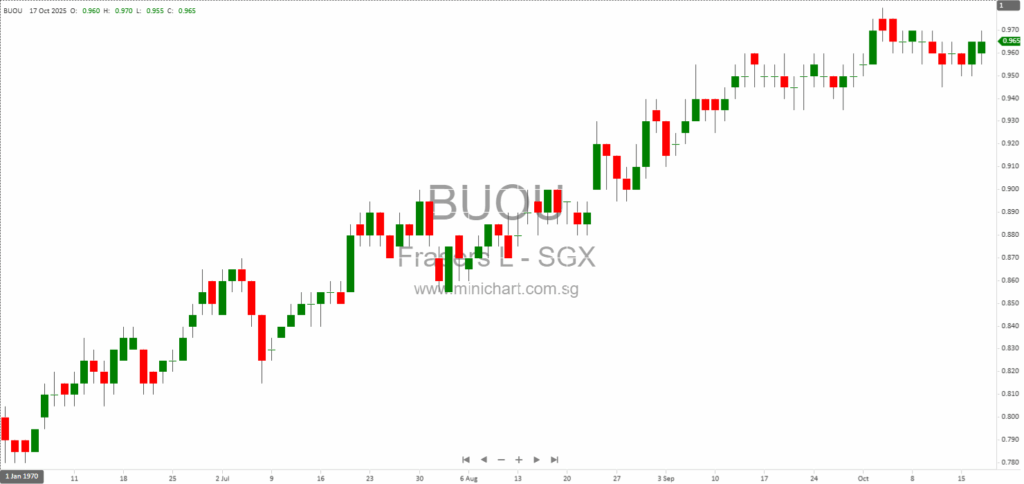

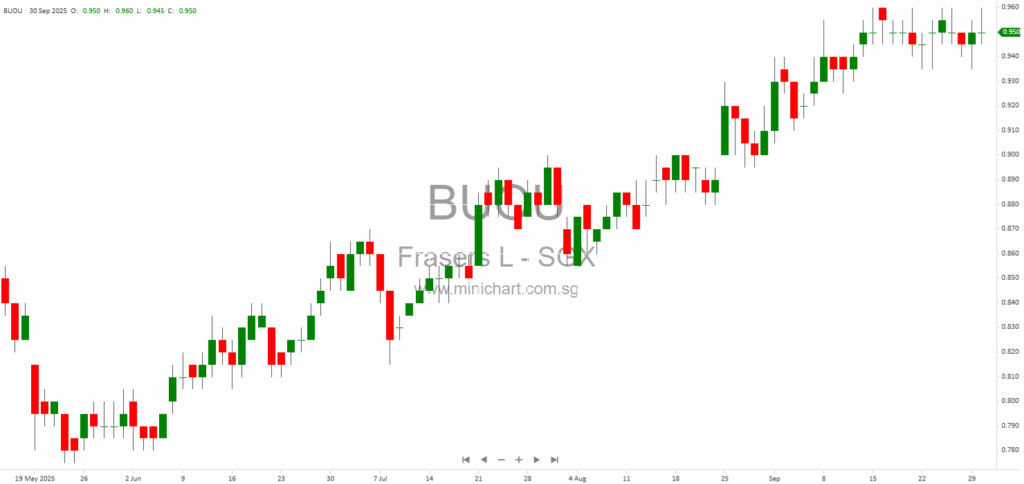

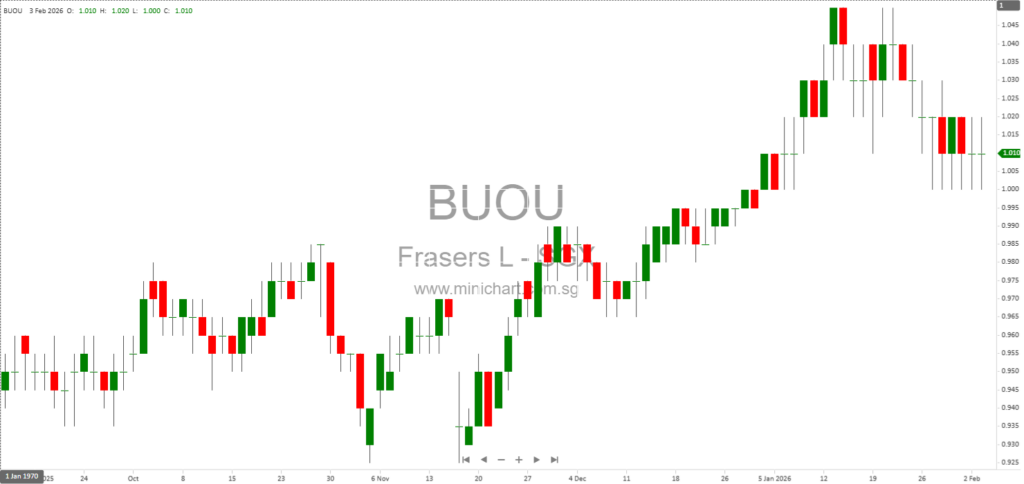

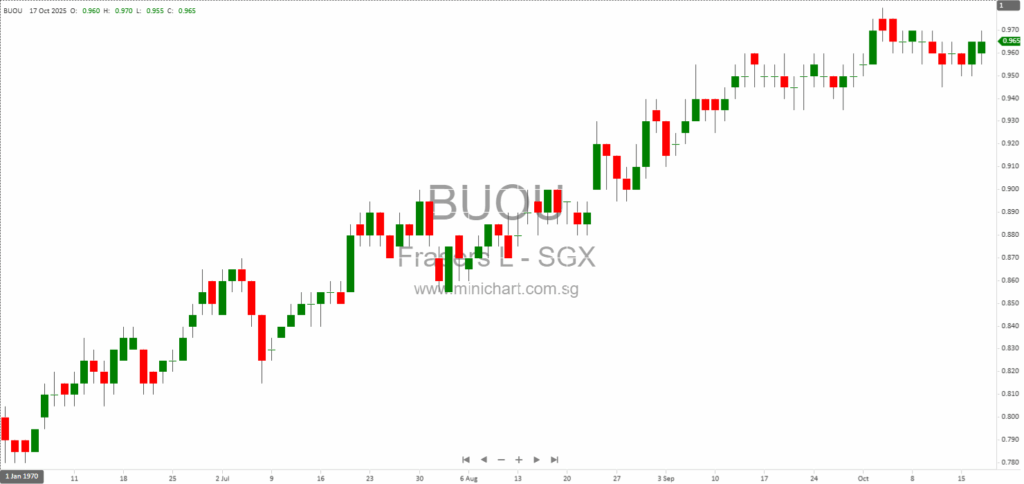

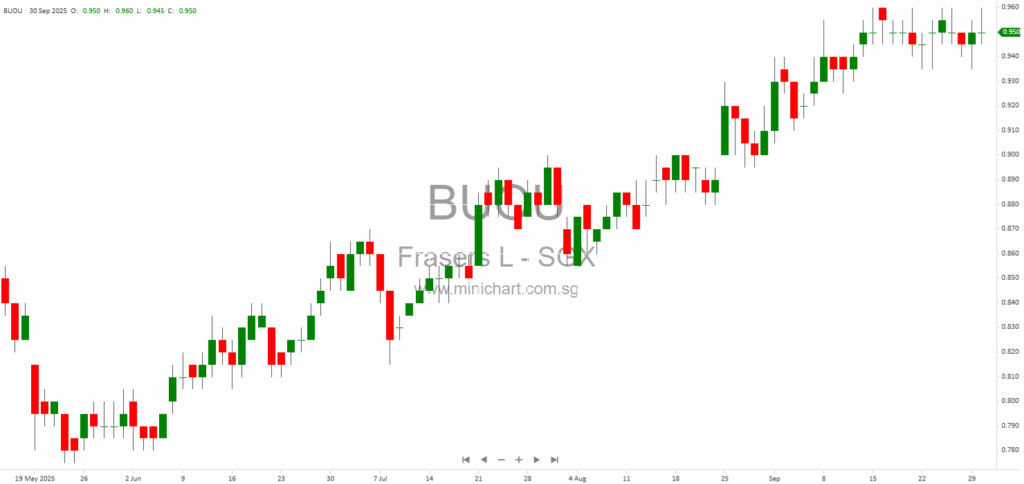

📈 Frasers Logistics & Commercial Trust Historical Chart

🧾 Recent Financial Statement Analysis

February 13, 2026

Frasers Logistics & Commercial Trust: Key Disclosure on Loan Facility Agreement Frasers Logistics & Commercial Trust Announces Key Loan Facility Event with Potential Impact on Shareholders Summary of the Announcement Frasers Logistics & Commercial Trust (FLCT), managed by Frasers Logistics…

