📊 Statistics

- Analyst 1 Year Price Target:

$0.78

- Upside/Downside from Analyst Target:

1.53%

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

6.42%

- EPS Growth Range (1Y):

25-50%

- Net Income Growth Range (1Y):

25-50%

- Revenue Growth Range (1Y):

<0%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

3.01%

📅 SGX Earnings Announcements for AU8U

CapitaLand China Trust (AU8U)

Market: SGX |

Currency: SGD

Address: 168 Robinson Road

CapitaLand China Trust (CLCT) is Singapore's largest China-focused real estate investment trust (REIT). CLCT's portfolio constitutes nine6 shopping malls, five business park properties and four logistics park properties. The geographically diversified portfolio has a total gross floor area (GFA) of approximately 1.8 million square metres (sq m), located across 12 leading Chinese cities. CLCT was listed on the Singapore Exchange Securities Trading Limited (SGX-ST) on 8 December 2006, and established with the objective of investing on a long-term basis in a diversified portfolio of income-producing real estate and real estate-related assets in mainland China, Hong Kong and Macau that are used primarily for retail, office and industrial purposes (including business parks, logistics facilities, data centres and integrated developments). CLCT's retail properties are strategically located in densely populated areas with good connectivity to public transport. The malls are positioned as one-stop family-oriented destinations that offer essential services and house a wide range of lifestyle offerings that cater to varied consumer preferences in shopping, dining and entertainment. CLCT's portfolio comprises a diverse mix of leading brands including ZARA, UNIQLO, Xiaomi, Li-Ning, Haidilao, Nanjing Impressions, TANYU, Nike, Sephora, Starbucks Coffee and Chow Tai Fook. The malls are CapitaMall Xizhimen, CapitaMall Wangjing, CapitaMall Grand Canyon in Beijing; Rock Square in Guangzhou; CapitaMall Xinnan in Chengdu; CapitaMall Nuohemule in Hohhot; CapitaMall Xuefu and CapitaMall Aidemengdun in Harbin and CapitaMall Yuhuating in Changsha. The portfolio of five business parks is situated in high-growth economic zones, with high quality and reputable domestic and multinational corporations operating in new economy sectors such as biomedical, electronics, engineering, e-commerce, information and communications technology and financial services. The business parks and industrial properties exhibit excellent connectivity to transportation hubs, and are easily accessible via various modes of transportation. The properties are Ascendas Xinsu Portfolio in Suzhou, Ascendas Innovation Towers and Ascendas Innovation Hub in Xi'an and Singapore- Hangzhou Science & Technology Park Phase I and Phase II in Hangzhou. The portfolio of four high-quality modern logistics parks is located in key logistics hubs near transportation nodes such as seaports, airports and railways to serve the growing domestic logistic needs of China's Eastern, Central and Southwest regions. The properties are fitted with modern features to meet a wide range of e-commerce and logistics requirements. The tenants cater to a variety of sectors from logistics and warehouse, pharmaceuticals, manufacturing to e-commerce. The properties are Shanghai Fengxian Logistics Park in Shanghai, Kunshan Bacheng Logistics Park in Kunshan, Wuhan Yangluo Logistics Park in Wuhan and Chengdu Shuangliu Logistics Park in Chengdu. CLCT is managed by CapitaLand China Trust Management Limited, a wholly owned subsidiary of Singapore-listed CapitaLand Investment Limited, a leading global real estate investment manager with a strong Asia foothold.

