📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

-

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

-

💰 Dividend History

No dividend history available.

📅 SGX Earnings Announcements for AWK

Fuxing China Group Limited (AWK)

Market: SGX |

Currency: SGD

Address: Hangbian Industry Area

Fuxing China Group Limited, an investment holding company, engages in the production and sale of zipper products in Mainland China and Hong Kong. The company operates through the Sales of Zipper Chains and Zipper Sliders; Trading of Textile Raw and Auxiliary Materials; and Zipper Processing Services segments. It offers zipper chains and sliders; and finished zippers. It is also involved in the manufacture and sale of dyed yarn; provision of zipper processing services, such as color dyeing of fabric tapes for zippers and electroplating services for zipper sliders; and real estate development activities. In addition, the company engages in trading raw and auxiliary materials, including rubber thread, nylon fabric, and nylon yarn. It sells its products under the 3F brand name to manufacturers of apparel and footwear products, camping equipment, bags, and manufacturers of upholstery furnishings, as well as other zipper manufacturers and trading companies. Fuxing China Group Limited was founded in 1992 and is headquartered in Jinjiang, China.

Show more

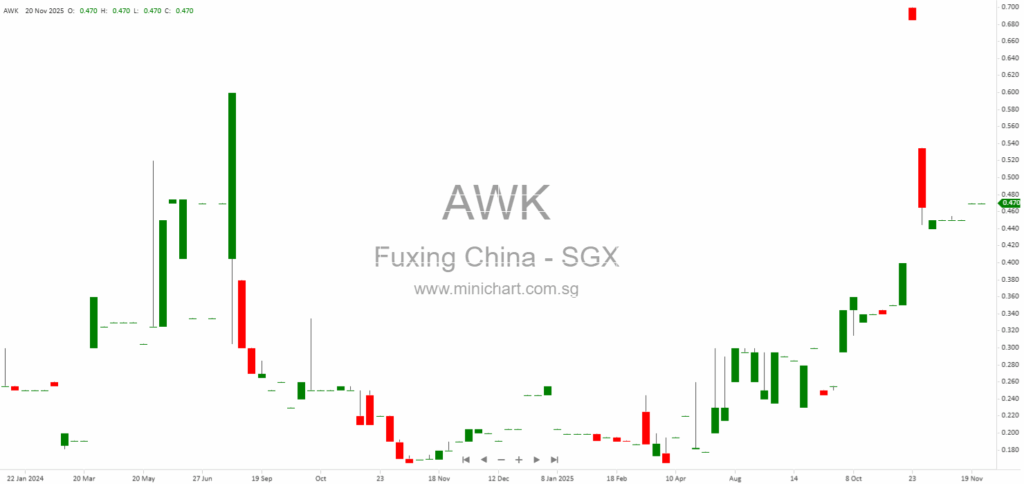

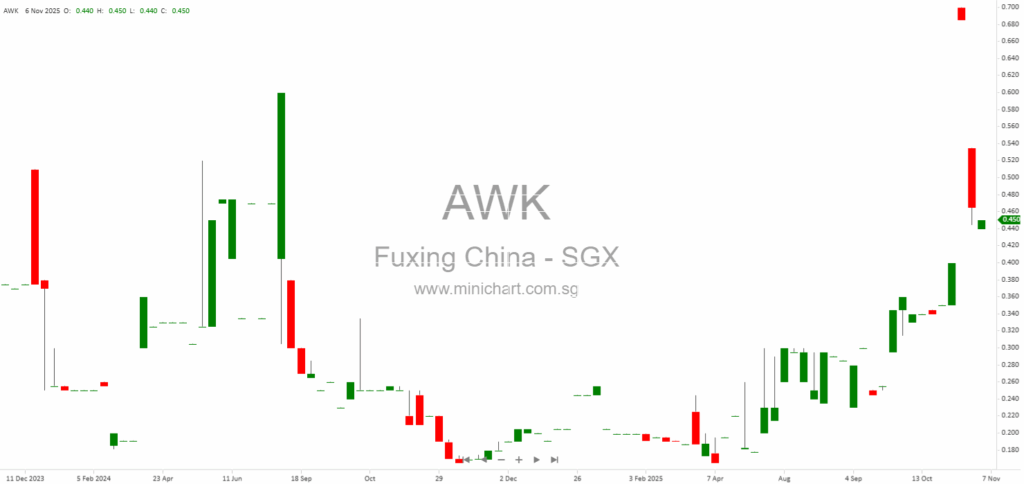

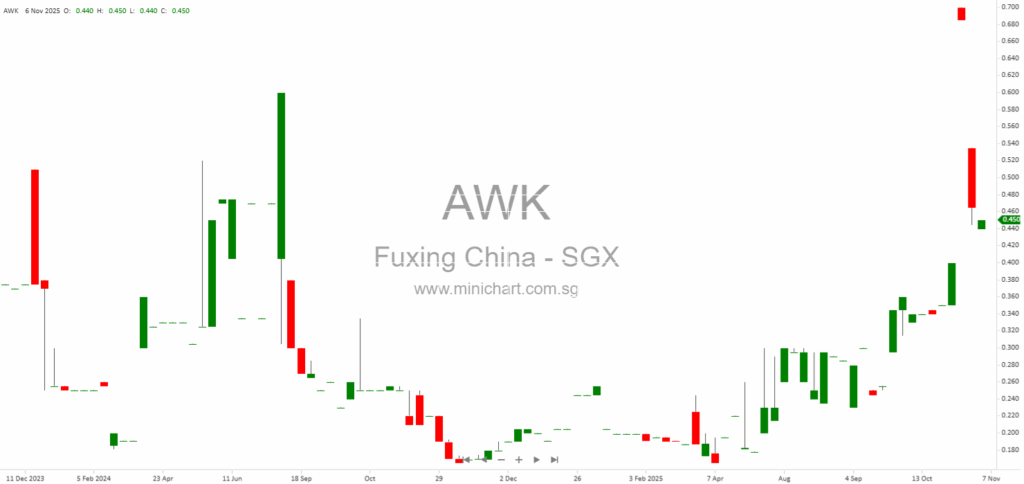

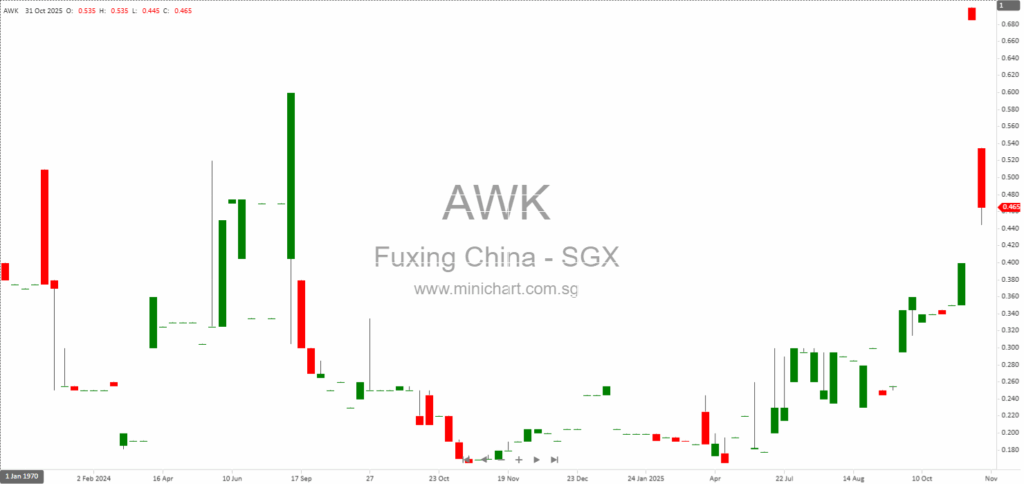

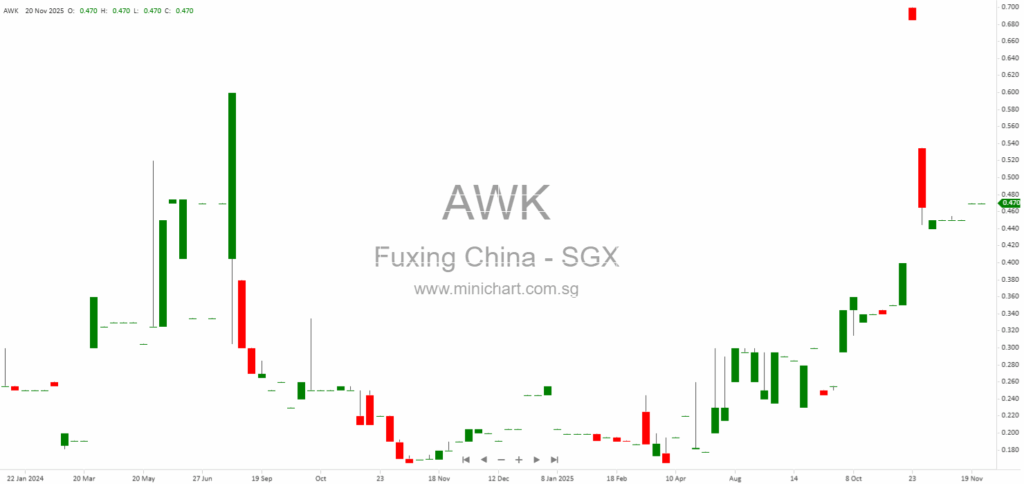

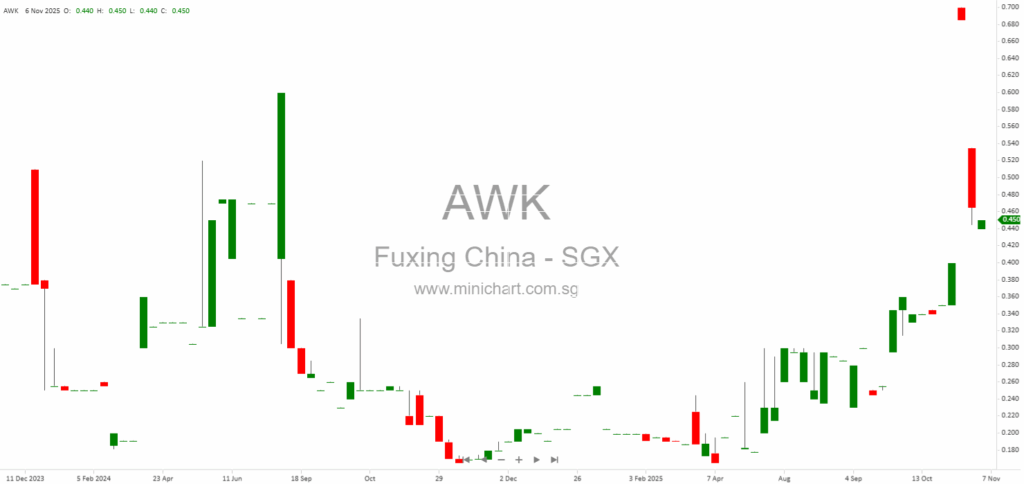

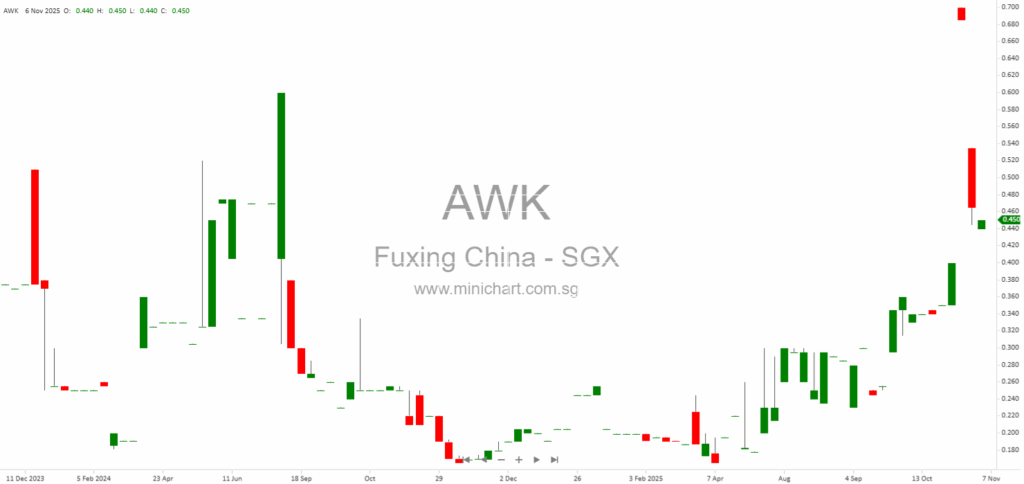

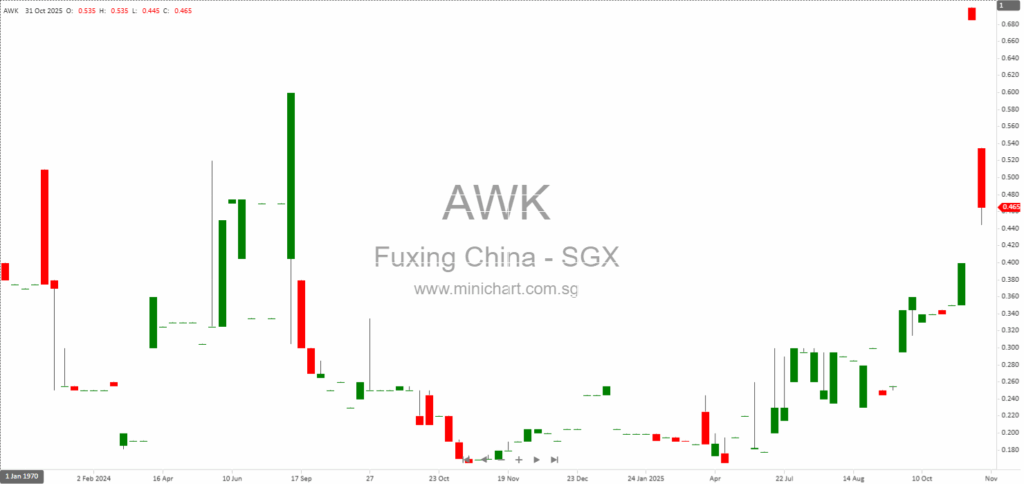

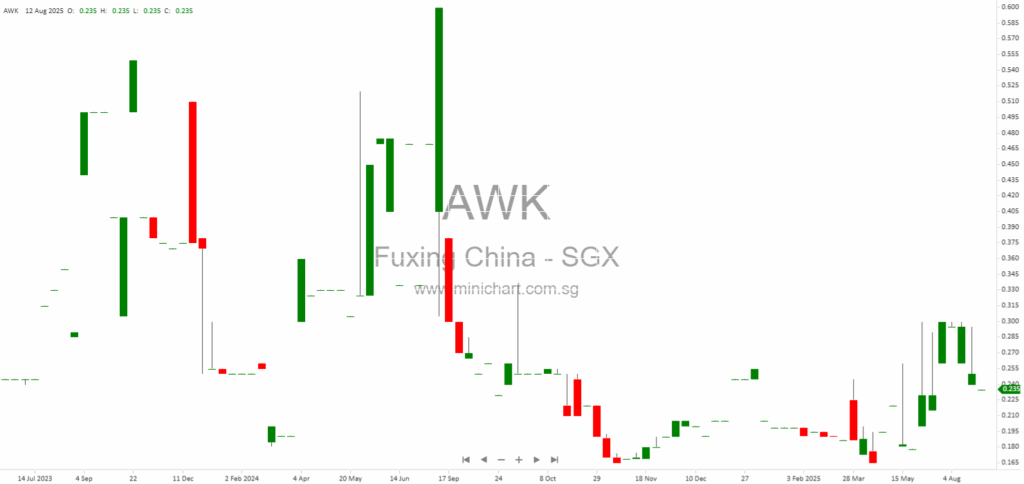

📈 Fuxing China Group Limited Historical Chart

🧾 Recent Financial Statement Analysis

