📊 Statistics

- Analyst 1 Year Price Target:

$1.24

- Upside/Downside from Analyst Target:

-2.05%

- Broker Call:

8

- Dividend Minimum 3 Year Yield:

4.35%

- EPS Growth Range (1Y):

<0%

- Net Income Growth Range (1Y):

0-10%

- Revenue Growth Range (1Y):

0-10%

-

Upcoming Earnings Date:

-

💰 Dividend History

Current year to date yield:

4.35%

Amount: $0.000000

Yield: -

Pay Date: -

Details:

Ratio: 1:5

Amount: -

Yield: -

Pay Date: 2003-05-21

Details:

10% LESS TAX

📅 SGX Earnings Announcements for 544

CSE Global Limited (544)

Market: SGX |

Currency: SGD

Address: 202 Bedok South Avenue 1

CSE Global Limited, an investment holding company, engages in the provision of integrated industrial automation, information technology, and intelligent transport solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa. The company offers process control, safety shutdown, fire and gas detection, supervisory control and data acquisition (SCADA), wellhead and subsea control, process skid, real-time information, and intelligent transport systems; two-way radio communication, fiber optic, microwave radio, conventional and trunked radio, public address, and general alarm systems; VSAT satellite communications, telephone, local and wide area, SCADA and telemetry networks; and CCTV, access control, and FIDS systems, as well as multiple hearth furnaces, rotary kiln and fluid bed incinerators, and carbon and energy recovery systems, and electric vehicle charging infrastructure, renewable energy, and utility solutions. It also provides e-business integration, research and development, and computer system integration services; computer network systems; electrical control and computer systems; infrastructure engineering services; process plant and environmental engineering services; contracting resources and permanent placement; panel fabrication; turnkey and telecommunication solutions; security system; and project management services. In addition, the company distributes electrical engineering equipment; designs and installs high temperature thermal process and incineration systems; designs and develops water treatment and disposal technology; provides commercial building controls and automation services; leases office and warehouse space; and offers engineered design packages, and field and networking services. CSE Global Limited was founded in 1985 and is headquartered in Singapore.

