📊 Statistics

- Analyst 1 Year Price Target:

$0.53

- Upside/Downside from Analyst Target:

0.96%

- Broker Call:

4

- Dividend Minimum 3 Year Yield:

7.16%

- EPS Growth Range (1Y):

200-500%

- Net Income Growth Range (1Y):

200-500%

- Revenue Growth Range (1Y):

10-25%

-

Upcoming Earnings Date:

2026-02-03

💰 Dividend History

Current year to date yield:

7.16%

📅 SGX Earnings Announcements for A7RU

Keppel Infrastructure Trust (A7RU)

Market: SGX |

Currency: SGD

Address: 1 HarbourFront Avenue

Keppel Infrastructure Trust is a listed business trust. It operates through Energy Transition, Environmental Services, and Distribution & Storage segments. The company produces and retails town gas and natural gas, as well as electricity produced by wind turbines and rooftop solar systems. It also offers desalination plants, water treatment plants, recycling and waste-to-energy plants. In addition, the company supplies and distributes water treatment chemicals, industrial and specialty chemicals, storage of petroleum products, and provision of essential bus services. The company has operations in Singapore, Australia, New Zealand, South Korea, and internationally. Keppel Infrastructure Trust was incorporated in 2007 and is based in Singapore.

Show more

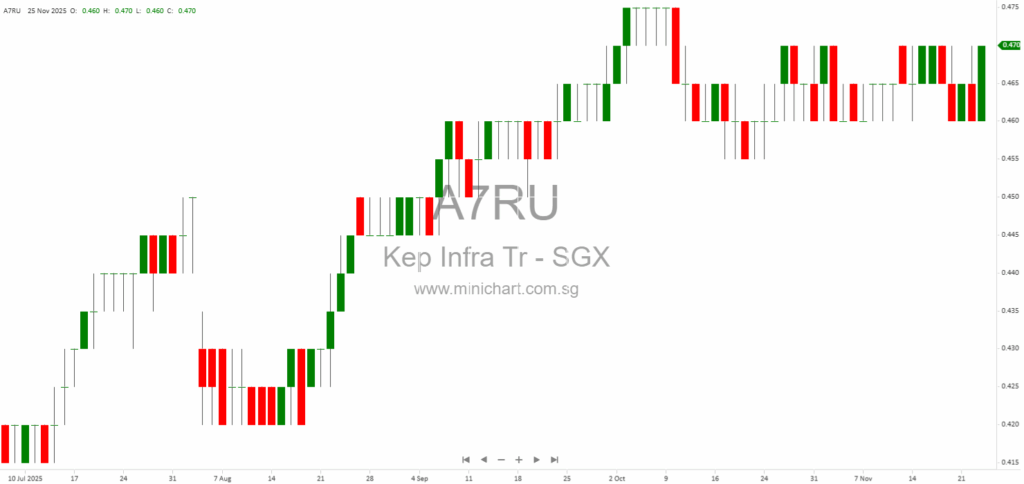

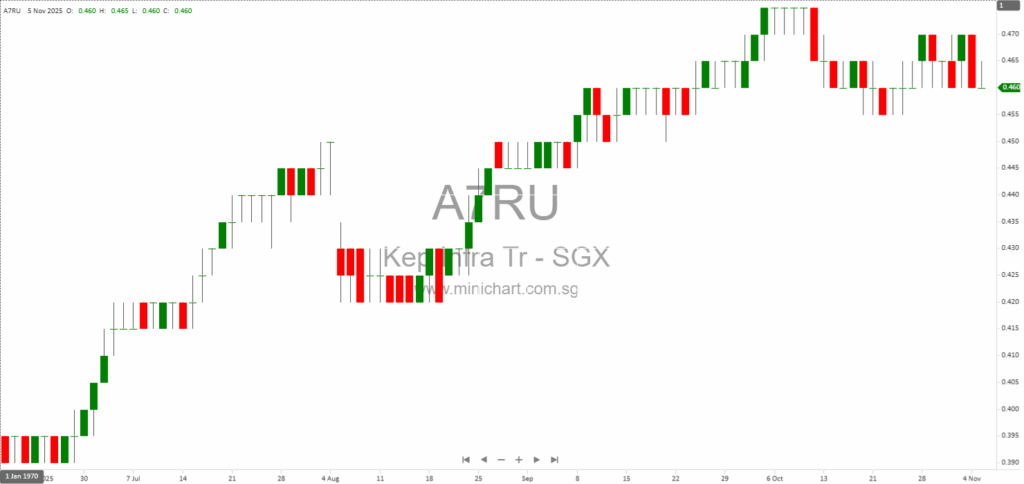

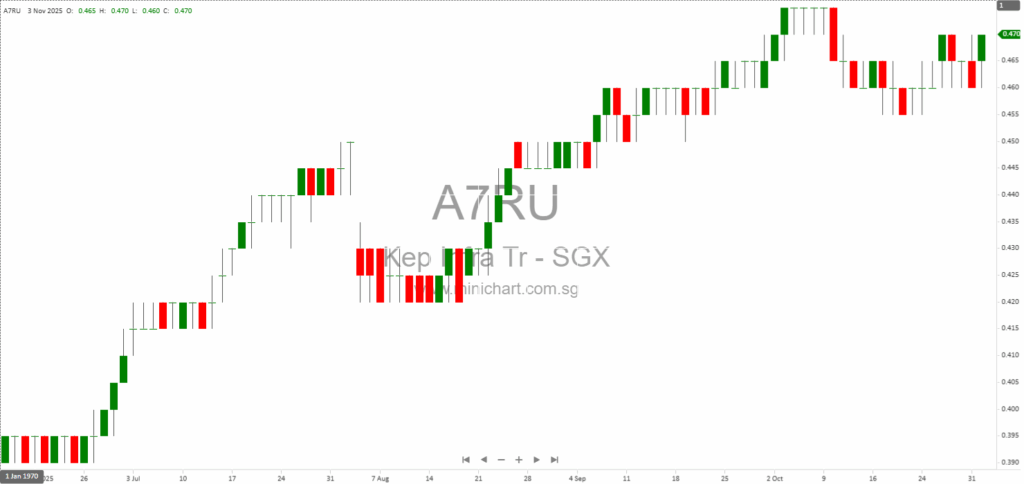

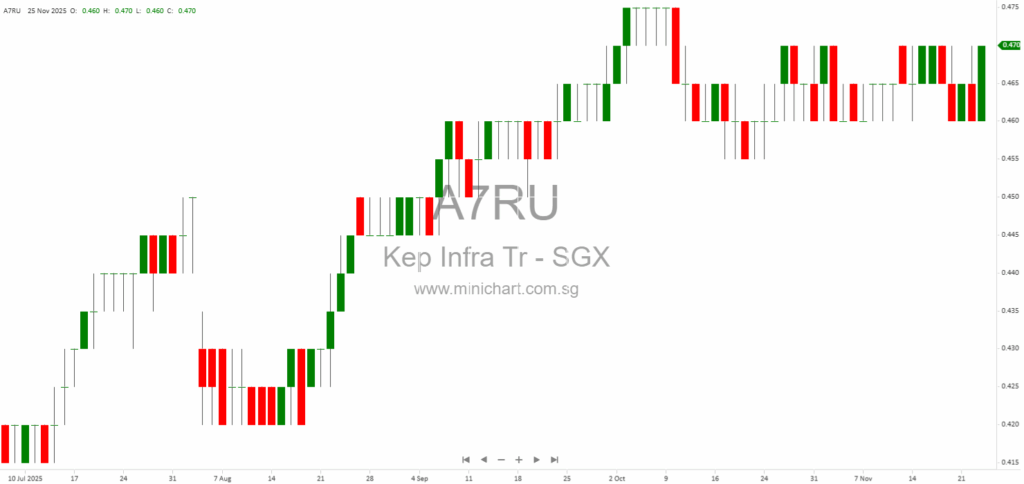

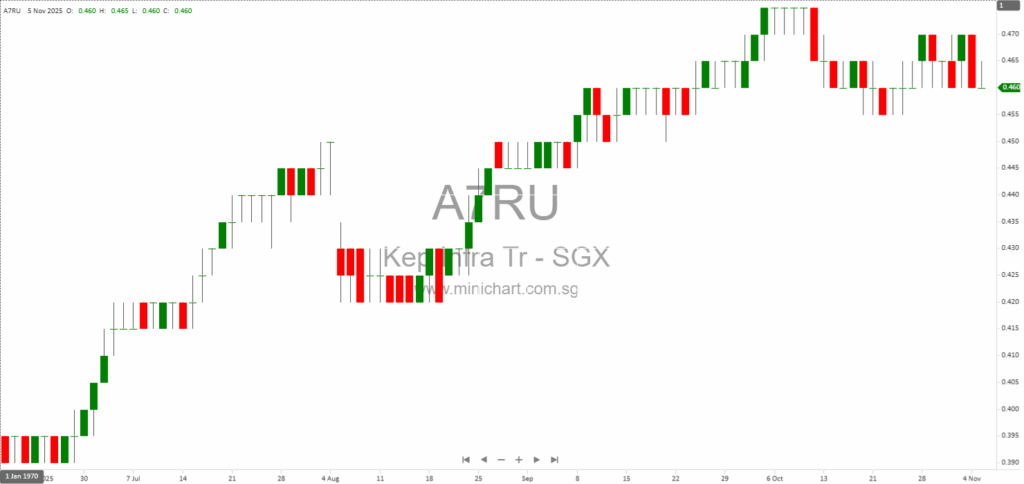

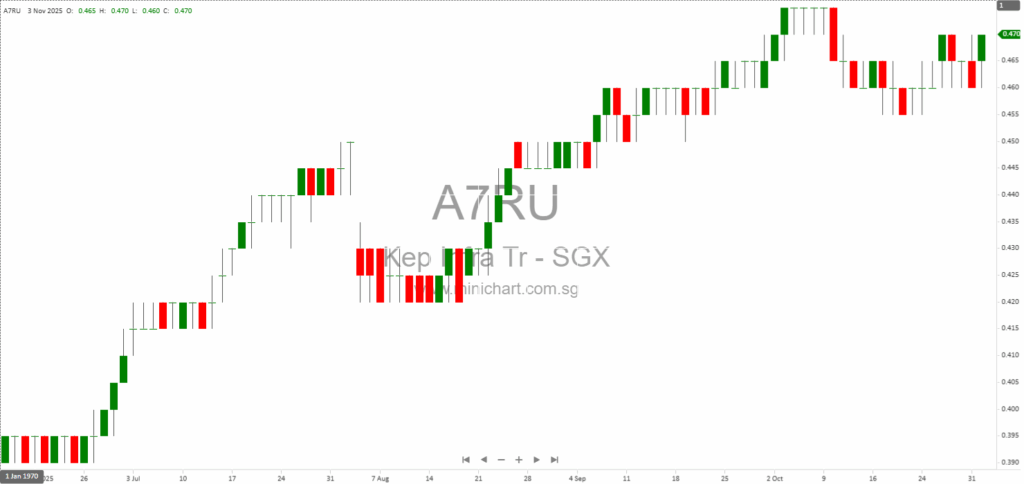

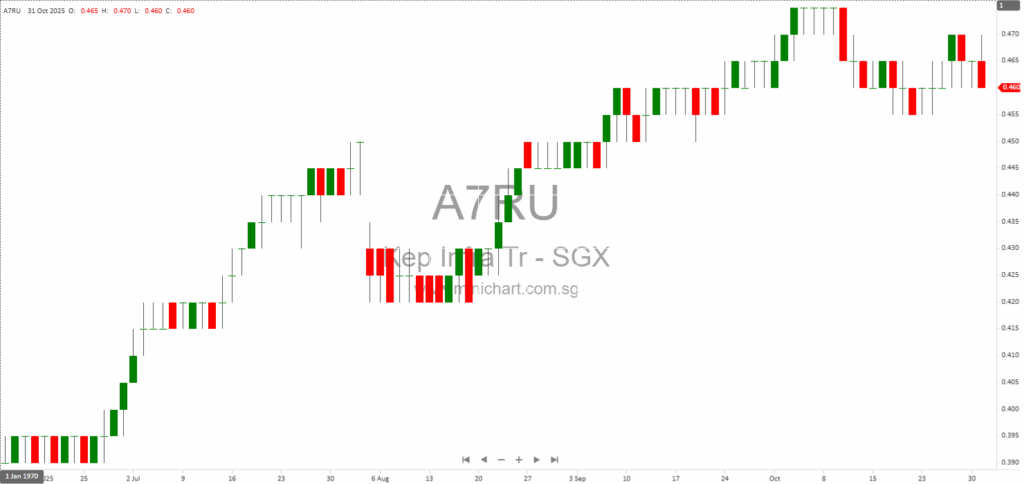