February 5, 2026

Key Transaction Overview GS Holdings Limited (“GS Holdings” or the “Company”) has announced its intention to divest its entire stake in its wholly-owned subsidiary, Hawkerway Pte. Ltd., to Wei Global Pte. Ltd. (“Buyer”) for a net cash consideration of S\$0.65…

February 4, 2026

GS Holdings Exits Legacy Businesses, Proposes Name Change to "Octopus (APAC) Holdings" GS Holdings Exits Legacy Businesses, Proposes Name Change to "Octopus (APAC) Holdings" Key Corporate Transformation with Potential Share Price Impact GS Holdings Limited ("GS Holdings" or "the Company"),…

November 24, 2025

Fuxing China Group Withdraws Proposed NASDAQ Listing Fuxing China Group Limited Abandons Proposed NASDAQ Listing: Key Details for Investors Summary of the Announcement Fuxing China Group Limited, incorporated in Bermuda and listed on the SGX-ST, has officially announced its decision…

November 12, 2025

Fuxing China Group Limited Completes Placement of 3,000,000 New Shares Fuxing China Group Limited Completes Placement of 3,000,000 New Ordinary Shares at S\$0.415 Each Key Points for Investors Completion of Share Placement: Fuxing China Group Limited has successfully completed the…

November 11, 2025

Fuxing China Group Receives Approval In-Principle for Strategic Share Placement Fuxing China Group Receives Approval In-Principle for S\$1.25 Million Share Placement Key Developments Investors Should Know Fuxing China Group Limited has made a significant announcement regarding its plans to strengthen…

November 6, 2025

Fuxing China Group Limited Announces Proposed Placement of New Shares Fuxing China Group Limited Announces Proposed Placement of Up to 3 Million New Shares at S\$0.415 Each Date: 5 November 2025 Company: Fuxing China Group Limited (SGX: [Ticker]) Announcement: Proposed…