Show more

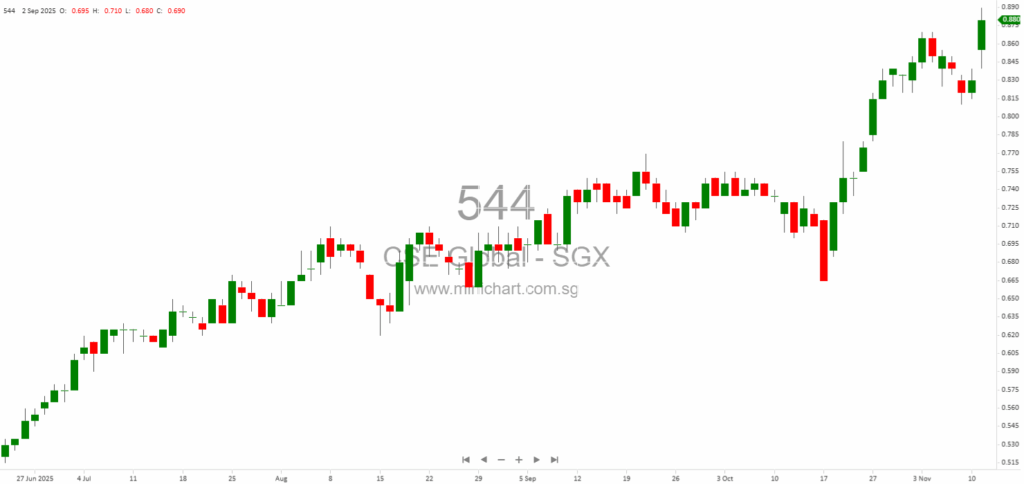

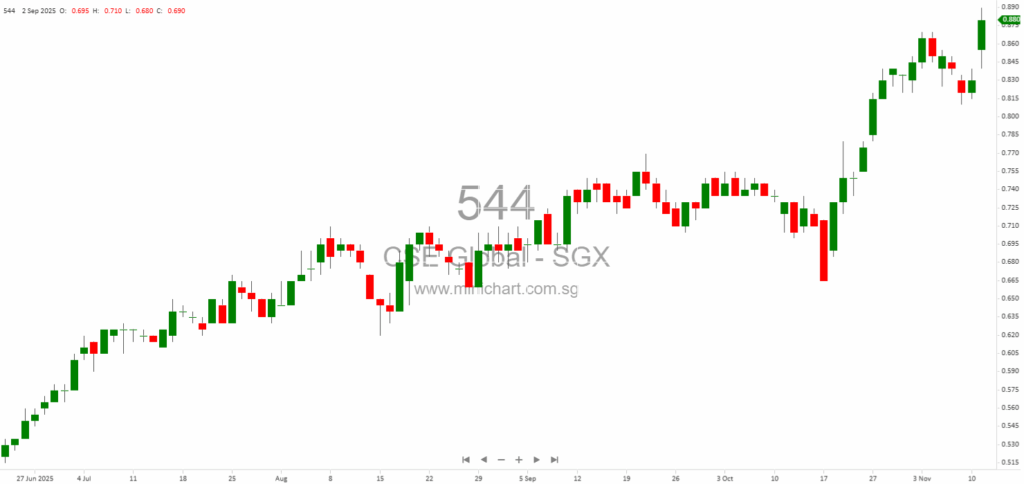

📈 CSE Global Limited Historical Chart

🧾 Recent Financial Statement Analysis

December 31, 2025

CSE Global Secures Major Contract Variations in US Data Centre Market CSE Global Secures US\$143.5 Million in Contract Variations for US Data Centre Market Key Highlights Major contract variations worth US\$143.5 million (approx. S\$186.3 million) secured for the data centre…

December 15, 2025

CSE Global Secures Major Electrification Contracts in USA CSE Global Secures Major Electrification Contracts Worth S\$161.7 Million in USA LNG Market Key Highlights for Investors CSE Global Limited announces the securing of three significant contracts valued at US\$124.6 million (approximately…

November 24, 2025

CSE Global Receives SGX Approval for Major Warrant Issuance CSE Global Secures SGX Approval-in-Principle for Large-Scale Warrant Issuance Key Highlights for Investors Approval-in-Principle Secured: CSE Global Limited has received an approval in-principle from the Singapore Exchange Securities Trading Limited (SGX-ST)…

November 20, 2025

CSE Global 3Q2025 Interim Business Update: Key Highlights for Investors CSE Global Limited Reports Strong 3Q2025 Revenue Growth Driven by Electrification Segment Date: 19 November 2025 Company: CSE Global Limited (SGX: 544) Location: Singapore Key Highlights from 3Q2025 Interim Business…

November 11, 2025

CSE Global Achieves Major Accolades and Sustained Profit Growth CSE Global Achieves Prestigious Billion Dollar Club Award for Consistent Profit Growth Investor-Focused Analysis of Recent Recognition and Strategic Progress CSE Global Limited ("CSE Global"), a leading global systems integrator specializing…

🔎 View more in SGX corporate News 🔎 View more in SGX Financial statements

📰 Related News & Research

Showing results matched by any of: 544, CSE Global Limited, CSE Global, CSE SP, CSE GLOBAL LTD, CSE GLOBAL

February 11, 2026

Broker Name: CGS International Date of Report: February 10, 2026 Excerpt from CGS International report. Report Summary CSE Global is expected to benefit from Amazon Web Services’ (AWS) significant data centre expansion, driving sustained demand for data centre electrification and…

December 31, 2025

CSE Global Secures Major Contract Variations in US Data Centre Market CSE Global Secures US\$143.5 Million in Contract Variations for US Data Centre Market Key Highlights Major contract variations worth US\$143.5 million (approx. S\$186.3 million) secured for the data centre…

