📊 Statistics

- Analyst 1 Year Price Target:

$5.88

- Upside/Downside from Analyst Target:

15.07%

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

2.43%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

4.51%

Amount: -

Yield: -

Pay Date: 2003-12-30

Details:

20% LESS TAX

Amount: -

Yield: -

Pay Date: 2003-08-20

Details:

25% LESS TAX

Amount: -

Yield: -

Pay Date: 2002-12-30

Details:

20% LESS TAX

Amount: -

Yield: -

Pay Date: 2002-09-06

Details:

20% LESS TAX

Amount: -

Yield: -

Pay Date: 2002-09-06

Details:

15% LESS TAX

📅 SGX Earnings Announcements for B61

Bukit Sembawang Estates Limited (B61)

Market: SGX |

Currency: SGD

Address: No. 13-01, 2 Bukit Merah Central

Bukit Sembawang Estates Limited, an investment holding company, engages in the property development, investments, and other property related activities in Singapore. It operates in three segments: Property Development, Investment Holding, and Hospitality. The company engages in development of residential properties for sale; and holding and management office buildings and investments. It also owns and operates serviced apartment units. The company was founded in 1911 and is based in Singapore.

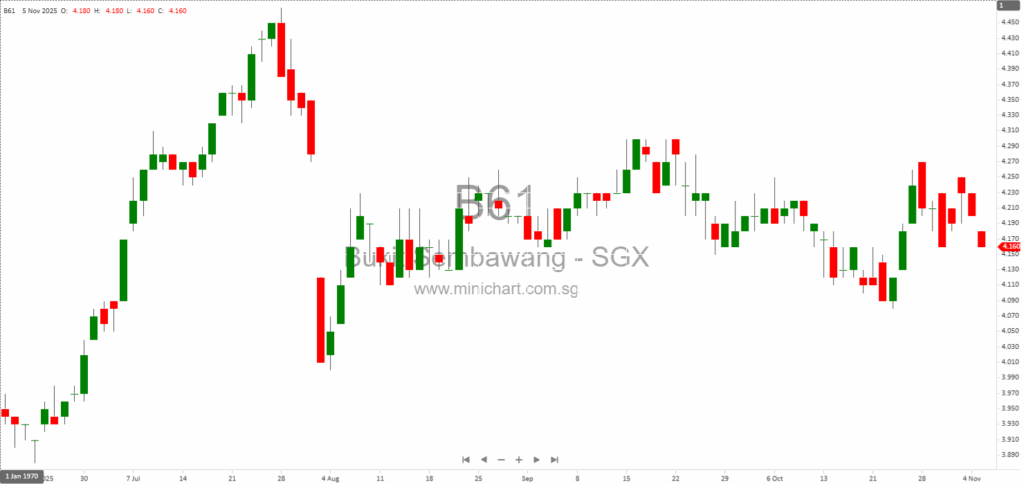

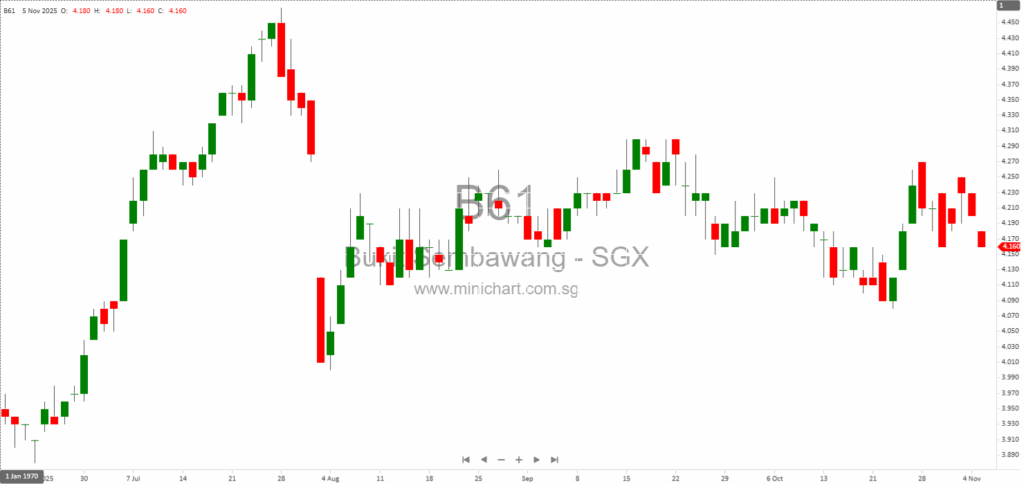

📈 Bukit Sembawang Estates Limited Historical Chart

🧾 Recent Financial Statement Analysis

November 6, 2025

Bukit Sembawang Estates Limited 1H FY2025/26 Financial Results Analysis Bukit Sembawang Estates Limited, a Singapore-based property developer and investment holding company, released its unaudited interim financial statements for the first half year ended 30 September 2025. This article provides a…

November 12, 2024

Bukit Sembawang Estates Limited Financial Analysis: Net Profit Increased by 149% Bukit Sembawang Estates Limited Financial Analysis: Net Profit Increased by 149% Business Description Bukit Sembawang Estates Limited is primarily engaged in property development, investment holding, and hospitality. The company…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: B61, Bukit Sembawang Estates Limited, Bukit Sembawang, BS SP, BUKIT SEMBAWANG ESTATES LTD, BUKIT SEMBAWANG ESTATES

December 1, 2025

Broker: Equity Explorer Date of Report: 01 Dec 2025 Excerpt from Equity Explorer report. Report Summary: Bukit Sembawang Estates is highlighted as a potential dividend powerhouse due to its significant landbank (>1.5mn sqft, GDV of SGD2.5bn) and fortress balance sheet…

November 6, 2025

Bukit Sembawang Estates Limited 1H FY2025/26 Financial Results Analysis Bukit Sembawang Estates Limited, a Singapore-based property developer and investment holding company, released its unaudited interim financial statements for the first half year ended 30 September 2025. This article provides a…

July 7, 2025

Broker: Not explicitly mentioned in the provided content Date of Report: Not specified in the provided content DBS Group Holdings: Leveraging Digital Innovation and Market Volatility for Sustained Growth Introduction: Singapore’s Financial Powerhouse in Focus DBS Group Holdings Ltd, together…

July 4, 2025

Broker: Lim & Tan Securities Date of Report: 4 July 2025 Singapore Market Update: Key Developments, Company Insights, and Sector Trends for July 2025 Market Overview: STI Hits 52-Week High Amid Global Volatility Singapore’s FSSTI Index closed at 4,019.6, marking…

May 27, 2025

Lim & Tan Securities May 27, 2025 Singapore Market Review: Bukit Sembawang Estates Analysis, Boustead Singapore Recommendation, and Fund Flow Insights Financial Markets Overview The FSSTI Index closed at 3,875.6, down 0.2%, with MTD and YTD gains of 1.1% and…

May 9, 2025

Maybank Research Pte Ltd. May 8, 2025 DBS Group: Navigating Volatility with a Resilient Platform and Cautious Outlook DBS Group's first-quarter 2025 core earnings landed in line with Street expectations, showcasing the resilience of its robust platform amidst volatile operating…

November 12, 2024

Bukit Sembawang Estates Limited Financial Analysis: Net Profit Increased by 149% Bukit Sembawang Estates Limited Financial Analysis: Net Profit Increased by 149% Business Description Bukit Sembawang Estates Limited is primarily engaged in property development, investment holding, and hospitality. The company…