📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

<0%

- Revenue Growth Range (1Y):

10-25%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

5.94%

📅 SGX Earnings Announcements for AVX

HL Global Enterprises Limited (AVX)

Market: SGX |

Currency: SGD

Address: No.19-08 International Plaza

HL Global Enterprises Limited, an investment holding company, engages in the hospitality and restaurant, and property development businesses in Singapore, Malaysia, and the People's Republic of China. It operates in three segments: Investments and Others, Hospitality and Restaurant, and Property Development. The company operates and manages hotels and restaurants under the Copthorne Hotel Cameron Highlands and Hotel Equatorial Shanghai names. It is also involved in development, sale, and rental of property; and provision of development project management, property management, and consultancy services. The company was formerly known as HLG Enterprise Limited and changed its name to HL Global Enterprises Limited in April 2008. HL Global Enterprises Limited was incorporated in 1961 and is based in Singapore.

Show more

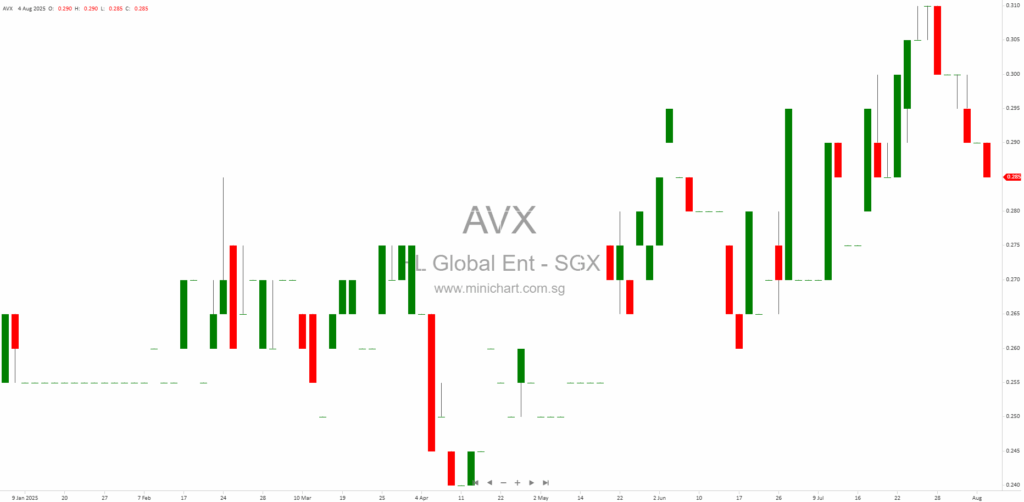

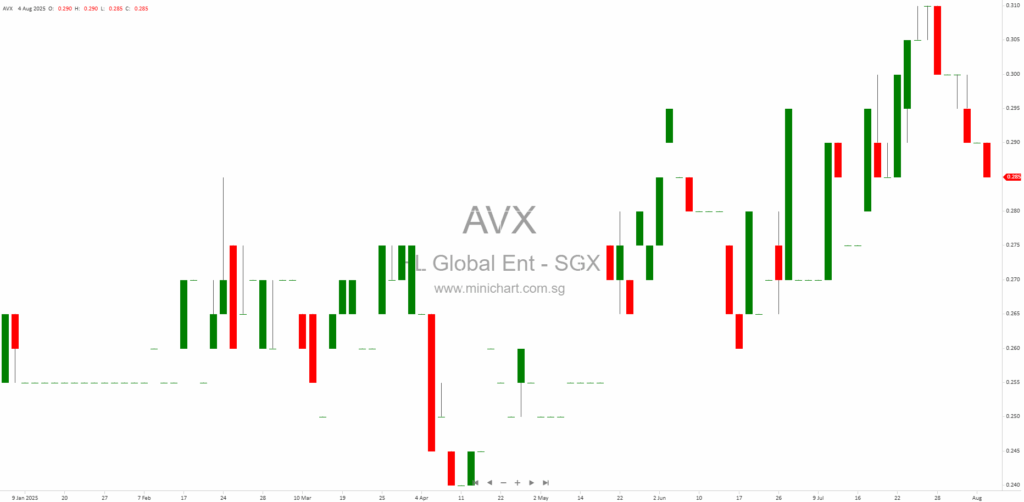

📈 HL Global Enterprises Limited Historical Chart

🧾 Recent Financial Statement Analysis

February 13, 2026

HL Global Enterprises Limited: FY 2025 Financial Results Analysis HL Global Enterprises Limited (“HLGE”), listed on the Singapore Exchange, reported its unaudited financial results for the six months and full year ended 31 December 2025. The Group operates in three…

November 4, 2025

China Yuchai Expands Stake in HL Global Enterprises: Strategic Move Signals Growing Influence in Hospitality Sector China Yuchai Expands Stake in HL Global Enterprises: Strategic Move Signals Growing Influence in Hospitality Sector Key Points for Investors China Yuchai International Limited…

August 4, 2025

HL Global Enterprises Limited 1H2025 Financial Analysis HL Global Enterprises Limited 1H2025 Financial Analysis Key Financial Metrics (1H 2025 vs 1H 2024) Revenue: \$2,843,000 (1H 2025) vs \$2,793,000 (1H 2024) (+1.8%) Cost of Sales: \$1,553,000 (1H 2025) vs \$1,517,000 (1H…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: AVX, HL Global Enterprises Limited, HL Global Ent, HLGE SP, HL GLOBAL ENTERPRISES LTD, HL GLOBAL ENTERPRISES

February 13, 2026

HL Global Enterprises Limited: FY 2025 Financial Results Analysis HL Global Enterprises Limited (“HLGE”), listed on the Singapore Exchange, reported its unaudited financial results for the six months and full year ended 31 December 2025. The Group operates in three…

November 4, 2025

China Yuchai Expands Stake in HL Global Enterprises: Strategic Move Signals Growing Influence in Hospitality Sector China Yuchai Expands Stake in HL Global Enterprises: Strategic Move Signals Growing Influence in Hospitality Sector Key Points for Investors China Yuchai International Limited…

August 4, 2025

HL Global Enterprises Limited 1H2025 Financial Analysis HL Global Enterprises Limited 1H2025 Financial Analysis Key Financial Metrics (1H 2025 vs 1H 2024) Revenue: \$2,843,000 (1H 2025) vs \$2,793,000 (1H 2024) (+1.8%) Cost of Sales: \$1,553,000 (1H 2025) vs \$1,517,000 (1H…