📊 Statistics

- Analyst 1 Year Price Target:

$5.03

- Upside/Downside from Analyst Target:

8.01%

- Broker Call:

6

- Dividend Minimum 3 Year Yield:

5.15%

- EPS Growth Range (1Y):

0-10%

- Net Income Growth Range (1Y):

0-10%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

3.00%

Amount: -

Yield: -

Pay Date: 2002-10-11

Details:

24% LESS TAX

📅 SGX Earnings Announcements for BEC

BRC Asia Limited (BEC)

Market: SGX |

Currency: SGD

Address: 350 Jalan Boon Lay

BRC Asia Limited, together with its subsidiaries, engages in the prefabrication of steel reinforcement for use in concrete in Singapore, Australia, Brunei, Hong Kong, Indonesia, Malaysia, Thailand, India, and internationally. It operates through three segments: Fabrication and Manufacturing, Trading, and Others. The company is involved in the trading of steel reinforcing bars; and manufacture and sale of wire mesh fences. It also provides reinforcing steel products; and weld fences, cages, wires, and rebars, hard-drawn wires, as well as prefabrication, cut, and bend services. BRC Asia Limited was incorporated in 1938 and is based in Singapore. BRC Asia Limited is a subsidiary of Green Esteel Pte. Ltd.

Show more

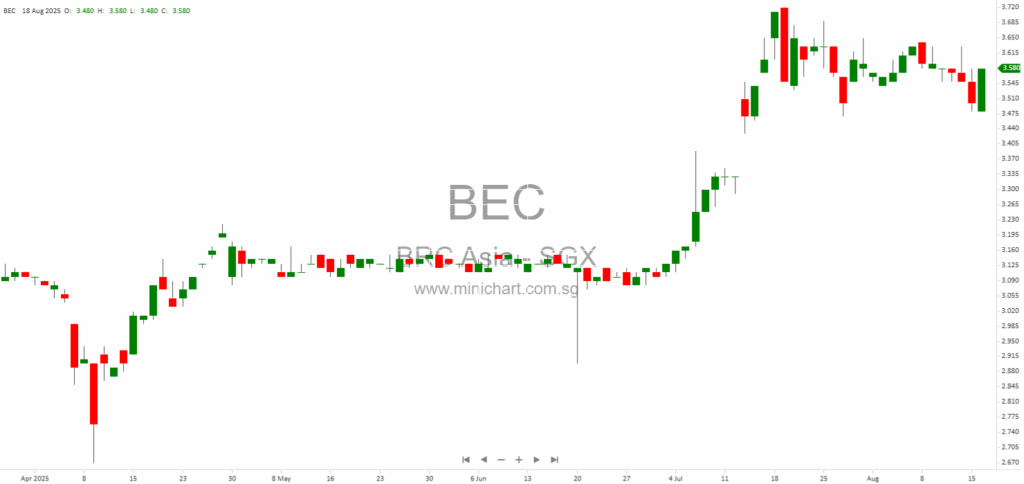

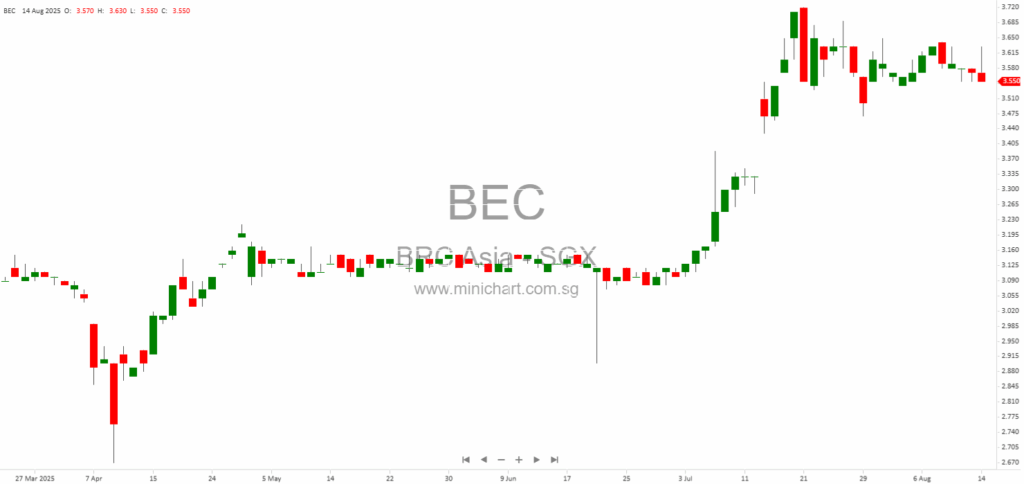

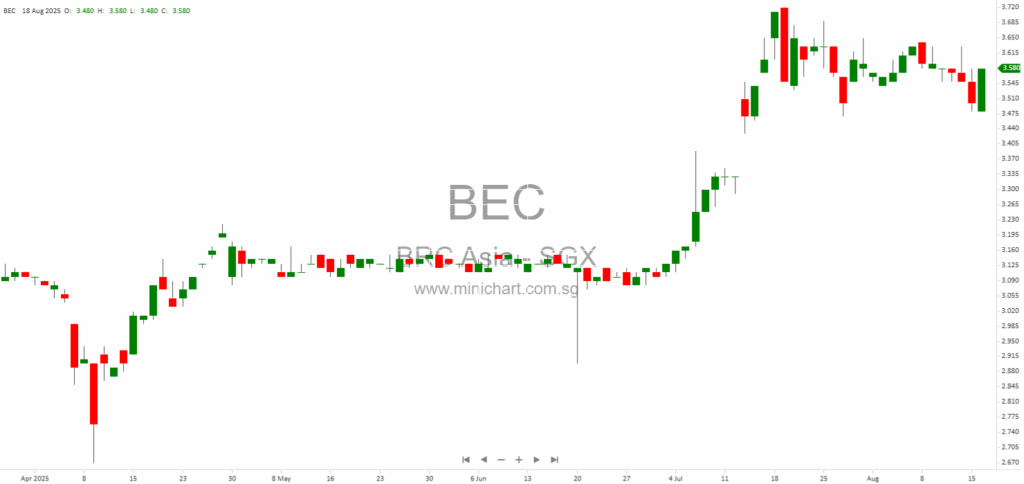

📈 BRC Asia Limited Historical Chart

🧾 Recent Financial Statement Analysis

February 12, 2026

BRC Asia Limited 1Q2026 Business Update: Key Insights for Investors BRC Asia Limited 1Q2026 Business Update: Key Insights for Investors Financial Highlights Revenue: S\$444.3 million for 1Q2026, reflecting robust demand and sustained sales momentum. Gross Profit: S\$46.7 million, highlighting healthy…

