📊 Statistics

- Analyst 1 Year Price Target:

-

- Upside/Downside from Analyst Target:

-

- Broker Call:

-

- Dividend Minimum 3 Year Yield:

0.00%

- EPS Growth Range (1Y):

-

- Net Income Growth Range (1Y):

-

- Revenue Growth Range (1Y):

25-50%

-

Upcoming Earnings Date:

2026-02-23

💰 Dividend History

Current year to date yield:

3.52%

📅 SGX Earnings Announcements for A30

Aspial Corporation Limited (A30)

Market: SGX |

Currency: SGD

Address: No.01-01, Aspial One

Aspial Corporation Limited, an investment holding company, operates in the real estate, financial service, and jewelry businesses in Singapore, Australia, Malaysia, Greater China, and Europe, and internationally. The company operates through Retail Business, Real Estate Business, Financial service Business, and Others segments. It is involved in the provision of pawn brokerage and secured lending services; retail and trading of pre-loved jewelry, timepieces, and bags; and branded merchandise. The company also operates the jewelry retail business under the Maxi-cash, Lee Hwa, Goldheart Jewelry, and Niessing brands. In addition, it engages in the rental of properties and provision of management and other support services; property management and development; and jewelry manufacturing and wholesaling activities, as well as operates and manages hotels; and resorts and serviced residences. Further, it offers real estate consultancy services; and treasury services. The company was formerly known as Lee Hwa Holdings Ltd. and changed its name to Aspial Corporation Limited in 2001. Aspial Corporation Limited was incorporated in 1970 and is based in Singapore. Aspial Corporation Limited is a subsidiary of MLHS Holdings Pte. Ltd.