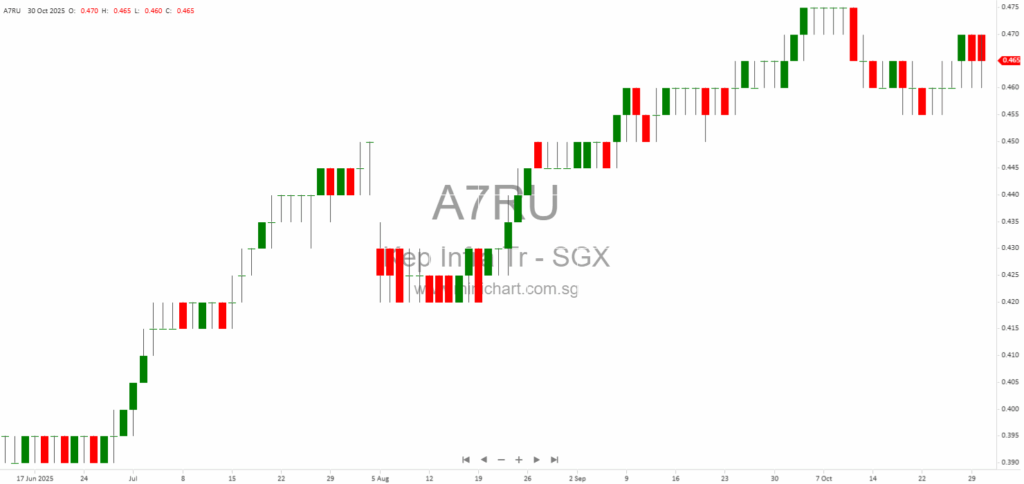

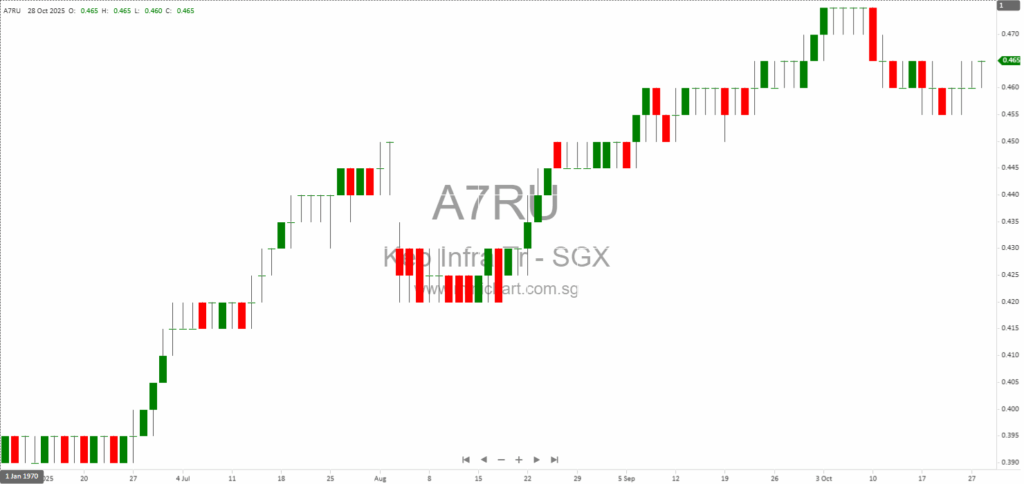

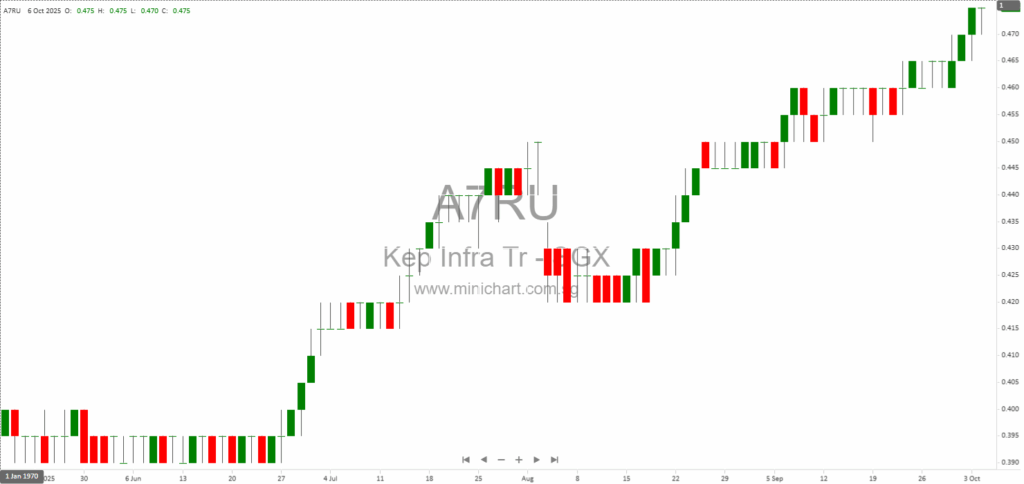

📈 Keppel Infrastructure Trust Historical Chart

🧾 Recent Financial Statement Analysis

January 10, 2026

Keppel Infrastructure Trust: Financial Results Announcement Notice for FY2025 Keppel Infrastructure Trust (KIT) has released a notice regarding the upcoming announcement of its financial results for the second half and full year ended 31 December 2025. The results are scheduled…