February 11, 2026

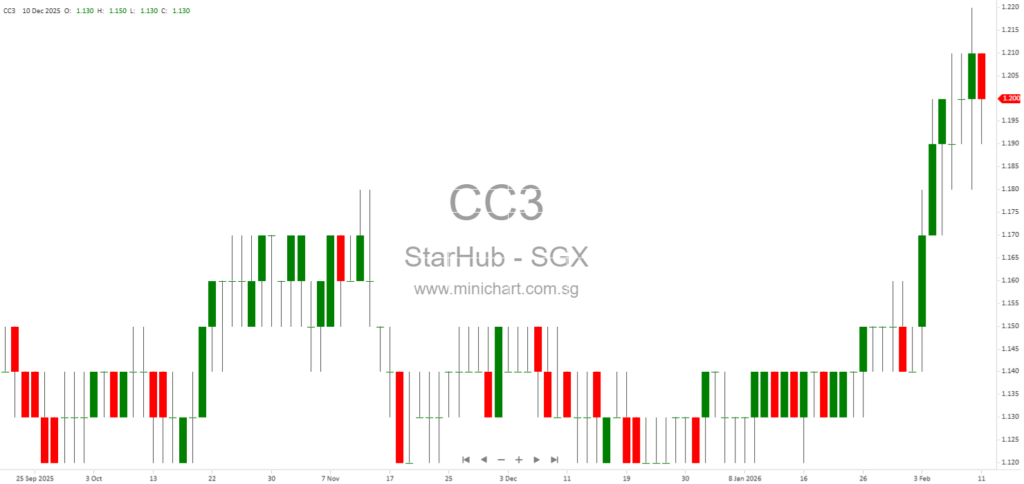

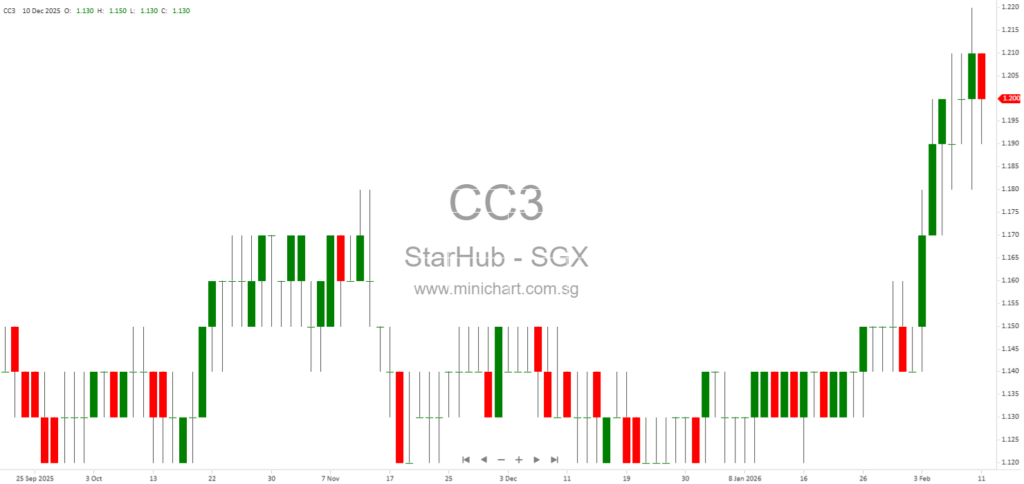

StarHub Increases Stake in MyRepublic Broadband to 100% with S\$94.3 Million Acquisition StarHub Acquires Remaining 49.9% Stake in MyRepublic Broadband for S\$94.3 Million Key Transaction Details Acquisition Date: 11 August 2025 Acquirer: StarHub Online Pte. Ltd., a wholly-owned subsidiary of…