December 15, 2025

CSE Global Secures Major Electrification Contracts in USA CSE Global Secures Major Electrification Contracts Worth S\$161.7 Million in USA LNG Market Key Highlights for Investors CSE Global Limited announces the securing of three significant contracts valued at US\$124.6 million (approximately…

November 24, 2025

Broker Name: CGS International Date of Report: November 21, 2025 Excerpt from CGS International report. Report Summary CSE Global is preparing for multi-year growth, especially in data centre electrification, with major contract wins expected in 4Q25, including a significant Amazon…

November 24, 2025

CSE Global Receives SGX Approval for Major Warrant Issuance CSE Global Secures SGX Approval-in-Principle for Large-Scale Warrant Issuance Key Highlights for Investors Approval-in-Principle Secured: CSE Global Limited has received an approval in-principle from the Singapore Exchange Securities Trading Limited (SGX-ST)…

November 20, 2025

Broker Name: Lim & Tan Securities Date of Report: 20 November 2025 Excerpt from Lim & Tan Securities report. CSE Global’s 3Q2025 revenue grew 20.5% year-on-year to S\$257.7 million, mainly driven by strong performance in its Electrification segment in the…

November 20, 2025

Broker Name: Lim & Tan Securities Date of Report: 20 November 2025 Excerpt from Lim & Tan Securities report CSE Global reported strong 3Q2025 results, with revenue up 20.5% year-on-year to S\$257.7 million, mainly driven by its Electrification segment in…

November 20, 2025

CSE Global 3Q2025 Interim Business Update: Key Highlights for Investors CSE Global Limited Reports Strong 3Q2025 Revenue Growth Driven by Electrification Segment Date: 19 November 2025 Company: CSE Global Limited (SGX: 544) Location: Singapore Key Highlights from 3Q2025 Interim Business…

November 14, 2025

Broker Name: Maybank Research Pte Ltd Date of Report: 13 November 2025 Excerpt from Maybank Research Pte Ltd report. OCBC Bank: Strong 9M25 core earnings beat expectations, driven by group synergies and resilient credit growth. Dividend momentum is expected to…

November 11, 2025

CSE Global Achieves Major Accolades and Sustained Profit Growth CSE Global Achieves Prestigious Billion Dollar Club Award for Consistent Profit Growth Investor-Focused Analysis of Recent Recognition and Strategic Progress CSE Global Limited ("CSE Global"), a leading global systems integrator specializing…

August 19, 2025

Broker: Maybank Research Pte Ltd Date of Report: August 17, 2025 CSE Global Poised for Multi-Year Growth: Data Centres, Utilities, and ESG Drive Bullish Outlook Overview: Robust Performance Sets the Stage for Expansion CSE Global (CSE SP), a global systems…

August 19, 2025

Broker: Maybank Research Pte Ltd Date of Report: August 17, 2025 CSE Global: Poised for a Multi-Year Growth Cycle with Robust Order Wins and Expanding Data Centre Exposure Executive Summary: CSE Global Positioned for Stronger 2H25 and Beyond CSE Global…

May 21, 2025

Maybank Research May 16, 2025 CSE Global: 2H25 Poised for Strong Growth – Maintain BUY Executive Summary Maybank Research maintains a BUY rating for CSE Global (CSE SP) with a target price of SGD0.58. Management anticipates a significant increase in…

April 1, 2025

CSE Global Ltd. Poised for Electrifying Growth Amid AI Boom KGI Securities, March 21, 2025 Surging Data Center Demand Fuels Electrification Opportunities CSE Global Ltd., a leading provider of technology-driven solutions, is well-positioned to capitalize on the growing demand for…

September 9, 2024

CSE Global (SGX: 544) – Electrification Business Boosts Outlook Recommendation: BUY Target Price: SGD 0.64 Date of Recommendation: September 8, 2024 Broker Company: Maybank Research Pte Ltd Investment Thesis: CSE Global is experiencing rapid growth, especially through its U.S.-based electrification…