December 11, 2025

Keppel Infrastructure Trust EGM: Key Details and Investor Takeaways Keppel Infrastructure Trust Approves Major Investment in Global Marine Group: Key Details for Investors Keppel Infrastructure Trust (KIT) held its Extraordinary General Meeting (EGM) on 11 November 2025, where unitholders approved…

November 25, 2025

Keppel Infrastructure Trust Completes Strategic Investment in Global Marine Group Key Points for Investors Completion of Major Transaction: Keppel Infrastructure Trust ("KIT") has officially completed its investment in Global Marine Group ("GMG"), one of the world's largest independent subsea cable…

November 6, 2025

Keppel Infrastructure Trust (KIT) Q3 2025: Major Strategic Moves and Proposed Entry into Digital Infrastructure Keppel Infrastructure Trust (KIT) Q3 2025: Major Strategic Moves and Proposed Entry into Digital Infrastructure Executive Summary Keppel Infrastructure Trust (KIT), the largest SGX-listed infrastructure…

November 3, 2025

Keppel Infrastructure Trust Unveils Bold Digital Expansion with \$119 Million Strategic Investment in Global Marine Group Major Move into Digital Infrastructure Signals Next Leg of Growth for KIT Keppel Infrastructure Trust (KIT) has announced a landmark proposal to acquire a…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: A7RU, Keppel Infrastructure Trust

January 10, 2026

Keppel Infrastructure Trust: Financial Results Announcement Notice for FY2025 Keppel Infrastructure Trust (KIT) has released a notice regarding the upcoming announcement of its financial results for the second half and full year ended 31 December 2025. The results are scheduled…

December 11, 2025

Keppel Infrastructure Trust EGM: Key Details and Investor Takeaways Keppel Infrastructure Trust Approves Major Investment in Global Marine Group: Key Details for Investors Keppel Infrastructure Trust (KIT) held its Extraordinary General Meeting (EGM) on 11 November 2025, where unitholders approved…

November 25, 2025

Keppel Infrastructure Trust Completes Strategic Investment in Global Marine Group Key Points for Investors Completion of Major Transaction: Keppel Infrastructure Trust ("KIT") has officially completed its investment in Global Marine Group ("GMG"), one of the world's largest independent subsea cable…

November 6, 2025

Keppel Infrastructure Trust (KIT) Q3 2025: Major Strategic Moves and Proposed Entry into Digital Infrastructure Keppel Infrastructure Trust (KIT) Q3 2025: Major Strategic Moves and Proposed Entry into Digital Infrastructure Executive Summary Keppel Infrastructure Trust (KIT), the largest SGX-listed infrastructure…

November 3, 2025

Keppel Infrastructure Trust Unveils Bold Digital Expansion with \$119 Million Strategic Investment in Global Marine Group Major Move into Digital Infrastructure Signals Next Leg of Growth for KIT Keppel Infrastructure Trust (KIT) has announced a landmark proposal to acquire a…

November 3, 2025

Broker Name: CGS International Date of Report: October 29, 2025 Excerpt from CGS International report. Report Summary Keppel Infrastructure Trust (KIT) benefited from its diverse portfolio, with strong contributions from Australian assets (Ixom and Ventura) offsetting weaker performance in European…

November 1, 2025

Keppel Infrastructure Trust's Game-Changing Bet on Global Marine Group: What Investors Must Know Keppel Infrastructure Trust's Game-Changing Bet on Global Marine Group: What Every Investor Needs to Know Major Strategic Move into Digital Infrastructure with High-Quality, Predictable Cashflows Keppel Infrastructure…

October 30, 2025

Keppel Infrastructure Trust's Strategic Dive into Subsea Digital Infrastructure: What Investors Need to Know About the US\$91.7 Million Global Marine Group Acquisition Keppel Infrastructure Trust’s Strategic Dive into Subsea Digital Infrastructure: What Investors Need to Know About the US\$91.7 Million…

October 28, 2025

Keppel Infrastructure Trust Delivers Robust 3Q 2025 Earnings, Eyes Strategic Expansion Into Digital Infrastructure Keppel Infrastructure Trust Delivers Robust 3Q 2025 Earnings, Eyes Strategic Expansion Into Digital Infrastructure Key Highlights from 3Q 2025 Report Distributable Income (DI) Surges 59%: For…

October 6, 2025

Keppel Infrastructure Trust Unveils Strategic Moves: Major Divestments, Digital Expansion, and Strong 1H 2025 Results Signal Value Creation Ahead Keppel Infrastructure Trust Unveils Strategic Moves: Major Divestments, Digital Expansion, and Strong 1H 2025 Results Signal Value Creation Ahead Key Takeaways…