November 25, 2025

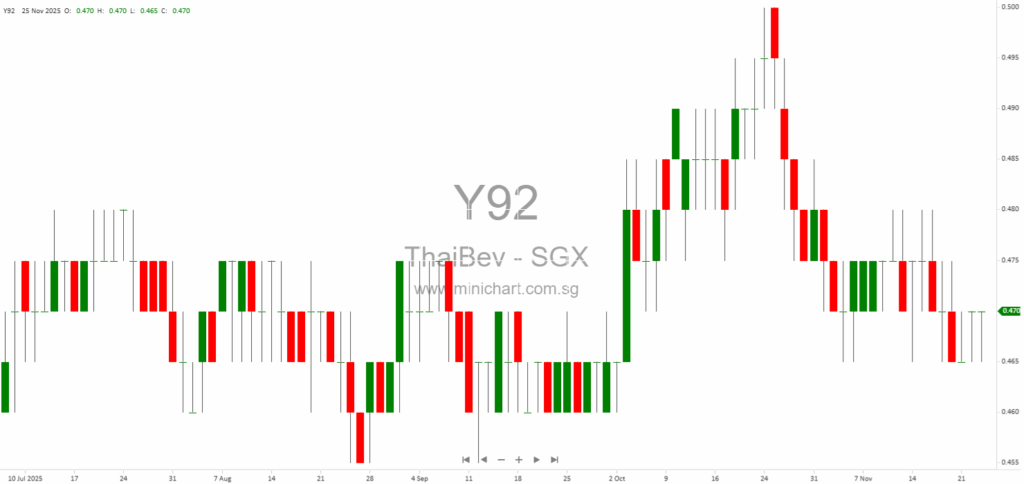

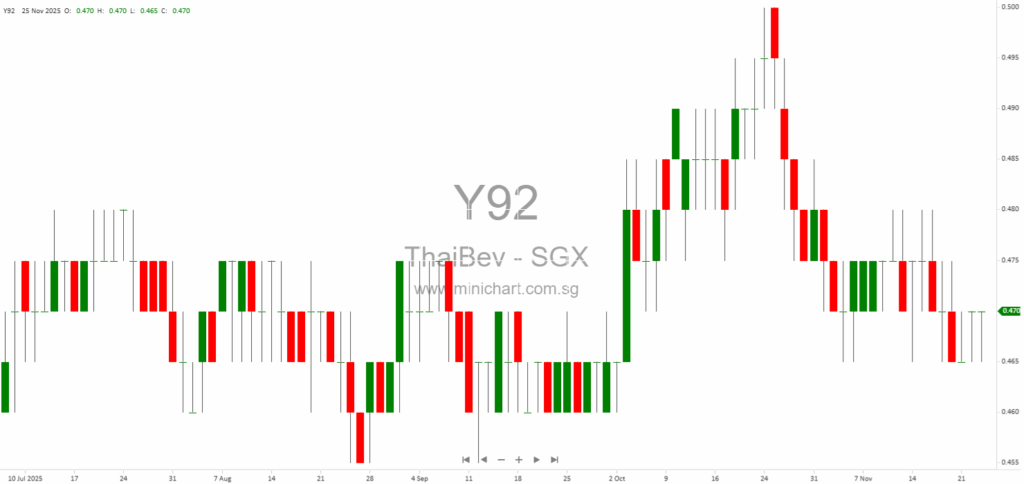

Key Highlights from THBEV's Latest Announcement Strategic Acquisition: SABECO, an indirect subsidiary of Thai Beverage Public Company Limited (THBEV), has increased its stake in Western – Sai Gon Beer Joint Stock Company (WSB), a Vietnam-based subsidiary, to approximately 86.32%. Transaction…