September 16, 2025

Fuxing China Group’s NASDAQ Ambitions: Key Updates, Risks, and What Investors Must Know Fuxing China Group’s NASDAQ Ambitions: Key Updates, Risks, and What Investors Must Know Summary of Key Developments Fuxing China Group Limited (Fuxing China), headquartered in Bermuda, has…

September 27, 2024

Key Facts & Investor Actions:Capital Reduction: The company proposes to reduce the par value of each share from S$5.00 to S$0.02 (previously S$0.10). This change is intended to provide flexibility for future share issuances and corporate actions like rights issues…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: AWK, Fuxing China Group Limited, Fuxing China, FUXC SP, FUXING CHINA GROUP LTD, FUXING CHINA GROUP

February 5, 2026

Key Transaction Overview GS Holdings Limited (“GS Holdings” or the “Company”) has announced its intention to divest its entire stake in its wholly-owned subsidiary, Hawkerway Pte. Ltd., to Wei Global Pte. Ltd. (“Buyer”) for a net cash consideration of S\$0.65…

February 4, 2026

GS Holdings Exits Legacy Businesses, Proposes Name Change to "Octopus (APAC) Holdings" GS Holdings Exits Legacy Businesses, Proposes Name Change to "Octopus (APAC) Holdings" Key Corporate Transformation with Potential Share Price Impact GS Holdings Limited ("GS Holdings" or "the Company"),…

January 27, 2026

Broker Name: CGS International Date of Report: January 27, 2026 Excerpt from CGS International report. Report Summary The report provides a technical buy call on Rex International Holding Ltd, an oil production and exploration company with assets in Norway and…

January 27, 2026

Broker Name: CGS International Date of Report: January 27, 2026 Excerpt from CGS International report. Report Summary Rex International Holding Ltd is showing signs of resuming its uptrend, supported by strong technical indicators such as bullish momentum, Ichimoku trend signals,…

January 20, 2026

Broker Name: CGS International Date of Report: January 19, 2026 Excerpt from CGS International report: Report Summary Fuxing China Group Limited is a vertically integrated zipper manufacturer based in Jinjiang City, Fujian Province, China, listed on SGX, and recently cancelled…

November 24, 2025

Fuxing China Group Withdraws Proposed NASDAQ Listing Fuxing China Group Limited Abandons Proposed NASDAQ Listing: Key Details for Investors Summary of the Announcement Fuxing China Group Limited, incorporated in Bermuda and listed on the SGX-ST, has officially announced its decision…

November 12, 2025

Fuxing China Group Limited Completes Placement of 3,000,000 New Shares Fuxing China Group Limited Completes Placement of 3,000,000 New Ordinary Shares at S\$0.415 Each Key Points for Investors Completion of Share Placement: Fuxing China Group Limited has successfully completed the…

November 11, 2025

Fuxing China Group Receives Approval In-Principle for Strategic Share Placement Fuxing China Group Receives Approval In-Principle for S\$1.25 Million Share Placement Key Developments Investors Should Know Fuxing China Group Limited has made a significant announcement regarding its plans to strengthen…

November 6, 2025

Fuxing China Group Limited Announces Proposed Placement of New Shares Fuxing China Group Limited Announces Proposed Placement of Up to 3 Million New Shares at S\$0.415 Each Date: 5 November 2025 Company: Fuxing China Group Limited (SGX: [Ticker]) Announcement: Proposed…

September 16, 2025

Fuxing China Group’s NASDAQ Ambitions: Key Updates, Risks, and What Investors Must Know Fuxing China Group’s NASDAQ Ambitions: Key Updates, Risks, and What Investors Must Know Summary of Key Developments Fuxing China Group Limited (Fuxing China), headquartered in Bermuda, has…

August 14, 2025

Fuxing China Group Completes Major Subsidiary Disposal: What Investors Need to Know Key Highlights Fuxing China Group Limited has completed the sale of its indirect, wholly-owned subsidiary. The purchase consideration for the disposal was RMB8.8 million, paid in cash. The…

August 12, 2025

Fuxing China Group Limited: 1H2025 Profit Guidance Analysis Fuxing China Group Limited has released a profit guidance for the half year ended 30 June 2025 (1H2025). The announcement signals a significant change in financial performance compared to the same period…

September 27, 2024

Key Facts & Investor Actions:Capital Reduction: The company proposes to reduce the par value of each share from S$5.00 to S$0.02 (previously S$0.10). This change is intended to provide flexibility for future share issuances and corporate actions like rights issues…