Show more

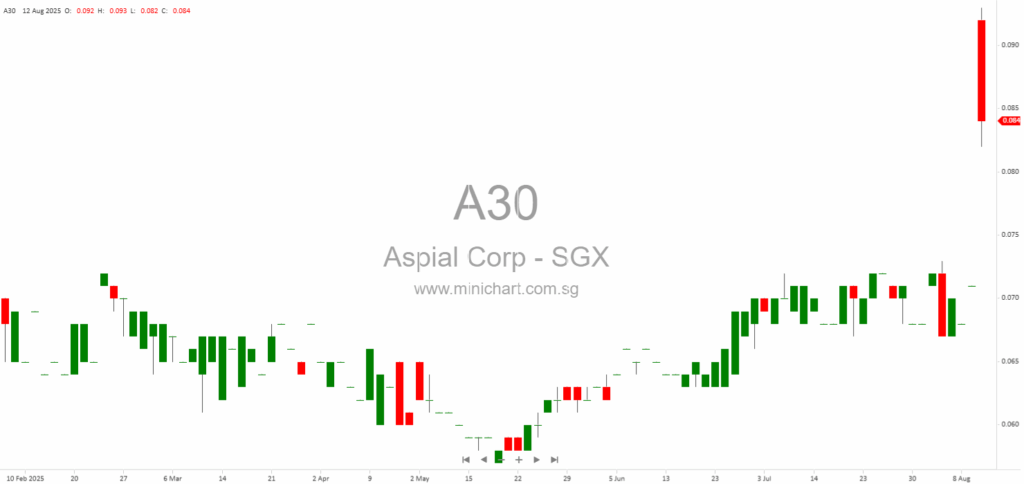

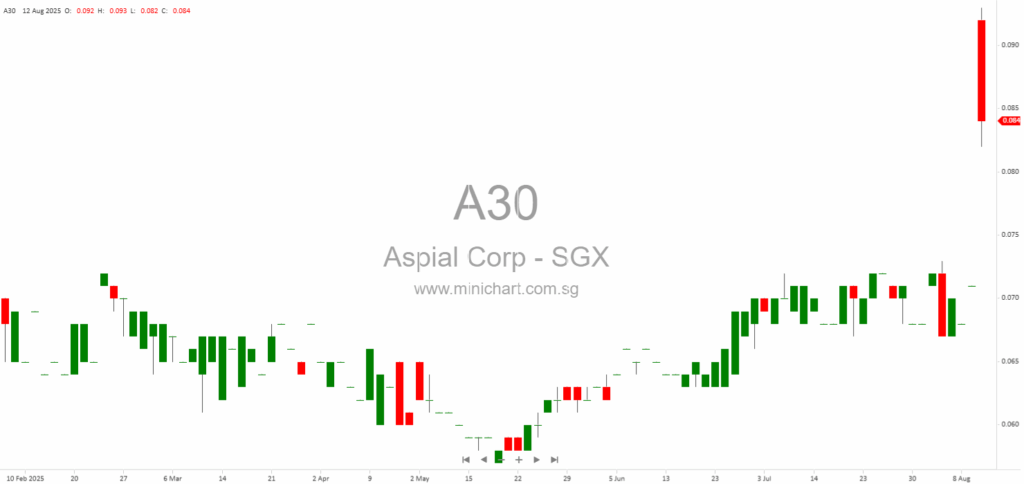

📈 Aspial Corporation Limited Historical Chart

🧾 Recent Financial Statement Analysis

December 3, 2025

Aspial Corporation: Detailed Analysis of the Proposed Acquisition of AF Global Limited Aspial Corporation: Independent Financial Adviser’s Detailed Opinion on the Proposed Acquisition of AF Global Limited Executive Summary Aspial Corporation Limited has proposed, together with JK Global Investment Pte.…

November 25, 2025

Detailed Investor Analysis: AF Global Limited Proposed Acquisition by Aspial Corporation Limited AF Global Limited: Proposed Acquisition by Aspial Corporation Limited — Detailed Investor Report Key Points of the Report Proposed Acquisition: Aspial Corporation Limited (“Aspial”), together with KWMCo, proposes…

October 7, 2025

Breaking: Aspial Consortium Launches \$31.8M Privatisation Scheme for AF Global Limited – What Investors Must Know Overview: Major Take-Private Offer Unveiled for SGX-Listed Hospitality Group Aspial Corporation Limited (“Aspial”), together with JK Global Investment Pte Ltd (“KWMCo”)—an entity wholly owned…

August 12, 2025

Aspial Corporation Ltd 1H 2025 Financial Review: Robust Earnings and Strategic Growth Aspial Corporation Ltd has released its unaudited condensed interim financial statements for the six months ended 30 June 2025. The Group delivered a strong set of results, marked…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: A30, Aspial Corporation Limited, Aspial Corp, ASP SP, ASPIAL CORP LTD, ASPIAL CORP

December 3, 2025

Aspial Corporation: Detailed Analysis of the Proposed Acquisition of AF Global Limited Aspial Corporation: Independent Financial Adviser’s Detailed Opinion on the Proposed Acquisition of AF Global Limited Executive Summary Aspial Corporation Limited has proposed, together with JK Global Investment Pte.…

November 25, 2025

Detailed Investor Analysis: AF Global Limited Proposed Acquisition by Aspial Corporation Limited AF Global Limited: Proposed Acquisition by Aspial Corporation Limited — Detailed Investor Report Key Points of the Report Proposed Acquisition: Aspial Corporation Limited (“Aspial”), together with KWMCo, proposes…

October 7, 2025

Breaking: Aspial Consortium Launches \$31.8M Privatisation Scheme for AF Global Limited – What Investors Must Know Overview: Major Take-Private Offer Unveiled for SGX-Listed Hospitality Group Aspial Corporation Limited (“Aspial”), together with JK Global Investment Pte Ltd (“KWMCo”)—an entity wholly owned…

August 12, 2025

Aspial Corporation Ltd 1H 2025 Financial Review: Robust Earnings and Strategic Growth Aspial Corporation Ltd has released its unaudited condensed interim financial statements for the six months ended 30 June 2025. The Group delivered a strong set of results, marked…