📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

30.82%

📅 SGX Earnings Announcements for BAZ

Lion Asiapac Limited (BAZ)

Market: SGX |

Currency: SGD

Address: No. 10-00 LTC Building A

Lion Asiapac Limited, an investment holding company, engages in lime manufacturing and sales activities in Malaysia and Singapore. The company operates through the Supply of Roofing Solution, Lime Sales, Trading, and Investment Holding segments. It also produces and sells quicklime, hydrated lime, and quicklime powder; trades in consumables for steel product manufacturing and mining equipment, scrap metal, roofing materials, and construction and roofing works; provides solutions for metal roofing and wall cladding; and manufactures and sells galvanized iron and colored galvanized iron roofing sheets. The company was formerly known as Metal Containers Limited and changed its name to Lion Asiapac Limited in 1996. Lion Asiapac Limited was incorporated in 1968 and is based in Singapore.

Show more

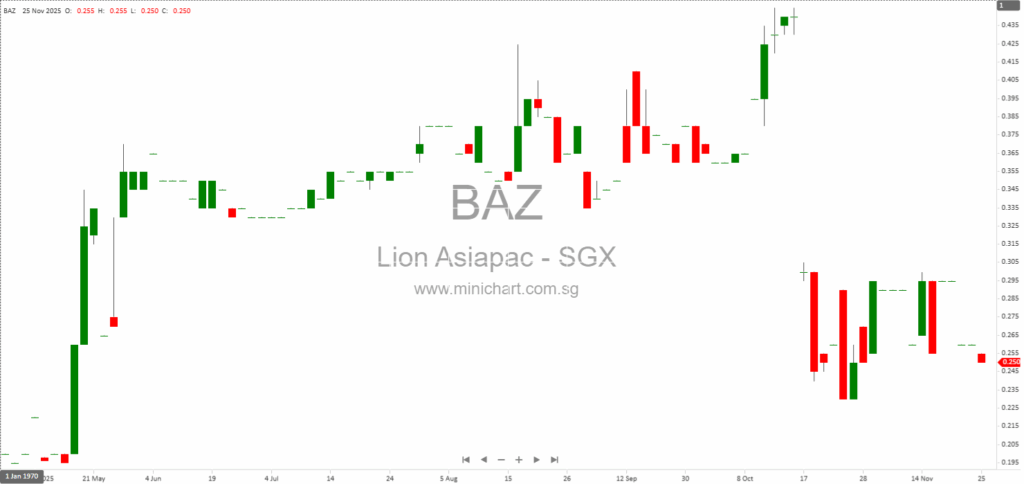