September 19, 2025

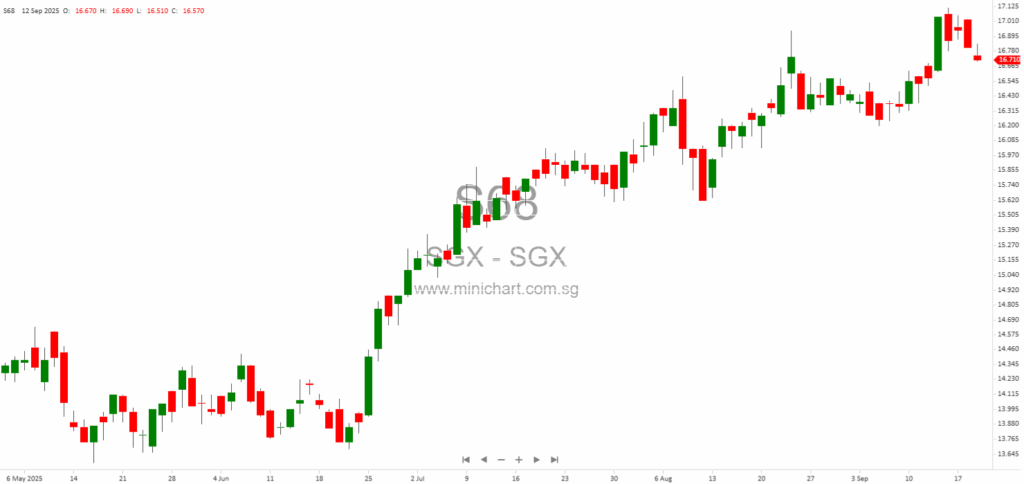

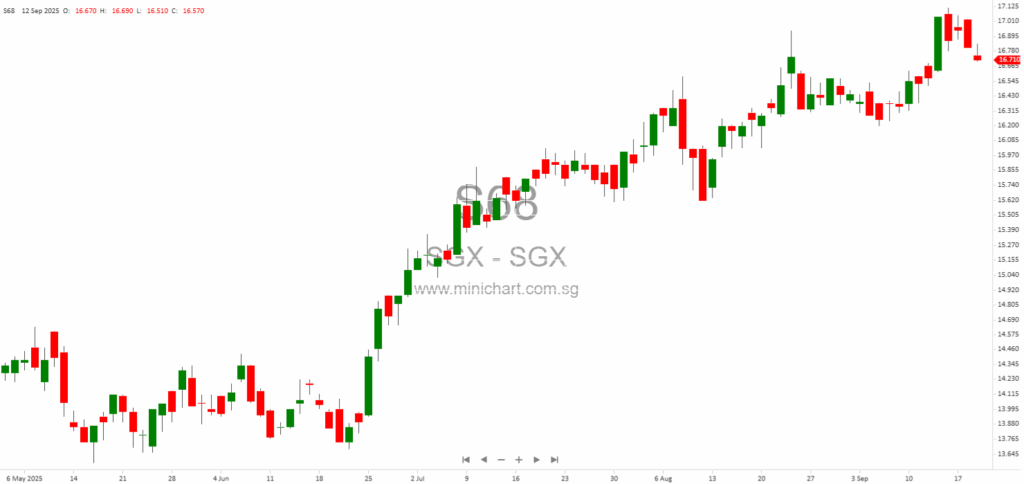

Groundbreaking SGX Listing: AvePoint Becomes First B2B SaaS Company to Debut on Singapore Exchange Mainboard Groundbreaking SGX Listing: AvePoint Becomes First B2B SaaS Company to Debut on Singapore Exchange Mainboard Key Details Investors Must Know About AvePoint’s SGX Debut AvePoint,…

August 18, 2025

BRC Asia’s S\$2 Billion Order Book and Changi T5 Win Signal Bullish Outlook Amid Robust Construction Demand BRC Asia’s S\$2 Billion Order Book and Changi T5 Win Signal Bullish Outlook Amid Robust Construction Demand Key Highlights from Q3 2025 Business…

August 14, 2025

BRC Asia Secures Controlling Stake in Southern Steel Mesh — What Retail Investors Need to Know BRC Asia Secures Controlling Stake in Southern Steel Mesh — What Retail Investors Need to Know Key Highlights of the Acquisition BRC Asia Limited…

January 10, 2025

BRC Asia Announces Books Closure and Proposed Dividend Payout for May 2025 BRC Asia Announces Books Closure and Proposed Dividend Payout for May 2025 BRC Asia Limited, a leading player in the construction and building materials sector, has made an…

January 9, 2025

BRC Asia Limited Announces Proposed Dividend – Key Dates for Shareholders BRC Asia Limited Announces Proposed Dividend – Key Dates for Shareholders BRC Asia Limited, a prominent Singapore-based company, has issued a formal notice regarding the proposed distribution of dividends…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: BEC, BRC Asia Limited, BRC Asia, BRC SP, BRC ASIA LTD, BRC ASIA

February 20, 2026

Broker Name: CGS International Date of Report: February 19, 2026 Excerpt from CGS International report. Report Summary BRC Asia Ltd reported strong 1QFY9/26 results, with PATMI of S\$28.8m (+48% yoy), benefiting from higher sales volumes, economies of scale, and lower…

February 16, 2026

Broker Name: CGS International Date of Report: February 13, 2026 Excerpt from CGS International report. Report Summary BRC Asia Ltd's 1QFY26 profit after tax and minority interests (PATMI) rose 48% year-on-year to S\$28.8m, beating expectations due to higher sales volumes,…

February 16, 2026

Broker Name: CGS International Date of Report: February 13, 2026 Excerpt from CGS International report. Report Summary: BRC Asia Ltd posted strong 1QFY26 results, with PATMI of S\$28.8m (+48% yoy), driven by higher sales volumes, economies of scale, and lower…

February 12, 2026

BRC Asia Limited 1Q2026 Business Update: Key Insights for Investors BRC Asia Limited 1Q2026 Business Update: Key Insights for Investors Financial Highlights Revenue: S\$444.3 million for 1Q2026, reflecting robust demand and sustained sales momentum. Gross Profit: S\$46.7 million, highlighting healthy…

February 11, 2026

StarHub Increases Stake in MyRepublic Broadband to 100% with S\$94.3 Million Acquisition StarHub Acquires Remaining 49.9% Stake in MyRepublic Broadband for S\$94.3 Million Key Transaction Details Acquisition Date: 11 August 2025 Acquirer: StarHub Online Pte. Ltd., a wholly-owned subsidiary of…

