📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

10-25%

- Net Income Growth Range (1Y):

10-25%

- Revenue Growth Range (1Y):

10-25%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

3.88%

Amount: $0.000000

Yield: -

Pay Date: -

Details:

Ratio: 6:100

📅 SGX Earnings Announcements for B58

Banyan Tree Holdings Limited (B58)

Market: SGX |

Currency: SGD

Address: 211 Upper Bukit Timah Road

Banyan Tree Holdings Limited, an investment holding company, operates as a hospitality company in Singapore, rest of South East Asia, Indian Oceania, the Middle East, North East Asia, and internationally. It operates through Hotel Investments, Residences, and Fee-Based segments. The company owns and manages hotels under the Banyan Tree, Angsana, and Cassia brands; sells hotel villas or apartments to investors under a leaseback scheme; and develops and sells vacation homes in Laguna Phuket, as well as develops and sells land. It is also involved in the management and operation of resorts and spas; tourist transportation activities; management and ownership of golf courses, and rental of retail outlets and offices; management of asset-backed destination club and a private equity fund; sale of merchandise; holding land plots for future development; farming and restaurant business; health leisure activities; and spa and gallery related businesses. In addition, the company provides architectural, design, purchasing, project coordination, and technical services for hotels, resorts, and spas, as well as consultancy and marketing services; laundry services; ancillary services related to the hospitality industry; and holiday club membership and property development services. Banyan Tree Holdings Limited was founded in 1984 and is based in Singapore.

Show more

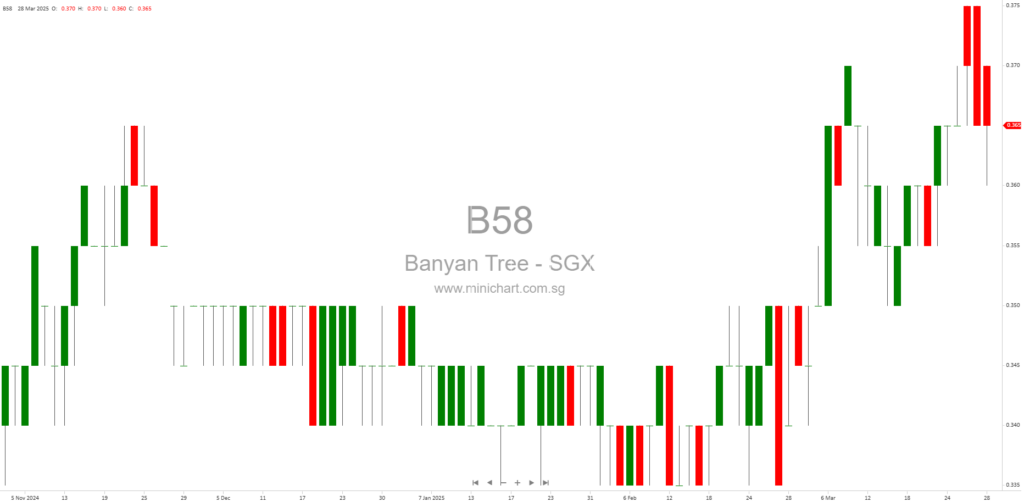

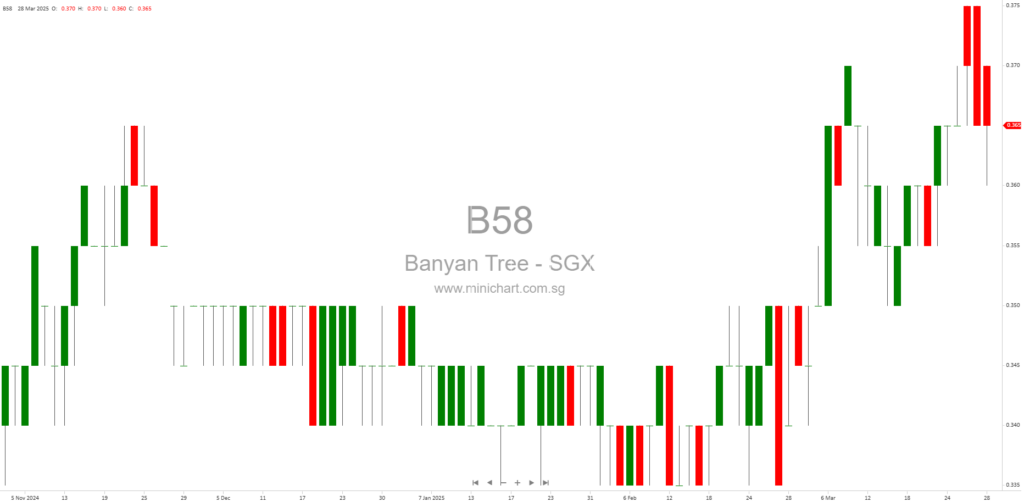

📈 Banyan Tree Holdings Limited Historical Chart

🧾 Recent Financial Statement Analysis

August 13, 2025

Banyan Tree Holdings Makes Bold Move: Major Stake Acquisition in Tropical Resorts Limited Banyan Tree Holdings Makes Bold Move: Major Stake Acquisition in Tropical Resorts Limited Key Points Retail Investors Should Know Significant Acquisition: Banyan Tree Holdings Limited, through its…

April 1, 2025

Banyan Tree Holdings Announces Dividend Payout for FY2024 Banyan Tree Holdings Limited, a leading global hospitality group, has announced the key details of its proposed first and final dividend for the financial year ended 31 December 2024. This news is…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: B58, Banyan Tree Holdings Limited, Banyan Tree, BTH SP, BANYAN TREE HOLDINGS LTD, BANYAN TREE

August 13, 2025

Banyan Tree Holdings Makes Bold Move: Major Stake Acquisition in Tropical Resorts Limited Banyan Tree Holdings Makes Bold Move: Major Stake Acquisition in Tropical Resorts Limited Key Points Retail Investors Should Know Significant Acquisition: Banyan Tree Holdings Limited, through its…

July 7, 2025

Broker: Not specified in document Date of Report: Not specified in document Banyan Tree Holdings Ltd: Strategic Expansion and Margin Growth Opportunities Amid Booming Asia-Pacific Travel Investment Highlights and Trade Recommendation Recommendation: BUY Entry Price: 0.44 Target Price: 0.48 Stop…

June 24, 2025

Broker Name: CGS International Date of Report: June 18, 2025 Banyan Tree Holdings and SingTel: Technical Breakout and Yield Prospects Amid Shifting Retail Backdrop Market Overview: US Retail Weakness and Tariff Headwinds The latest retail data from the US highlights…

June 18, 2025

Broker: CGS International Date of Report: June 18, 2025 Banyan Tree Holdings and SingTel: In-Depth Technical and Fundamental Analysis for Singapore Investors Market Overview: US Economic Data Influences Global Sentiment Recent economic indicators from the US signal a cooling in…

April 1, 2025

Banyan Tree Holdings Announces Dividend Payout for FY2024 Banyan Tree Holdings Limited, a leading global hospitality group, has announced the key details of its proposed first and final dividend for the financial year ended 31 December 2024. This news is…