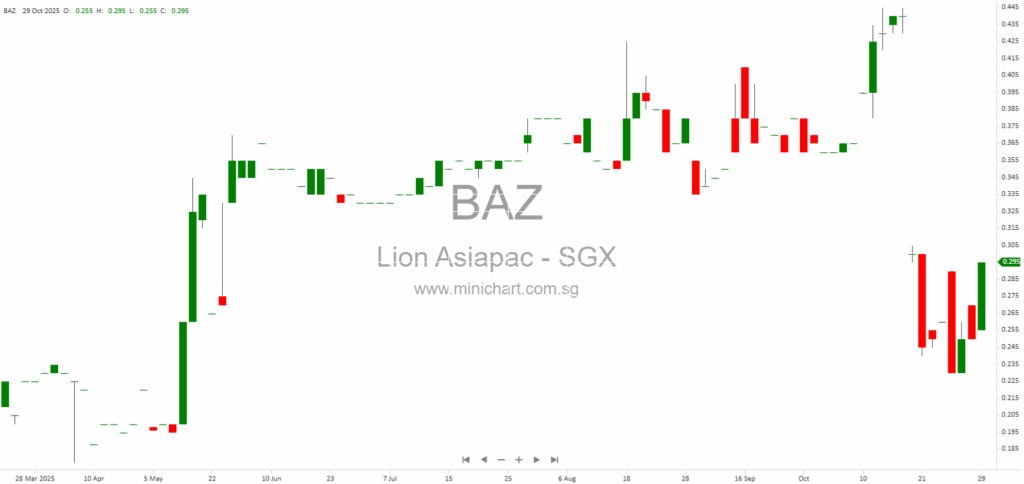

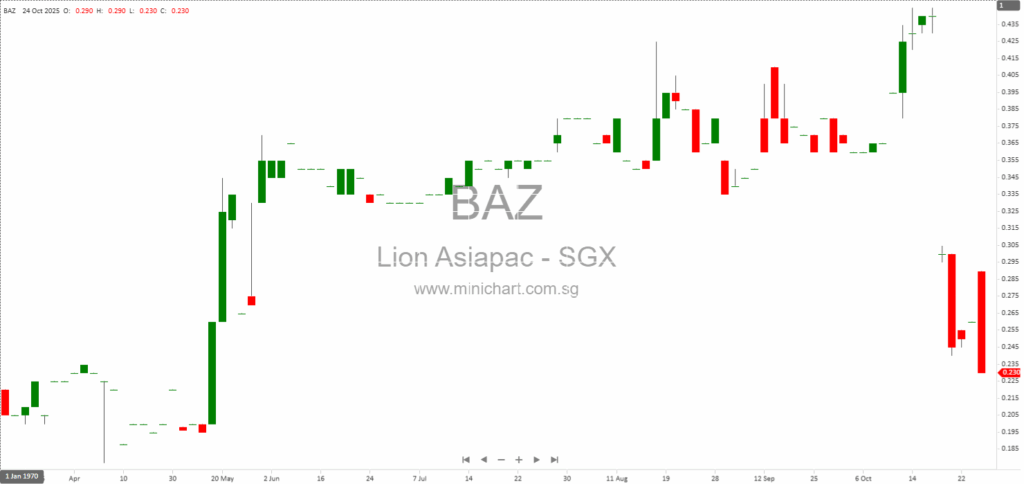

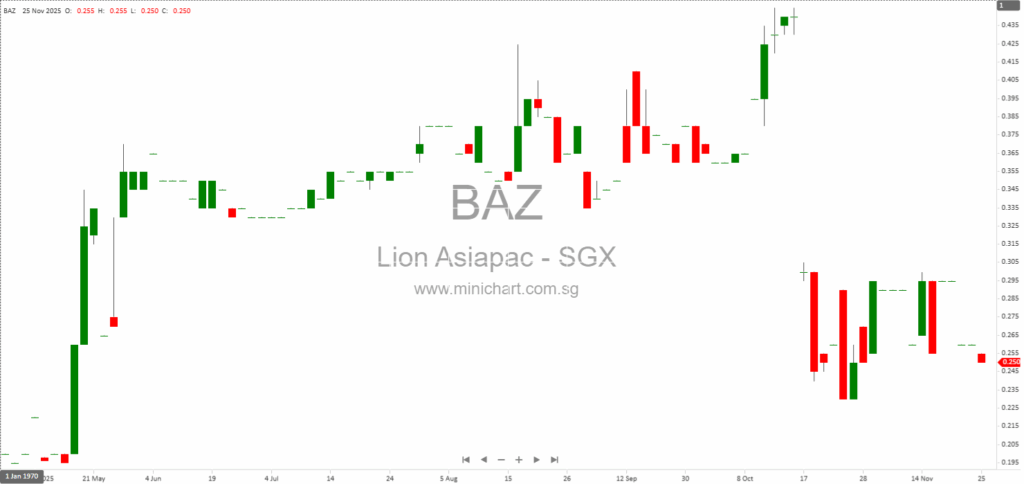

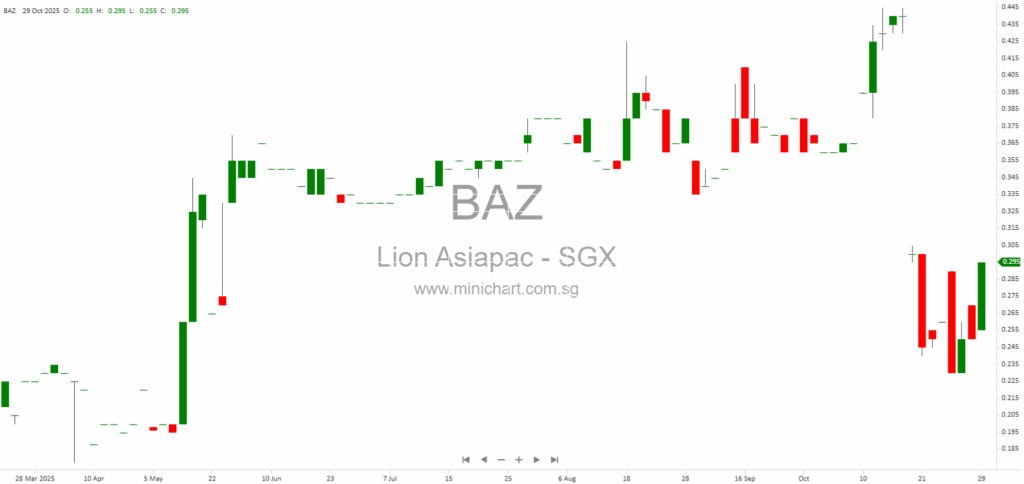

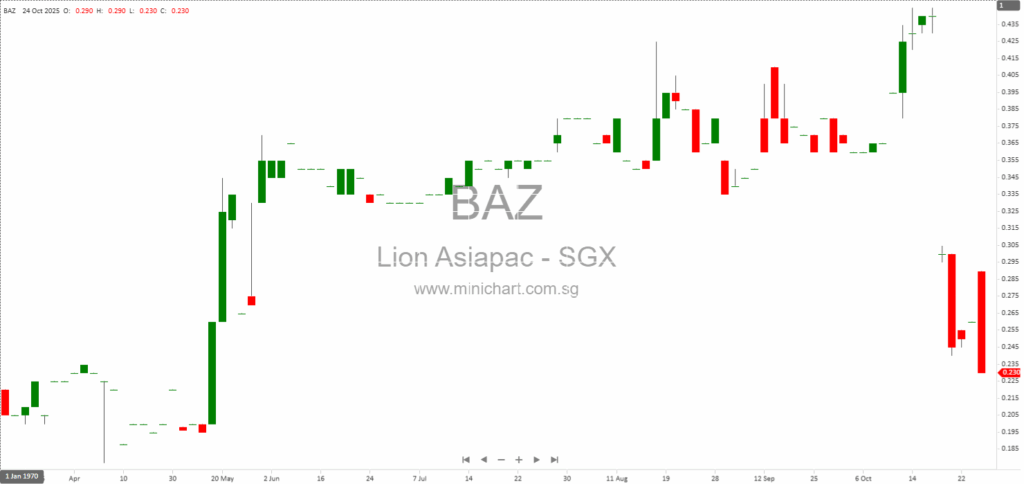

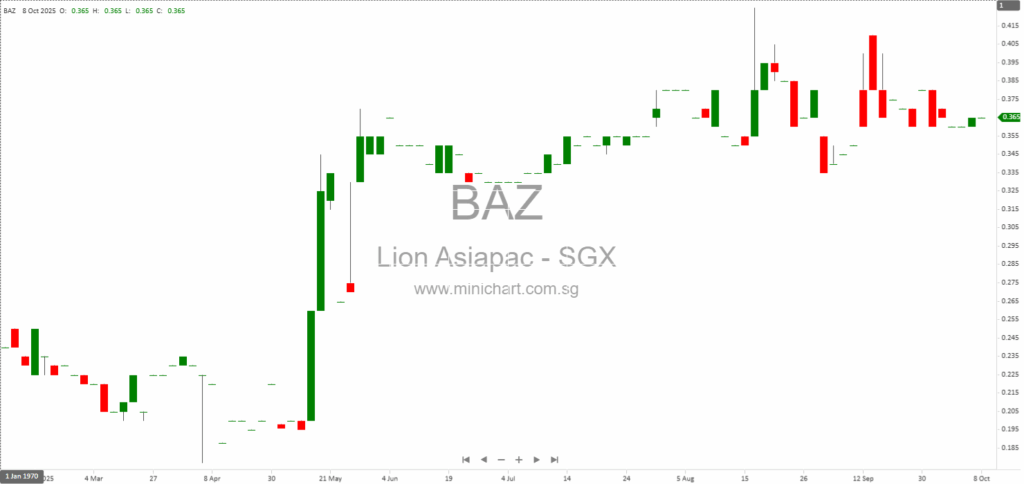

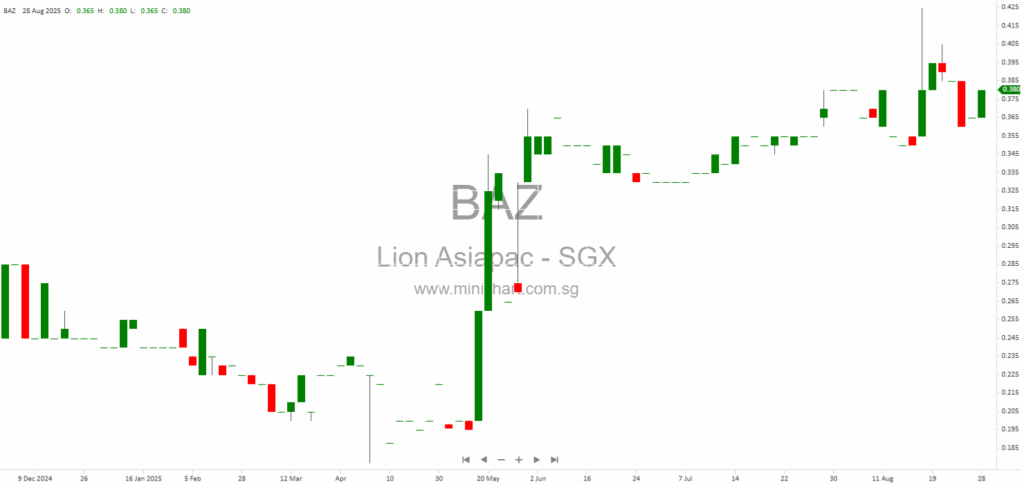

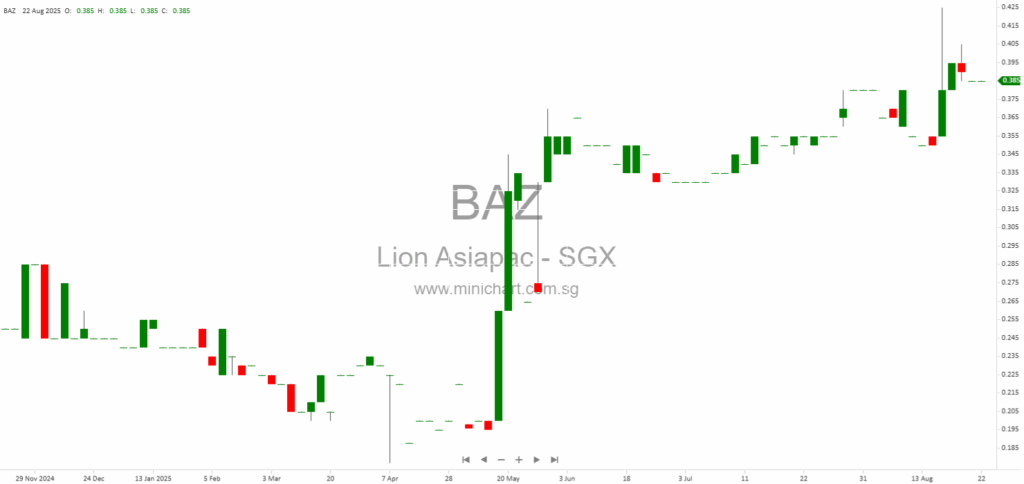

📈 Lion Asiapac Limited Historical Chart

🧾 Recent Financial Statement Analysis

February 4, 2026

Lion Asiapac Limited: 2Q & Half-Year FY2026 Financial Analysis Lion Asiapac Limited (“Lion Asiapac”) released its unaudited condensed interim financial statements for the second quarter and half-year ended 31 December 2025. The company operates mainly in roofing solutions, trading of…

January 23, 2026

Lion Asiapac Limited: Profit Guidance for Half Year Ended 31 December 2025 Lion Asiapac Limited has released a profit guidance for the half year ended 31 December 2025. This announcement provides insight into the Group’s expected financial performance ahead of…