December 2, 2025

Broker Name: CGS International Date of Report: December 1, 2025 Excerpt from CGS International report. Report Summary BRC Asia Ltd is expected to benefit from a peak in Singapore construction volumes in FY26F-27F, delivering higher operational and financial leverage, with…

December 1, 2025

Broker Name: BRC Asia Ltd Date of Report: Not specified (inferred as FY25/FY26) Excerpt from BRC Asia Ltd report. Report Summary BRC Asia's adjusted PATMI surged 36% year-on-year in 2H25, driven by a 34% increase in steel rebar delivery volumes…

December 1, 2025

BRC Asia Ltd - Broker Name and Report Date Broker Name: Not specified in the provided document Report Date: Not specified in the provided document Excerpt from Broker report Report Summary BRC Asia Ltd reported a 36% year-on-year spike in…

December 1, 2025

Broker Name: CGS International Date of Report: December 1, 2025 Excerpt from CGS International report. Report Summary BRC Asia is set to benefit from peak construction volumes in Singapore over FY26F-27F, which are expected to drive operational and financial leverage,…

November 25, 2025

Key Highlights from THBEV's Latest Announcement Strategic Acquisition: SABECO, an indirect subsidiary of Thai Beverage Public Company Limited (THBEV), has increased its stake in Western – Sai Gon Beer Joint Stock Company (WSB), a Vietnam-based subsidiary, to approximately 86.32%. Transaction…

October 10, 2025

Broker Name: CGS International Date of Report: October 9, 2025 Excerpt from CGS International report. Report Summary Singapore's construction demand in 2025 is expected to reach S\$36bn (inflation-adjusted), matching the previous peak, driven by higher density developments and increased gross…

September 19, 2025

Groundbreaking SGX Listing: AvePoint Becomes First B2B SaaS Company to Debut on Singapore Exchange Mainboard Groundbreaking SGX Listing: AvePoint Becomes First B2B SaaS Company to Debut on Singapore Exchange Mainboard Key Details Investors Must Know About AvePoint’s SGX Debut AvePoint,…

August 24, 2025

📈 Big Deals, New Contracts and Bold Bets: Intel, GRC, KSH, Lum Chang, BRC Asia, Singtel and Pop Mart in Focus SGX:5UX.SI:GRC GRC, formerly OKH Global, has secured another contract worth A$36.6 million to build a three-storey housing project in…

August 22, 2025

CGS International August 22, 2025 Singapore Retail Momentum: BRC Asia’s Uptrend, Pop Mart’s Global Surge, and Key Market Signals Market Overview: U.S. Labor Data Signals Weakening, Domestic Demand Slows Markets opened to a cautious tone as fresh U.S. labor market…

August 22, 2025

CGS International August 21, 2025 BRC Asia Leads Singapore’s Construction Upcycle: Robust Growth, Market Dominance, and Attractive Dividends Executive Summary: Singapore’s Steel Giant Surges Ahead BRC Asia Ltd, covered in the latest CGS International report dated August 21, 2025, continues…

August 19, 2025

Broker: Morgan Stanley Date of Report: August 17, 2025 Singapore Set to Become Asia’s Top REIT Market by 2035: In-depth Outlook and Key Investment Picks Introduction: Singapore’s REIT Market on the Rise Singapore is rapidly emerging as Asia’s next dominant…

August 18, 2025

BRC Asia’s S\$2 Billion Order Book and Changi T5 Win Signal Bullish Outlook Amid Robust Construction Demand BRC Asia’s S\$2 Billion Order Book and Changi T5 Win Signal Bullish Outlook Amid Robust Construction Demand Key Highlights from Q3 2025 Business…

January 10, 2025

BRC Asia Announces Books Closure and Proposed Dividend Payout for May 2025 BRC Asia Announces Books Closure and Proposed Dividend Payout for May 2025 BRC Asia Limited, a leading player in the construction and building materials sector, has made an…

January 9, 2025

BRC Asia Limited Announces Proposed Dividend – Key Dates for Shareholders BRC Asia Limited Announces Proposed Dividend – Key Dates for Shareholders BRC Asia Limited, a prominent Singapore-based company, has issued a formal notice regarding the proposed distribution of dividends…