February 3, 2026

Frasers Logistics & Commercial Trust (FLCT) 1QFY26 Business Update: Detailed Investor Analysis Frasers Logistics & Commercial Trust (FLCT) 1QFY26 Business Update: Comprehensive Investor Report Key Financial and Operational Highlights for 1QFY26 Strong Portfolio Performance: For the quarter ended 31 December…

October 17, 2025

Frasers Logistics & Commercial Trust Faces Potential Loan Acceleration on Change of Manager: What Investors Must Know Frasers Logistics & Commercial Trust Faces Potential Loan Acceleration on Change of Manager: What Investors Must Know Key Highlights from the Latest SGX-ST…

September 30, 2025

Frasers Logistics & Commercial Trust Completes Major Divestment of 357 Collins Street in Melbourne: What Investors Should Know Key Highlights Frasers Logistics & Commercial Trust (FLCT) has completed the sale of a significant commercial asset in Australia – 357 Collins…

November 6, 2024

Frasers Logistics & Commercial Trust: Financial Analysis Report with 6.5% Net Profit Decline Frasers Logistics & Commercial Trust: Financial Analysis Report for the Financial Year Ending 30 September 2024 Business Description Frasers Logistics & Commercial Trust (FLCT) is a Singapore-domiciled…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: BUOU, Frasers Logistics & Commercial Trust

February 13, 2026

Frasers Logistics & Commercial Trust: Key Disclosure on Loan Facility Agreement Frasers Logistics & Commercial Trust Announces Key Loan Facility Event with Potential Impact on Shareholders Summary of the Announcement Frasers Logistics & Commercial Trust (FLCT), managed by Frasers Logistics…

February 4, 2026

Broker Name: DBS Date of Report: 1Q26 (Inferred from multiple mentions of "1Q26" and recent data in the report) Excerpt from DBS report. Report Summary Frasers Logistics & Commercial Trust (FLCT) delivered strong operating results in 1Q26, driven by its…

February 4, 2026

Broker Name: DBS Date of Report: Not explicitly stated in the document, but inferred to be 1Q26 (likely calendar Q1 2026, based on context). Excerpt from DBS report. Report Summary Frasers Logistics & Commercial Trust (FLCT) reported strong operational performance…

February 3, 2026

Frasers Logistics & Commercial Trust (FLCT) 1QFY26 Business Update: Detailed Investor Analysis Frasers Logistics & Commercial Trust (FLCT) 1QFY26 Business Update: Comprehensive Investor Report Key Financial and Operational Highlights for 1QFY26 Strong Portfolio Performance: For the quarter ended 31 December…

December 1, 2025

Broker Name: CGS International Date of Report: December 1, 2025 Excerpt from CGS International report. Report Summary Frasers Logistics & Commercial Trust (FLT) is showing a bullish trend continuation, with technical indicators supporting a positive outlook. Entry prices range from…

November 10, 2025

Broker: CGS International Date of Report: November 7, 2025 Excerpt from CGS International report. Frasers Logistics & Commercial Trust (FLCT) reported solid results for 2H/FY9/25, with distributable income slightly above forecasts despite a 10.6% year-on-year decline due to higher finance…

October 17, 2025

Frasers Logistics & Commercial Trust Faces Potential Loan Acceleration on Change of Manager: What Investors Must Know Frasers Logistics & Commercial Trust Faces Potential Loan Acceleration on Change of Manager: What Investors Must Know Key Highlights from the Latest SGX-ST…

September 30, 2025

Frasers Logistics & Commercial Trust Completes Major Divestment of 357 Collins Street in Melbourne: What Investors Should Know Key Highlights Frasers Logistics & Commercial Trust (FLCT) has completed the sale of a significant commercial asset in Australia – 357 Collins…

September 2, 2025

Broker: CGS International Date of Report: September 2, 2025 Singapore Market Update: Bullish Momentum Returns for Frasers Logistics & Commercial Trust, BYD Electronic Outpaces on Apple Orders Global Market Recap: A New Month, New Opportunities As September unfolds, global markets…

August 4, 2025

CGS International August 1, 2025 Frasers Logistics & Commercial Trust: Resilient Performance with Growth Opportunities Despite Short-Term Vacancy Drag Overview: Strong Rental Reversions Offset by Temporary Occupancy Dip Frasers Logistics & Commercial Trust (FLCT) delivered a robust 3QFY9/25 business update,…