November 26, 2025

Lion Asiapac Limited AGM 2025: Key Highlights, Strategic Updates, and Shareholder Insights Lion Asiapac Limited AGM 2025: Key Highlights, Strategic Updates, and Shareholder Insights Overview of the AGM Lion Asiapac Limited ("the Company") convened its 55th Annual General Meeting (AGM)…

October 30, 2025

Lion Asiapac Reshuffles Subsidiaries: Strategic Share Transfer and Disposal Announced Key Points Investors Must Know Disposal of Compact Energy Sdn Bhd: Ongoing process with multiple announcements and shareholder circulars issued over the last two years. Transfer of Swissma Building Technologies…

October 24, 2025

NIL Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research or consult financial advisors before making investment decisions. View Lion Asiapac Historical chart here

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: BAZ, Lion Asiapac Limited, Lion Asiapac, LAP SP, LION ASIAPAC LTD, LION ASIAPAC

February 4, 2026

Lion Asiapac Limited: 2Q & Half-Year FY2026 Financial Analysis Lion Asiapac Limited (“Lion Asiapac”) released its unaudited condensed interim financial statements for the second quarter and half-year ended 31 December 2025. The company operates mainly in roofing solutions, trading of…

January 23, 2026

Lion Asiapac Limited: Profit Guidance for Half Year Ended 31 December 2025 Lion Asiapac Limited has released a profit guidance for the half year ended 31 December 2025. This announcement provides insight into the Group’s expected financial performance ahead of…

November 26, 2025

Lion Asiapac Limited AGM 2025: Key Highlights, Strategic Updates, and Shareholder Insights Lion Asiapac Limited AGM 2025: Key Highlights, Strategic Updates, and Shareholder Insights Overview of the AGM Lion Asiapac Limited ("the Company") convened its 55th Annual General Meeting (AGM)…

October 30, 2025

Lion Asiapac Reshuffles Subsidiaries: Strategic Share Transfer and Disposal Announced Key Points Investors Must Know Disposal of Compact Energy Sdn Bhd: Ongoing process with multiple announcements and shareholder circulars issued over the last two years. Transfer of Swissma Building Technologies…

October 24, 2025

NIL Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research or consult financial advisors before making investment decisions. View Lion Asiapac Historical chart here

October 9, 2025

Lion Asiapac Limited: Analysis of FY2025 Audited Financial Statements Lion Asiapac Limited has released its audited financial statements for the year ended 30 June 2025. This article summarizes key changes between the unaudited and audited figures, highlights notable corporate actions,…

September 2, 2025

Lion Asiapac Sells Compact Energy Sdn. Bhd. for USD10.4 Million: What Retail Investors Need to Know Lion Asiapac Sells Compact Energy Sdn. Bhd. for USD10.4 Million: What Retail Investors Need to Know Key Points From the Report Completion of Disposal:…

August 23, 2025

Lion Asiapac Limited: Profit Guidance for Q4 and Full Year Ended 30 June 2025 Lion Asiapac Limited has issued a profit guidance for the fourth quarter and full year ended 30 June 2025. The company has indicated that it expects…

January 24, 2025

Lion Asiapac Limited - Financial Analysis for Investors (Net Loss Guidance) Lion Asiapac Limited - Financial Analysis for Investors (Net Loss Guidance) Business Description Lion Asiapac Limited is incorporated in the Republic of Singapore. The company operates as a group…

November 2, 2024

Financial Analysis of Lion Asiapac Limited - Net Profit Decline Business Description Lion Asiapac Limited is a Singapore-based company listed on the Singapore Exchange Securities Trading Limited (SGX-ST). The company operates through four main segments: Supply of roofing solutions…

October 13, 2024

Business Description:Lion Asiapac Limited operates in three primary business segments:Roofing Solutions: Contributed S$14.0 million, accounting for approximately 34% of total revenue.Lime Sales: Contributed S$15.5 million, representing the largest revenue segment at around 38%.Steel Consumables and Mining Equipment Trading: Generated S$11.7…

October 10, 2024

Key Facts from the 2024 Lion Asiapac Limited Annual ReportReport Date & Financial YearDate of the Report: The report covers the financial year ending 30 June 2024.Financial PerformanceRevenue: S$41.2 million, representing a 36% increase compared to the previous year.Profit After…