Show more

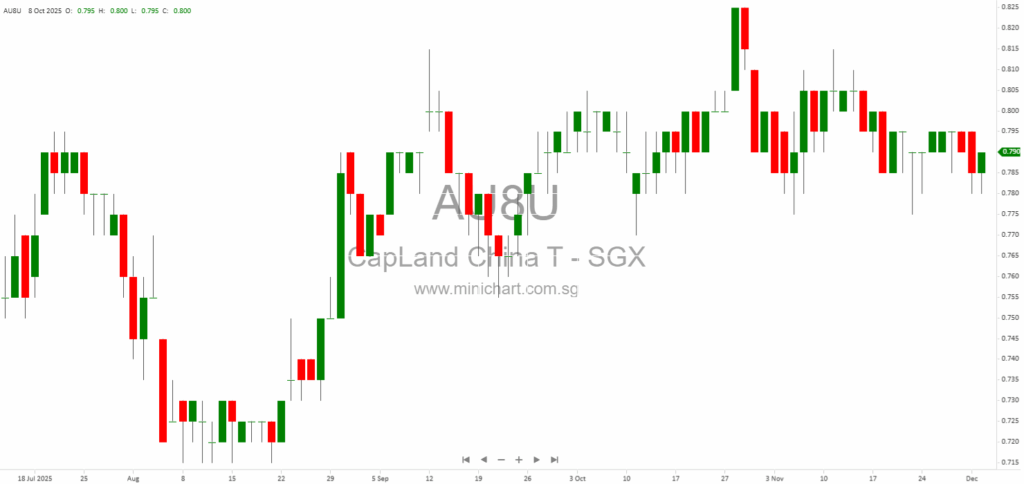

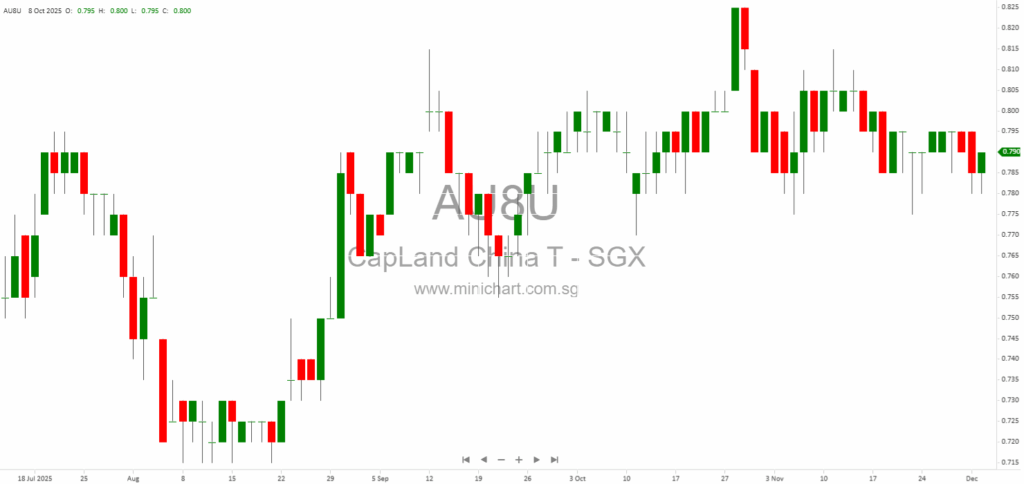

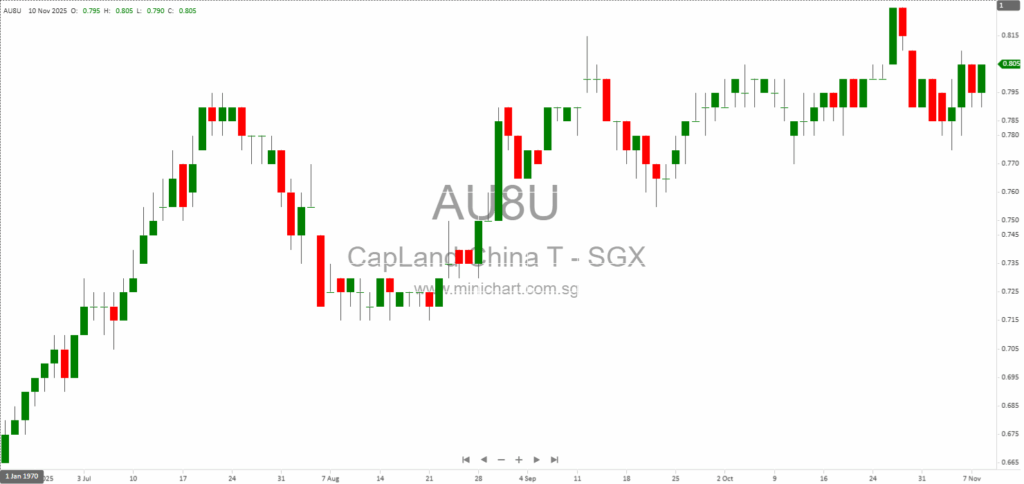

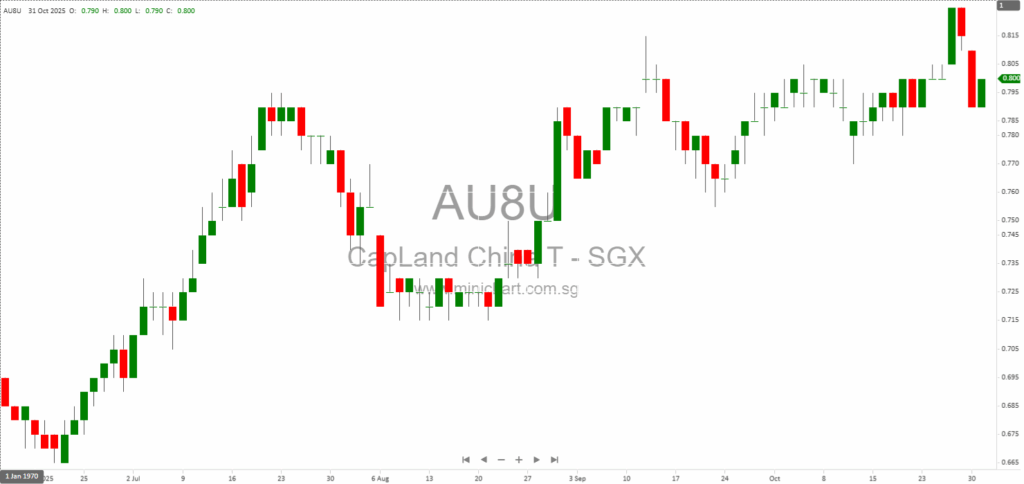

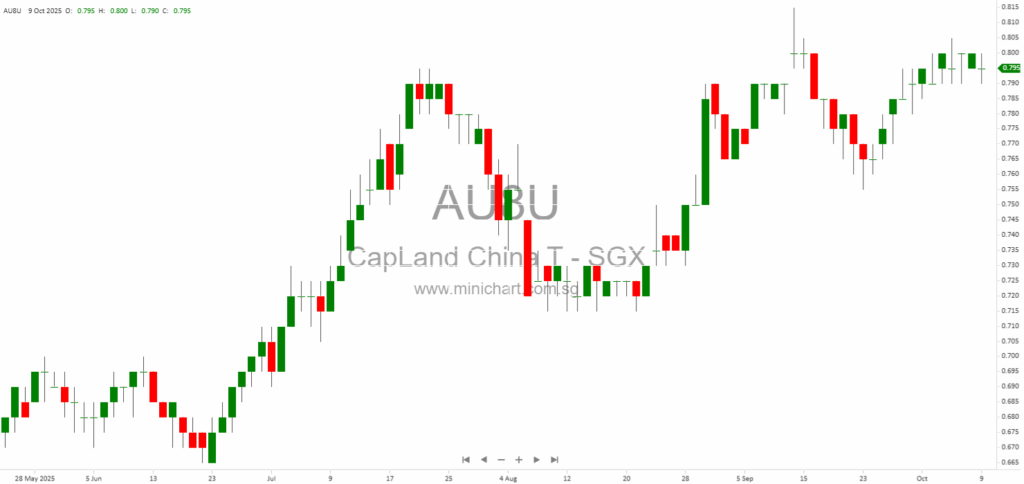

📈 CapitaLand China Trust Historical Chart

🧾 Recent Financial Statement Analysis

February 4, 2026

CapitaLand China Trust Announces Divestment and Strategic Investment in CapitaLand Commercial C-REIT CapitaLand China Trust Announces Major Divestment and Participation in CapitaLand Commercial C-REIT on Shanghai Stock Exchange Key Points of the Announcement Divestment of Wholly Owned Subsidiary: CapitaLand China…

February 4, 2026

CapitaLand China Trust FY2025 Financial Results: Analysis and Outlook CapitaLand China Trust (CLCT), the first and largest China-focused S-REIT, released its FY2025 results amidst a challenging macroeconomic environment. The Trust maintains a diversified portfolio across retail, business parks, and logistics…

January 6, 2026

CapitaLand China Trust (CLCT): Key Highlights and Investor-Relevant Developments from DBS Global Financial Markets - Regional Property Conference 2026 CapitaLand China Trust (CLCT) Unveils Strategic Growth Initiatives and Portfolio Updates at DBS Regional Property Conference 2026 Key Takeaways for Investors…

January 2, 2026

CapitaLand China Trust Updates S\$1 Billion Multicurrency Debt Issuance Programme CapitaLand China Trust Announces Key Updates to S\$1 Billion Multicurrency Debt Programme CapitaLand China Trust (CLCT), managed by CapitaLand China Trust Management Limited, has announced significant updates to its S\$1,000,000,000…

December 2, 2025

CapitaLand China Trust Issues Divestment Fee Units Following CapitaMall Yuhuating Divestment CapitaLand China Trust Issues Divestment Fee Units Following CapitaMall Yuhuating Divestment Key Developments in Recent CapitaLand China Trust (CLCT) Transaction CapitaLand China Trust (CLCT), managed by CapitaLand China Trust…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: AU8U, CapitaLand China Trust

February 4, 2026

CapitaLand China Trust Announces Divestment and Strategic Investment in CapitaLand Commercial C-REIT CapitaLand China Trust Announces Major Divestment and Participation in CapitaLand Commercial C-REIT on Shanghai Stock Exchange Key Points of the Announcement Divestment of Wholly Owned Subsidiary: CapitaLand China…

February 4, 2026

CapitaLand China Trust FY2025 Financial Results: Analysis and Outlook CapitaLand China Trust (CLCT), the first and largest China-focused S-REIT, released its FY2025 results amidst a challenging macroeconomic environment. The Trust maintains a diversified portfolio across retail, business parks, and logistics…

January 6, 2026

CapitaLand China Trust (CLCT): Key Highlights and Investor-Relevant Developments from DBS Global Financial Markets - Regional Property Conference 2026 CapitaLand China Trust (CLCT) Unveils Strategic Growth Initiatives and Portfolio Updates at DBS Regional Property Conference 2026 Key Takeaways for Investors…

January 2, 2026

CapitaLand China Trust Updates S\$1 Billion Multicurrency Debt Issuance Programme CapitaLand China Trust Announces Key Updates to S\$1 Billion Multicurrency Debt Programme CapitaLand China Trust (CLCT), managed by CapitaLand China Trust Management Limited, has announced significant updates to its S\$1,000,000,000…

December 2, 2025

CapitaLand China Trust Issues Divestment Fee Units Following CapitaMall Yuhuating Divestment CapitaLand China Trust Issues Divestment Fee Units Following CapitaMall Yuhuating Divestment Key Developments in Recent CapitaLand China Trust (CLCT) Transaction CapitaLand China Trust (CLCT), managed by CapitaLand China Trust…

November 10, 2025

CapitaLand China Trust: China NDR Investor Presentation Highlights – November 2025 CapitaLand China Trust China NDR Investor Presentation: Key Takeaways for Investors Overview CapitaLand China Trust (CLCT), the largest Singapore-listed REIT platform focused exclusively on China, delivered a comprehensive investor…

November 3, 2025

Broker Name: CGS International Date of Report: October 29, 2025 Excerpt from CGS International report. Report Summary CapitaLand China Trust (CLCT) is showing technical signs of a potential bottoming out, with indicators such as a bullish cup and handle pattern,…

November 1, 2025

CapitaLand China Trust Completes Strategic Divestment and Participation in Shanghai-Listed C-REIT: Will RMB663.4 Million Boost Unitholder Value? CapitaLand China Trust Completes Strategic Divestment and Participation in Shanghai-Listed C-REIT: Will RMB663.4 Million Boost Unitholder Value? Key Highlights for Investors CapitaLand China…

October 30, 2025

CapitaLand China Trust Delivers Strategic Portfolio Optimisation Amid Economic Headwinds: Key Milestones, Financials, and Outlook for 3Q 2025 CapitaLand China Trust Delivers Strategic Portfolio Optimisation Amid Economic Headwinds: Key Milestones, Financials, and Outlook for 3Q 2025 Key Highlights from the…

October 9, 2025

CapitaLand China Trust Faces S\$1.6 Billion Cross Default Risk on Manager Change Clause CapitaLand China Trust Faces S\$1.6 Billion Cross Default Risk on Manager Change Clause Key Points from the Latest Disclosure Facility Agreement Signed: CapitaLand China Trust (CLCT) has…